Justin Padgett

BlackRock Utilities, Infrastructure and Power Opportunity Trust (New York Stock Exchange:BUI) is a closed-end fund that invests in utilities, infrastructure and power companies around the world. Seek current income, capital gains, and long-term capital appreciation as part of the whole. return package. The fund invests in stocks and also sells options to increase returns.

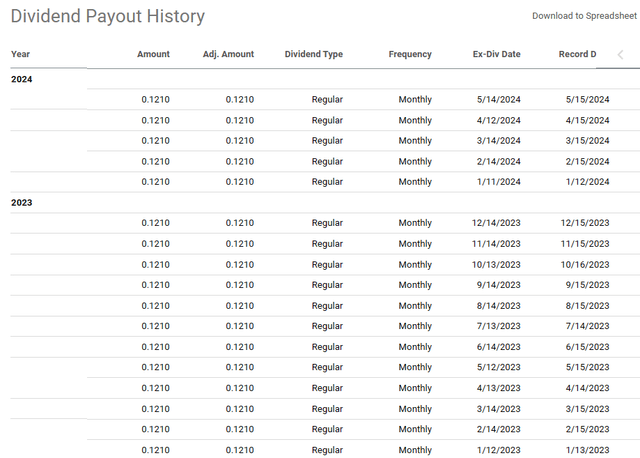

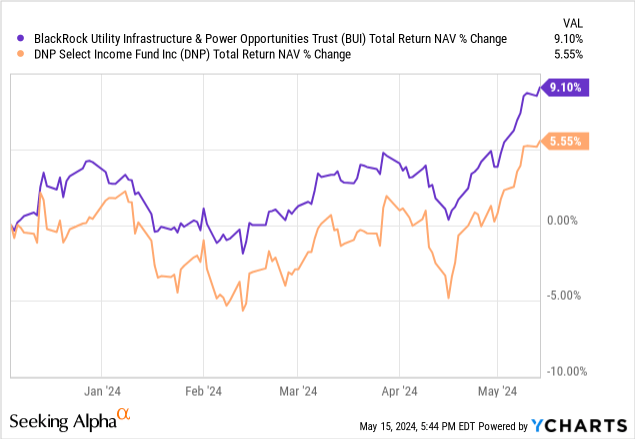

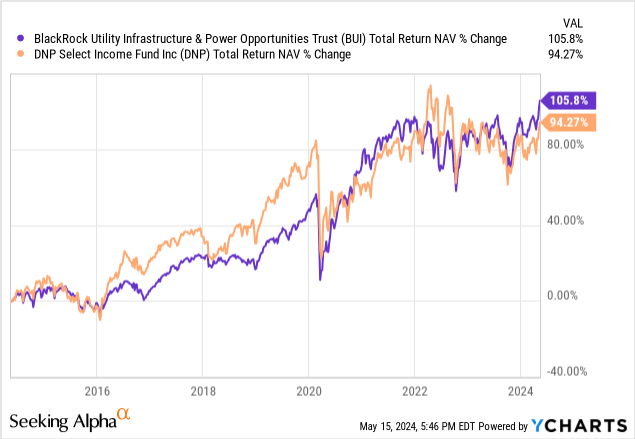

We’ve featured this fund several times on our platform and rated it a Buy multiple times. The previous article was published in December and was purchased by us at the time. I compared it with DNP Select Income Fund (Dai Nippon Printing Co., Ltd.), another utility-focused closed-end fund. BUI matched his DNP in his NAV total return over the past 10 years. And that’s without leverage, differs from the latter. How to use options, There are cherry blossoms on top. Yes, DNP had an advantage in terms of distribution yield, which was enough for income groups to buy it at a premium. On the other hand, BUI was trading at a discount. While we were supporters of BUI, we also thought DNP was ripe for a bounce back.

What we need to note is that DNP’s NAV yield is currently 9.9% and is much more likely to be pulled down than at any other time in the fund’s history. BUI is paying just 6.7% on his NAV, which we believe is sustainable for a fund with zero leverage and supplemented with covered calls. Of course, we can reap the harvest and the promise that the past is always the future. I don’t think it will work in the medium term. In the short term, DNP’s Z-score increased significantly. A large negative number here suggests that the fund’s current price is cheaper than in the past.

So there is some risk of DNP rebounding here. We’ve upgraded it from a ‘strong sell’ to a ‘hold’ rating, and continue to support the BUI (buy rating) for the next few years.

sauce: BUI vs. DNP: One clear winner among utility CEFs

Since then, BUI has outperformed DNP, and 10-year returns now show BUI comfortably outperforming DNP.

