by calculated risk May 14, 2024 11:00:00 AM

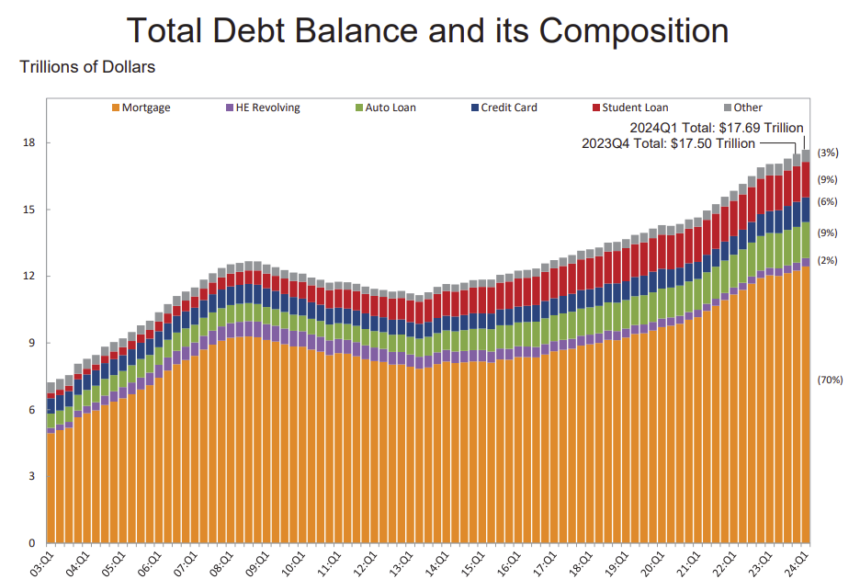

From the New York Fed: Household debt increased by $184 billion in the first quarter of 2024.Delinquency transition rate increases for all debt types

The Federal Reserve Bank of New York’s Microeconomic Data Center today announced that Quarterly report on household debt and credit. According to the report, total household debt increased by $184 billion (1.1%) in the first quarter of 2024 to $17.69 trillion. The report is based on data from the New York Fed’s national representatives. consumer credit panel.

The New York Fed also released an accompanying statement. Blog post about Liberty Street Economics We investigate the relationship between credit card usage and delinquency. The quarterly report also includes a one-page summary of key takeaways and supporting data points.

“In the first quarter of 2024, rates of credit card and auto loan transitions into serious delinquency continued to rise across all age groups,” said Joel Scully, director of regional economics in the Household and Public Policy Research Department at the New York Fed. said. “It has become clear that the number of borrowers who are behind on their credit card payments is increasing, and some households are facing worsening financial hardship.”

Home loan balances increased $190 billion from the previous quarter to $12.44 trillion at the end of March. Home equity lines of credit (HELOCs) outstanding increased by $16 billion, the eighth consecutive quarterly increase since Q1 2022, and now stands at $376 billion. Credit card balances decreased by $14 billion to $1.12 trillion. Other balances, including retail cards and consumer loans, also fell by $11 billion. Auto loan balances continued their upward trajectory since 2020, increasing by $9 billion and now at $1.62 trillion.

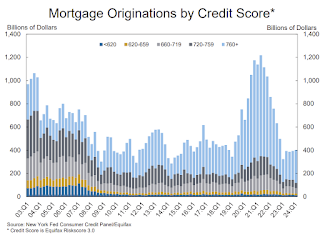

Mortgage originations continue to grow at the same pace as the past three quarters and now stand at $403 billion. Total limits on credit card accounts increased modestly to $63 billion, an increase of 1.3% from the previous quarter. The HELOC limit increased by $30 billion, increasing by 14% in the past two years after a decade of observed decline.

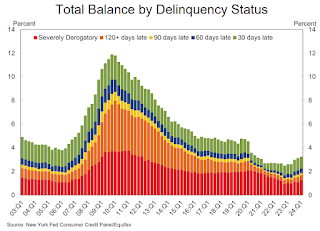

Total delinquency rates increased in the first quarter of 2024, with 3.2% of outstanding debt in some stage of delinquency at the end of March.. Delinquency transition rates have increased for all debt types. Annualized, about 8.9% of credit card balances and 7.9% of auto loans went into delinquency. Mortgage delinquency transition rates increased by 0.3 percentage points, but remain low by historical standards.

Emphasis added

Three graphs are shown below. report:

The first graph shows that household debt increased in the first quarter. Household debt previously peaked in 2008 and bottomed out in the third quarter of 2013. Unlike after the Great Recession, debt did not decline during the pandemic.

From the New York Fed:

Total household debt outstanding in Q1 2024 increased by $184 billion, an increase of 1.1% from Q4 2023. The current balance is $17.69 trillion, an increase of $3.5 trillion from the end of 2019, just before the pandemic recession.

Overall delinquency rates increased in the first quarter. From the New York Fed:

Total delinquencies increased in the first quarter of 2024. As of March, 3.2% of his outstanding debt was in some kind of delinquency stage, an increase of 0.1 points from the fourth quarter. Still, the overall delinquency rate remains 1.5 percentage points lower than in the fourth quarter of 2019.

From the New York Fed:

The credit quality of new loans was stable, with 3% of mortgages and 16% of auto loans originating to borrowers with credit scores below 620, roughly unchanged from the fourth quarter. The median credit score for newly originated mortgages was flat at 770, while the median credit score for newly originated auto loans was 724, an increase of 4 points from the previous quarter and a record high. did.

There are many more report.