Ninitta

BP stock’s high yield and low P/E ratio

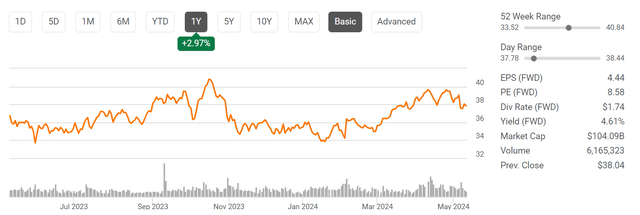

blood pressure(NYSE:New York Stock Exchange:blood pressure) The stock price has been almost flat recently. As you can see in the chart below, the S&P 500 only gained about 3% last year, while Best year with more than 20% profit. There are certainly good reasons for this delay, some of which I’ll touch on later. Despite some headwinds on the profit front, BP has been improving its finances. The purpose of this article is therefore to argue that price stagnation and improving financial conditions have combined to produce a substantial value-price gap and a highly asymmetric return-risk profile.

Reflecting this combination, BP’s dividend yield is close to 5% (4.61% to be exact), and as you can see from the chart, its FWD P/E ratio is just 8.58x. On top of that. When I see such a combination of high yield and low P/E, my experience tells me that I should immediately check his two potential pitfalls:

- Risk of dividend reduction in the near future.

- The risk of acquiring a terminally stagnant business at a low price.

In the case of BP, neither danger exists, as detailed in the rest of this article.

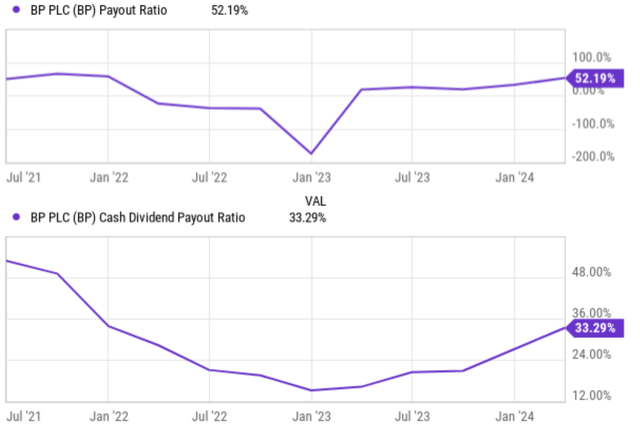

BP stock dividend safety and share buybacks

First, let’s consider the risk of an impending dividend cut. The following image shows BP’s EPS payout ratio (top panel) and cash payout ratio (bottom panel) over recent years. As you can see, the EPS payout ratio is around 52%, either in absolute terms (i.e. it’s only about 1/2 of earnings) or in relative terms (i.e. compared to past performance or the sector average). Both are very safe. The situation is even stronger when it comes to cash dividend payout ratio. As you can see, the EPS payout ratio is currently only 33%.

We expect BP’s shareholder-friendly policies to continue in the future. Given the current safe payout ratio, I would expect the opposite of a dividend cut. We expect there to be plenty of room for annual dividend increases over the next few years.

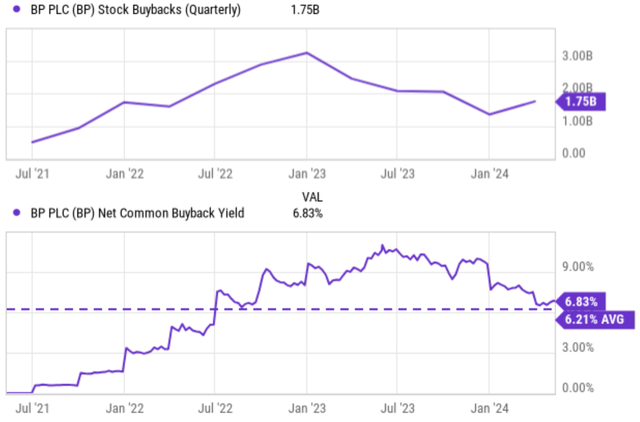

As another testament to the safety of its dividend (and another testament to its generous shareholder-friendly policies), BP has a significant level of share buybacks. And it recently increased its buyback authorizations through the first half of this year.

As seen in the top panel of the chart below, BP has allocated significant capital to share buybacks in recent years. Share buybacks in the quarter peaked at more than $3 billion earlier this year, and totaled $1.75 billion in the past quarter. To better illustrate the magnitude of these share repurchases, the bottom panel displays the net common share repurchase yield. As you can see, share buyback yields recently peaked above 10%, averaged about 6.21% over the past five years, and currently sit at about 6.83%. These numbers outweigh the already large cash dividends.

Finally, keep in mind that share buybacks are much more powerful than cash dividends in the long run, especially when done at the current low P/E ratio. There are many reasons why I like share buybacks (all of which are explained in detail in my article) Other articles), here we quote the top 1 factor: taxes. This is a factor that we actually have control over (in investing, most factors are ultimately outside of our control).

