Gremlins

The following is an excerpt from This fund letter.

Calgro is a residential property developer focused on affordable housing for the low and middle income market segments in South Africa. The company delivers approximately 2,000-3,000 detached homes. The company builds more than 1000 houses and apartments per year, with developments concentrated primarily in the economic centres of Cape Town and Johannesburg, and also has a growing and promising memorial parks (cemeteries) business.

With a population of almost 60 million and only 6.7 million formal homes, South Africa’s housing shortage is glaring. Developers are delivering 75,000 new affordable homes per year, but this makes little difference to the estimated backlog of 5.5 million homes. The opportunity is huge. Demand remains strong despite a tough economic environment and high interest rates. Banks Financial institutions recognise the value for money that Calgro homes offer and continue to offer 100% mortgage financing to creditworthy buyers.

Calgro currently has nine ongoing development projects that contribute to revenues and profits. At the end of the financial year, it had a pipeline of approximately 23,000 units, a huge number given current volumes. After the reporting period, Calgro acquired a new project in Bankenveld, which significantly expanded the company’s pipeline by another 20,000-30,000 units. At a reasonable run rate of approximately 3,000 units per year, this equates to a pipeline of approximately 15 years.

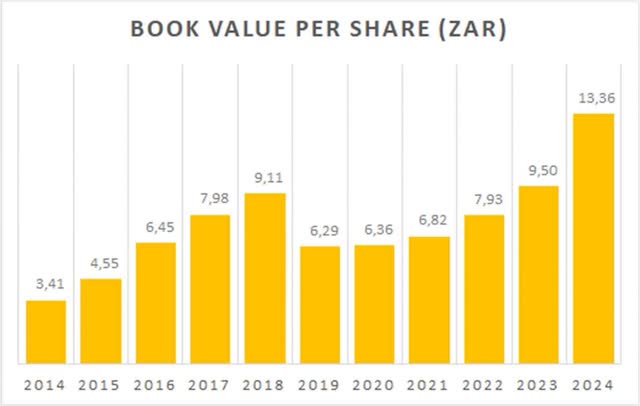

In my dealings with them over the years, and more broadly, the management team has a reputation for competence, integrity and a good work ethic. They have also demonstrated very good capital allocation skills. For example, over the past year, Calgro has bought back 21% of its shares at an average price of R2.92 each, a PE of less than 3 and well below book value. Such buybacks create significant value enhancement for shareholders. The share price is currently around R5.60.

Calgro recently announced its financial results for the fiscal year ending February 2024. The results were impressive.

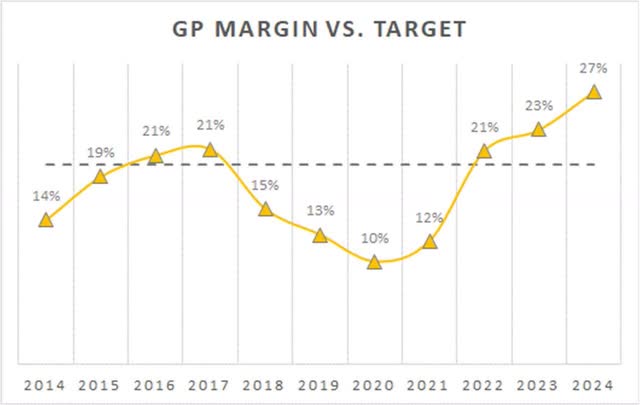

Although sales volumes and revenues declined slightly (for strategic reasons), efficiency and profitability improvements led to higher profit margins.

Gross margin of 27% was above the internal target range of 20% to 25%.

