Buena Vista Images/Digital Vision via Getty Images

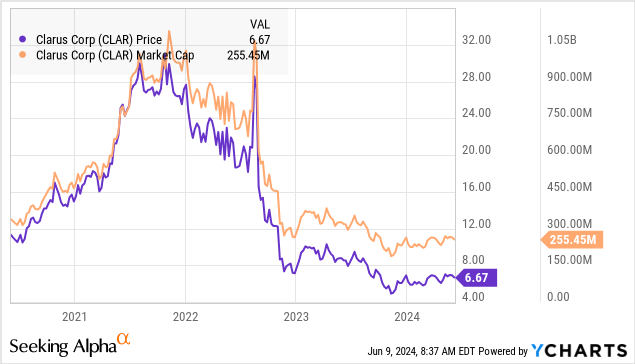

Clarus Corporation stock (Nasdaq:Kraal) has struggled after a pandemic-era surge that sent its shares to a market cap of $1 billion. Its shares have fallen more than 25% in the past year and are on the brink of a deeper selloff. That’s down from a record high in 2021.

The outdoor and adventure gear specialist, known for its leadership in niche areas such as rock climbing equipment, four-wheeler accessories and vehicle storage devices, is trying to cope with changing demand and sluggish sales.

The good news is that the company’s latest results show some signs of a turnaround. Efforts to refocus the business on its core competencies to improve margins point to an improving outlook. With a debt-free balance sheet and rising profitability, CLAR is worth keeping an eye on.

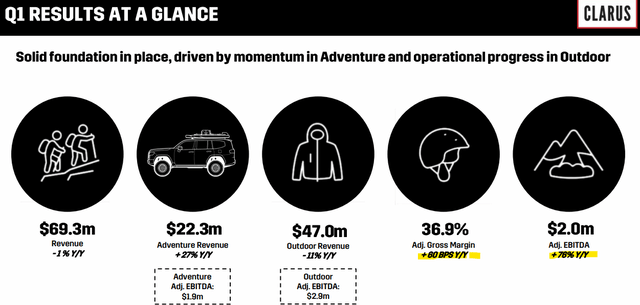

CLAR First Quarter Financial Summary

Clarus reported its first-quarter earnings in early May. One GAAP EPS: $0.57Up from $0.04 in the same period last year. Revenue was $69.3 million, down 1.3% year over year.

Despite the weaker sales, adjusted gross margin reached 36.9%, an 80 basis point improvement from the first quarter of 2023. A change in sales mix and a leaner inventory strategy were the driving forces behind this trend. SG&A expenses decreased 4.1% year over year, highlighting the company’s efforts in cost management.

the result, Adjusted EBITDA Revenue for the quarter was $2 million, up 78% from $1.1 million in the same period last year.

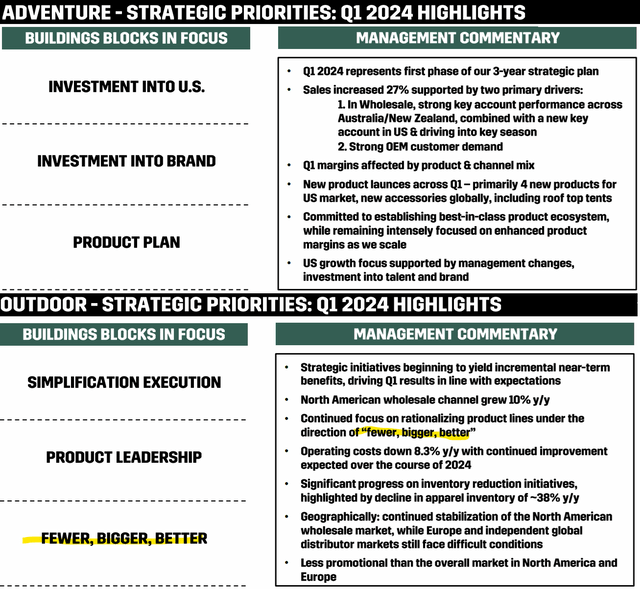

Clarus is looking to strengthen its presence in the U.S., relative to its historically strong position in Europe, where domestic sales rose 17% in the first quarter, helping to offset an 11% decline overseas.

Clarus is moving away from apparel merchandising in favor of higher-value categories, a move that’s part of the company’s “fewer, bigger, better” strategic priority, and it appears to be paying off, especially with signs of improvement in North America, where wholesale activity has picked up.

Management comments at the financial results briefing Conference call Optimism for an improving situation: In its guidance, Clarus is targeting full-year revenue of $270 million to $280 million, a midpoint decline of 4% from 2023. This takes into account ongoing product mix rationalization and the expectation of new business momentum in 2025.

