PM image

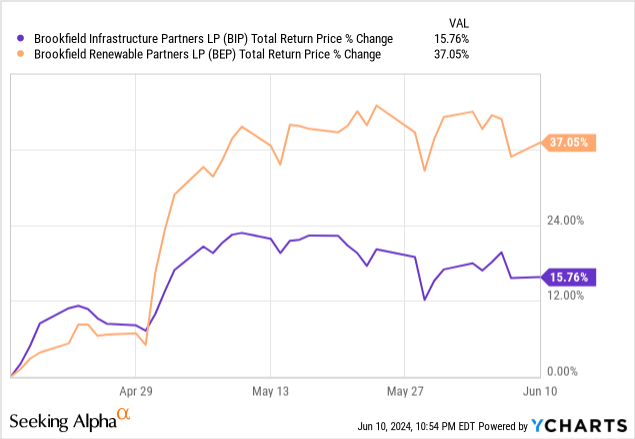

After crashing earlier this year in the high yield bond market, many of my holdings have recovered in recent weeks and months. Some of my favorite investments include: Buy aggressively on dipsLike Brookfield Renewable partner(Beppu) and Brookfield Infrastructure Partners (VIP) has recovered sharply and delivered attractive returns in a short period of time.

Nonetheless, there are still some very attractive dividend stocks with solid dividend growth momentum but at contained valuations. In this article, we’ll discuss two stocks that are particularly appealing to risk-averse income-oriented investors, especially retirees, and another that’s a bit more speculative for those willing to take on more risk for the higher current yield and total return potential.

Real estate income (oh)

The first stock I find attractive right now is Realty Income. Offering a 5.9% dividend yield, the company has recently retreated from short-term gains, losing 14% over the past year and nearly 25% over the past five. Despite the stock’s sluggish price, dividends and FFO per share have been steadily increasing. The balance sheet also remains strong with an A-minus credit rating, and the portfolio is increasingly diversified.

The company Recently Boosted The company updated its investment guidance, now expecting investments to reach $3 billion in 2024, up 50% from its previous forecast of $2 billion, primarily due to an improving environment in Europe, where the European Central Bank’s recent interest rate cuts should provide further tailwinds for the company as it continues to grow there.

Though the market values it as a solid company with growth slowing due to high interest rates, Realty Income has defy economic gravity and continues to deliver solid growth per share and higher monthly dividends than ever before.With such an initial yield and the low risk profile offered by the company’s business model and balance sheet, it’s hard to argue against adding Realty Income to a retirement portfolio.

Enbridge (ENNB)

Another stock facing headwinds from rising interest rates is Enbridge. It has a dividend yield of about 7.5%, has nearly 30 consecutive years of dividend increases, is rated BBB+ by S&P, has little exposure to commodity prices, and about 95% of its counterparties are investment grade. Dream retirement stocks All of the following conditions are met:

1. Defensible and durable business model

2. Strong balance sheet

3. Safe and growing dividend payments

4. The current dividend yield is very attractive

Additionally, the company recently acquired Dominion Energy (is) has further strengthened its regulated business, making it an even more attractive choice for income-focused investors, while it expects EBITDA to grow at about 5% CAGR over the long term and is targeting dividend growth of 3-5% per year for the foreseeable future.

EPR Properties (European Commission)

Finally, EPR Properties is an attractive investment opportunity for investors who don’t mind taking on some risk. In particular, the company offers an attractive monthly dividend with a forward yield of 8.5%. Earlier this year, management expressed great confidence in the safety of the dividend and raised it by 3.6%, a significant increase given the already high yield.

The main risk here is the possibility of AMC Entertainment going bankrupt.AMC) is one of EPR’s major tenants. However, the recent recovery in meme stock has allowed AMC to issue stock, pay down debt and mitigate some of its bankruptcy risk. Additionally, EPR maintains that its lease with AMC is structured to withstand tenant bankruptcy, and it expects year-over-year growth in adjusted operating income of just over 3% in 2024. EPR is also reducing its exposure to lower quality assets through divestitures and diversifying away from theaters by acquiring a range of experiential and entertainment assets.

With the stock trading at just over 8x AFFO, EPR could provide significant upside for investors if it can navigate its high exposure to AMC, given that its three-year average P/AFFO multiple is 10.1x, its five-year average P/AFFO multiple is 11.6x, and its ten-year average P/AFFO multiple is 12.6x. This means that if EPR can restore some market confidence by navigating the AMC risk, shareholders could expect 25%-50% upside from expanded valuation multiples alone.

Investor View

Through Realty Income, Enbridge and EPR Properties, investors have access to high quality investment grade real asset businesses that offer very attractive current yields with dividends that grow at or above the rate of inflation. Meanwhile, the share prices of these companies remain suppressed primarily due to high interest rates over a prolonged period, meaning that if this situation were to change, the share prices could skyrocket. As a result, now is a great time to buy these stocks, with O and ENB more attractive to risk-averse investors and EPR more attractive to more aggressive investors.