by calculated risk May 16, 2024 12:01:00 PM

In today’s Calculated Risk Real Estate newsletter: MBA: Mortgage delinquencies slightly increase in Q1 2024

A brief excerpt:

From MBA: Mortgage delinquencies increase slightly in Q1 2024

According to the National Mortgage Bankers Association (MBA) National Delinquency Rate, the delinquency rate for mortgages on one- to four-unit residential properties rose to a seasonally adjusted 3.94% of total loan balances at the end of the first quarter of 2024. did. investigation.

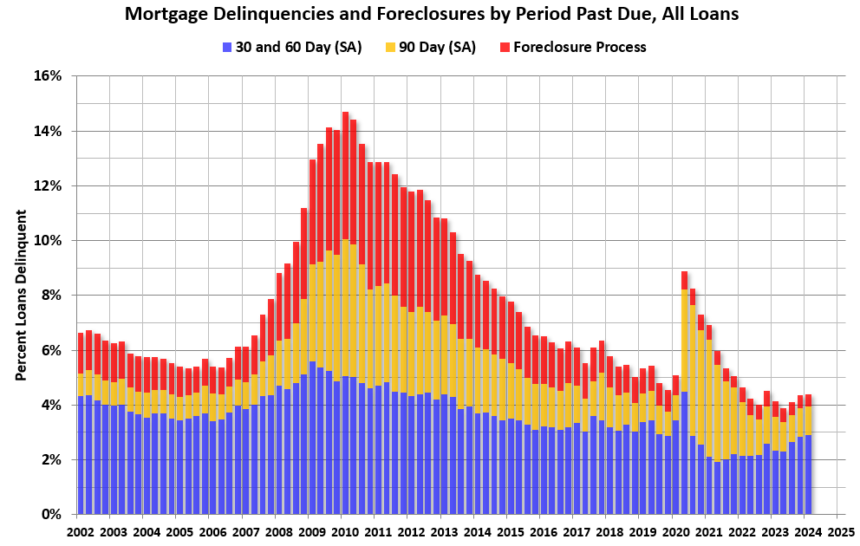

The following graph shows the percentage of past due loans by number of days past due. Overall delinquencies increased slightly in the first quarter. The sharp increase in the 90-day bucket in 2020 was due to pending loans (included as delinquent but not reported to credit bureaus).

The percentage of loans in foreclosure proceedings decreased year-on-year from 0.57 percent in Q1 2023 to 0.46 percent in Q1 2024 (red), despite the end of the foreclosure moratorium. remains at a historically low level.

…

The main concern is the increase in 30-day and 60-day delinquency rates, which, although historically low, will increase from 2.32% in Q1 2023 to 2.92% in Q1 2024. doing. I don’t think this increase is that large. It’s worrying, but something to keep an eye on.

There’s a lot more to this article.