rapid eye

introduction

It’s time to talk about Enbridge (New York Stock Exchange:ENB) (TSX:ENB:Canada)one of my favorite stocks on the market for two main reasons.

- The company is North America’s largest midstream company and the backbone of (the world’s) energy security.It’s a great company to learn from For “supply chain managers” like me.

- The company has great value characteristics at 7%, making it a great stock for what I believe will be a very favorable time for “value” stocks.

my recent article I wrote about this stock on February 5th when I combined it with another stock I like (and own), Antero Midstream (morning).

Since then, ENB has returned 7%, outperforming the S&P 500 by about 150 basis points.

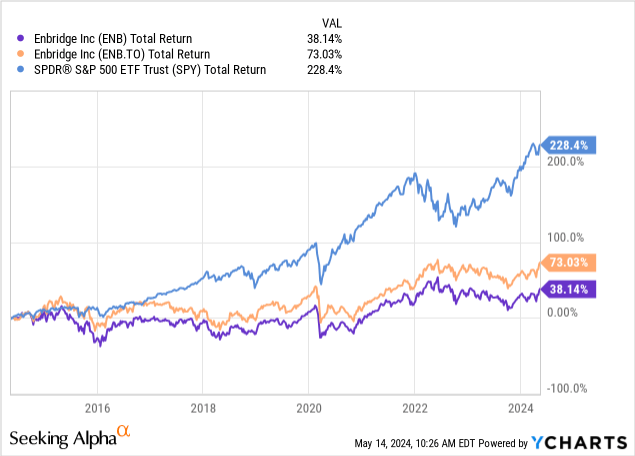

The problem is that ENB’s long-term performance remains poor.

Over the past decade, Toronto-listed ENB stock has come back. 73% including dividends. The New York-based stock returned just 38%.

As a result, every time I wrote an article, readers complained that ENB was getting a lot of coverage from analysts without showing decent profits.

Don’t get me wrong. Agree!

ENB is getting a lot of attention, but its returns are very poor. Even if I were a long-time shareholder, I would feel the same way.

However, if you include dividends, every article I’ve written since early 2023 has been profitable.

I don’t say this to brag (most returns are still razor thin). Because this article is about my long-term thesis. This includes Wall Street’s new love for middle-class assets.

As I mentioned in a previous article, I think the market is finally starting to realize how much value Enbridge and its high-quality competitors bring.

Now, let’s take a look at the details.

Wall Street suddenly became interested.

