Ellavau/E+ via Getty Images

Investment Thesis

Snowflake (New York Stock Exchange:snow) is in an unfamiliar place today.

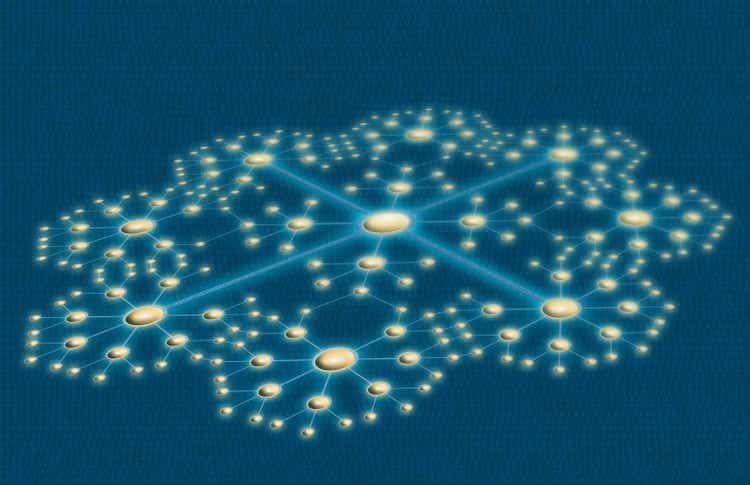

The maker of cloud data services and products is seeing a slowing pace of growth for its widely acclaimed cloud data product platform of the same name. That’s a big change from the days when the company was nearly doubling its revenue every quarter. Then, in a shocking announcement, former CEO Frank Slootman surprised investors by announcing his sudden retirement. The market hasn’t taken kindly to the latest developments, with shares down 34% year to date.

The market sold Snowflake in the first half of 2024 (SA)

The company announced that Sridhar Ramaswamy, founder of Neeva, a law school-based search technology product startup that was acquired by Snowflake about a year ago, will lead the company in its next phase. But as the chart above shows, investors seem to be discounting the CEO change amid a falling stock price.

Further exacerbating Snowflake’s plight is Cybersecurity-related incidents from last week.

There has been a lot for me to digest and analyze over the past few months. FY24 Analyst Day I provided plenty of information about the product roadmap and strategy, and last week’s analyst day commentary was enough to back up my analysis.

I recommend buying Snowflake shares here.

Snowflake’s transition to a true data services company

in My first interview with SnowflakeI recommend a neutral view on the stock. “Snowflake has a lot to prove or lose in its next phase of growth.” Ironically, this was two weeks before the shocking CEO transition. In that post, I said:

With automation and AI now taking center stage, businesses across the globe are reassessing their long-term strategies to survive in the new world. Snowflake appears to be leaning towards providing more ways to access the data on its platform.”

Their Analyst Day presentation seemed to live up to my previous expectations of more avenues of data access that I spoke about in my last post.

First, it is necessary to revisit Snowflake’s revenue generation mechanisms, which are the basis of Snowflake’s product strategy outlined during its Analyst Day, and their expected revenue impact.

Snowflake is in the business of providing cloud-based solutions that collect data for its customers, and then delivers it to them on demand, regardless of their location or infrastructure. But it’s important to remember that the company makes money not just on the amount of data stored, but also on the amount of data queried or transferred. The more data consumed from Snowflake’s servers, the more revenue Snowflake makes from its customers. Here’s an excerpt from the company’s statement: Latest 10-K:

The majority of our revenue is derived from fees charged to customers based on the compute, storage, and data transfer resources consumed on our platform as a single, integrated service. For compute resources, the consumption fee is based on the type of compute resource used and the duration of usage, and for some features, the amount of data processed. For storage resources, the consumption fee is based on the monthly average terabytes of all customer data stored on our platform. For data transfer resources, the consumption fee is based on the number of terabytes of data transferred, the public cloud provider used, and the region in which the transfer occurs.

Therefore, I think it is very important for Snowflake to provide more ways for its customers to access the data stored in Snowflake.

So far, as Snowflake acquires more customers for legacy database systems, they will be primarily focused on cloud migration type workloads, i.e., migrating data from legacy on-premise systems to Snowflake’s cloud storage. However, Snowflake’s planned suite of products for FY25 looks very promising to me, given the company’s consumption revenue model.

