photoschmidt/iStock via Getty Images

Previously featured Broadcom (Nasdaq:Nasdaq:AVGO) in February 2024 and explained why, after multiple hold ratings, we ultimately upgraded the company’s stock to a buy recommendation.

This is because FWD’s assessment was more reasonable than the others. Very optimistic outlooks from peers and management for fiscal 2024 have already led to a consensus of modest increases in outlooks through fiscal 2026.

Since then, AVGO has posted a further +7.5% share price increase, outperforming the broader market +5.7%, establishing $1.2K as a floor, with much of the tailwind unsurprisingly coming from the accelerated revenue growth reported in Q1FY24 and the raised AI-related sales guidance for FY24.

A similar promising market trend is Nvidia (NVDA), Super Microcomputer (SMCI), c3.ai (artificial intelligence), generative AI offerings will permeate from the infrastructure layer down to the SaaS layer.

Combined with the strong shareholder returns to date, AVGO remains a recommended buy stock on every moderate dip for an improved margin of safety, and since my last article, I believe I have maintained my bullish investment thesis on this generative AI stock. I am reiterating my buy recommendation.

AVGO Remains an Attractive Generative AI Company – Thanks to Enhanced Guidance

For now, we believe the market will be waiting with bated breath for AVGO’s earnings call scheduled for June 12, 2024, given the very insightful commentary and promising future outlook from multiple generative AI companies during their recent Q1 2024 earnings call.

For example, NVDA, the clear market leader in AI chips, has made impressive Q1 2024 revenue of $26.04 billion (+17.8% QoQ / +262.1% YoY), while forecasting Q2 2024 revenues of $28.0 billion (+7.5% QoQ / +107.4% YoY), well above consensus estimates of $22.03 billion and $26.8 billion, respectively.

SMCI, a complete server solutions company, also reported strong results. Q1 2024 revenue of $3.85 billion (+5.1% QoQ / +200% YoY) Q2 2024 sales are expected to reach $5.3 billion (+37.6% QoQ / +143.1% YoY), but the company is still seeing aDemand remains strong for AI/ML compute and networking products from hyperscale customers.”

At the same time, we are beginning to see the growth of generative AI infrastructure. SaaS penetration As C3.ai similarly reported in its latest earnings call, the company’s results “exceeded initial guidance and the high end of analyst expectations.”

AVGO’s management has also emphasized the same point, resulting in strong performance in the first quarter of 2024. Network revenue: $3.3 billion (+6.4% compared to the previous quarter/ YoY +43.4%) announced that it has raised its network revenue outlook for fiscal 2024 to an increase of more than 35% year over year due to “strong demand for custom AI accelerators.”

This compares with initial guidance of +30% YoY, suggesting that the company’s products remain a top choice for many hyperscalers so far.

At the same time, AVGO expects AI-related revenues to grow by more than $10 billion in fiscal 2024. This is higher than the initial guidance of $7.5 billion provided in its fourth-quarter fiscal 2023 earnings call, and the annual total of $6 billion reported in fourth-quarter fiscal 2023.

As a result, AVGO’s consensus estimates for Q2 2024 appear to be fairly conservative with revenue of $12.0 billion (+0.3% Q/+37.4% YoY), adjusted EBITDA of $7.05 billion (-1.3% Q/+24.1% YoY), and adjusted EPS of $10.84 (-1.3% Q/+5% YoY), and we believe it is very likely that the company will surpass expectations again and deliver better performance.

This is especially true since the management team has an impressive record of 16. Consecutive top/bottom line beats The company also reaffirmed its fiscal 2024 revenue guidance of $50 billion (up 39.6% year-over-year) and adjusted EBITDA of $30 billion (up 29.2% year-over-year), marking its first increase in revenue and profit since the second quarter of 2020.

These developments, coupled with increased network guidance for Q1 2024, further highlight why we believe AVGO remains an attractive generative AI company, lending further strength to its core investment thesis.