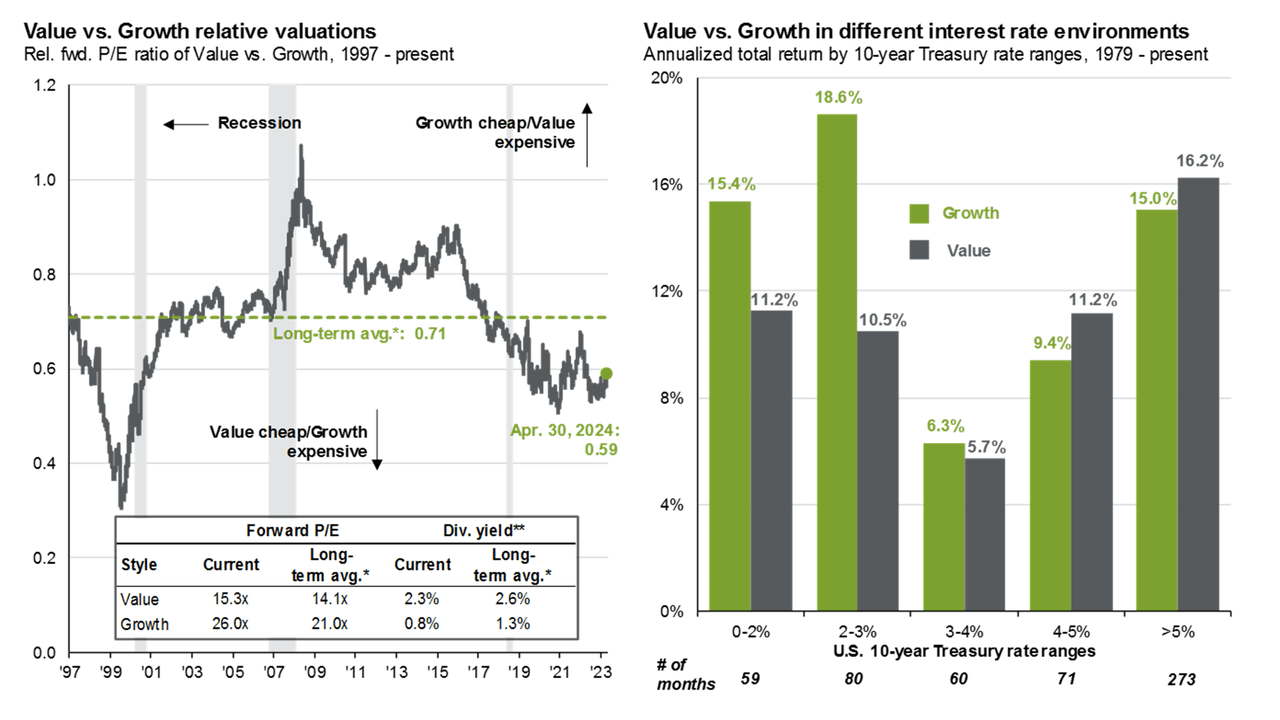

I have written countless articles believing that the market will move from “growth” to “value.” This includes: article title”The party is over for FANG+ stocks – are you ready?“

While the allure of tech giants like Mag 7/FANG+ stocks may be strong, changing market winds suggest a shift toward value stocks may be wise.

As inflationary pressures mount and the era of low inflation could end, the balance of risk and reward favors companies with strong balance sheets, broad businesses, and long-term growth potential. .

JP Morgan

Midstream companies are the place to be.

After more than a decade of aggressive investment in new pipelines, the industry is finally beginning to benefit from a wide range of tailwinds, including increased free cash flow, stable commodity prices, high energy demand, and rising interest rates. , the attractiveness of purchasing is increasing. Income stocks.

That’s where Wall Street comes in.

As the Bloomberg title below suggests, the buyers are back.

by articlepublished on April 10th (emphasis added):

Investors are eagerly buying up stocksbecause companies provide large dividends to their shareholders. This is a particularly attractive feature if your interest rate is fixed above 5%..

(…) Just in case, Pipeline company stocks have lagged well behind gains in oil and gas producers.Even if those higher payments are included on a total return basis. The S&P 500 Energy Index is up more than 17% in total return since the beginning of the year, while the popular Alerian MLP ETF is up just under 14% over the same period.

Paul Baiocchi, chief ETF strategist at SS&C Technologies, which offers the Alerian MLP fund, said: Given that many stock sales are oversubscribed, we think the gap should be narrower..

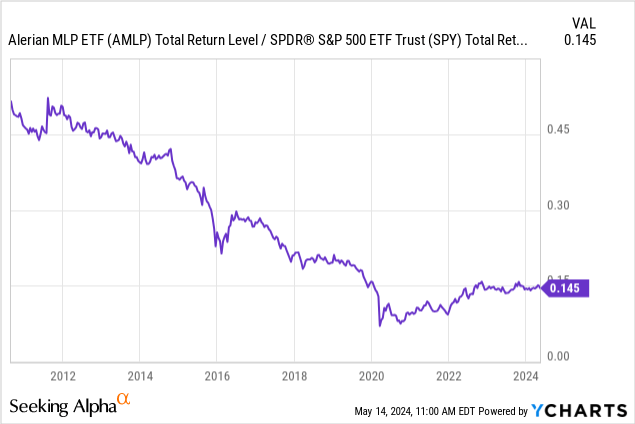

On the other hand, Alerian MLP ETF (AMLPThe ETF used as a benchmark in the Bloomberg article has underperformed the S&P 500 by a mile in the past due to unfavorable factors, but the market has fared better since the pandemic, as the AMLP/S&P 500 ratio below shows. is outperforming.

Despite the rise in tech stocks last year, the tech-heavy S&P 500 index did not outperform MLPs.

I believe midstream assets are very likely to outperform going forward.

That’s where Enbridge comes in.

There is little doubt that Enbridge will perform well for years to come.

Or, as Enbridge puts it, “It’s on tomorrow. ”

After updating the numbers and polishing the paper, I have to say that everything went according to plan.

First, the company reported record financial results in the first quarter, which (not surprisingly) owed its success to strong operating results and energy fundamentals.

After all, both energy demand and supply are healthy, which benefits pipeline owners.

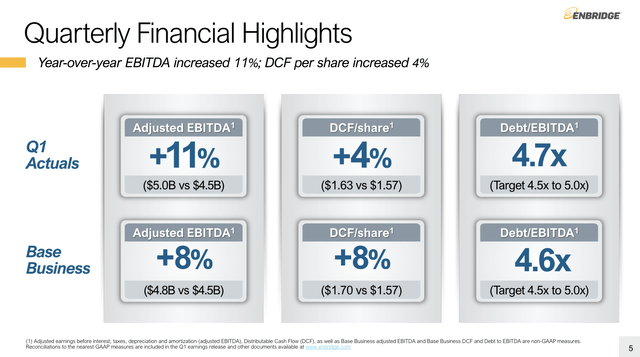

Highlights of the quarter include 11% year-over-year increase in adjusted EBITDA and progress toward achieving 2024 financial guidance, as shown below.

