Eonelen/E+ via Getty Images

Co-author: Treading Softly

Passive investing in market-wide ETFs has brought both big rewards and big disasters. Over $7.1 trillion invested in various passive market ETFsThis means: Various indexes have assessed them as being extremely overvalued compared to historical levels. This has allowed millions of Americans to benefit from rising stock prices. However, the question that often arises is whether the value is rising because the companies are valuable or simply because investors are blindly putting their money into these passive market ETFs. Scholars on both sides cite various reasons to argue that either or both could be true.

I use my proprietary income method as a lens to view the markets. I love earning passive income, but most passive market ETFs The income I want. I have to hold the stock and then sell it to get some usable profit. Unrealized profits aren’t real profits until they’re realized. This is why tax authorities don’t go after unrealized profits today, because they can disappear just as quickly as they appeared.

Today I want to examine two funds that I use to generate significant income from different segments of the overall market. These are diversified funds that will provide you with income for a lifetime.

Let’s begin!

Pick #1: PFFA – Yield 9.4%

If I were to manage an exchange-traded fund focused on preferred securities, its structure and strategy would look something like this: Virtus Infrastructure Cap US Preferred Stock ETF (PFFA).

I have mentioned how attractively priced fixed income investments are in the current market conditions. Preferred stocks are a great way to take advantage of the high yields and low prices in the fixed income arena through investments that are likely to remain outstanding for much longer than fixed income investments. Although structurally “equity”, preferred stock receives a predetermined dividend that is not subject to the discretion of the board of directors as common stock dividends are. Dividends are specific amounts, usually fixed, but can also vary. In most cases, amounts owed to preferred stockholders must be paid in full before dividends can be distributed to common stock investors.

Ultimately, you’ll end up with an investment that pays predictable amounts like bonds, but offers higher yields with some of the risks inherent in stocks.

PFFA Because it is structured as an ETF (exchange-traded fund), it has mechanisms in place to ensure it trades close to its NAV, unlike some preferred CEFs (closed-end funds) which may periodically trade at a premium or discount.

Additionally, PFFA uses leverage to enhance returns, targeting 20-30% leverage depending on financial circumstances, which is common in CEFs but rare in ETFs.

Finally, PFFAs are Actively managedManagement tracks the portfolio daily and trades within the portfolio to maximise returns, which has contributed immensely to the outperformance.

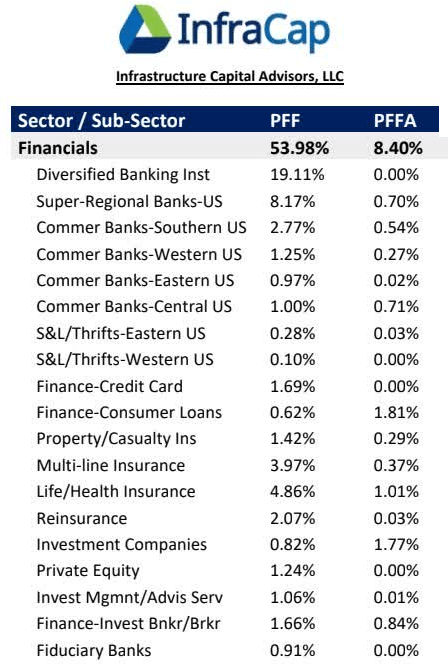

Remember last year when bank stocks crashed and that fear spread to preferred stocks as well? I noted that PFFA has low exposure to the financial sector and very little exposure to banks. In particular, the benchmark preferred stock ETF, iShares Preferred and Income Securities ETF (PFF). We wrote article Emphasize this:

Infrastructure Cap

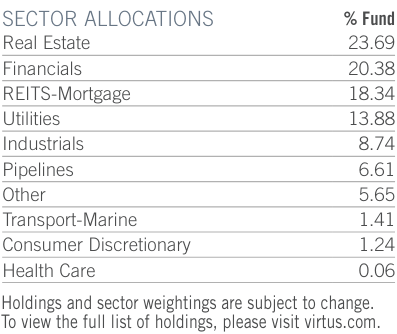

A year later, the percentage of PFFA’s portfolio invested in “finance” has doubled. sauce

