Justin Padgett/DigitalVision via Getty Images

American Electric Power Company (Nasdaq:AEP) is an electric utility holding company that generates, transmits, and distributes electricity for sale to retail and wholesale customers in the United States.it is one of the biggest It is a national power company with more than 5 million customers in 11 states.

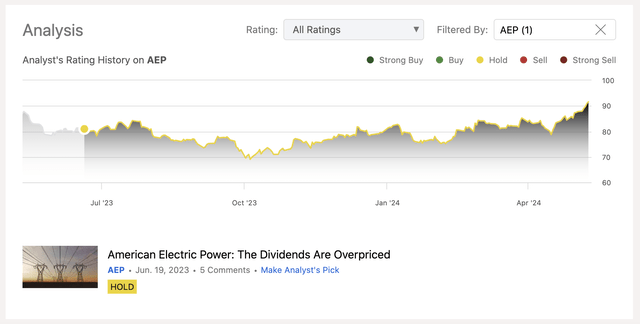

we have I started interviewing We sold the company in June 2023 with a hold rating because our estimated fair value range ($47 to $83 per share) was below the then-current share price ($85). In addition, the high interest rate environment and high debt balances pose concerns for the Company.

Today we will take another look at AEP’s evaluation.We plan to use the dividend discount model as before, but updated parameter. What we specifically mean here is the expected dividend growth rate and required rate of return based on the company’s latest cost of capital estimates. We complement this method by also looking at a range of price multiples. Along the way, we’ll also discuss the latest developments in our financial performance.

Rating update

dividend discount model

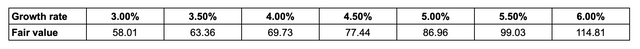

In a previous article, we assumed a dividend growth rate of 3% to 6% based on our historical dividend growth rate and a required rate of return of 10.25%, resulting in a fair value range of $47 per share. Found it to be $83. , which corresponds to a company’s weighted average cost of capital.

Let’s take a look at how these input parameters have changed after 10 months.

1. Dividend growth rate

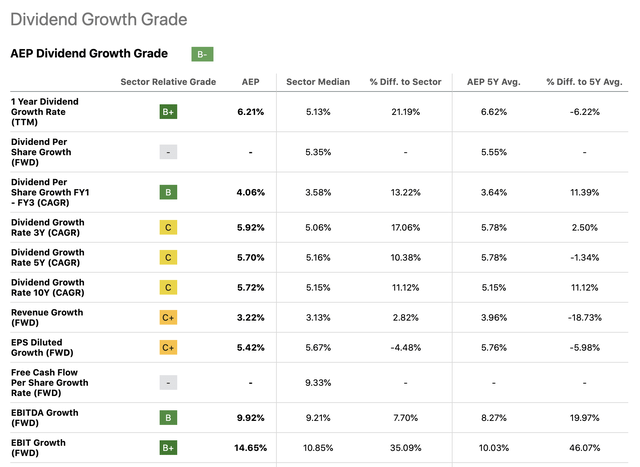

The amount of dividend increases based on historical values has not changed significantly. If you want to use a single-stage dividend discount model, we think a range of 3% to 6% is still applicable.

dividend growth rate (In search of alpha)

2. Required rate of return

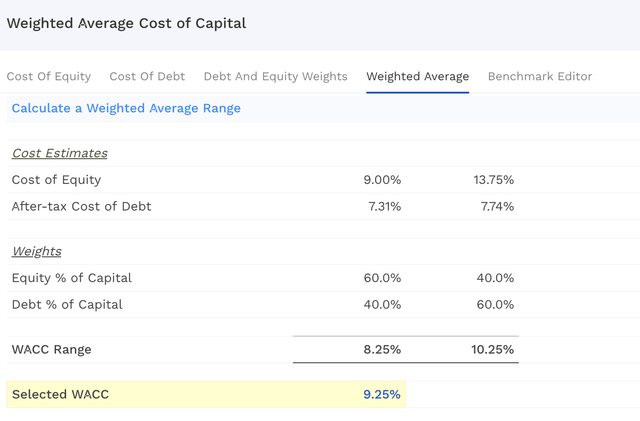

The following table shows that the required rate of return decreases from 10.25% to 9.25% due to the lower cost of capital.

required rate of return (Finbox.com)

This change was driven by a lower cost of equity, but the after-tax cost of debt remained essentially unchanged. After adjusting this required rate of return downward, the previous fair value range is expected to shift upward.The following table shows these updated parameters and Recently announced quarterly dividends $0.88 per share.

Based on the changes described above, our current fair value estimates range from $58 to $115 per share. The current stock price of $92 is within the calculation range, but at the higher end of the spectrum. At this point we have to ask ourselves: Is 5% to 6% dividend growth possible forever? Probably not. Furthermore, our dividend discount model does not directly consider two important factors.