Stock buybacks are much more tax efficient for both the company and its shareholders. In the case of stock repurchases, shareholders do not realize any capital gain or loss until they actually sell their shares. This allows you to defer paying taxes on the rise in stock prices. In contrast, in the case of cash dividends, he is first taxed twice. First, dividends are taxed by the company, and shareholders are liable to pay taxes on them again as income when they receive the money, regardless of whether they reinvest the dividend or spend it.

Growth potential of BP stock

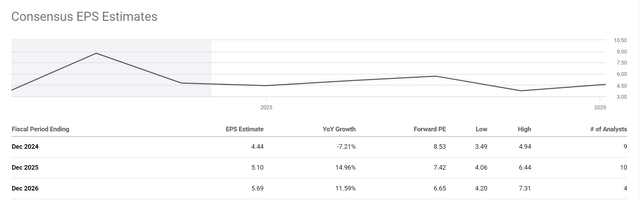

Now let’s consider the second potential danger: the danger of acquiring a permanently stagnant company at a cheap price.

The graph below is Consensus EPS estimate BP stock forecast for the next three years. Thus, analysts as a whole expect BP’s EPS to grow in the coming years. Consensus estimates indicate that his EPS for fiscal year 2024 will be $4.44, a slight decrease year-over-year. After that, the market expects it to rise to $5.10 by the end of FY2025 and $5.69 by the end of FY2026. These numbers represent a year-over-year growth rate of 14.96% in 2025 and 11.59% in 2026.

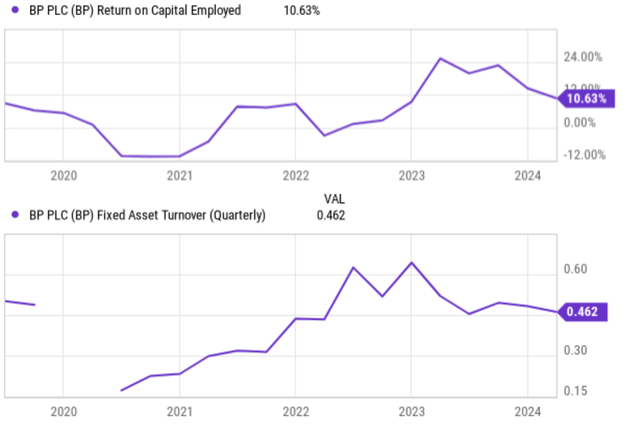

I think there is certainly a good reason for the decline in 2024. BP has recently faced some challenges with production volumes. As you can see from the next graph below, ROCE (Return on Capital Employed) has declined significantly from a recent peak of around 24% to current levels of just 10.6%. And the main driver of this decline is asset utilization, which has fallen from over 0.6x a few quarters ago to current levels of just 0.46x. There are several other headwinds afoot that will further exacerbate the problem. Current product prices are relatively low compared to average prices in recent years. Rising labor costs and inflation also increased profit pressure.

Looking ahead, we see these issues as only temporary and expect a strong EPS recovery over the next 1-2 years, in line with consensus expectations. Among all the drivers of ROCE, asset turnover is a knob that is primarily within management’s control. Additionally, upstream production levels are expected to improve in the coming quarters, based on management’s latest outlook. Of course, oil prices are outside management’s control. However, my outlook on oil prices is very optimistic, as detailed in a recent article. chevron articles (CVX). Finally, the company has several other initiatives that will help it grow in the short and long term. Its renewable energy business is gradually expanding. The company’s alternative energy pipeline is growing sequentially, particularly in the Americas and Asia Pacific. Bolt-on acquisitions are another growth driver. For example, BP recently announced the acquisition of a German energy supplier.

Other risks and final thoughts

In terms of downside risks, BP faces many of the same risks common to oil stocks. As mentioned above, large fluctuations in oil prices are an ever-present risk for oil stocks. Geopolitical instability, economic fluctuations, and even changes in consumer behavior can cause fluctuations in oil prices that have a significant impact on profitability. Additionally, the global push for cleaner energy sources is a long-term challenge. BP is making some efforts in this area, but in my view they are all in the early stages (for example, BP is committed to achieving net-zero emissions by 2050). These efforts and our commitment to clean energy may result in increased initial costs in the short term.

All in all, my conclusion is that BP presents an attractive buying opportunity for value-oriented investors under current conditions. The stock trades at a very low forward P/E and offers an attractive dividend yield. The company’s aggressive share repurchase program further strengthens shareholder returns. In fact, share buybacks return far more capital to shareholders than already generous cash dividends, especially when adjusted for taxes. Although EPS growth may face headwinds in the short term, we expect a solid recovery over the next 1-2 years. In my view, these positives far outweigh the potential risks, resulting in a highly skewed reward/risk benefit.