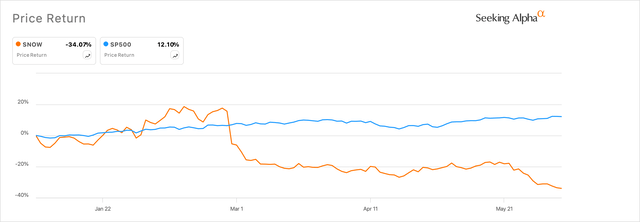

Exhibit A: Snowflake’s product lineup beyond FY2025 to further drive consumption revenue growth (2024 Analyst Day, Snowflake)

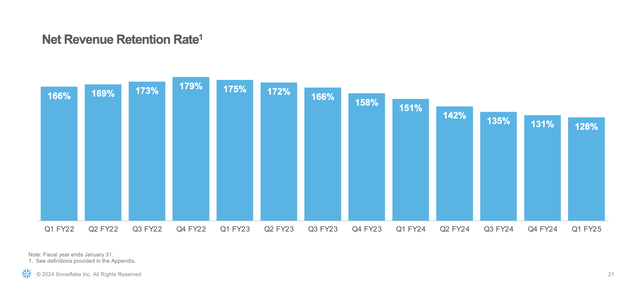

What particularly struck me was the management’s comment that they designed the product around data consumption. Cortex AIListed in Exhibit A above, Iceberg, Unstructured Data, and Snowpark are all designed for heavy query-driven workloads and therefore will see heavy usage, while the other products are lighter query oriented, broadening the dimension of use cases in which customers’ data in Snowflake can be used. As the company’s products move through the adoption curves of their respective product lifecycles, it would not be surprising to see their industry leading NRR (Net Retention Rate) start to rise again.

Exhibit B: Snowflake’s quarterly net retention rate (Q1 presentation, Snowflake)

Historically, cloud migration workloads have made up the majority of Snowflake’s workload types as cloud data companies have continued to win customers away from traditional database software. But with Snowflake’s new product launches, I think Snowflake is broadening its range of use cases and giving customers more options to run a wider range of workloads, especially around AI, application, and collaboration workloads.

To me, this suggests that the revenue-per-query strategy will pave the way for further growth in consumption revenue, and that the land-and-expand model may start to deliver even higher results for the company. I also note that the current product roadmap is largely aligned with the vision of the new CEO, a former Google executive who also founded Neeva, a GenAI-based search company that was acquired by Snowflake last year.

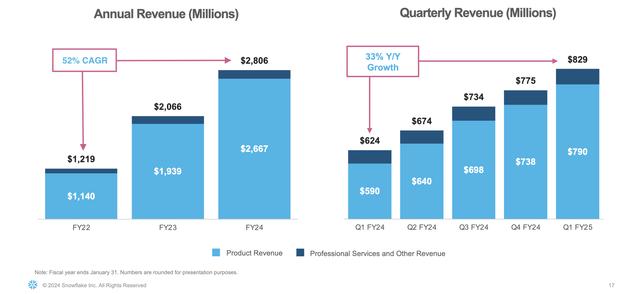

So far, Snowflake has shown a +50% CAGR in revenue (see Exhibit C below), but as the company gets bigger, I expect growth to normalize to a 25-26% CAGR over the next three years, which is slightly higher than the 24% CAGR rate I originally assumed in my previous article on Snowflake.

Exhibit C: Snowflake Annual and Quarterly Revenue Trends (Q1 Presentation, Snowflake)

We believe that increased product adoption and expected rise in NRR will drive consumption, which will ultimately pay dividends as the company grows at this pace.

Despite recent rumors of a software spending slowdown, TAM is growing

Recent comments from cloud software companies such as Salesforce (Customer Relationship Management) and MongoDB (M.D.B.S.) drove Snowflake’s shares lower further in May as rumors of a slowdown in enterprise cloud spending gained momentum.

At the same time, Gartner Public Cloud Spending Report A few days before Salesforce’s fiscal first quarter 2025 earnings report, Gartner’s cloud spending report for the first half of 2024 noted that 2024 is expected to see a slight increase compared to the previous report. Second Half Report 2023In fact, projected spending on SaaS + PaaS is expected to remain largely unchanged compared to Gartner’s H2 2023 report.

Returning to the broader commentary from other cloud companies’ earnings calls, I believe investors may have been too optimistic about cloud companies in general in Q1. At the same time, in my view, Q1 tends to be a generally weak quarter for most cloud companies, and the market has defied the trend in light of the optimistic outlook attributed to GenAI.

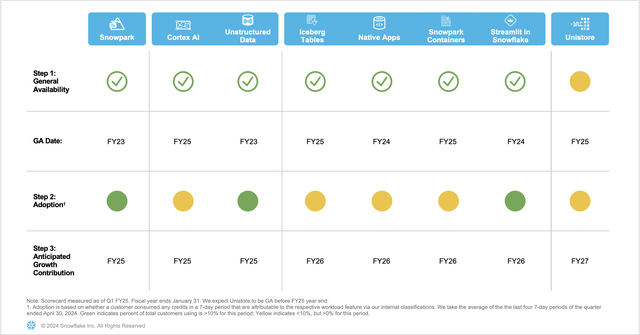

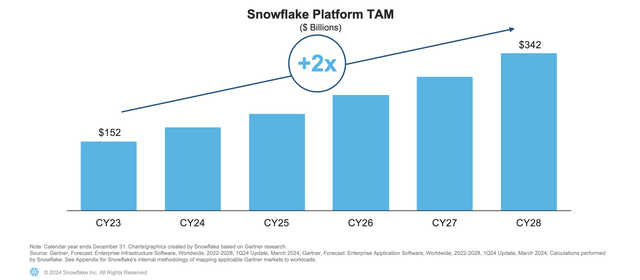

Additionally, at Snowflake’s Analyst Day, management updated the TAM based on the product roadmap and the general availability of those products (detailed in Exhibit A).

