Tom Warner

PayPal (Nasdaq:PYPL) is currently trading at a less demanding valuation, but this doesn’t seem to be justified given its strong fundamentals and good growth prospects going forward.

Company Profile

PayPal is a major fintech company, Digital and mobile payments across several platforms, including the company’s Checkout business, Venmo, and more. The company has historically grown through both organic efforts and acquisitions, and is now one of the leading players in the digital payments industry. Its current market value is approximately $66 billion, and its shares trade on the Nasdaq Stock Exchange.

Its core business is to provide online payment solutions to merchants and consumers and generate fees from transactions. Therefore, a key metric to consider is total payout, which is highly correlated with overall revenue.

Its business has evolved since its inception, evolving from online checkout. Through both organic growth efforts and acquisitions, Button offers several financial services and expands its product offering into digital wallets, money transfers, and loans beyond others. This has created a strong and unchallenged ecosystem for consumers and sellers. This has been the key to PayPal’s leadership position in the digital payments industry.

Growth of PayPal

PayPal has had an impressive history of growth since its inception, and its profile is justified by its leading position in the digital payments industry and the trend of digitalization over the past 25 years, namely the rise of e-commerce around the world.

The financial industry has also become increasingly digital over the past decade, providing strong tailwinds for PayPal’s growth, allowing the company to expand its product offering beyond its core checkout business and expand its overall addressable market. Ta.

This background has enabled the company to report strong growth over the years, despite facing the headwinds of the recession. eBay (ebay) The decision to switch from PayPal to another competitor in the platform.

Additionally, the pandemic was a major tailwind for the company’s business in 2020-21, as people shifted from in-store purchases to online due to repeated lockdowns around the world. .

At the time, the company was very bullish about its growth prospects and announced aggressive growth targets. February 2021we found that while the digital payments industry as a whole still has good long-term growth prospects, that growth is short-lived and more pandemic-related than structural.

In fact, PayPal’s growth has slowed considerably since the last quarter of 2021 as consumers returned to in-store purchases and competition increased across several business segments, but this background has been It was clearly a difficult situation.

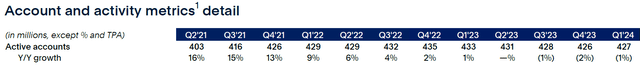

As shown in the table below, PayPal’s total number of consumer and merchant accounts is largely unchanged from the end of 2021, going from double-digit annual growth to decline in recent quarters.

As of the end of March last year, the total number of accounts was 427 million, down about 9 million from the peak of 435 million at the end of 2022, and there are no good signs for future growth. This indicates that PayPal’s business has reached a maturity stage and further growth may be difficult to achieve due to the presence of competitors such as: Adien (OTCPK:ADYEY) or block (square) are improving their services, and PayPal’s competitive advantage appears to be waning.

Additionally, PayPal used to have very good pricing power, but this appears to be changing as it can no longer raise prices without losing customers. This has had a negative impact on the company’s profit margins over the past few quarters, and is another worrying sign for future profit growth.

This also means that PayPal’s fees are somewhat high and competitors are offering increasingly lower-priced products and services, putting pressure on PayPal’s leadership position, especially among merchants. It’s another sign that customers now have more choice and can switch to another payment platform.

To offset these trends, PayPal has invested in new services and leveraged data to better serve customers. While this may have a positive impact on reducing customer churn and increasing engagement, it is unlikely to be a major growth driver going forward. Year.

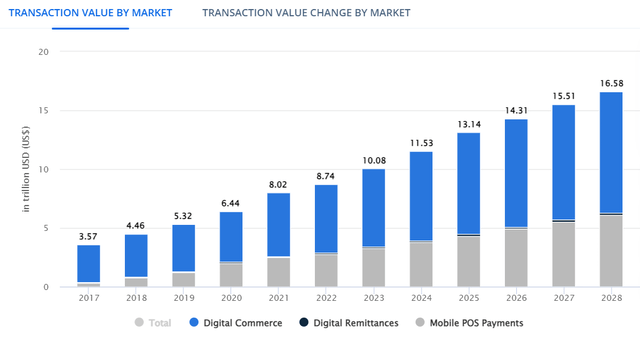

Nevertheless, PayPal’s growth will continue to be supported by the structural shift in commerce from physical retail to online, although competition may increase and differentiation from competitors may decline. must. surely, According to the Bureau of Statisticstotal transaction market value is expected to grow by nearly 9.5% annually from 2024 to 2028, which, while a slower growth rate than before the pandemic, will be a strong tailwind for PayPal’s growth in the coming years.

Financial overview

In terms of financial performance, PayPal has a checkered history, given that it reported very strong growth up to 2021, but more recently, growth amid increased competition and a more challenging macroeconomic environment. The financial numbers are much worse, reflecting the decline in rates.

