SDI Productions

While much of the focus has been on the utilities sector following its recent strong performance, we should not ignore the consumer staples sector, another important sector that tends to benefit from a risk-off period. Relative momentum looks increasingly attractive. of iShares U.S. Consumer Staples ETF (Knee search:IYK) It’s worth paying close attention here. IYK is designed to track the investment results of an index comprised of U.S. stocks in the consumer staples sector. This sector includes companies involved in the production and distribution of goods and services considered essential for everyday use, such as food, beverages, household goods, and personal items. Given its non-cyclical nature, the consumer staples sector is often considered a hedge against economic fluctuations. By providing exposure to a wide range of companies within this sector, IYK aims to provide investors with the potential for stable returns and a means to earn lower returns. Volatility relative to the broader market.

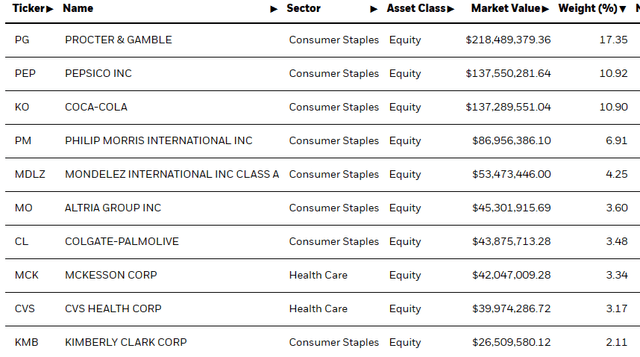

Details of ETF holdings

IYK’s portfolio is literally a collection of well-known names. Some of its major holdings include industry giants such as Procter & Gamble, Coca-Cola, PepsiCo, and Philip Morris. One thing to note about this fund is that the top three stocks – Procter & Gamble, PepsiCo, and Coca-Cola – account for a whopping 39% of the fund. While these are certainly stable companies, this fund clearly has some idiosyncratic risks at the top, despite having 59 names in its portfolio.

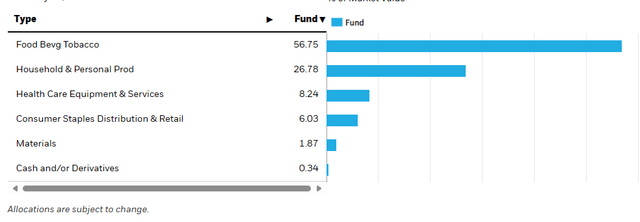

Sector composition and weighting

IYK’s portfolio is focused on food and beverages, with less allocation to household and personal products. This must make sense. After all, people need to eat and drink during a recession. Because these are parts of the economy that people need from a basic livelihood standpoint. No matter how volatile stock prices become, no matter how scared investors are, they still need toiletries, they still need medical services, and they still need food.

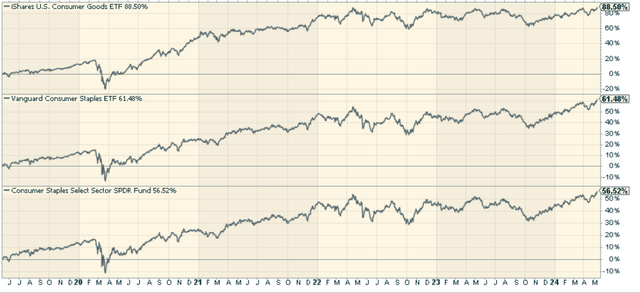

peer comparison

Consumer Staples Select Sector SPDR Fund (XLP) and Vanguard Consumer Staples ETF (VDC), IYK has significantly outperformed over the past five years, but not even close.

The reason is very clear. This is entirely related to the weighting of the top three companies in IYK, especially Procter & Gamble. PG accounts for 12% of the VDC ETF, while it accounts for 14.71% of the XLP. The significantly higher PG weight in IYK made a big difference. I don’t like the risk of concentration there, but it clearly favors outperforming the overall fund performance compared to other consumer staples proxies.

Pros and cons of investing in consumer staples themes

Investing in consumer staples through an ETF like IYK comes with a series of benefits and considerations. On the positive side, the inherent stability of essential goods, supported by constant demand for essential goods, provides a buffer against market fluctuations. The defensive nature of this sector makes it an attractive option for risk-averse investors and those looking to diversify their portfolios. Additionally, companies in this space often have strong brand loyalty and pricing power.

This of course has its downside as well. Because the very stability that makes basic goods attractive can also limit their potential for growth in good economic times. This is because these products may not experience the same high prices as more cyclical sectors. Additionally, concentration on a small number of top stocks may present certain risks related to the performance of individual companies.

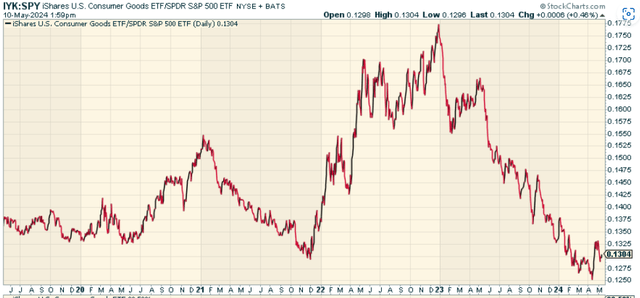

To that end, it seems like the perfect time to play defense. Looking at the price ratio of IYK to the S&P 500 ETF (spy), suggesting that the uptrend appears to be fast and the outperformance could easily continue.

conclusion

The iShares U.S. Consumer Staples ETF is an excellent fund for those looking to reduce risk through exposure to a sector known for its resilience and stable demand. With a focus on essential products and services, combined with a carefully curated portfolio of leading companies, IYK is a potentially valuable addition to a diversified investment strategy, especially where relative momentum is growing. It is positioned as an addition. Note the top three holdings here. Despite clearly favoring the fund’s overall returns over the past few years, this involves more idiosyncratic risks than I would like.

Predict crashes, corrections, and bear markets

Predict crashes, corrections, and bear markets

Tired of being a passive investor and ready to take control of your financial future? Check out the Leadlag Report, an award-winning research tool designed to give you a competitive edge. This is an introduction.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high-yield ideas, and capturing valuable macro observations. Stay ahead of the game with key insights about leaders, laggards, and everything in between.

Move from risk-on to risk-off easily and confidently. Subscribe to the Lead Lag Report now.

Click here to access and try Leadlag Report for free for 14 days.