AVGO appears to be fairly valued compared to its peers.

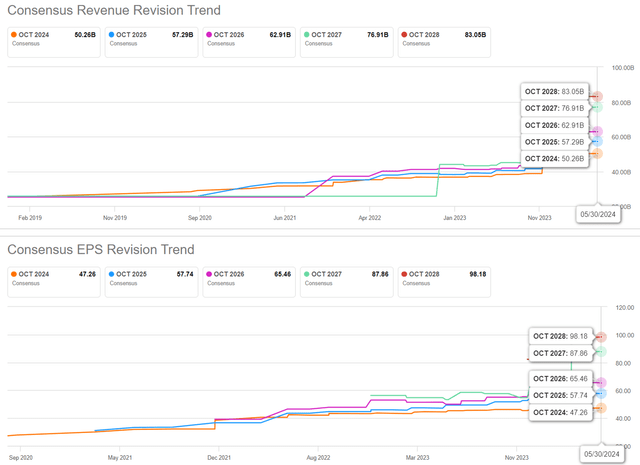

Consensus Forecast

For now, the consensus continues to raise future estimates, with AVGO expected to accelerate its revenue and earnings growth through FY2026, reporting CAGRs of +20.7% / +15.7%, up from previous expectations of +18.6% / +13.8%, respectively.

The increase in estimates is likely due to AVGO’s robust performance. Multi-year remaining performance obligations $27.7 billion (+36.4% compared to previous quarter/ Year-on-year increase of 21.4%), providing clarity on long-term sales prospects.

At the same time, readers should also note that management reported continued growth in SaaS revenue for the year to $18.19 billion (up 148% year-over-year), although SaaS gross margins deteriorated to 81.9% (down 9.9 percentage points year-over-year), the latter primarily due to multiple one-time adjustments resulting from the company’s recent merger with VMWare.

Still, with SaaS revenue now accounting for 37.9% of sales (up 17.4 percentage points year over year), AVGO is likely to be at the forefront of the AI race, and accelerating SaaS growth should boost future revenues.

AVGO Rating

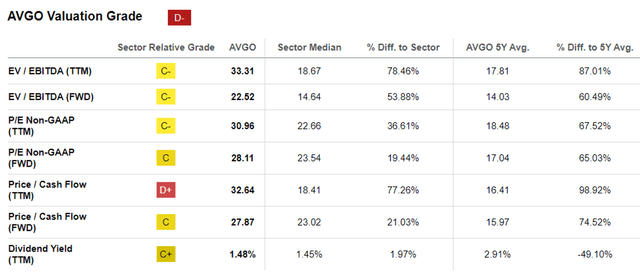

As a result of these developments, it is understandable why the market continues to assign AVGO higher FWD EV/ EBITDA valuations of 22.52x and 28.11x, compared to 20.16x/26.95x in our last article and the sector median of 14.64x/23.54x.

AVGO is ahead of NVDA and Advanced Micro Devices (Am) at 54.45x/47.49x, Intel (International Trade Commission) were 11.20x/28.24x, respectively.

This is especially so since AVGO is expected to grow revenue and earnings at a healthy CAGR of +20.7%/ +15.7% from FY2023 to FY2026, respectively (or normalized to +15.8%/ +17.5% from FY2019 to FY2026).

- NVDA was +43.7%/ +46.4% (or +49.5%/ +61.4% normalized),

- AMD +19.2%/ +40.3% (or +28.3%/ +41.6% normalized),

- INTC +8.1%/+34.7% (or normalized to -0.7%/-8.7% due to ongoing PC adjustments/price reductions),

This means that AVGO is reasonably valued at a FWD P/E valuation of 28.11 compared to its peers, taking into account the relative comparison of growth rates.