BUI has moved quickly in recent months, and it’s worth revisiting the fundamentals to update our paper.

set up

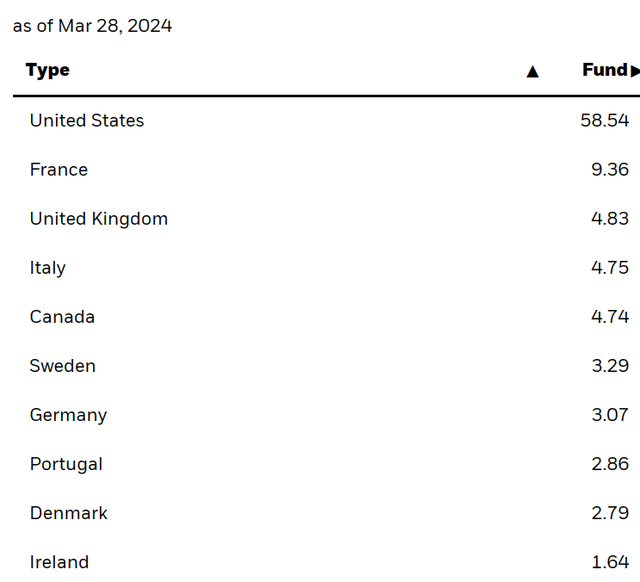

BUI continues to travel the world to find carefully selected products. But like all global funds that believe the US is the center of the investing world, BUI keeps nearly two-thirds of his holdings in the land of freedom.

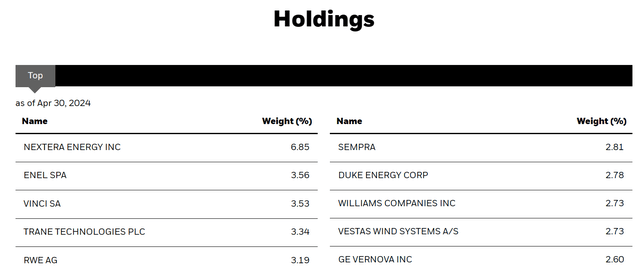

Over the past few years, the non-U.S. part has actually been an issue with the dollar’s strength. 60% is also about right for investors looking for some exposure without straying too far from non-S&P exposure. The top 10 holdings include NextEra Energy Inc. (knee) and Duke Energy Corp (duck), both of which I wrote about recently.

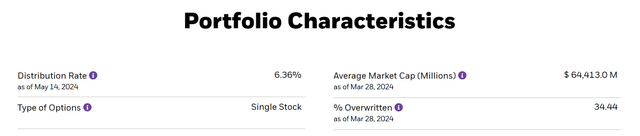

The weights appear to be reasonably concentrated in the top 10, with the fund having a total of 57 holdings. BUI continues to make covered calls when the opportunity arises, and at last check approximately one-third of the fund’s holdings were covered calls.

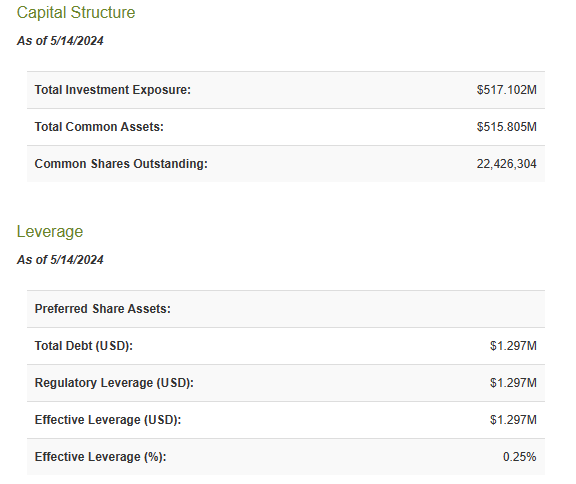

One of the things we like most about this fund is that it is non-leveraged. Investors are always looking for enhanced returns, but we don’t think leverage is appropriate at this late stage of the cycle. The BUI stayed true to form as on the previous dive. Leverage is still subject to rounding error.

CEFConnect-BUI

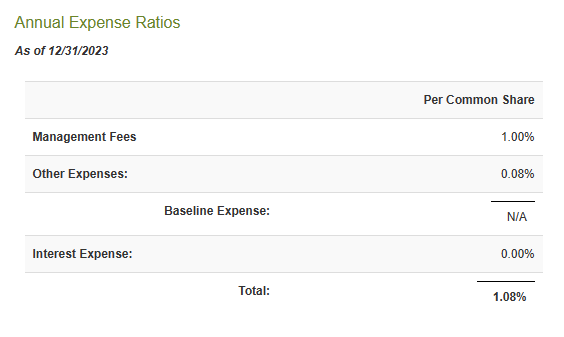

Today’s investors continue to have access to many choices with low fees. BUI is not one of them. Management fees are a little higher than many people want these days.

