Haysar Keres/iStock via Getty Images

introduction

About 5 months ago, I discussed SP Group for the first time (OTCPK:SPGGF), Danish manufacturer of plastic and composite parts Industrial and medical use.One of the most commonly used products is plastic vials for pharmaceuticals, but some of their composite materials Used in wind turbine blades. These two divisions account for about 65% of total revenue, making SP Group an interesting healthcare and cleantech company. Additionally, 12% of his revenue comes from food-related sources.

Yahoo Finance

The company’s main listing is in Denmark, where it is listed on the Copenhagen Stock Exchange under the ticker symbol SPG. His average daily trading volume in Copenhagen is Approximately 15,000 shares per day. The net number of shares is approximately 12.1 million, giving a market capitalization of approximately DKK 2.6 billion.At the current exchange rate of about 7 DKK per US dollar, this The market capitalization is equivalent to approximately $375 million.

We continue to focus on cash flow

The original article argued that 2023 will be a transition year in which the company’s financial performance will be strengthened. However, the guidance for 2024 remains quite aggressive, which is why I was keeping an eye on the company’s performance.

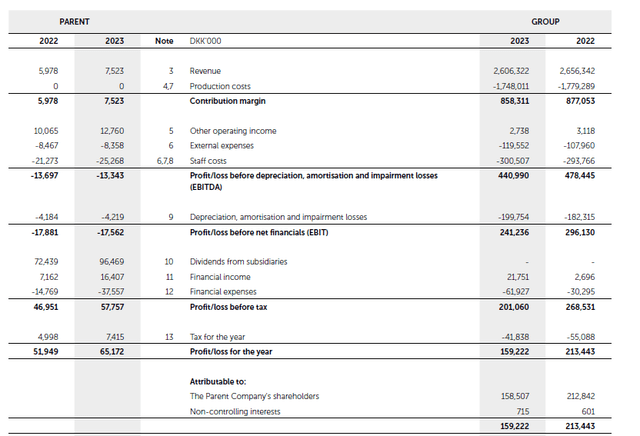

SP group reported. Total revenue in 2023 is DKK 2.6 billionThis represents a 2% decrease compared to 2022 total revenue. Fortunately, COGS also decreased at a similar rate, keeping the decrease in gross profit to less than DKK 20 million.

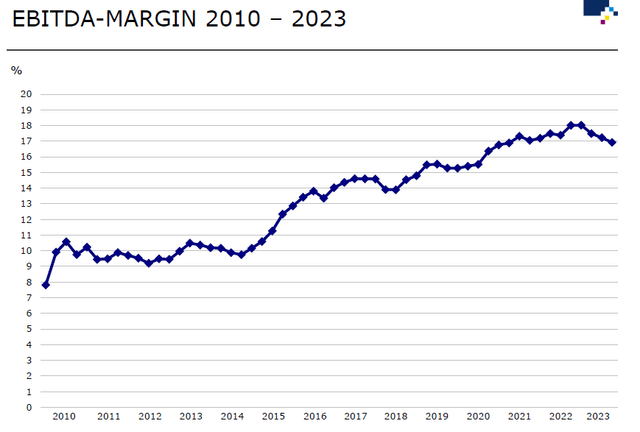

Unfortunately, other operating expenses increased. As shown below, total external expenses increased by more than 10% and personnel costs increased by just over 2%. This reduced EBITDA by approximately DKK 38 million. This means that EBITDA was approximately 8% lower than in 2022, resulting in an EBITDA margin of 16.9%.

SP Group Investor Information

After deducting approximately DKK 40 million in net financial costs, pre-tax profit was just DKK 201 million (EBT margin of just 7.7%), resulting in a net profit of DKK 159.2 million, of which DKK 158.5 million went to shareholders. It belonged to SP group. This corresponds to his EPS of 13.04 DKK per share. This means the current share price of 214 DKK is quite expensive, but there is more to this than meets the eye and using the lower end of the company’s guidance, SP Group could see at least a 20% increase in pre-tax profits. We expect that (more on that later). Implicit guidance for 2024 is discussed later in this article).

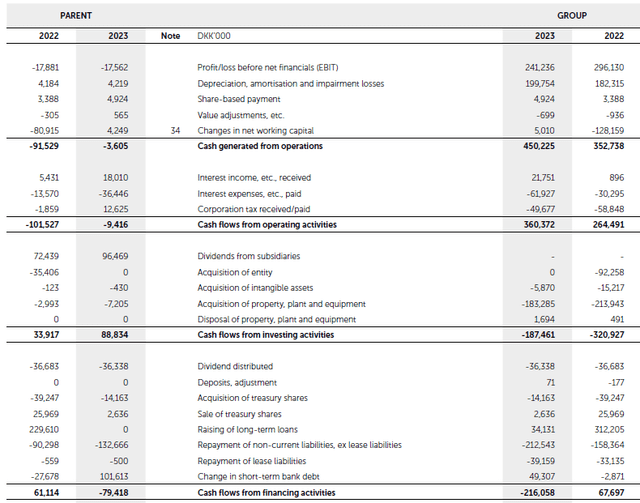

Moving on to the cash flow statement, we see that the company below generates DKK 360 million in operating cash flow, which includes a working capital inflow of DKK 5 million, which covers the lease payments. You also have to deduct DKK 39 million. In addition, the cash tax results must be adjusted. This was because the tax was approximately DKK 8 million higher than the tax payable by the company according to the income statement.

