Rear chic

I don’t know about you, but I hate taxes. And if you’re in the minority like me, it’s worth considering a local mandate that gives you a federal income tax exemption. The problem? There are so many options. So why? Why not just invest through closed-end funds? BlackRock Investment Quality Municipal Trust (New York Stock Exchange:BKN) is an income fund that has been trading since 1993 and specializes in tax-free income and asset preservation.

The closed-end fund structure differs from an ETF in that a predetermined number of shares are issued to the public and traded on a secondary exchange. BKN strives to invest at least 80% of its holdings in municipal bonds, which are exempt from federal income tax, but, like most municipal bond funds, does not. Some interest may be subject to the federal alternative minimum tax (AMT).

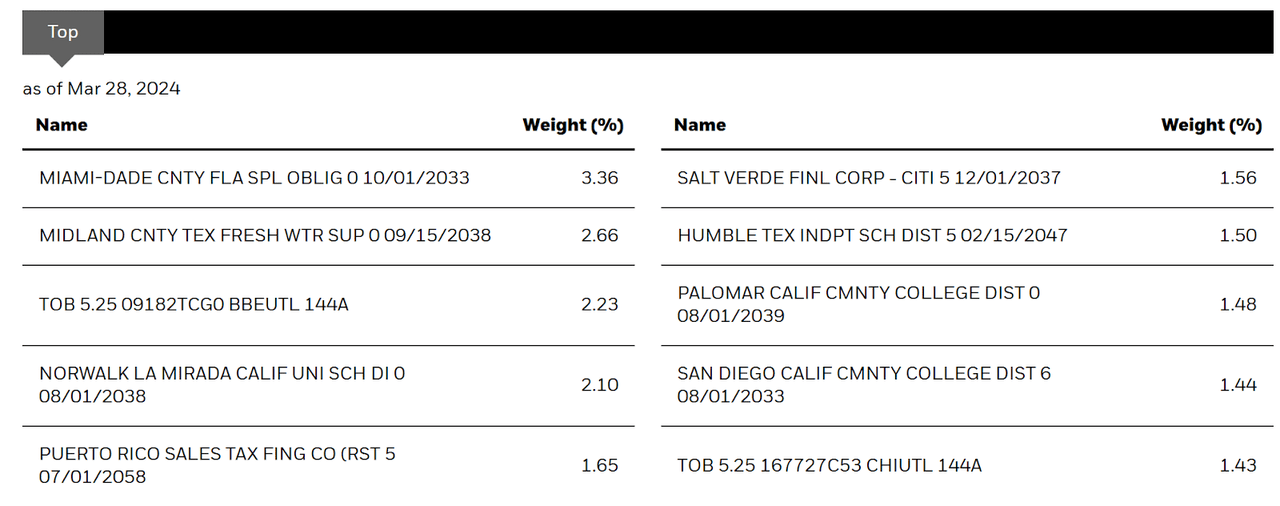

Overview of assets held

No position exceeds 3.36% of the fund, and the top holdings are a perfect example of my earlier point about the world of mini-bonds: I myself wouldn’t even know where to start if I wanted to access these individual securities, much less how to do due diligence on the issuers.

Black Rock

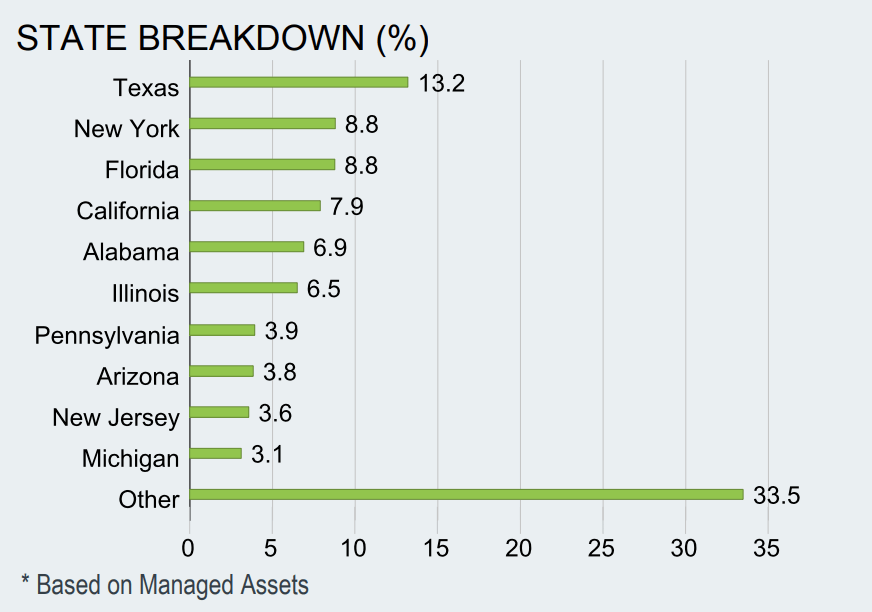

In terms of state allocations, Texas has the largest share, followed by New York and Florida. Texas is clearly in better financial shape, while New York is not.