CEFConnect-BUI

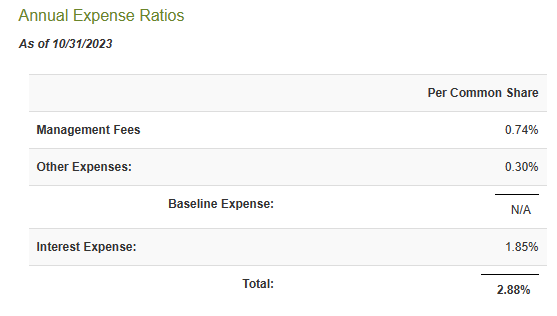

But this is an actively managed fund, and a global fund at that. There are also non-automatic covered call lights that add additional income without blindly giving up all the upside. Considering all this, this isn’t such a bad thing. Among closed-end funds, BUI is one of the best because it does not use leverage. Below is a quick comparison with DNP.

CEFConnect-DNP

verdict

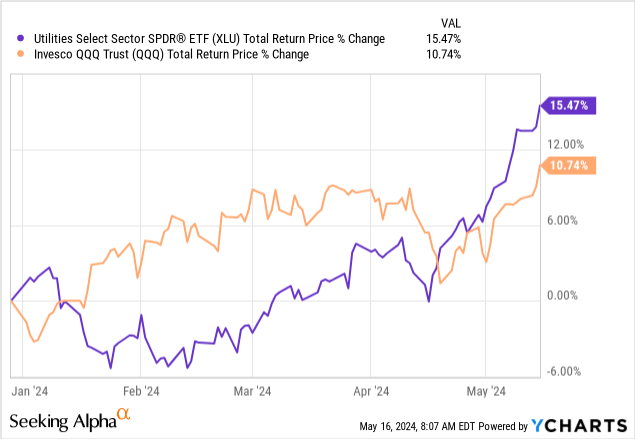

Our belief in the markets is to be tactical and not get attached to any one stock or sector.Overall, we believe the market remains very expensive and our outlook for the future is Total return over 10 years is extremely low. From that perspective, utilities have some positives and negatives. The plus is that as a defensive unit, you’re likely to do better there than most other places. The rapid growth of data centers around the world has also increased demand for electricity, which is likely to continue to provide at least a small tailwind. The downside is that everyone believes in rate cuts and a soft landing. While there is evidence to the contrary. Another downside is that utilities as a sector have outperformed AI enthusiasts since the beginning of the year. Just imagine.

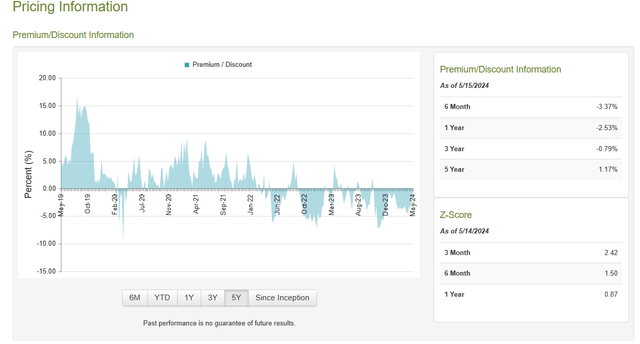

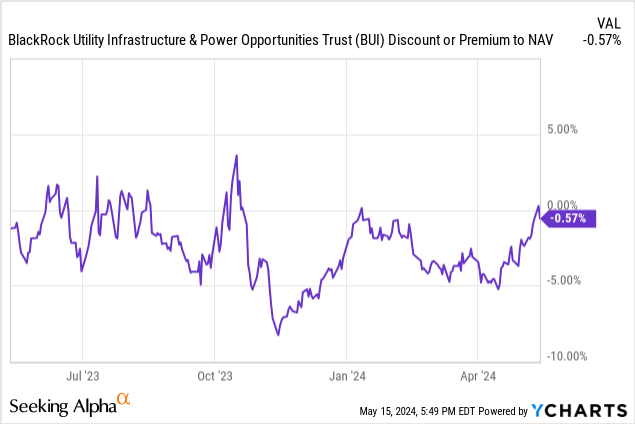

So things aren’t as cheap as they once were, and the best reflection of that is BUI’s NAV discount. When we last wrote, the discount to NAV was close to 6%, but today it’s just leveling off.

The Z-score, which reflects how expensive (positive numbers) or cheap (negative numbers) a fund is, also supports our view that utilities are currently being chased.

This fund remains a good defensive option among the many alternatives. This distribution looks like it can be earned over time thanks to the valuation, lack of leverage, and covered call writing.

The NAV-based distribution yield (also price-based as there is no deep discount) is less than the 10-year total return. I would like to point out the sustainability aspect here as well. However, a “buy” rating should be the exception rather than the rule in this book. If every stock you write about is a buy at every point in time, what the hell are you adding to the conversation? This last dash into utilities is where things really fall apart Looks like a run-up to the previous late 2021 utility. While we downgrade this to ‘Hold’, we continue to praise this as the best house in a bad region for utility closed-end funds.

Please note that this is not financial advice. It may seem and sound like that, but surprisingly it’s not. Investors are expected to conduct their own due diligence and consult professionals who understand the objectives and constraints.