Needless to say, the merger with VMWare has directly contributed to the deterioration of the balance sheet, with the company now reporting a decline in cash and cash equivalents of $11.86 billion in Q1 2024 (-16.3% QoQ, -6.1% YoY), while current and long-term debt has skyrocketed to $75.89 billion (+93.4% QoQ, +93.2% YoY), resulting in a massive net debt of $64.03 billion (+155.7% QoQ, +140.4% YoY).

A similar impact was seen in AVGO’s Q1 2024 adjusted EPS of $10.99 (-0.6% QoQ, +6.3% YoY) and a significant increase in annualized interest expense to $3.7 billion (+128% QoQ, +128% YoY).

However, we are not too concerned given that adjusted free cash flow generation in the first quarter of 2024 is very generous at $5.35 billion (up 13.8% quarter-on-quarter and up 37.1% year-on-year) and margins are at 45% (-6ppt quarter-on-quarter and +1ppt year-on-year), and especially given that only $13.3 billion of long-term debt is due in 2025, with the remainder on track to be paid off very well through 2051.

Should AVGO Stock Be a Buy?sell or hold?

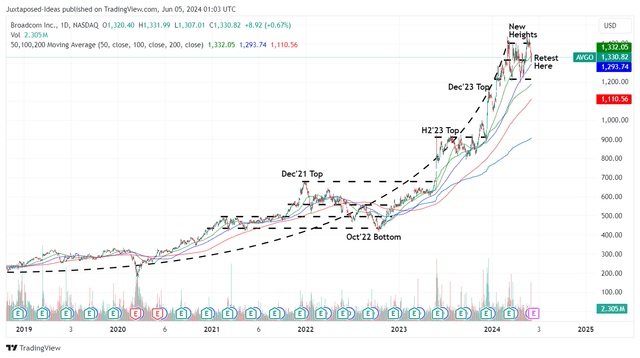

AVGO 5 Year Stock Price

For now, AVGO has established a solid support level at $1.2K and a clear resistance level at $1.4K, and with the market fluctuating between a bullish generative AI boom and bearish/prolonged inflation pain, the stock is likely to remain sideways in the near term.

Incidentally, in my previous article, I offered a fair value estimate of $1.13K based on FY2023 adjusted EPS of $42.25 (up 12.2% year-over-year) and a previous FWD P/E of 26.95x.

However, with AVGO’s LTM adjusted EPS of $42.91 (up 1.5% from our last article) and FWD P/E rising to 28.11x, the stock appears to be trading slightly above our new fair value estimate of $1.2K.

Given the revised FY2026 adjusted EPS estimates in our previous article, raised from $62.21 to $65.46, and the raised FWD P/E to 28.11x, there remains excellent upside potential of +38.3% against our long-term price target of $1.84K.

Most importantly, it’s hard to ignore AVGO’s generous annual dividend of $21, which allows long-term investors to dollar-cost average down while continually reinvesting quarterly.

As a result, we maintain our buy recommendation but have not set a specific entry point as it depends on each individual investor’s risk tolerance.

With the current trading range being between $1.2K and $1.4K, interested investors may want to add in a moderate pullback to the lower end of the range to increase upside potential, depending on their own dollar-cost averaging and portfolio allocation.

Risk Warning

Needless to say, a rising P/E ratio comes with high expectations, and a painful correction would likely occur, especially if AVGO issues weaker-than-expected earnings or disappointing future guidance.

This is especially true since it is still unclear when NVDA’s sales will ultimately slow down, which could trigger a potential exit for all other generative AI players such as AVGO.

At the same time, with inflation remaining elevated and a change in Fed policy unlikely until Q4 2024, the macroeconomic normalization process may be protracted and stock markets are likely to remain volatile for some time to come.

Finally, with the US-China trade war still ongoing, some of AVGO’s China-related revenue of $11.53 billion for fiscal 2023 may be at risk. micron (M), Advanced Micro Devices (Am), Intel (International Trade Commission).

Investors beware.