Tadamichi

In March of this year I article About BlackRock TCP Capital CorporationNasdaq:TCPC) We downgraded the BDC to “hold” from “buy” due to less than optimal fourth-quarter results and signs of weakening fundamental momentum going forward.

More specifically, The reasons for the downgrade are as follows:

- Increased leverage.

- The adjusted NII results are declining.

- Net investment flows fell.

At the same time, I would not advocate a short (or sell) move, as dividend coverage levels remained strong at 129% even taking into account the most recent NII figures. Additionally, and this is a more general argument, going against BDCs is very risky in the current environment where the secular high dividend scenario is reinforced, coupled with a thriving economy.

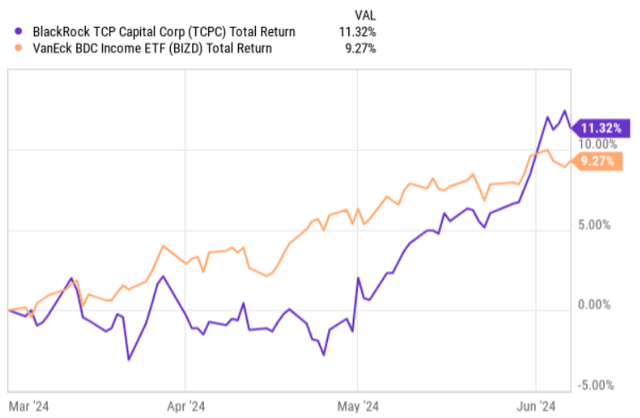

Since the publication of my article, TCPC has edged up slightly. The BDC index saw its stock prices clearly lagging the index (even falling into negative return territory) until the release of its Q1 2024 earnings results.

Y Chart

TCPC rose significantly immediately following the release of its Q1 2024 earnings. However, it is important to acknowledge that recent macroeconomic data suggests interest rates will remain elevated for an extended period of time, creating tailwinds in favor of the most leveraged and high-beta BDCs.

So let’s review TCPC’s recent financial performance to see if this share price rally is justified.

Thesis Review

The first quarter of 2024 performance looks decent with no major negative surprises on either the downside or upside.

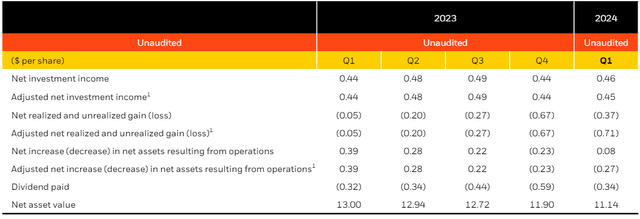

TCPC posted adjusted net income of $0.45 per share for the first quarter of 2024, up from $0.44 per share in the previous quarter but below the all-time highs it achieved in the second and third quarters of 2023.

However, from a NAV perspective, things are less stable as total NAV fell 6.4% in Q1 2024. This is mainly due to net unrealized losses in two (relatively large) portfolio companies. These price reductions were high enough to offset excess cash retention from adjusted NII after dividend distributions.

BlackRock TCP Capital Q1 2024 Earnings Results

In this regard, Chairman and CEO Raj Vig recently Earnings Report These impairments are not indicative of the overall portfolio quality, which remains strong.

The first quarter write-downs were primarily due to circumstances specific to a small number of companies and, as we have previously noted, we do not believe these circumstances are indicative of broader credit challenges in our portfolio. The majority of our portfolio companies continue to report revenue and margin expansion, with many achieving sustained operating improvement.

And when we look at the non-accrual side, the actual data is very strong, with only five portfolio companies on non-accrual, representing 1.7% of the portfolio by fair value, which we believe is below the industry average.

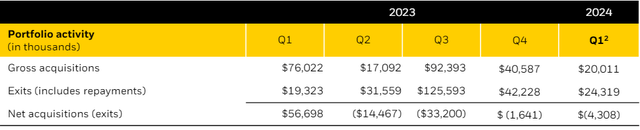

Portfolio activity was also relatively suboptimal, with total acquisition volume continuing to decline and exits still exceeding new capital raised for the fourth consecutive quarter, preventing TCPC from expanding its portfolio size.

BlackRock TCP Capital Q1 2024 Earnings Results

However, I want to highlight that these new financings, of approximately $20 million, were underwritten at very attractive yields. For example, the overall effective yield on TCPC’s debt portfolio is currently 14.1%. The weighted average effective yield on investments in new companies in the first quarter was 14.7%, which is approximately 70 basis points above the yield on the overall portfolio.

This leads us to conclude that TCPC is selective in its new investments by optimizing margins and credit quality. With regard to the latter factor, President Phil Tseng stated in the earnings call:

When considering new opportunities, we focus on transactions where we have the leverage to act as a lender, have direct relationships with borrowers and can leverage our 20+ years of experience to negotiate yield terms that we believe provide protection from significant downside risk, which we believe is a primary factor in the low realized loss rates we have seen to date.

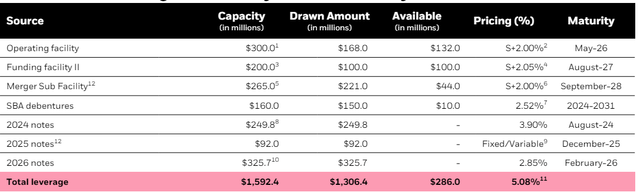

Finally, with new fundraising volumes now negative for four consecutive quarters, the leverage profile has decreased accordingly. TCPC’s current net debt-to-equity ratio is 1.08x, which is in line with the industry average level.

However, the debt maturity profile does carry some risks, which are highly dependent on shifts in the interest rate curve. Specifically, the table below shows that there is approximately $660 million (just under half of total borrowings) of borrowings under below-market fixed rate loans, of which approximately $250 million is due to mature in 2024, which will immediately augment TCPC’s interest expense component once funding costs converge to market rates after refinancing/debt rollover.

BlackRock TCP Capital Q1 2024 Earnings Results

This is followed by the next notable fixed rate debt refinancing event scheduled to occur in early 2026, which will create further headwinds for TCPC adjusted NII generation if interest rates remain unchanged or close to current levels.

Conclusion

Simply put, TCPC exhibits some positive and some negative dynamics that combine to make the investment case suboptimal.

On one hand, dividend coverage is robust at 132% and there is ample cash remaining on the books to deploy towards additional fundraising and debt optimization.On the other hand, net fundraising remains negative, which coupled with upcoming fixed rate debt rollovers will be a further headwind for TCPC to generate growth in the adjusted NII segment.

Considering the aforementioned factors and the fact that TCPC is trading at 0.99x P/NAV (effectively in line with the underlying NAV), I believe there are other more attractive BDC options out there.