The company also increased its DCF (distributable cash flow) per share by 4%, with underlying business growth of 8%.

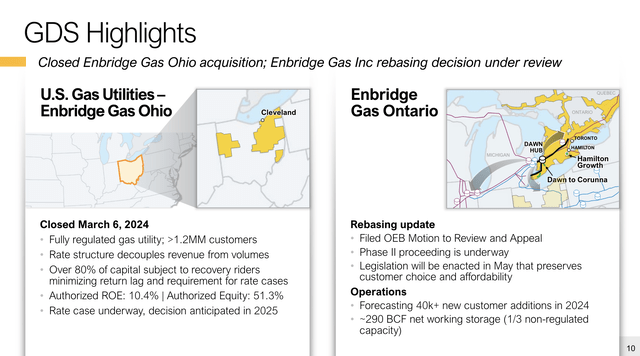

The company also completed the acquisition of East Ohio Gas, part of Dominion Energy (D) transaction To sell natural gas assets to Enbridge:

(…) The acquisition of East Ohio Gas was completed on March 6, further diversifying our business, expanding our growth prospects and strengthening the stable cash flow profile of our asset base. it was done. As a reminder, we have already secured more than 85% of the financing needed to acquire a U.S. gas company, and the rest is through hybrid or debt issuance, capital recycling, ATM issuance, and other alternatives. We plan to raise funds in combination. – ENB 2024 Q1 Financial Results Announcement

Enbridge is in a great position because these deals add a tremendous amount of safety to the portfolio.

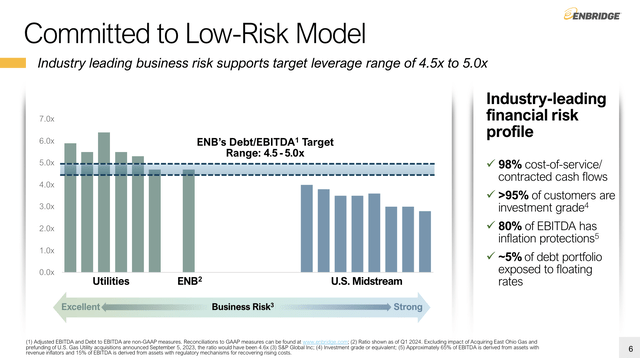

ENB not only has a net leverage ratio of 4.6x (near the lower end of its long-term 4.5x to 5.0x range), but also a service cost/contracted cash flow of 98%, which is over 95% . Acquired investment grade customers and protected 80% of EBITDA from inflation.

Only 5% of the debt has variable interest rates, which is very helpful in the current rising interest rate environment.

The good news is that we also aim for consistent growth.

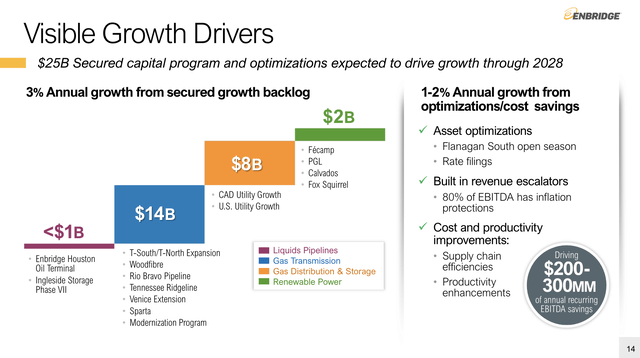

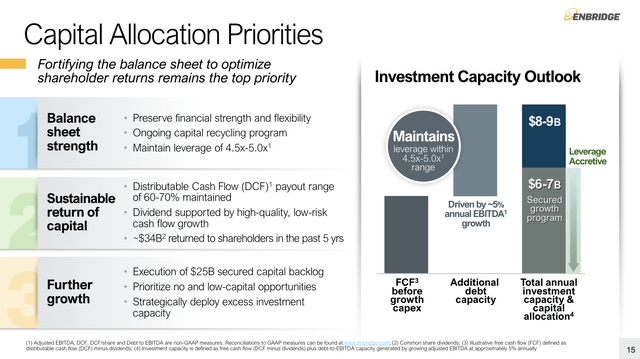

Enbridge’s growth strategy revolves around a safe capital program and optimization opportunities, which provide visibility into 4% to 5% of the company’s overall medium-term growth outlook.

Our solid growth program now stands at $25 billion, with a significant portion of our backlog focused on gas transportation and utilities, as you can see in the overview below.

In addition, the company focuses on cost efficiencies, including reducing overhead, increasing productivity, and incorporating inflation protection into commercial contracts.

