greenwalds

Introduction and investment thesis

Etsy (Nasdaq:ETSY), an e-commerce market for handmade and vintage goods, has significantly underperformed the S&P 500 and Nasdaq 100 year-to-date. The company recently 2024 Q1 Revenuerevenue increased This was an increase of 0.8% compared to the previous year, and adjusted profit decreased by 1.4% compared to the previous year. The company is facing headwinds from lower consumer discretionary spending, negatively impacting gross merchandise sales (GMS). We continue to work on product innovation, With the start of gift mode Although we need to improve the buyer search functionality on our platform to improve the buyer experience and accelerate the frequency and size of purchases, the macroeconomic and competitive environment will continue to put downward pressure on margins. I am receiving it.

For FY2024, we expect GMS to grow moderately while maintaining similar margins compared to the previous year. If you evaluate both the “good points” and “bad points”, Although we believe the stock has long-term upside potential, we expect near-term volatility to continue until management successfully accelerates product innovation to GMS. As a result, I’m taking a wait-and-see approach and rate the stock a “hold.”

About Etsy

Etsy is an e-commerce marketplace that connects 91.6 million active buyers and sellers around the world. Their primary marketplace is his Etsy.com, which connects artisans and entrepreneurs with customers looking to buy handmade and vintage goods by curating high-quality listings and providing a trusted shopping experience. Masu. In addition to Etsy.com, the Etsy Marketplace also includes Reverb Holdings, a musical instrument marketplace, and Depop, a fashion resale marketplace.

From a business model perspective, Etsy primarily makes money from its marketplace activities. This includes transaction fees, payment processing, listing fees, and ancillary services such as advertising on the site, shipping labels, and other merchant services.

Pros: Increased revenue and active buyers despite GMS decline, launch of gift mode, and increased search relevance for buyers

Etsy reported first quarter 2024 earnings with revenue of $646 million, up 0.8% year over year. Under the difficult macroeconomic environment, GMS decreased 3.7% year-on-year to $3 billion, but active buyers increased 1.9% year-on-year to $91.6 million. At the same time, Etsy successfully reactivated 6.3 million buyers, an increase of 5.9% year-over-year, and active buyer retention increased compared to the previous year.

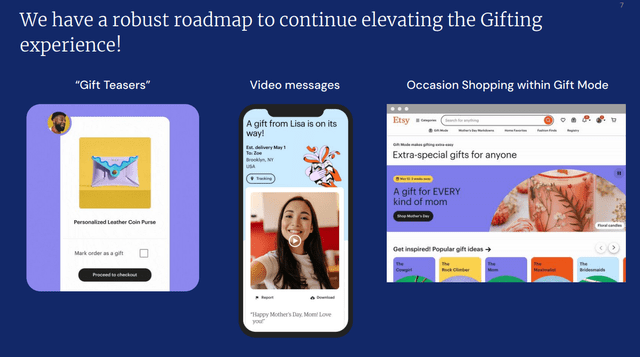

The company continues to drive strong product innovations in the market to attract buyers and increase the frequency and size of purchases and has launched gift mode. It’s an interactive gift shopping experience that combines AI and human curation to help buyers find the perfect present.Between financial statement, Etsy CEO Josh Silverman said Etsy’s gross gift GMS growth in the first quarter was in the low single digits, outperforming peers focused on online gifts, which were down year-over-year. As the company continues to increase its buyer awareness, I believe the launch of Gift Mode will improve the overall customer experience and help drive more buyers into the funnel. Etsy has already seen success with his PR campaign, with conversions increasing by over 200%. .

Q1 2024 Earnings Slides: Gift Mode Product Roadmap

At the same time, the company also worked to improve search relevancy. This includes updates to search engines and ranking algorithms to better understand the context of buyer searches. I think this will make it easier for buyers to find what they’re looking for. They want to increase conversion rates and sales on the platform.

Meanwhile, Etsy continues to leverage AI to suppress and remove product listings that violate our policies, removing 115% more product listings than last year. While I believe that the increased level of removals has had a negative impact on his GMS on the platform to some extent, improving the shopping experience for customers on the platform is an important investment and one that will lead to long-term success. Sho.

The bad: High inflation and interest rates weigh on consumer spending, which, combined with intense competition, hurts sales and profits.

The macroeconomic environment continues to be a headwind for Etsy, with inflation still above the Fed’s target of 2.2%, forcing interest rates to remain high for an extended period of time. This has led Americans to turn to credit card debt. Best ever The share of personal payments in credit debt also continues to increase.At the same time, the labor market is also beginning to be affected. early signs of weakness This is because the number of job openings continues to decline and growth in average hourly wages has slowed. I think this is squeezing a significant portion of the discretionary spending of deal-seeking Americans.

During the financial results conference, Josh Silverman expressed a similar opinion to mine, which I quote below.