Nevertheless, PayPal has been able to grow sales and earnings and generate significant free cash flow in recent years, demonstrating that the company’s business still has good fundamentals and has a strong position in the digital payments industry. It shows that it is maintained.

in 2023, its total payment value (TPV) has reached more than $1.5 trillion, an increase of 13% year-over-year, which means that PayPal has about 15% market share of the overall industry. This resulted in sales of $29.7 billion, an increase of 8% year over year. This is lower than historical growth rates, but still acceptable for a large company like PayPal. Despite the increase in TPV and revenue, the company’s trading margin decreased 1% year over year to $13.7 billion, indicating that its pricing power has weakened in recent years compared to the previous year.

Despite the inflationary environment, PayPal has made certain efforts to reduce costs and operate more efficiently. This explains why operating expenses were down 11% year-over-year to $7.0 billion, and 2023 non-GAAP operating income was $6.7 billion (up 14% year-over-year). ). Non-GAAP operating margin was 22.4%, which was significantly lower than the peak margin of approximately 28% reported in 2021, but still quite good. Net income was $4.1 billion (up 13% year over year) and free cash flow was $4.2 billion.

inside First quarter of 2024, PayPal maintained strong operating momentum and delivered financial results that exceeded its own guidance. The company’s TPV increased 14% year-over-year to over $400 billion, and quarterly revenue was nearly $7.7 billion (up 9% year-over-year). Trading margins were better than last quarter, increasing 4% year over year to $3.46 billion.

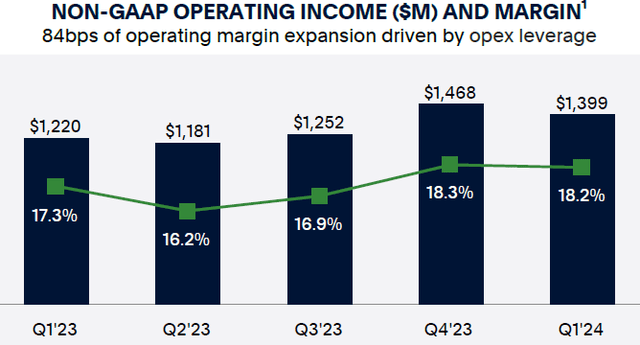

Regarding operating margins, PayPal has made significant changes to the way it reports its results and now includes stock-based compensation (SBC) in its non-GAAP results. This explains why non-GAAP operating margin was 18.2% in Q1 2024 (22.4% in 2023), but SBC-adjusted operating margin was essentially unchanged from the prior quarter. doing.

Operating profit margin (PayPal)

Non-GAAP operating income for the quarter was approximately $1.4 billion (up 15% year-over-year), and free cash flow was more than $1.8 billion, a significant increase from the same period last year.

In terms of guidance, PayPal expects to continue its solid growth trajectory, with revenue increasing approximately 6.5% next quarter, mid-to-high single-digit non-GAAP EPS growth and free cash growth for the full year. is expected to reach approximately $5 billion. flow.

Although PayPal’s growth has clearly slowed over the past few years, its business is still growing, the business remains highly cash-generating, and it will continue to benefit from industry tailwinds in the coming years. There is a possibility.

In terms of financial health, PayPal’s balance sheet is solid, considering its net cash position was approximately $6.6 billion at the end of March last year. The company’s strategy was to return most of its free cash flow to shareholders through share buybacks.

In fact, the company repurchased about $5 billion of its shares last year, in excess of its annual free cash flow, and repurchased $1.5 billion of its shares in the first quarter of 2024, just below its free cash flow generation. For the full year, the company expects to generate about $5 billion of free cash flow and repurchase the same amount of shares, so the company’s strong cash position is expected to change significantly in the near future.

Despite this strong background, PayPal doesn’t pay a dividend and is unlikely to change its strategy in the short term. However, the company clearly sustainable dividend Expanding the investor base to include income-oriented investors could be a positive factor in increasing stock prices in the long run.

conclusion

Although growth has slowed by historical standards over the past two years, PayPal remains a leader in the digital payments industry, with a growing business, strong cash generation, and strong financial positioning. It has a foundation.

Despite this strong backdrop, the market has penalized slowing growth, and the company’s stock price is currently transaction It trades at just 14.2 times forward earnings, while the historical average over the past five years is nearly 30 times. Additionally, compared to Block (trading at 19x return); visa (V) 26x or master Card (Ma) At 29x, PayPal also seems clearly undervalued.

This shows that the market is clearly mispricing the company’s stock because, in my opinion, PayPal is a major player in a growing industry and is a good strategy for both growth and value for long-term investors. means.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.