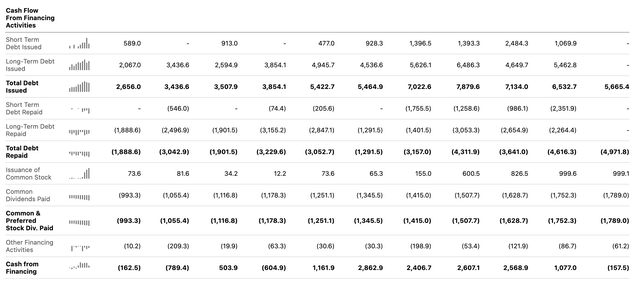

One of these is changes in the number of shares. The company has issued a significant amount of stock over the past few years, resulting in shareholder dilution.

Cash flow (In search of alpha)

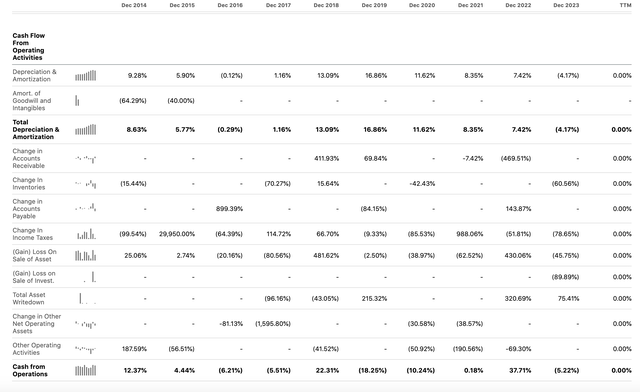

Second, growth rates are expected to be higher in the short term than in perpetuity. However, looking at the past few years, there has been a lack of strong and consistent growth that suggests estimates based on dividend discount models are too conservative.

Cash flow (In search of alpha)

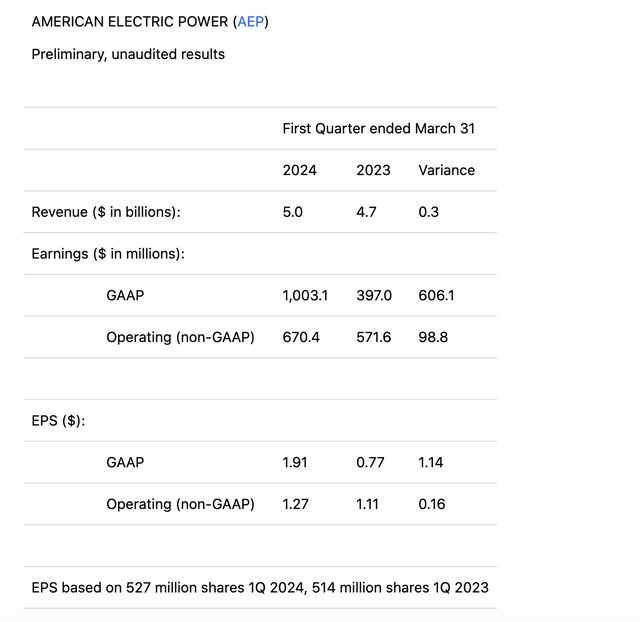

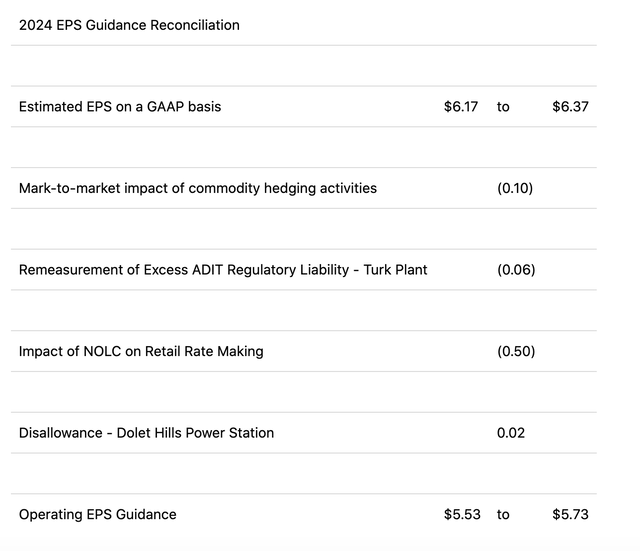

Meanwhile, revenue increased by 6.4% year over year, as reported in the report. Latest quarterly earnings. More importantly, the company reaffirmed its 2024 operating profit outlook and long-term growth rate of 6% to 7%, which is in line with the upper end of its expected dividend growth rate.

First quarter results (AEP) guidance (AEP)

It is also important to point out that the company is committed to and on track to reach more customers, which we believe is an important factor when looking to the future. Masu.

