Daniel Grizelgi/DigitalVision via Getty Images

investment thesis

Criteo (Nasdaq:C.R.T.O.) is showing strong momentum as it transitions into a fast-growing ad tech software provider. Strengthening management guidance 2024 revenue and EBITDA have returned 16% since then. our last article However, Criteo’s EBITDA multiple was almost flat. We think this shows that the market is still valuing his Criteo based on this year’s metrics and not doing justice to Criteo’s long-term growth potential. If the execution continues to be successful, Criteo stock could continue to rise in the coming months.

Remembering the migration underway at Criteo

Criteo’s business model was, and still is, to some extent dependent on cookies. Cookies are small files used by advertisers to track consumers’ online behavior. Criteo’s retargeting solution leverages cookies to collect detailed data, particularly regarding your browsing and shopping behavior. Precise ad targeting and retargeting. As a result, the online advertisements shown to consumers are tailored based on the consumer’s personal preferences, which is a key pillar in ensuring a viable return on investment for online advertising campaigns.confronting Retirement of cookies Due to both regulatory and commercial pressures, Criteo’s revenue in this area has steadily declined in recent years. Criteo’s future now lies in alternatives addressability solutions, leveraging first-party data, and emerging tools such as Google (google) Privacy Sandbox and Contextual Targeting Enabled by Machine Learning.

Positive signals from management

Q1 2024, Criteo report Retail media contribution excluding TAC increased 34% year-over-year, while performance media increased 13%. Even the challenging retargeting sector, which has been in decline since 2021, showed resilience with a growth rate of 4%. Given the structural challenges retargeting faces in the context of the retirement of third-party cookies, we’re not reading too much into the modest increase in retargeting. Over time, we expect Criteo’s other segments to become key revenue drivers.

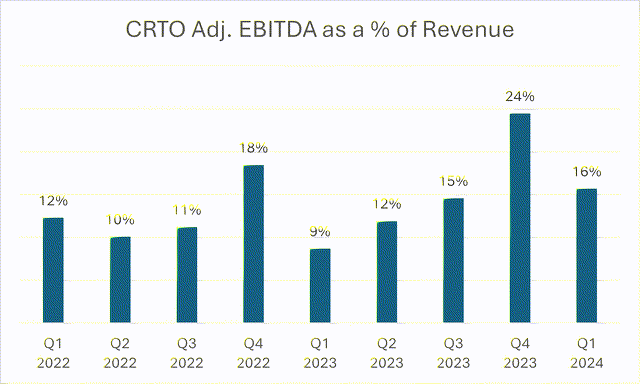

Ex-TAC contribution as a percentage of revenue remained stable at 56% compared to Q4 2023, which is impressive given that the previous quarter set a high bar. The average for the past eight quarters was 49%. Meanwhile, EBITDA margin (as a percentage of revenue) contracted significantly from 24% in Q4 2023 to 16% in the previous quarter. However, 16% is still 7 percentage points above Q1 2023, and as shown in the chart below, there has been some seasonality in this metric in recent years, starting weakly in Q1. It peaked in the fourth quarter.

Criteo EBITDA margin as a percentage of revenue (Capital IQ)

We would like to note that we prefer to view EBITDA as a percentage of revenue, as opposed to management’s preference to calculate EBITDA as a percentage of contribution excluding TAC. This allows an ad tech company some flexibility in how to allocate certain costs between his TAC and operating expenses, and therefore provides some flexibility when comparing the profitability of peers in this space. Because there will be a difference. Therefore, looking at EBITDA as a percentage of total revenue provides a more reliable and comparable number. Nevertheless, management’s EBITDA margin shows that management was right on target with its 30% guidance. This represents an increase of 12 percentage points compared to the same period last year and an increase of 2 percentage points compared to the previous quarter. .

Operating metrics continue to be strong, with an overall retention rate of nearly 90% and a same retailer retention rate of 136% as measured by contribution excluding TAC. Cash balance as of March 2024 was $289 million, with an additional $88 million to be repurchased between Q2 and Q4 2024, in addition to the $62 million already deployed in Q1. It is calculated that the amount will be distributed to shareholders through These results were generally in line with market expectations and did not cause a significant reaction in the stock price.

financial outlook

In our previous article, we expressed confidence that the company would achieve its 2024 EBITDA margin guidance of 30%, which proved to be spot on in the first quarter and was revised to 31% for the full year. I did. I also wrote that the 2024 contribution (excluding TAC) growth rate guidance of mid-single digits seems conservative, but management has actually revised it upward to “low single digits.” We wrote that if the company meets these estimates, we expect the stock price to rise approximately 13%, based on an enterprise value of $1.8 billion. We are pleased to say that as of this writing, the company’s value is $1.9 billion. This means that Criteo has gained 16% since we last covered it.

Our forecast for 2024 remains unchanged. The Company underwrites management’s forecast of low single-digit growth and his EBITDA margin of over 30%. Furthermore, we are confident that Criteo will achieve its double-digit growth from 2025. So far, the company’s share price growth has been very close to its expected EBITDA growth, resulting in an EV/NTM multiple that remains virtually unchanged at just over 5x. EBITDA. If positive indicators of double-digit growth are shown towards the end of this year or the beginning of 2025, this multiple will be reassessed over time, and in the medium term he could be more than 10.0x EV/NTM EBITDA. expected to reach and converge. Other ad tech companies are growing at a similar pace. This would imply a stock value of approximately $3.7 billion and a return of approximately 75% compared to the current share price of $37.40.

Key risk factors

The key risks to Criteo’s investment thesis remain unchanged from those identified in our previous analysis. Like other companies in the adtech space, the main concern for Criteo is the potential negative impact of difficult economic conditions. The advertising industry is known to be sensitive to economic fluctuations, and economic fluctuations can reduce our clients’ advertising budgets and impact Criteo’s revenue. Accordingly, the Company’s results of operations may be affected by changes in economic conditions that may affect advertising expenditures.

Additionally, there are concerns that retargeting revenue, which remains a key component of Criteo’s revenue mix, will decline faster than expected. The sector is likely to face continued challenges as the industry moves away from the use of third-party cookies, a critical tool for targeting and measuring advertising effectiveness.

Additionally, the regulatory and commercial environment surrounding user privacy poses ongoing risks. Changes in data privacy laws and standards, particularly those relating to online advertising and consumer data protection, may create new compliance requirements or limit certain advertising methods. Major industry players such as Apple and Google may continue to enforce privacy in their ecosystems, which could negatively impact the business models of third-party companies that rely on these platforms. Google’s recent put off The phaseout of cookies by 2025 will provide some leeway in this regard. Similar moves across the industry could have a major impact on Criteo’s business plans.

conclusion

Criteo’s strategic shift towards becoming a fast-growing ad tech company once again shows positive signs, highlighted by a positive revision of its management guidelines for 2024. Despite this recent strong performance, market perception of this stock remains anchored in short-term metrics. It overlooks the potential for broader growth in the coming years. We believe that Criteo is a resilient name in the face of ongoing industry challenges, particularly the transition away from third-party cookies. Barring unanticipated macroeconomic downturns, we expect Criteo’s stock price to be more consistent with its intrinsic growth potential over time. As the market gradually recognizes the company’s long-term value proposition, we expect the company’s valuation multiples to be revalued relative to those of its high-growth peers, resulting in significant stock price appreciation.