Aerial Photographer

Notes:

I am a director of Borr Drilling Limited (New York Stock Exchange:Bol) so investors should look at this as my update. Previous Post About the company.

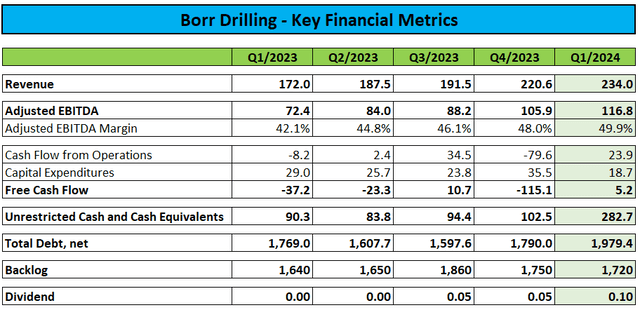

Last month, major offshore drilling contractor Bore Drilling report The first quarter of 2024 performance is as follows: A combination of slightly lower than expected revenue and higher finance and tax expenses:

Company Press Releases/Regulatory Documents

Operating cash flow for the quarter was:Late invoices for certain contractsAs outlined in the press release, the company still managed to generate a small amount of free cash flow, but this was more than offset by $23.8 million in dividend payments and $10.6 million used to repurchase convertible notes.

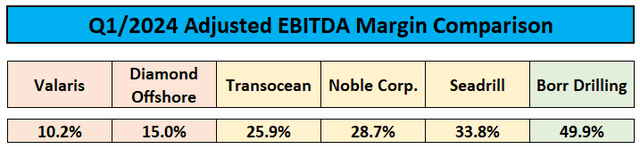

Adjusted EBITDA margin came in at 49.9%, a record high and well ahead of its peers.

Company Press Release

but The company remains heavily indebted.

Bo Drilling ended the quarter with unrestricted cash and cash equivalents of $282.7 million and debt of $1.979 billion, up from $102.5 million and $1.79 billion at the end of last year. issue In February, it issued an additional $200 million of 10% senior secured notes due 2028.

As a result, total liquidity increased to $432.7 million from $252.5 million at the end of the fourth quarter of 2023.

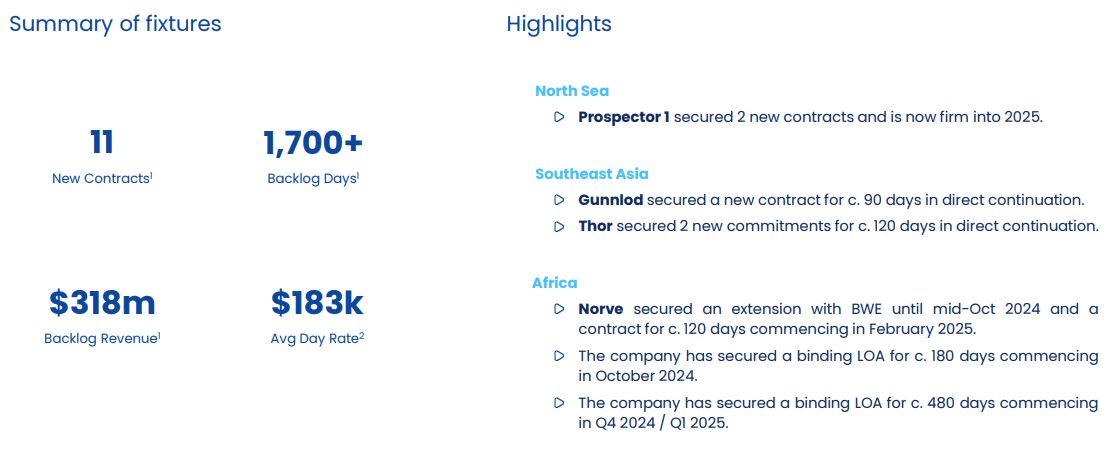

The backlog of orders declined slightly to $1.72 billion. So far this year, the company has won 11 new contracts totaling $318 million, with an average daily wage of $183,000.

Company Presentation

In a press release, Bore Drilling said it recently saw clean day rates of more than $200,000. Announced Binding Award:

Notably, in the second quarter, we achieved our first ever contract exceeding $200,000 per day on a clean day rate basis.

This milestone not only underlines the high quality and excellent operational performance of our fleet, but also positively confirms our view that, despite recent developments in Saudi Arabia, the market remains balanced.

Statements made during the financial results announcement Conference callNew ship rig Vari They are scheduled to be deployed under this contract with delivery scheduled for October.