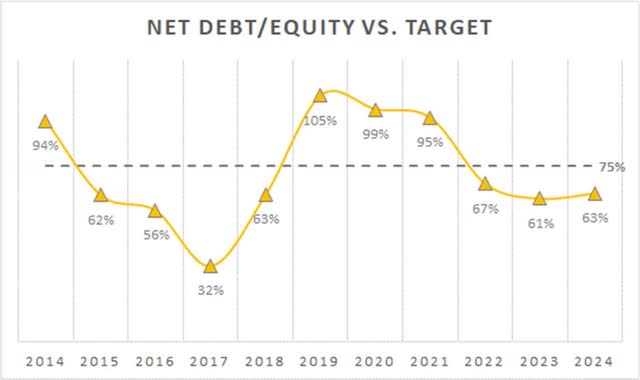

Cash flow was strong. Even after spending cash on share repurchases, net debt-to-equity was 63%, well below our internal target of 75%. Our debt agreements cap our net debt-to-equity ratio at 150%. Our balance sheet is strong.

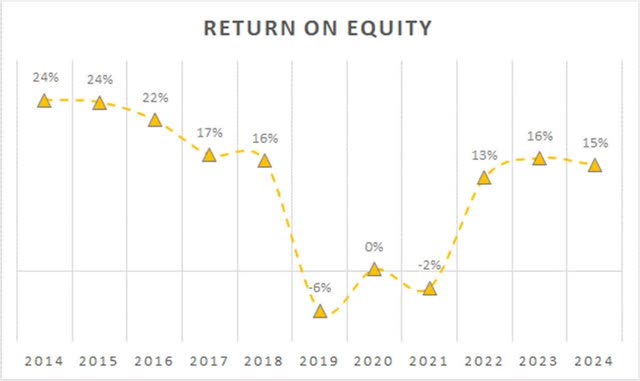

Ending return on equity was 15% and average return on equity was 16%. We expect these figures to stabilize in the 15% to 20% range.

Book value per share increased a solid 41%, helped by share buybacks at steep discounts.

Additionally, higher profits and a lower share count led to a 32% increase in earnings per share.

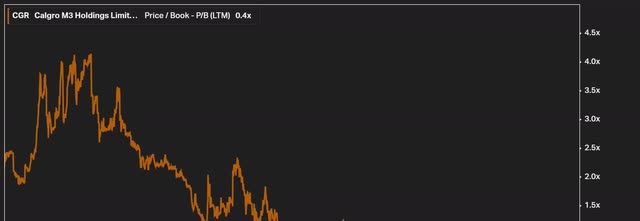

At the current share price, Calgro is trading at a PE multiple of less than 3x and a 58% discount to book value. I think it is reasonable to assume an average return on equity of around 16%. If you invert these numbers and look at it from another perspective, we currently own a business that is growing earnings at around 16% per annum with an earnings yield of 33%. We should be able to make more than enough even if the multiple never expands. However, I believe that at some stage the market will recognize the value of this overlooked gem and the multiple will expand to more reasonable levels. There was a time in the past when Calgro was trading at around 4x book value and a PE multiple of 20x. History shows that these things move in cycles.

We’re not necessarily suggesting the stock price multiple will return to its historic highs, but in a slightly easing interest rate environment, the company’s performance justifies a valuation multiple of at least half of its historic highs, which would mean the stock is 3-4x higher than it is today. Time will tell. For now, I’m willing to settle for a 33% earnings yield generated by a reliable management team backed by a solid balance sheet.