Black Rock

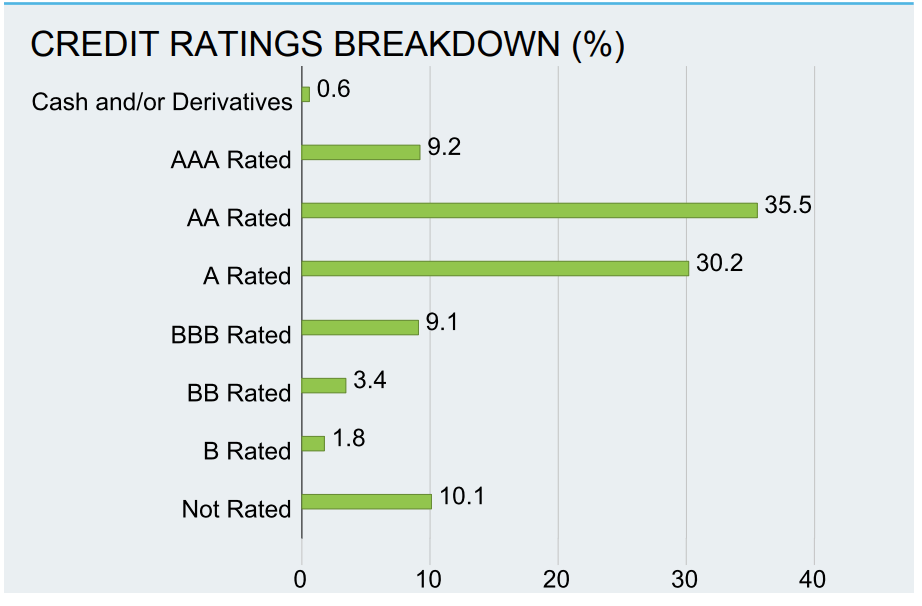

Importantly, credit quality is good overall, with roughly 75% rated at or above A. While the 10.1% allocation to unrateds may be a bit concerning (no one knows the true credit risk), this is a relatively small percentage and is balanced with a lot of high-quality municipal bonds, so I’m not too worried.

Black Rock

Sector Composition and Weightings

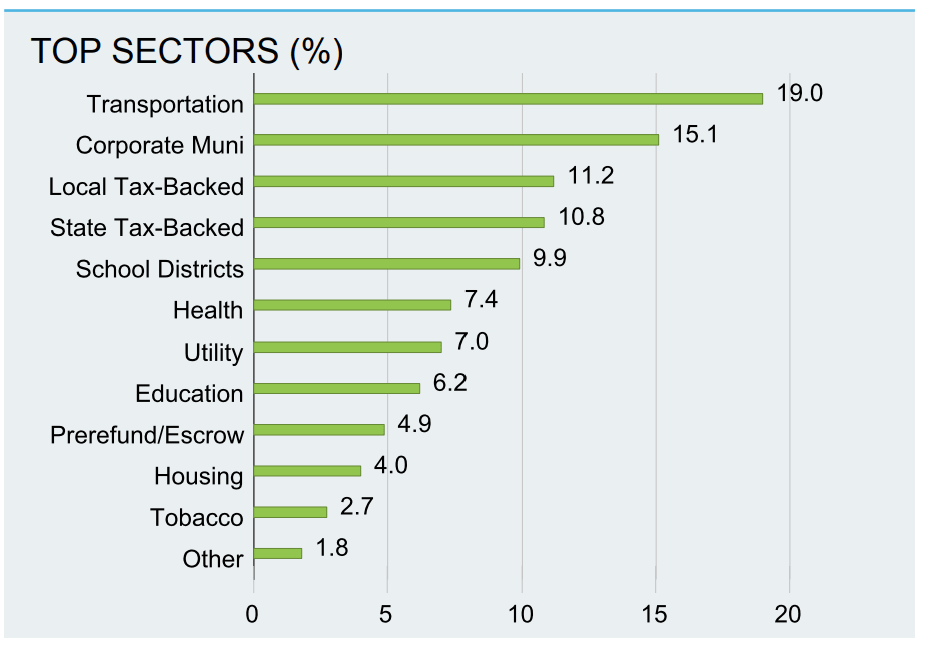

Looking at BKN from a sector composition perspective, we see that it differs from how corporate bonds are categorized.