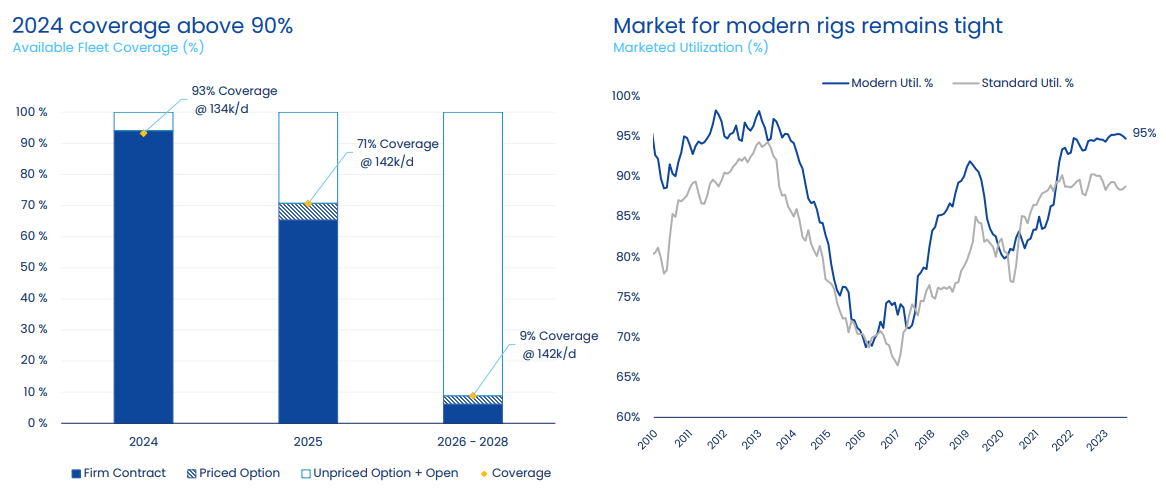

As a result of recent contract awards, the 2024 contract coverage (including paid options) has increased to 93% (previously 87%) with an average daily rate of $134,000.

Contract coverage for 2025 increased from 64% to 71%, and the average daily rate increased from $134,000 to $142,000.

Company Presentation

During the conference call, management said Saudi Aramco’sArmco) recently decided to mothball 22 of Bore Drilling’s jack-up drilling rigs. Arabia I The rig (emphasis added):

From a broader market perspective, utilization rates for modern jack-up drilling rigs remain strong at around 95%, even without taking into account Aramco’s mothballing of 22 drilling rigs, including Arabia I. While some of the mothballed rigs have already been recontracted elsewhere, others may not be competitive in the international market due to their older capacity or the lack of international footprint of their current operators.

About 13 of these rigs are likely to be competitive in the international market, and as a result, operating rates are expected to remain at healthy levels of over 90%. However, we believe this fluctuation in utilization rates is temporary, as increased demand should offset and exceed the number of available drilling rigs in Saudi Arabia. Based on current tenders and discussions with customers, the company continues to forecast an increase in demand of 20 to 25 rigs within the next 12 to 18 months.

In that regard, we are optimistic about our ability to re-contract Arabia I during the third quarter. While we have seen competitor equipment priced below prevailing market prices in some regions, we do not expect this trend to continue for long as fundamentally the jack-up market remains balanced and tight.

The company reiterated its guidance for full-year adjusted EBITDA to be in the range of $500 million to $550 million.

Perhaps most importantly, the company doubled its quarterly cash dividend to $0.10 per share and projects that it will continue to grow going forward.

Finally, reflecting our positive outlook, the Board of Directors has approved a doubling of the quarterly dividend to $0.10 per share. We expect dividends to continue to grow over time, in line with our earnings outlook.

While I’d like to see Borr Drilling focus more on reducing its significant leverage, the strong dividend increase should be viewed as a strong sign of confidence in the company’s prospects beyond 2025.

At current share price levels, the annual dividend yield is 6.5%.

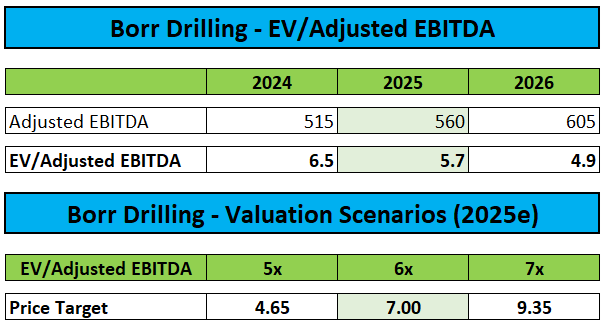

I have increased my estimates due to strong contracting activity so far this year and favorable market commentary from management, but they are still well below our original assumptions given the potential impact to Saudi Aramco.

Company forecasts / Authors’ estimates

While the stock’s industry-leading 6.5% dividend yield is attractive, I will refrain from upgrading the stock at this time due to the limited upside potential relative to my increased $7 price target.

However, if the stock falls below $5.80 again, I’ll have a more positive view on Borr Drilling.

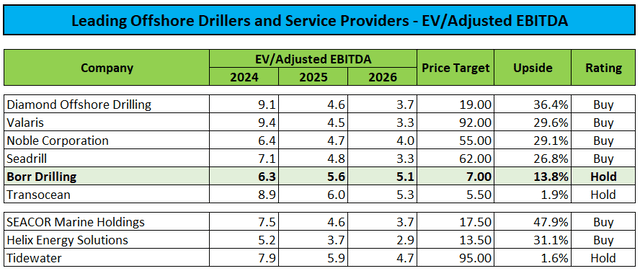

Investors looking to invest in the offshore drilling industry should consider Diamond Offshore Drilling, Inc.do), Valaris (Val), Noble Corporation (Northeast) and Seadrill (SDRL) are both trading at significantly lower forward valuations but have much stronger balance sheets.

Author’s Estimates

Offshore support vessel provider SEACOR Marine HoldingsSMHI) offers even more room for growth.

Conclusion

Bore Drilling reported slightly weaker than expected first-quarter results and reiterated its full-year outlook as management remained optimistic about jack-up market conditions despite the potential short-term impact from Saudi Aramco.

The company has been successful in winning additional contracts at fair rates in recent months, further improving its revenue outlook for the remainder of the year and into 2025.

Reflecting the positive outlook, Borr Drilling decided to double its quarterly cash dividend to $0.10.

While management’s commentary and commitment to returning capital to shareholders are encouraging, my upgraded forecast and price target aren’t enough to lift the stock.

As a result, IOwnershipWe raised our price target to $7 and assigned a “” rating based on the company’s 2025 projected EV/adjusted EBITDA multiple of 6x.

However, I would be more positive on Borr Drilling if the stock price falls below $5.80.