boy willat

Seema Shah, Chief Global Strategist

April’s CPI data provided the first (slight) downward surprise in inflation since the start of the year, allaying lingering concerns that inflation is starting to trend upward again.

Composite CPI slows down The month-on-month rate was 0.3%, slightly below the consensus estimate of 0.4%, and the first drop in six months. Core CPI in April also slowed, but was in line with expectations.

From the Fed’s perspective, today’s inflation report is not soft enough to consider a July rate cut, but it does make a September rate cut more likely.

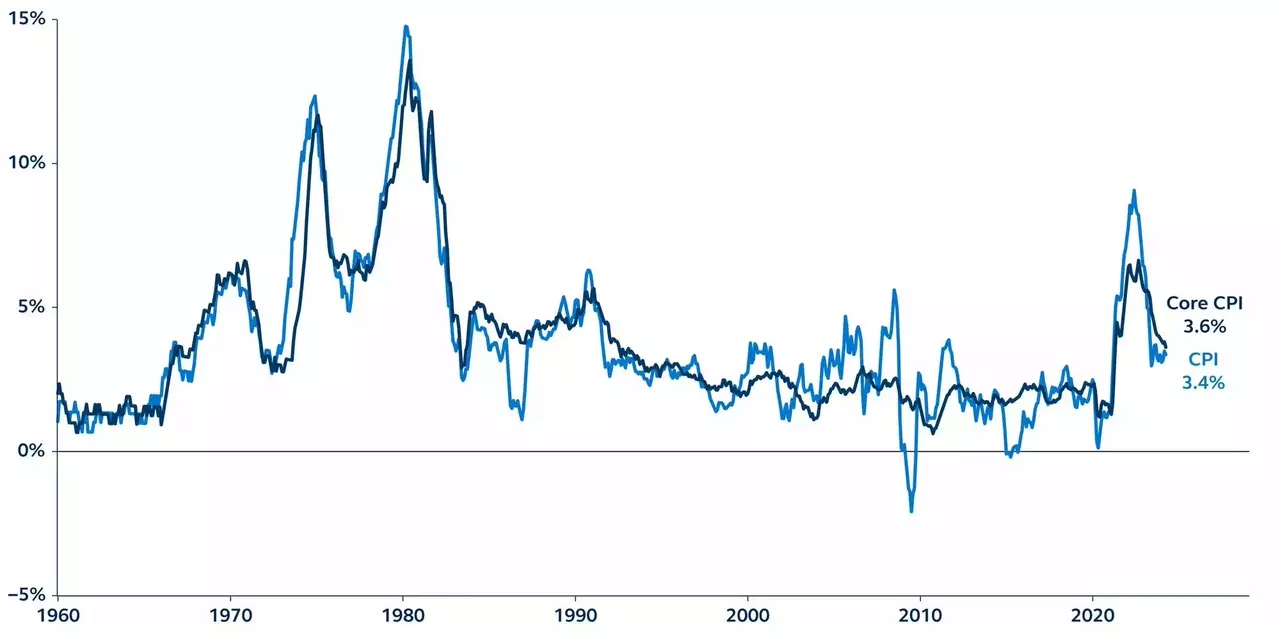

consumer price index

Year-on-year change (1960 to present)

sauce: Bureau of Labor Statistics, Office of Major Asset Management. Data as of May 15, 2024.

Report details

- Monthly headline inflation slowed to 0.3% in April from 0.4% in March, slightly below consensus expectations for a further 0.4% rise.yearly headlines Inflation rate fell to 3.4%. After hovering at 0.4% for three months, the monthly core inflation rate also fell to 0.3%, which was in line with consensus expectations. The annual core inflation rate has now fallen to 3.6%, the lowest level since April 2021.

- Headline inflation was lower than expected due to the downward surprise in food inflation.

- Core goods inflation fell by 0.1% in April due to lower new and used car prices. In contrast, core services inflation rose 0.4% in April, with motor insurance a big positive, with annual prices rising at the fastest pace since 1976.

- Shelter-in-place inflation continued to defy expectations. Equivalent rents for owners, the biggest factor in shelter inflation, remained at 0.4% in April, the same as in previous months. The Fed expects prices to continue trending downward, but as Chairman Powell pointed out yesterday, the gap between newly signed leases and shelter costs in the CPI report was longer than expected. .

- The Fed’s preferred measure of supercore inflation (core services excluding housing inflation) rose 0.4% in April, down from 0.7% the previous month and the smallest increase since December.

policy outlook

Unsurprisingly, today’s report has been well received by the market. While inflation remains too high to make a policy rate cut in July a realistic prospect, today’s numbers certainly reassure markets that the tail risk of another rate hike has been reduced.

The retail sales figures for April announced on the same day were also lower than expected, reinforcing the impression that the economy is losing momentum. Financial markets now have strong expectations that the Fed’s first rate cut will occur in September, which is in line with our own expectations.

Editor’s note: The summary bullet points in this article were selected by Seeking Alpha editors.