Management’s latest TAM has been added as Exhibit D below.

Exhibit D: Management Projects Snowflake’s TAM to Grow to $342B in 2027 (2024 Analyst Day, Snowflake)

As shown in Exhibit D above, the Company’s TAM is expected to grow at a CAGR of 17.6% over the next five years. Compare this to the Company’s previous TAM detailed in its FY23 Analyst Day slides (Slide 41), and TAM CAGR expanded by 1.9%.

To me, this signals a larger market for Snowflake to capture, given that the scope of use for its products is now much broader.

Snowflake price target increase

I currently believe Snowflake is poised for some upside based on management’s product roadmap and overall market expectations.

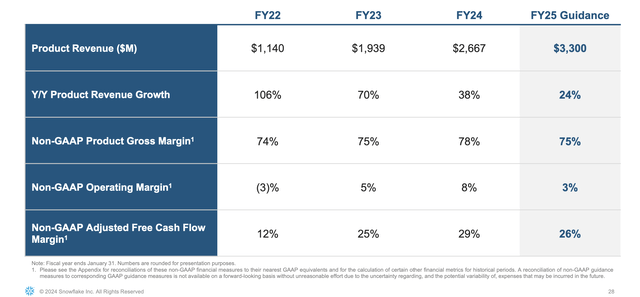

Exhibit E: Snowflake Management’s FY25 Guidance (First Quarter Presentation, Snowflake)

My assumptions about Snowflake are:

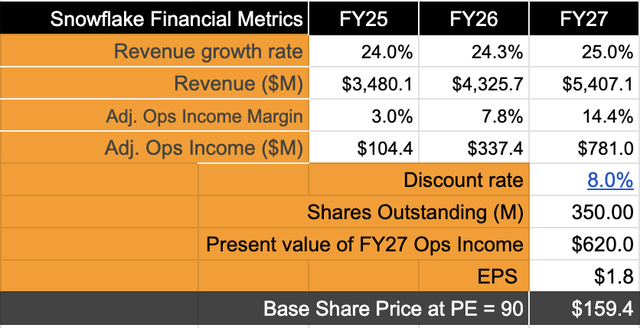

- For revenue, we already stated our assumption of 25-26% compound growth in the previous section. These expectations are higher than our previous assumption of a long-term CAGR of 24%.

- In terms of adjusted operating margins, management expects adjusted margins to decline to 3% in FY25. This is because the company is operationalizing the cost of acquired GPUs rather than leveraging the costs as most of its peers do. However, management has suggested that by owning these GPUs, it is looking to deploy them for inference workloads. In my view, this one-time hit to operational costs will translate into significant margin expansion going forward. As per my estimates, I believe the company’s adjusted operating margins will grow at a compound annual growth rate of around 50%.

- I assume a CAGR of approximately 2.5% for dilution, but the discount rate is based on my calculations. here.

Exhibit F: Snowflake’s valuation model shows an upward trend (Author)

Based on this, I believe the company currently warrants around 90x forward P/E, which is more than half of the forward P/E+200 where it is currently trading.

This would represent an increase of at least 20% from current levels.

Risks and other factors to consider

Databricks is considered Snowflake’s strongest competitor. Reports FY24 Revenue of $1.6 Billionwith 50% year-over-year growth. The startup’s operating leverage profile is unknown, but compared to Snowflake’s 36% revenue growth in the same reporting year, Databricks has an edge over Snowflake in terms of revenue growth. This will be an important area to watch going forward, as Databricks will compete for investor capital while targeting Snowflake’s target market. The data startup is It is widely expected to be listed soon.

I also want to address the risk posed by the Snowflake hack I mentioned earlier. At this point, based on the information we have, I don’t think it’s a significant issue for Snowflake. The hack appears to have been an error on the part of Snowflake’s customers who didn’t have MFA turned on. Google’s Mandiant has charts How an attacker gained unauthorized access to a public Snowflake instance via a compromised device on a customer’s end user account. This indicates a security lapse on Snowflake’s customer side or in the security policies that Snowflake customers should implement. In my opinion, this incident does not indicate a lapse on Snowflake’s side. However, this may impact stock price in the short term and assuming there are no further updates on this front, I do not believe there will be any material impact on Snowflake.

Notes: Databricks plans to launch its own products. Product launch event to be held in San Francisco from June 10th to 13th this week.

remove

Investors have a number of reasons to be pessimistic about Snowflake: The company’s sales have slowed and its former CEO suddenly left the company, which may have left investors feeling abandoned even as they hold the stock at a relatively high valuation.

Based on my model, I expect the valuation premium to decline further over time, but I expect the decline in the premium to be driven by a fantastic product lineup that leverages the company’s core consumption-driven revenue model, complemented by stable sales growth and stronger earnings growth.

I am encouraged by the insights revealed during Snowflake’s analyst day and have upgraded the stock to a Buy recommendation.