Even more favorably, the company is forecasting adjusted EBITDA of $16 million to $18 million in 2024, which would be a significant improvement over 2023’s result of $1.2 million due to higher margins.

Clarus benefits from a solid balance sheet with $47.5 million in cash against virtually zero debt. The company also pays a regular quarterly dividend of $0.025 per share, which equates to an annualized dividend of about $4 million and a modest yield of 1.5%.

What’s next for CLAR?

When considering where Clarus stock is headed, the first step in any sustained upside would be signs of a return to growth. While the company appears to have had some success achieving profitability in early 2024, stronger operating momentum will be important as a sign of the brand’s health.

The attraction here is the company’s focus on a unique product category within the outdoor and adventure market – ultimately an opportunity to establish itself as a premium consumer option, gaining both a loyal customer base and a reputation for high quality.

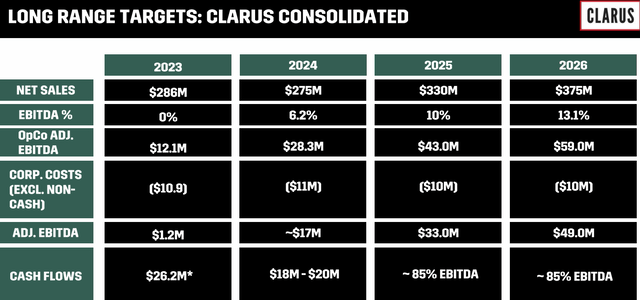

Through implemented strategic initiatives, Clarus has set itself the goal of increasing sales by more than 100%. 30% by 2026 Achieve improved cash flow conversion and increased profits.

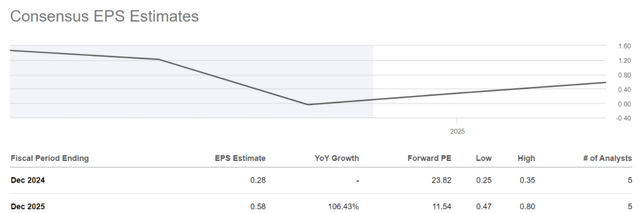

This outlook is starting to shape the current consensus, with the market expecting EPS to more than double from $0.28 in 2024 to $0.58 by fiscal 2025.

A one-year forward P/E of 11.5x is attractive for a company with this kind of growth momentum, and of course, if this trend were to materialize, it could be a powerful tailwind for the stock as part of the bull thesis.

At the same time, we believe a degree of caution is warranted given the level of work Clarus still needs to do. Setting lofty goals is always welcomed by investors, but achieving those goals is easier said than done.

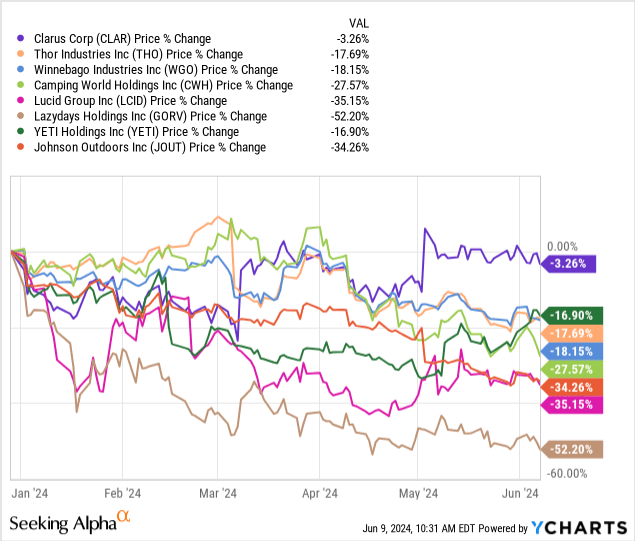

we, Challenging Background In the related “outdoor lifestyle” category, such as the recreational vehicle (RV) market, THOR Industries, Inc.but) have The outlook was lowered. Annual shipments exceed 2 million units.The impression is that high interest rates and persistent inflation continue to stifle consumer demand for these types of discretionary purchases.

Shares in this segment include Camping World Holdings, Inc.CWH), Johnson Outdoors Co., Ltd.Johto), and YETI Holdings, Inc.Yeti) has underperformed the broader market. A risk to consider for Clarus is that economic conditions could worsen, forcing it to reassess its earnings trajectory.

Final thoughts

Clarus is off to a solid start in 2024, but that alone isn’t enough to give me bullish confidence in the stock.

We would like to see this trend continue over the next few quarters and growth stabilize towards more sustainable profitability. For now, I would rate this stock a Hold and will be watching closely for signs of a stronger trend going forward.