SP Group Investor Information

This means that while adjusted operating cash flow was approximately DKK 324 million, it spent DKK 189 million on capital expenditures, resulting in an underlying free cash flow of DKK 135 million. means. SP Group continues to invest in growth, with DKK 189 million on capital expenditures and DKK 39 million on lease payments being spent in these periods, with depreciation and amortization totaling his 200 million yen. Note that DKK is weak.

SP Group’s balance sheet remains very strong as it continues to direct the majority of its free cash flow to the balance sheet. This is a consolation prize for SP shareholders, as SP has proposed a dividend of only DKK 3.00 for the 2023 financial year, which corresponds to a payout ratio of less than 25% of reported net income.

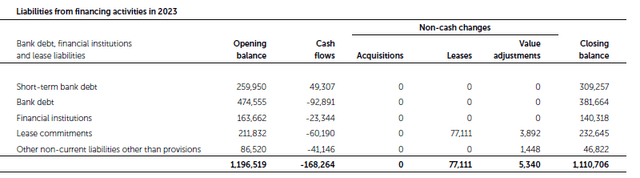

At the end of 2023, SP Group’s cash position decreased by DKK 43 million to DKK 50 million, while bank debt decreased as well. At the end of the year, SP Group’s total financial debt was approximately DKK 1.1 billion, but after deducting lease liabilities and other non-current liabilities of DKK 279 million, its net financial debt was approximately DKK 831 million.

SP Group Investor Information

EBITDA in 2023 was DKK 441 million, but after adjusting for lease amortization, the actual EBITDA was just over DKK 400 million, and the net financial debt ratio was just over twice EBITDA. This is fine, especially since SP Group is aiming for an EBITDA result of DKK 437 million to DKK 569 million (including lease amortization). Therefore, at the very least, SP’s focus on debt reduction will further reduce the debt ratio, while EBITDA results will remain stable.

Guidance for 2024: weaker than planned, but that’s not unexpected

The initial 2024 guidance was what drew me to the story, but I wasn’t sure if the company could actually meet that expectation. Updated guidance for 2024 This happened when SP Group announced its full-year financial results.

The latest guidance is for revenue growth of 5% to 15%, with EBITDA margins expected to be approximately 16% to 19% and EBT margins expected to be approximately 9% to 12%. While it’s good to have more realistic expectations, the range of guidance is still quite wide.

SP Group Investor Information

Using the midpoint of the guidance (i.e. using 7.5% revenue growth and 10.5% EBT margin), revenue would increase to DKK 2.8 billion and profit before tax would be DKK 294 million.

If SP Group can indeed achieve that guidance, I would be very pleased as it would mean a 46% increase in pre-tax profit. It would also probably mean a net profit of DKK 160 million increasing towards DKK 220-225 million on EPS per share. About 18DKK.

Broad revenue and EBT margin guidance means results could still go either way. Applying the 5% revenue increase and his EBT margin of 9%, the EBT would be only DKK 246 million. This still represents an increase of more than 20% compared to 2023 results, but a relatively “disappointing” increase given how aggressive the company’s previous 2024 targets were.

On a more optimistic note, applying 15% revenue growth and a 12% EBT margin would result in pre-tax profit of DKK 359 million, an 80% increase over 2023 results.

In short, the company’s official guidance is still too broad to be very helpful. According to the guidance, pre-tax income will be between DKK 246 million and DKK 359 million. The midpoint is approximately DKK 294 million.

If you look at it, Analyst consensus forecastConsensus predicts pre-tax income of DKK 190 million this year, rising to DKK 224 million in 2025. This is significantly lower than the implicit guidance issued by the SP Group and will likely require an update to the estimate, similar to the consensus estimate. Revenue growth is expected to be 1% and EBT margins are expected to be just 7.2%. SP Group will probably strengthen its guidance when it reports its first quarter results.

investment thesis

If SP Group hits the midpoint of its guidance and indeed reports a pre-tax profit of close to DKK300 million, this would imply an EPS of close to DKK20 per share, so I’m already pretty happy. Sho.

At the current share price of DKK 214 per share, the company’s enterprise value is approximately DKK 3.4 billion. Using the midpoint of this year’s EBITDA guidance and subsequently adjusting for lease amortization, EBITDA including lease payments is expected to be DKK 450 million. This means the stock is currently trading at around 8x EBITDA, which is not outrageous. However, while this is significantly higher than the price at which SP Group was trading before lowering its 2024 outlook, I would prefer companies to lower their outlook towards realistic outcomes rather than chasing near-unachievable targets. I hope that.

Although I have no position in SP Group, I am happy to see more realistic guidance for 2024. I’m watching the stock price closely and may dip my toe in the water if it’s weak.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.