From Halbergmann/E+, Getty Images

My scope includes not only airlines but also home-based solutions Sky Harbor Group etc. (sky) and business jet manufacturers, etc. bombardier (OTCQX:BDRBF) and general dynamics (GD). Investment ideas in the business jet manufacturing and home base sectors have yielded high returns that easily outperform the market. This also sparked my interest in investigating whether private jet operators are an attractive investment. In this report, we will talk about that outlook. Fly Exclusive Co., Ltd. (New York Stock Exchange:fries) and explain why I like established businesses but not investment stocks.

How does flyExclusive work?

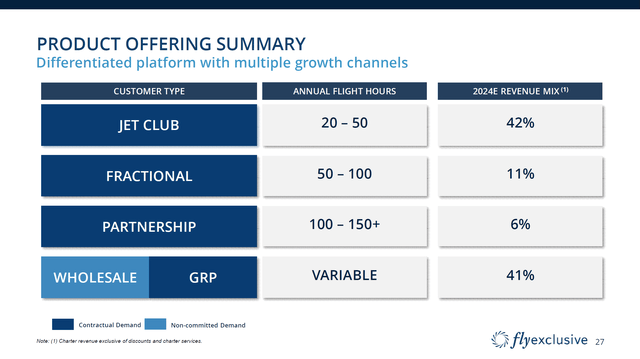

FlyExclusive has different types of customers and each approaches them in a different way. Jet Club focuses on membership, allowing members to pay membership fees and book flights based on established pricing structures depending on their membership level.Membership composition The focus is on low annual flight hours. As the annual flight time increases, fractional ownership arises, where the owner pays for a portion of the jet and a fee for the air service. This partnership level allows flyExclusive to expand its fleet by purchasing jets from owners, refurbishing jets, and doing sale-and-leaseback deals to add aircraft to his flyExclusive fleet. .

Although GRP is essentially a charter program, the only customer of the Guaranteed Revenue Program was Wheel Up (WUP). As a result, GRP’s revenues are not expected to be significant going forward. Files from flyExclusive:

Termination of Wheel Up (“WUP”) On June 30, 2023, the Company served WUP with notice of termination of the parties’ Fleet Guaranteed Revenue Program Agreement (the “GRP Agreement”), effective November 1, 2021 . As a result of the termination, he does not believe that the GRP program will generate any revenue after his GRP contract termination date, which will have a material impact on his financial statements for the year ended December 31, 2023. Masu. Upon termination of the GRP agreement, we plan to wind down our business with WUP for strategic reasons to avoid over-reliance on a single customer and to shift our focus to wholesale and contract retail customers. and was already reflecting a correspondingly reduced revenue. Our published forecasts expect GRP revenue to represent only 1.5% of total projected revenue for fiscal year 2024.

While the wholesale part of the business is aimed at selling excess capacity, the company also provides MRO (maintenance, repair and overhaul) services.

Wheel Up Debacle Hurts fly Exclusive

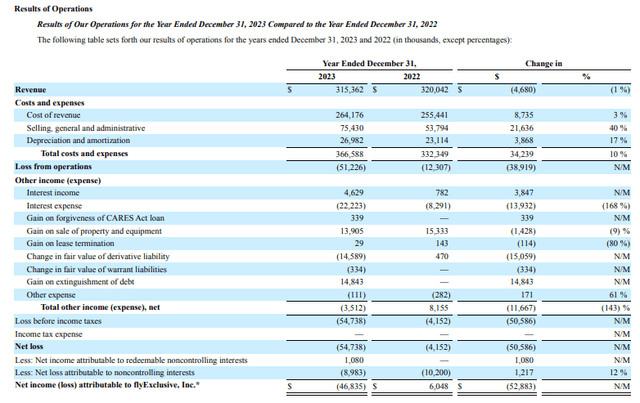

flyExclusive terminated its contract with Wheel Up, which appears to have actually harmed the company. Revenue decreased 1%, driven by a 46% decline in GRP revenue from $123 million in 2022 to $66.9 million in 2023, offsetting approximately $43 million of growth in the jet club and charter business it was done. Upon termination of the WUP agreement, flyExclusive anticipates that it will have no future revenue under the GRP program. This means that in 2024, the company will likely try to make up the remaining $66.7 million in GRP revenue that will occur in 2023. 2024.

Cost of revenue increased 3% primarily due to increases in payroll, lease costs and maintenance, partially offset by lower fuel prices. SG&A expenses increased 40% due to an increase in marketing expenses of $14.2 million and increased labor costs. Depreciation and amortization expenses increased due to an increase in the number of vehicles in our fleet. The operating profit line wasn’t pretty for flyExclusive. Losses widened to $38.9 million, primarily reflecting lower contracted revenue due to discontinuation of service to Wheels Up.

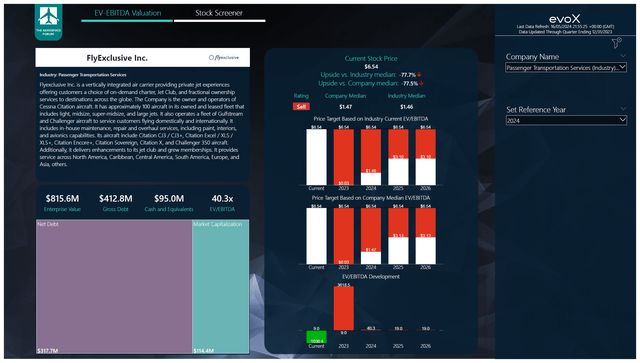

FlyExclusive does not have an attractive investment angle

After processing the projected cash flows; flyExclusive balance sheet data, I can’t find any attractive investment case. The stock price of $6.54 is significantly higher than the EV/EBITDA valuation and book value of $2.79 per share. As a result, I’m marking this stock as a “sell” as I believe there are a lot of stocks in the market that have gone up fundamentally, but Fly Exclusive has offset the losses on the Wheels Up contract and is on the way. Because we need to use 2024 and possibly 2025 to find out. Towards positive cash flow. Until that happens, it will either have to increase its debt or dilute its shareholders.

Bottom line: FlyExclusive is not delivering value at this point.

I like FlyExclusive’s business concept and it is profitable on an adjusted EBITDA basis. However, losses from the Wheels Up business will be evident in the company’s 2023 results, and will need to be offset by an additional $66.9 million in 2024. I think the road to positive free cash flow and lower debt levels will be a long one. As a result, I’m marking the stock as a sell, but I wouldn’t mark it as a short-term idea. flyExclusive, Inc., in my view, is just another company that doesn’t offer a compelling investment case, but I’m sure there are plenty of other opportunities based on its fundamentals.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.