Lido Franz/iStock via Getty Images

CEO Tim Cook gave it his all. Apple. (Nasdaq:AAPL) Earnings and triggered blue vertical lines, buy signals are displayed in both the daily and weekly reports below.Both short-term and long-term signals The target is to test the $190 resistance.

The launch of the new ultra-thin iPad helps bring continued good news. And we can expect more news about AI soon. Finally, the iPhone 16 was launched just to keep AAPL alive with the dream of still being a growth company. Revenues have not grown much over the past year. Investors love its massive free cash flow and share buybacks, but Warren Buffett just sold part of his position in AAPL and chose to use it as a source of capital.he still has huge position AAPL and made great profits.

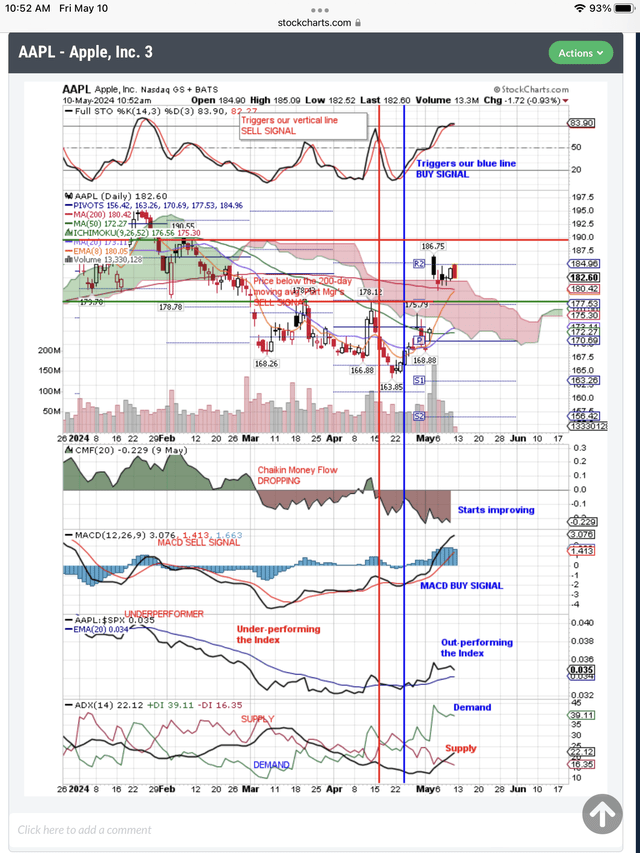

This is a daily chart and I have drawn a blue vertical line buy signal triggered by a full stochastic signal at the top of the chart.

AAPL daily chart AAPL buy signal before earnings announcement (StockCharts.com)

As you can see on the daily chart above, other signals confirm the buy signal on the blue line. Chaikin Money Flow (CMF) is improving and a change in direction is important. MACD crossover, a buy signal occurs near the blue line. Similarly, AAPL switches from stocks that underperform the index to stocks that outperform it around the blue line. Additionally, the ADX signal at the bottom of the chart indicates that demand is occurring above the falling supply line and near the blue line buy signal.

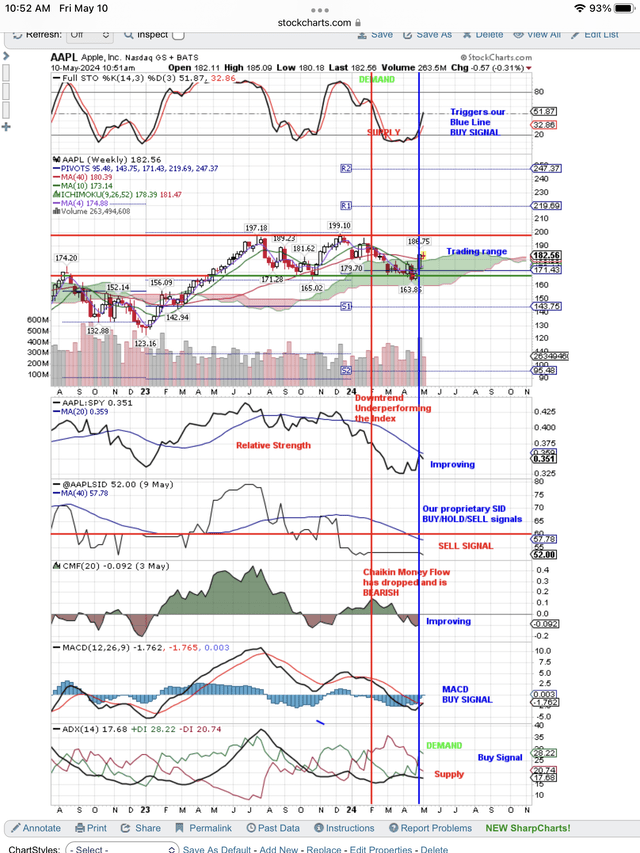

Next, let’s look at buy signals on the long-term weekly chart. This indicates that the gap on the daily chart may not close in the short term. On the contrary, the positive news regarding AAPL could continue to push the price up to $200. This is a weekly chart and the signal at the top is triggering the blue vertical line buy signal.

AAPL weekly chart Buy signal aiming at the upper end of the trading range at $190 (StockCharts.com)

In the chart above we can see positive signals, especially buy signals on MACD and ADX. However, there are some caveats. It is his unique SID cell signal that uses both fundamentals and technicals. Our SID signal has a fundamental bias against overvalued stocks.

We perform due diligence by checking SID signals against Seeking Alpha’s quant scores. The SA quant grade gives AAPL an “F” grade. evaluation. This confirms our own fundamental view of AAPL. Additionally, SA gives her AAPL a “D+”. growth. This is a deadly combination. An “A” for growth and a poor rating are typical of aggressive growth stocks.

AAPL is a blue-chip company, not an aggressive growth company. SA gives AAPL an “A+” Profitability And B- revisionThis is typical of blue-chip companies with good earnings but no aggressive growth prospects. But a good company shouldn’t earn an ‘F’ on valuation, and that’s a big problem for AAPL, especially if the market turns from bullish to bearish.

Meanwhile, enjoy the technical buy signal on the chart and the move that AAPL is about to make to the top of its trading range.