|

Disclaimer This document (the “Document”) has been prepared solely for the use of potential investors in Desert Lion Capital Fund I, LP (the “Fund”) managed by Desert Lion Capital Investment Management, LP (“Desert Lion Capital”) and shall be kept strictly confidential. The recipient agrees that the contents of this document are confidential and that disclosure could cause significant and irreparable competitive harm to Desert Lion Capital and/or its investment vehicles and their respective affiliates. Any reproduction or distribution of this document in whole or in part, or disclosure of its contents, without the prior written consent of Desert Lion Capital, is prohibited. The information contained herein is not intended to be complete, and we are under no obligation to update or revise such information. Other events not considered may occur and may materially affect the analysis. Any assumptions should not be construed as an indication of events that will actually occur. This document does not constitute an offer to sell or a solicitation of an offer to buy, which will be made only upon receipt by eligible applicants of the private placement prospectus describing the offering and the related subscription agreement. Nothing contained herein constitutes investment, legal, tax or other advice and should not be relied upon when making any investment or other decision. All information contained in this document is qualified in its entirety by the information contained in the Fund’s confidential private placement prospectus. Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. This information and other important information about the Fund is contained in the Fund’s offering prospectus. Please read the confidential private placement prospectus carefully before investing. The information in this document is current as of the date stated and may be superseded by subsequent market events or for other reasons. Statements regarding financial market trends are based on current market conditions, which will fluctuate. No representation or warranty (express or implied) is made or can be provided as to the accuracy or completeness of the information in the document. Some of the statements contained herein may contain forward-looking statements. These forward-looking statements are based on current expectations, estimates and projections. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Although Desert Lion Capital believes that the expectations reflected in the forward-looking statements are based on reasonable assumptions, it can give no assurance that such expectations will be achieved. Accordingly, actual outcomes or results may differ materially from those expressed or projected in such forward-looking statements. Desert Lion Capital assumes no obligation to update the forward-looking statements contained in this document. Investing in securities involves significant risks and you may lose some or all of your investment capital. Diversification does not guarantee profits or guarantee that losses will not occur in a market decline. Investors should consider the investment objectives, risks, and fees and expenses of the underlying assets before investing. The views, opinions, and assumptions expressed in this document are made as of the date of this document, are subject to change without notice, may not be realized, and do not represent a recommendation or offer of any specific securities, strategies, or investments. This document does not purport to contain all of the information that may be required to evaluate the matters discussed therein. It is not intended to be a risk disclosure document. Furthermore, this document is not intended to provide a recommendation and should not be relied upon as tax, accounting, legal, or business advice. Persons into whose receipt of this document receive it are encouraged to ask Desert Lion Capital for responses and to obtain any additional information they may require concerning the matters contained herein. The information contained herein has not been and will not be filed with the Securities and Exchange Commission, any state securities law regulator or any other governmental or self-regulatory authority. No governmental authority has not approved, and will not approve, the merits of this offering or the adequacy of this document. Any representation to the contrary would be unlawful. References to the MSCI Emerging Markets Index (“MXEF”) and the FTSE/JSE Composite Index (JSE Alpha Code “ALSH” or JSE Index Code “J203”) are based on published results and are derived from sources believed to be accurate, but have not been independently verified. The MSCI Emerging Markets Index is mentioned because it is an index typically used to measure the overall performance of mid and large cap stocks in the global emerging equity markets of over 24 emerging market countries, including South Africa, China, India, South Korea, Mexico, Taiwan and the United Arab Emirates. MSCI Emerging Markets Index returns include realized and unrealized gains and losses, plus reinvested dividends, but do not include fees, commissions and/or mark-ups. The FTSE/JSE Composite Index is mentioned because it is an index typically used to measure the overall performance of the Johannesburg Stock Exchange as a whole. FTSE/JSE All Share Index returns include realized and unrealized gains and losses, but do not include reinvested dividends, fees, commissions and/or mark-ups. Use of these indexes is not indicative of the asset composition, volatility or strategy of the portfolio of securities held by the Fund. The Fund’s portfolio may or may not include the securities that comprise the MSCI Emerging Markets Index and the FTSE/JSE All Share Index, will hold a significantly smaller number of the various securities that comprise the MSCI Emerging Markets Index and the FTSE/JSE All Share Index, and may engage or engage in fund strategies not employed by the MSCI Emerging Markets Index and the FTSE/JSE All Share Index, such as short selling and the use of leverage. As such, an investment in the Fund should be considered to be riskier than an investment in the MSCI Emerging Markets Index and the FTSE/JSE All Share Index. In addition, indexes are unmanaged, do not incur management fees, costs or expenses, and are not available for direct investment. |

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.