PFFA Fact Card

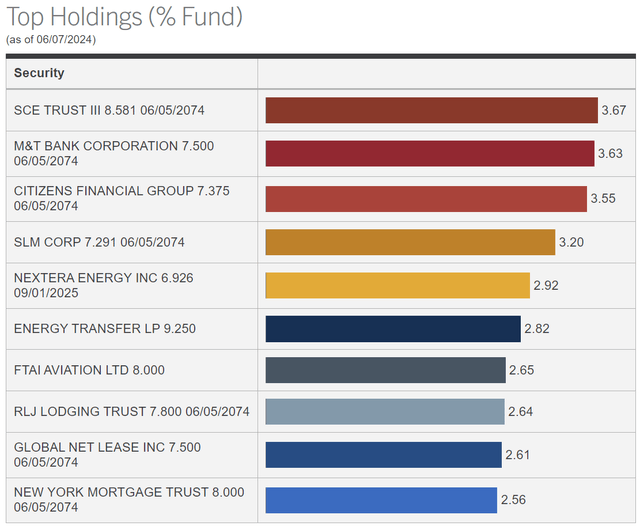

And if you look at PFFA’s current top 10 holdings, there are two banks. sauce

PFFA was not a buyer for banks when prices were high, which helped banks hedge their risk, and was a buyer when prices were low.

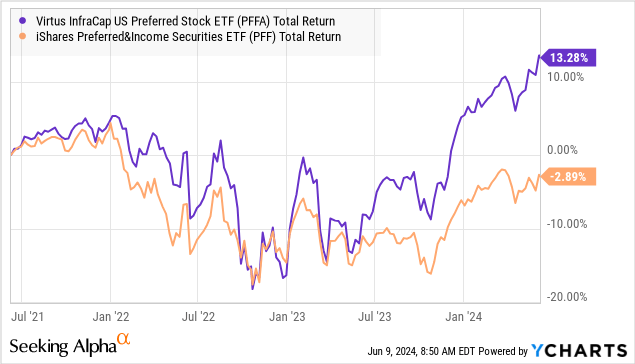

This proactive management has enabled PFFA to significantly outperform PFF over the past three years.

PFFA pays a monthly dividend of $0.1675 per share, which at current prices yields 9.4%. Of particular note is that PFFA is leveraged. As the saying goes, “leverage is a double-edged sword.” In market downturns, all else being equal, leveraged investments tend to underperform. However, even when the preferred stock market is down, PFFA has outperformed. This is because PFFA is actively managed. Management continues to do a great job in tough times. I’m excited to see what they do in the good times.

Pick 2: HQH – 13.5% Yield

abrdn Healthcare Investor (Highest quality) is a CEF formerly known as “Tekla Healthcare Investors”. Aberdeen acquired Tekla and all of its funds. Importantly, there has been no change in management of the Tekla funds. One of the reasons Aberdeen wanted to acquire the company was the skill of Tekla’s staff, who lacked expertise in the healthcare sector.

One thing Aberdeen is trying to change is distribution. Highest quality HQH has a floating dividend policy, paying out a percentage of its NAV each quarter. When Aberdeen acquired the fund, HQH was paying out 2% per quarter. That amount has since doubled, to now pay out 3% of NAV per quarter. press releaseAberdeen said it expects this high dividend level to be maintained for at least another year “barring a material unforeseen change in market conditions.”

The press release further outlined a bullish outlook for the sector in the medium to long term to support dividend growth.

“After a long period of sluggish earnings in this sector, we are seeing increased merger and acquisition activity, successful clinical trials, and approval of certain new products. The recently approved GLP-1 family of products has shown phenomenal success in the treatment of obesity and diabetes, which is a sign of the promise and potential impact the pharmaceutical and biotechnology sectors have on human health and well-being. Additionally, the macroeconomic environment appears to be heading in an improving direction. Rising interest rates, which have negatively impacted growth-related sectors such as biotechnology, appear to have peaked, and we expect to see potential rate cuts thereafter, which will provide a tailwind for the sector. The fund is well poised to take advantage of these trends.”

They also note that a higher dividend payout ratio may lead the fund to trade at a smaller discount to its NAV.

We previously discussed how the distribution policy of a CEF like HQH does not have a material impact on the fund’s long-term total return. The reason is that distributions are deducted from the NAV. If distributions are higher than the total return generated by the portfolio, the NAV will decrease. If distributions are lower than the total return, the NAV will increase. The net result is that shareholders’ long-term return will be a combination of distributions received and changes in the NAV. Because HQH’s policy is variable, distributions will increase or decrease in response to changes in the NAV.

