Prime Image

Welcome to the latest edition of our Preferred Stock Market Weekly Review, where we provide bottom-up coverage of the trends in the preferred stock and baby bond markets, highlighting specific news and events, and top-down market overviews. We add historical context and themes that we believe are moving the market and that investors should keep in mind. This update covers the period up to the last week of May.

For a look at the broader revenue space, be sure to check out our other weekly updates covering the Business Development Company (BDC) and Closed-End Fund (CEF) markets.

Market trend

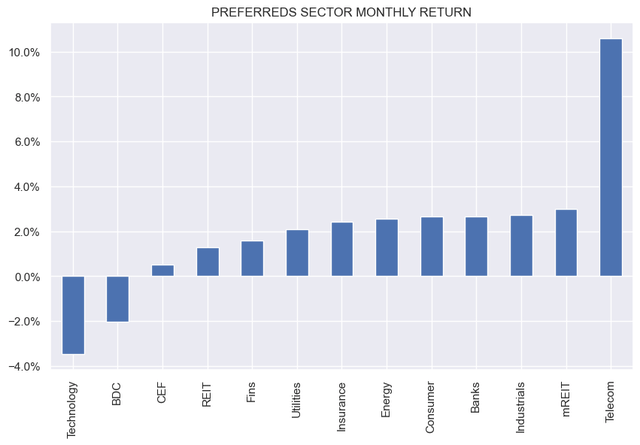

Preferred stocks had a strong week and month with most sectors finishing in the positive, making May the asset class’s sixth best month in the last seven months.

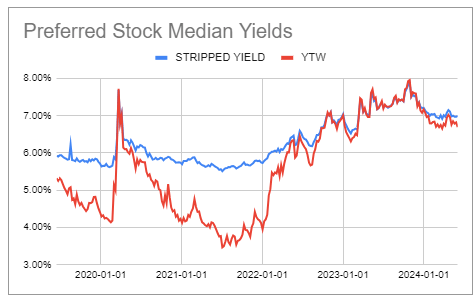

Yields have remained fairly range-bound this year at just under 7%.

Systematic Income Preferred Tool

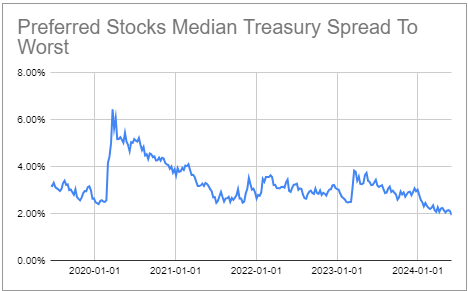

Spreads continue to trade at very tight levels, a trend that is consistent across a broad range of income sectors.

Systematic Income Preferred Tool

Market Themes

BDC Main Street (Major) is offering $300 million in 6.5% bonds due in 2027. While the issuance itself is a great thing, what’s interesting here are two features of the new bond.

First, the bond’s maturity is fairly short at three years, on the short end of the typical three-to-five year range for BDC bonds. Bonds of comparable quality tend to have much longer maturities. Investment grade corporate bonds average duration in the high single digits, roughly double that of a typical BDC bond.

Because the yield curve is inverted, shorter-term bonds tend to offer higher yields, all else being equal — MAIN is paying 0.15-0.25% more for a five-year note, for example — meaning the shorter maturities of relatively high-quality BDC bonds offer investors higher yields in the current environment (not to mention lower interest rate exposure).

The second interesting feature of this bond is its make-whole provision. This is not uncommon in the BDC space, but unusual in the broader corporate bond space. This means that if a company redeems the bond early, it must repay future coupons appropriately discounted. The discount is typically done at a spread below the company’s market spread. In other words, when the bond is redeemed, it will likely be redeemed at a price higher than the bond’s market price, but it may be redeemed at a price lower than the coupon would be simply valued as risk-free.

Because this feature favors the bondholder upon redemption (compared to a traditional call bond), the bond’s yield will be lower than a traditional call bond structure where the bond can be redeemed at par. At the same time, there is a slight chance that the holder could receive a windfall if the company decides to redeem the bond, such as if the company needs to eliminate debt or wants to exchange the bond for another security.

This is the second bond the company has issued this year. Interestingly, MAIN issued a 6.95% 2029 note in January, a five-year note that will likely be used to repay the 5.2% note maturing this year. The use of proceeds for the 6.5% 2027 note mentions repaying credit facilities, which is not surprising given that interest rates on credit facilities are over 7%. Replacing credit facilities with debt is one way companies can manage increased interest expense from debt refinancing (i.e., replacing 5.2% notes with 6.95% notes). However, there are limitations to this, and few BDCs would want to fully replace floating-rate secured loans with debt.

We continue to like the BDC baby bond sector for several reasons. First, book values in this sector are strong, especially compared to other investment company sectors such as mortgage REITs and many CEFs. Second, these companies are subject to the asset coverage requirements of the Investment Company Act, unlike mortgage REITs and the like. Third, most BDCs have secured lending (instruments such as repos and bank loans that take priority over unsecured debt) making up an average of half of their liability profile. This contrasts with mortgage REITs, where secured lending is much larger than the typical debt in the capital structure. In this sector, we like bonds such as HTFC, OXSQZ, and TRINZ, all of which are trading at yields of around 8% or more.