For that matter, while U.S. unemployment is low and inflation statistics are mixed, consumer sentiment remains weak, and some speculate that this is due to extremely high prices. Consumers’ wallets remain so tight that they often have little left over after paying for food, gas, rent, and childcare. And there is significant data showing that the largest e-commerce platforms have been able to grow primarily by selling everyday items at very low prices. ”

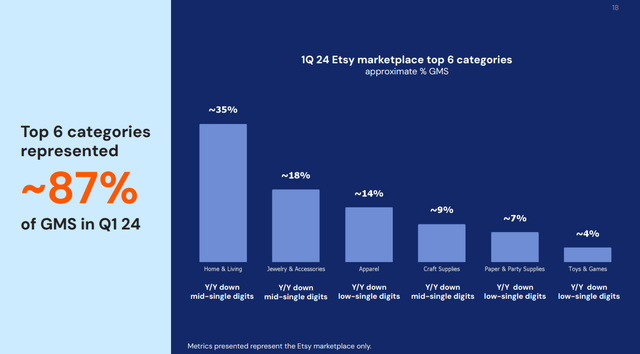

Q1 2024 Earnings Slide: Decrease in Spend by Category on Etsy Platform

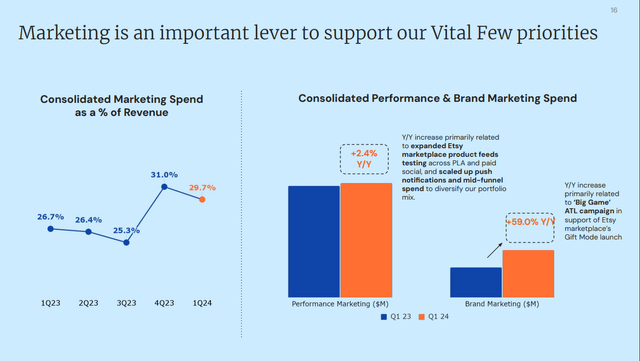

This weighed on operating margins, with Etsy generating $167.9 million in adjusted EBITDA, down 1.4% year-over-year, for a profit margin of 26% (versus 26.6% a year ago). Etsy’s marketing efforts will need to work harder to drive growth as his GMS on the platform declines. The company’s focus on staying agile and lean has increased the productivity of its product development organization, as well as delivering compelling full-funnel marketing efforts across channels to improve inventory quality and improve the customer journey. However, I am concerned about the following: In addition to a weakening U.S. labor market and consumers further cutting back on discretionary spending, PDD Holdings (NASDAQ:P.D.D.) discount platform Temu, Amazon (NASDAQ:AMZN) and Walmart (NYSE:WMT), which, as the CEO pointed out on the earnings call, can offer deeper discounts in a “sea of sameness in e-commerce.”

Q1 2024 Revenue Slide: Marketing Improvements as % of Revenue

Connect: Etsy is a “hold”

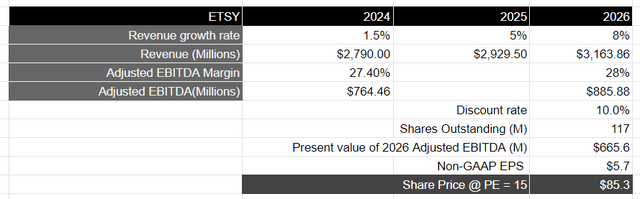

Looking ahead, management is guiding GMS to accelerate modestly year-on-year in the second half of FY24, with adjusted EBITDA margin remaining at approximately 27.4%, in line with FY23. This valuation assumes that revenues tend to match his GMS, growing modestly by 1.5% year-over-year to $2.78 billion in FY24, and adjusted EBITDA of $764 million. I expect it to be $. I believe that unless the U.S. and global economy enters a recession, our goals for 2024 are for Etsy to maintain a lean and agile operation and continue product innovation to improve the customer’s journey on the platform. I believe that we should be able to achieve this. It should help attract buyers while emphasizing value through discount-related signals to create a competitive position.

Over the next two years through fiscal 2024, I expect Etsy to generate at least high single-digit growth and approximately $3.16 billion in revenue as consumer spending recovers. Assuming the company can maintain margins at current levels, adjusted EBITDA should be $885 million by FY26, which equates to $732 million discounted at 10%.

I take the Using the S&P 500 as a proxyIts companies have averaged 10-year earnings growth of 8% and a price-to-earnings ratio of 15:18. Given its growth rate, I believe Etsy should trade at par with the S&P 500. income during this period. This translates to a 35% upside at a price target of $85.

There’s no question that this upside is attractive, and I believe it can achieve upside in the long term if the company returns to growth mode. But in my opinion, that path can be erratic. Because Etsy’s management believes that current product innovations must be able to translate into higher GMS on the platform while maintaining profitability. Until then, we expect investor sentiment to remain subdued. Assessing both the “good” and “bad”, we believe there is more uncertainty at the moment. Therefore, I choose to sit on the sidelines and wait for further developments in the coming quarters before reevaluating my investment thesis. Until then, I will keep my rating on the company “Hold.”

conclusion

While Etsy is driving strong product innovation with Gift Mode and improving search capabilities to enhance the customer journey on our platform, we face an uncertain macroeconomic environment and a strong competitive environment that allows us to better serve you. This has combined to reduce spending in the category. The high value prompts me to stay on the sidelines, and I’m giving the stock a ‘hold’ rating at this time.