Black Rock

The transportation sector has the largest allocation at 19%, while corporate muni bonds make up 15.1%. For the other categories, it’s harder to get a sense of where they’re coming from (local and state taxes aren’t detailed from this perspective), but at least this breakdown suggests a well-diversified mix of exposure.

Peer Comparison

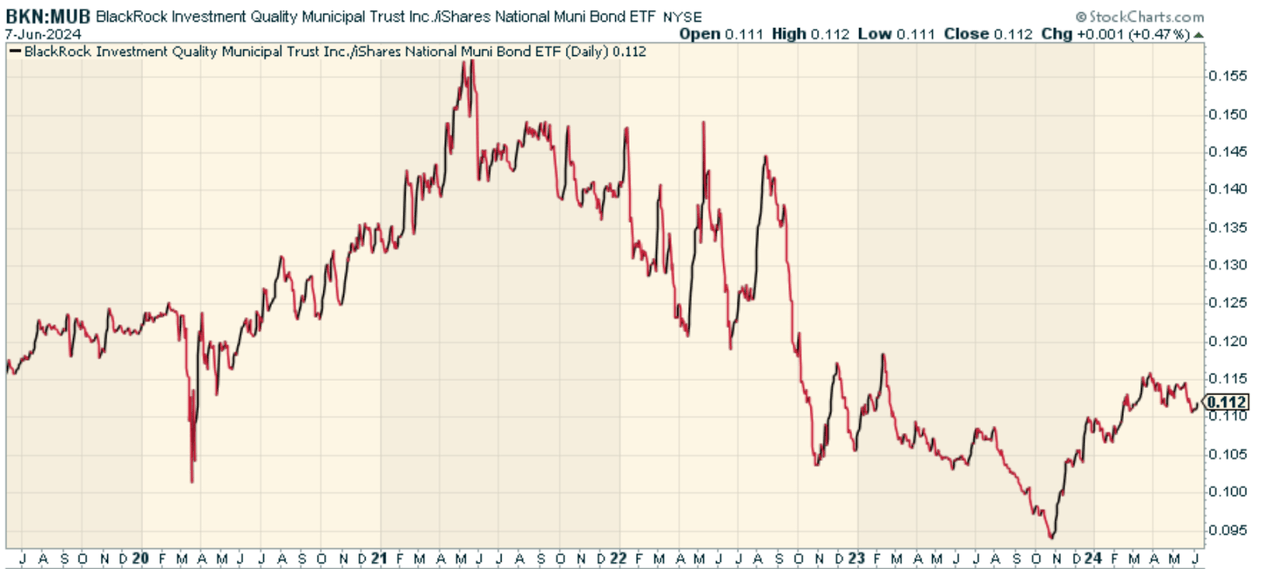

One ETF (that is not a closed-end fund) worth comparing with this is the iShares National Muni Bond ETF (Mubu) is the go-to benchmark in the municipal bond index fund space. They are roughly the same quality. Comparing BKN to MUB on a price ratio basis, we see that BKN lags behind. This is likely due more to BKN’s fees (3.4% total expense ratio) than anything else. Also, keep in mind that closed-end funds can trade at discounts or premiums, adding complexity to thinking about their relative performance.

Stock Chart

Another important aspect of BKN is its use of leverage, which is currently just under 32% and also increases fees in terms of interest expense compared to MUB. This has the dual effect of lengthening the fund’s duration (currently 12.27 years) and adding some extra yield (currently 5.37%).

Pros and Cons

Perhaps BKN’s most valuable long-term benefit is that distributions from the fund are exempt from federal income tax. This tax advantage significantly increases BKN’s overall income potential, making it attractive to those looking to maximize returns and reduce their tax burden.

What’s the real risk here? To me, it’s more the leverage. I’m not that concerned about the credit risk aspect because it’s mostly tax-backed. But the leverage just increases the overall volatility potential.

Conclusion: Leverage tax-efficient income

BKN is a tax-efficient investment with good returns and capital preservation. The overall portfolio composition looks sound and is a much more convenient approach than picking individual securities. Keep in mind that the closed-end fund structure is not ideal. But overall it is a good fund.

Predicting crashes, corrections and bear markets

Predicting crashes, corrections and bear markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing Lead-Lag Reporting, an award-winning research tool designed to give you a competitive advantage.

The Lead-Lag Report is your daily source for identifying risk triggers, discovering high-yield ideas, and gaining valuable macro observations. Stay one step ahead with key insights into leaders, laggards, and everything in between.

Move from risk-on to risk-off with ease and confidence. Subscribe to the Lead-Lag Report now.

Click here to access and try the Lead-Lag report free for 14 days.