However, what the distribution policy may affect is the premium/discount to the NAV at which the fund trades. Many investors are attracted to higher distributions. If the fund is trading at a discount to the NAV, shareholders can be confident that higher distributions will allow them to derive value.

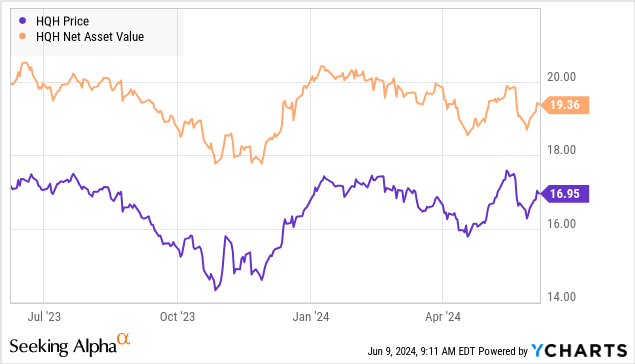

HQH has been priced well below NAV over the past year and is currently trading at approximately a 12% discount to NAV.

What happens if the NAV increases by $1 to $20.36? HQH’s prior dividend pays $0.41, bringing the NAV to $19.95. At a 12% discount to the NAV, the stock would trade at about $17.56. This means that the NAV increased by $1.00, but shareholders have made a total gain of $1.02 ($0.41 dividend + $0.61 price increase).

Under the new policy, if the NAV rises to $20.36 next quarter, HQH will pay a dividend of $0.61, bringing the NAV to $19.75. Assuming the same 12% discount to the NAV, the price would be about $17.38. Thus, shareholders would receive $0.61 in cash and a $0.43 increase in price, for a total return of $1.04. In both cases, the NAV increased by exactly $1.00, but shareholders would get a higher total return due to the increased dividend.

The reason for this difference is that if the price is at a discount to the NAV, any changes in the NAV will be reduced as they are reflected in the share price. If the stock is trading at a premium to the NAV, the opposite is true – if the premium is the same, any increase or decrease in the NAV will be amplified in the share price.

Of course, premiums and discounts are subject to change, and Aberdeen appears to be hoping that the change in distribution policy will reduce or eliminate the discount to NAV at which HQH trades.

We agree with the secular outlook for the healthcare sector, which has underperformed in recent years due to a variety of challenges including high interest rates, high inflation, regulatory uncertainty, and natural fluctuations as the spread of infections slows during the COVID-19 pandemic.

Fundamentally, the long-term demand for health care is very strong and will continue to grow.

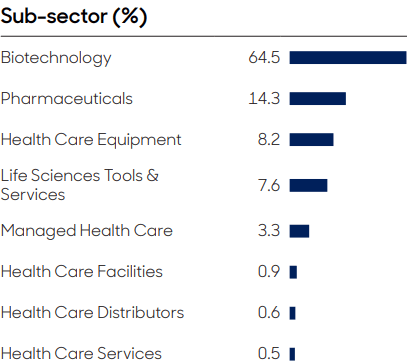

HQH invests primarily in biotechnology and pharmaceuticals. sauce

HQH Fact Sheet

The market has given us the benefit of being able to purchase HQH at a discount to NAV, and the fact that HQH is currently paying a higher dividend helps ensure we earn a total return even if market sentiment towards HQH remains negative.

As income investors, we want to own companies that manufacture things people use every day. Healthcare is something most of us use regularly and prioritize. The market allows us to purchase HQH at a deep discount, and Aberdeen increases the amount we receive, filling our pockets with cash!

Conclusion

By leveraging the skilled managers of HQH and PFFA, you can earn substantial, regular income from a market sector that can provide income for decades to come. When you build a home, you don’t build it with the expectation that it will collapse and fall apart in 12 months. You build it to be lived in and used for decades. The average holding period for investors has decreased from nearly a decade to a few months, or even weeks. The ability to hold anything as a long-term investment has rapidly declined, leading many to build their portfolios as if they were building a shoddy home, with the expectation that their holdings would not even remain intact for a year.

When building a portfolio to cover my retirement expenses, I don’t want to have to rebuild it every 12 months. I want a portfolio that will sustain me through retirement and provide me with a regular income. To achieve this, I hold a minimum of 42 high-quality investments and reinvest 25% of the income I receive back into my portfolio to grow my income streams while I enjoy life to the fullest.

That’s the beauty of my income method. That’s the beauty of income investing.