We are making significant progress with a solid capital plan focused on wire and new generation resources to meet customer demand. This includes investing more than $27 billion in our electricity transmission and distribution systems over the next five years to strengthen our grid and make it more resilient. We also submitted an aggressive RFP for the addition of diversified generation resources at our operating companies and secured approval for $6.6 billion of our planned $9.4 billion investment in regulated renewable energy. (…)

Overall, we believe that despite the higher fair value range and current stock price, an update from Hold to Buy is not yet warranted. Looking ahead, on the one hand we expect the company to deliver on his 6%-7% growth promise, but on the other hand we expect the stock price to decline slightly to ensure a higher margin of safety. doing. .

Now let’s look at valuation from a different perspective and see if a similar story is told.

price multiple

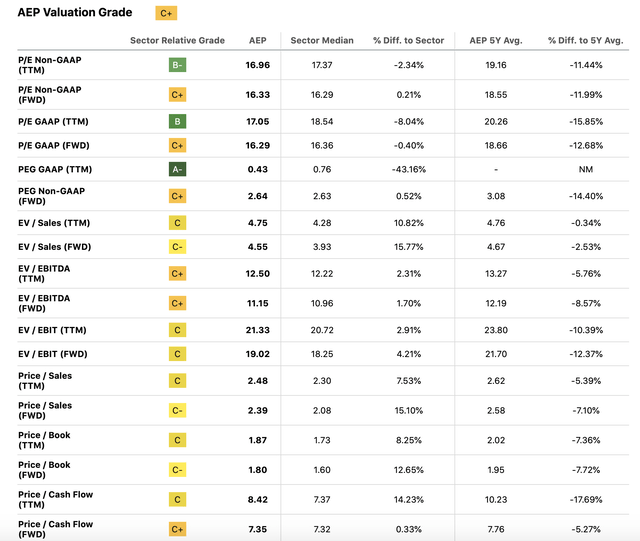

The following table summarizes a set of traditional price multiples that can help you determine whether a company is fairly valued and can complement your previous analysis.

Evaluation index (In search of alpha)

The table above shows that AEP’s metrics are fairly close to the median for the utilities sector. On the other hand, when comparing its current valuation to the company’s historical valuation, AEP stock appears to be selling at a slight discount, according to most metrics.

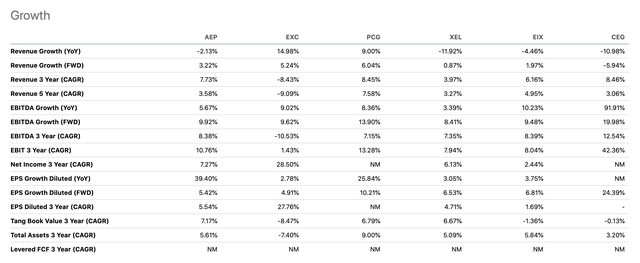

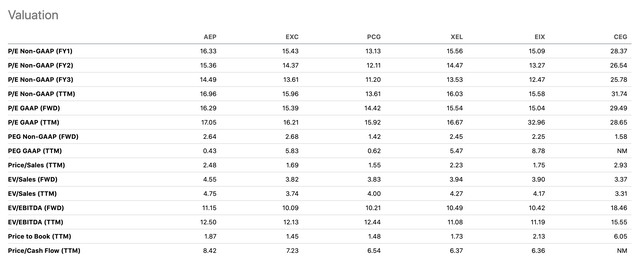

If we narrow down the peer group to some of AEP’s closest competitors in the electric utility industry, we find that AEP is slightly more expensive than most.

comparison (In search of alpha)

Although this premium is not necessarily significant, we believe it is unjustified for several reasons. First of all, the company’s growth has been modest compared to its peers. Even considering the company’s recently reaffirmed long-term growth target of 6-7%, it’s still not very attractive.

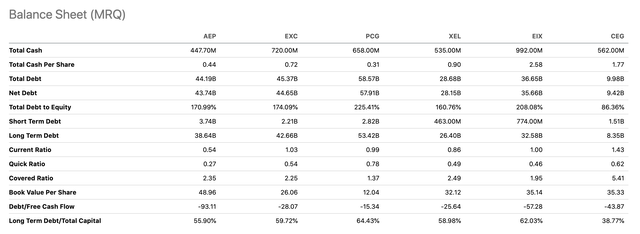

Additionally, the company’s liquidity ratios are significantly worse than its peers.

Balance sheet (In search of alpha)

Overall, based on this valuation methodology, we don’t see significant upside potential from current price levels.

conclusion

Today’s article presents a previously established fair value range of $58 to $115 based on a single-stage dividend discount model, assuming a required rate of return of 9.25% and a perpetual dividend growth rate of 3% to 6%. has been adjusted upward. . The company’s stock is currently trading around $92, and the company has issued a large amount of stock over the past year, so we don’t think the margin of safety is still large enough for the company.

Looking at a range of price multiples does not indicate an attractive investment opportunity.

For these reasons, we believe an upgrade from Hold to Buy is not warranted yet. Repeat hold rating.