Hapabapa

Twilio Accelerates GAAP Profitability Growth

Twilio Co., Ltd.New York Stock Exchange:TWLO) shares have been trading above the $55 consolidation zone since February 2024. However, investors seem to lack enough buying conviction to push it further. Previous Bullish TWLO Article I upgraded TWLO in late February. Cautious assessment of TWLO in December 2023 The results have paid off. I argued in February that Twilio’s solid growth profile and relatively attractive valuation were key considerations for upgrading my outlook. Over the past three months, TWLO has underperformed the market, but the selling momentum has also slowed significantly.

Despite relatively attractive valuations, Twilio’s First Quarter Earnings Report The early May 2024 announcement hasn’t given growth investors enough confidence to invest more aggressively. Twilio has been mired in a period of growth normalization since deciding to focus on profitable growth. Twilio GuidanceThe company “advanced its GAAP operating margin target from fiscal 2027 to fourth quarter of fiscal 2025.” Additionally, Twilio also commits to “break even” in its segment business by the second quarter of fiscal 2025. Additionally, Twilio is “on track” with its upgraded $3 billion share repurchase program, repurchasing over $720 million of Twilio stock in the first quarter. Additionally, Twilio expects to complete its remaining $1.5 billion share repurchase by the end of the year. As a result, we believe Twilio has demonstrated strong free cash flow capabilities and net cash balance sheet that allow it to aggressively repurchase shares when assessed to be undervalued.

Despite Twilio’s optimistic outlook and promise of seemingly solid revenue growth, the market remains unconvinced of the company’s recovery. The CPaaS leader maintained its fiscal 2024 organic revenue growth guidance of 5% to 10%. However, Twilio’s second-quarter guidance falls short of expectations This increases Twilio’s fiscal 2024 performance execution risk and calls for stronger performance in the second half of the year.

Twilio must navigate churn headwinds

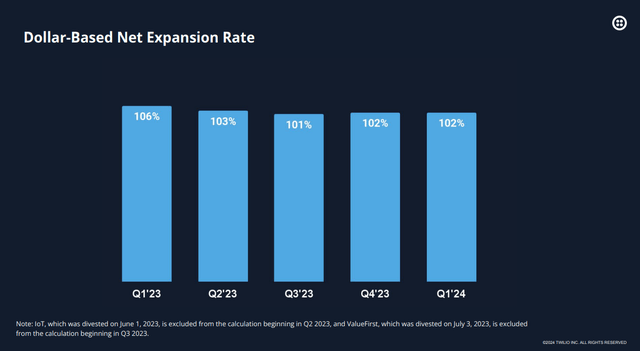

Twilio Net Increase in Dollars % (Twilio filing)

I assess that the market’s concerns about Twilio’s performance are justified. Twilio’s net addition rate is a meager 102%. While we’re seeing some improvement starting in Q3 FY23, this slight improvement doesn’t seem to be enough to convince investors of an inflection point for solid revenue growth.

Twilio boosts AI growth The company is expanding what’s possible by embedding generative AI across its platform, and it is also integrating Segment with other third-party data platforms to enhance Twilio’s CDP capabilities and improve interoperability with data platforms.

Nonetheless, there are concerns about whether the continued defections experienced in the segment business will impact Twilio’s growth inflection point.Customer Relationship Management) Recent earnings announcements also dampened market confidence. Salesforce’s near-term AI monetization outlookAs a result, concerns that Twilio may face higher execution risk in the second half of the year were justified as management maintained its full-year outlook.

TWLO shares are very attractively valued

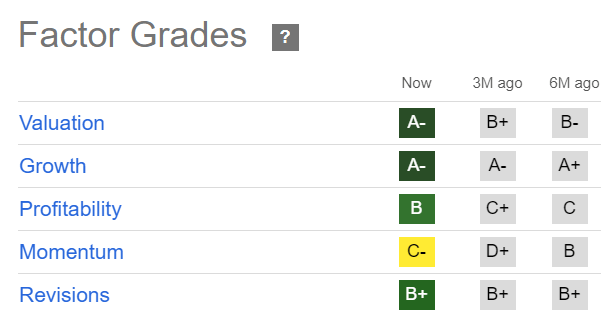

TWLO Quant grade (Seeking Alpha)

But the market is not stupid. TWLO’s valuation remains very attractive (‘A-‘ valuation grade) and has improved over the past 3-6 months. Additionally, Twilio’s focus on profitable growth should maintain the support of GARP investors, justify Twilio’s CPaaS leadership, and validate its business model. Additionally, TWLO’s ‘C-‘ momentum grade has improved over the past three months, indicating a notable decline in sell-off momentum.

I felt the market was too pessimistic about Twilio’s growth prospects. TWLO’s Forward Adjusted PEG Ratio is only 0.6. This therefore represents a discount of about 70% compared to the sector median for TWLO, highlighting the divergence in TWLO’s valuation. Wall Street raises Twilio profit estimatesThis reinforces the market’s confidence that Twilio can maintain its profitability trajectory.

Therefore, despite TWLO’s underperformance in the near term, I believe it offers an attractive risk/return profile for long-term investors at current levels.

Should you buy, sell, or hold TWLO stock?

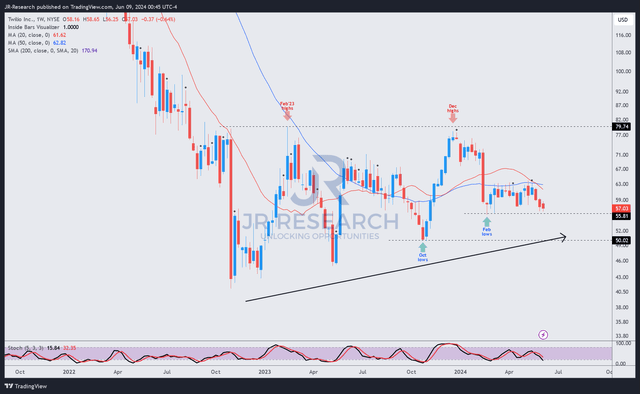

TWLO Price Chart (Weekly, Medium Term) (TradingView)

TWLO price action indicates that sell digestion from the February 2024 highs has been well supported above TWLO’s $55 price over the past three months. This is an important observation as it indicates that buyers buying low are likely adding to their holdings. This therefore justifies my observation of TWLO’s relatively attractive risk/reward potential as mentioned above.

TWLO has continued to make higher highs and lower lows since the October 2022 bottom, which is crucial in validating the theory of a continued uptrend thereafter.

Despite my optimism, the market’s downgrade in TWLO’s growth thesis is justified given the relatively weak outlook. Combined with near-term bearish sentiment on Twilio’s ability to more strongly monetize AI, I expect buying interest to remain subdued.

Nonetheless, I view TWLO’s consolidation (flat price movement) as constructive, and therefore should provide more confidence for high conviction TWLO investors to take advantage of the short-term pessimism in the market and buy more shares.

Rating: Maintain Buy.

Important Note: Investors are cautioned to conduct their due diligence and not rely on the information provided as financial advice. Consider this article as a supplement to your required research. Always exercise your independent thinking. Please note that unless otherwise specified, ratings are not intended to indicate specific entry/exit timings at the time of writing.

I want to hear your voice

Do you have any constructive comments to improve our paper? Did you find any significant flaws in our findings? Did you spot any important points that we didn’t notice? Do you agree or disagree? Please comment below to help everyone in the community learn better.