The company says asset optimization, cost management and contract negotiation have historically generated 1% to 2% of Enbridge’s annual growth and will continue to be key drivers of its business. is.

When it comes to capital expenditures, the company has always kept a close eye on its balance sheet, which has supported it. “Recent” sales Au Sable, Alliance and NR Green joint venture shares sold to Pembina for $2.3 billion.

It plans to allocate up to $7 billion in secured growth programs to meet growth targets without additional spending. The long-term goal is to increase EBITDA by 5% annually.

In terms of dividends, the company has distributed $34 billion to shareholders over the past five years, and expects this number to increase to approximately $40 billion over the next five years, while keeping DCF’s dividend range between 60% and 70%. It is expected.

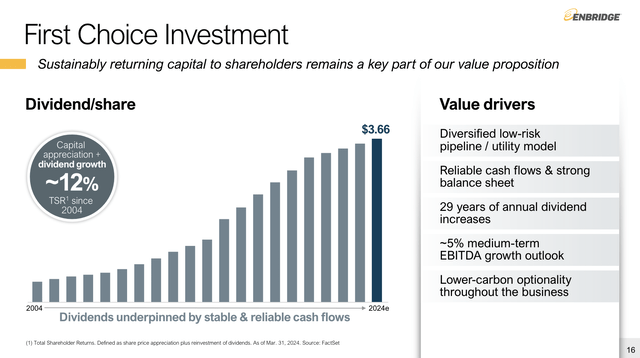

The company has continued to increase dividends for 29 consecutive years. Although the growth rate of dividends has decreased significantly, 5 year dividend CAGR It’s still 5.1%.

After raising its dividend by 3.1% on November 29, it now pays C$0.915 per share per quarter. This translates into a yield of 7.1%.

The good news continues.

As mentioned above, valuation is a big reason why “smart money” finds high-quality midstream companies like Enbridge attractive.

evaluation

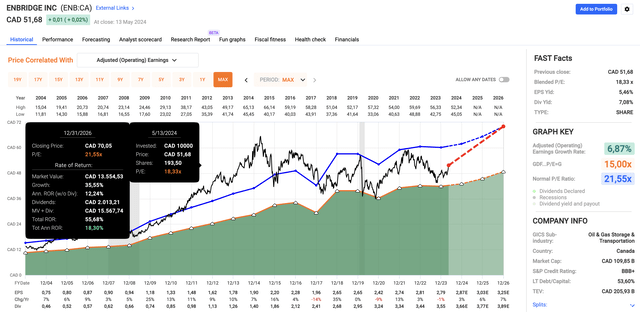

ENB’s blended P/E ratio is 18.3x, lower than its long-term normalized P/E ratio of 21.6x.

Even better, using FactSet data in the chart below, we can see that analysts expect EPS growth to accelerate from 3% in 2024 to 7% in 2026.

It may take some time for ENB to return to its normalized P/E ratio, but this puts the fair price target in Toronto at around CA$70, which means around 35% above the current price. The same applies to New York-listed ENB stock.

Including dividends, we think it’s very likely that you’ll see a 10-15% annual return over the long term.

Since January 2004, ENB has returned 9.6% per year in Toronto. That includes very poor performance over the past decade.

This also shows the power of ENB’s dividend.

Needless to say, based on everything said in this article, I expect ENB to finally break out of its very long sideways trend and provide above-average returns for many years to come.

remove

Enbridge may be facing increased scrutiny due to lackluster long-term results, but recent developments point to a promising future.

As Wall Street (slowly) moves toward value stocks, midstream assets like ENB are gaining momentum.

With solid financials, consistent dividend increases, and strategic acquisitions, ENB is poised for significant growth.

Despite past challenges, current valuations suggest significant upside potential. In short, I expect ENB to break out of its sideways trend and deliver strong returns over the next few years.

Advantages and disadvantages

Strong Points:

- solid finances: ENB achieved record financial results and a strong balance sheet with steady growth in adjusted EBITDA and distributable cash flow.

- Stable dividend: ENB offers attractive income potential with a history of 29 consecutive years of dividend increases and a current yield of 7.1%.

- strategic acquisition: Recent acquisitions such as East Ohio Gas have diversified ENB’s portfolio, strengthened its cash flow profile, and increased its security and stability.

- valuable opportunity: ENB offers an attractive value opportunity as it trades below its long-term normalized P/E and analysts predict accelerating EPS growth.

Cons:

- Concerns about past performance:Despite recent improvements, ENB’s long-term performance has been lackluster and may keep investors away, but that now appears to be changing.

- External risks: As a midstream company, ENB is subject to market fluctuations, regulatory changes and other industry-specific risks, which may affect its results of operations.

- economic weakness: ENB benefits from a rate-based business with utility-like security, but underlying economic weakness could result in lower-than-expected growth rates.