MF3d/E+ (via Getty Images)

The AI software field is waiting to launch. C3.ai Co., Ltd. (New York Stock Exchange:A.I.) remains a prime example of frustration. The company will report fourth-quarter results next week (After marketing on May 29th) and should This is a good indicator of whether growth will accelerate in FY25, especially considering that the transition to consumer billing should start with further growth by now.my investment thesis We remain neutral on the stock price relative to earnings.

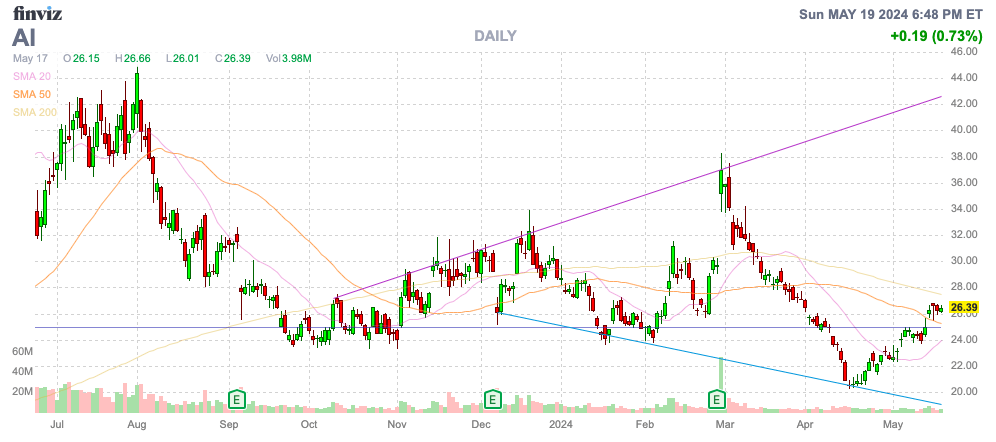

Source: Finviz

AI pilot lamp

C3.ai is currently adding a large number of new AI customers in its pilot program, in addition to existing customers who have switched to a pay-as-you-go pricing model. The overall scenario suggests that revenue will increase as both customers expand their usage over time.

The AI software company announced 445 engagements during the third quarter. This was an 80% increase from February in the previous quarter. C3.ai has started The consumption pricing model was introduced in Q1 2023 and we are now in Q9 with the transition to a pricing model based on vCPU/hour usage rather than a large upfront subscription model.

The company outlined the following pilot deals during this period and expanded significantly last year.

- Q3 2024: 29 total, 17th generation AI

- FQ2 ’24: 36 total, 20th generation AI

- Q1 2024: 24 total, 8th generation AI

- Q4 2023: 19 total

- Q3 2023: 17 total

- Q2 2023: 13 total

- Q1 2023: 13 total.

The point of switching to a consumption model is to increase the number of customers engaging with the C3.ai software platform through these pilot transactions. This model should start to bear fruit in his fiscal year, and the company should start converting these pilot programs into production deals, with about 70% of deals moving into production programs. A 12-week generation AI pilot requires him to pay only $250,000 for 12 weeks. Trial of the week.

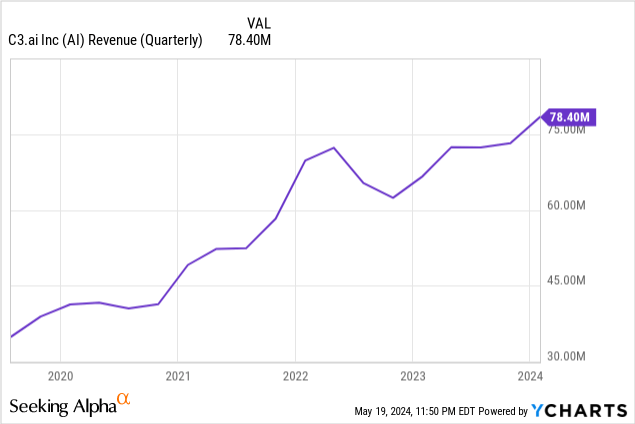

The key to the next quarter will be C3.ai pivoting to a post-transition consumption model. This software company increased its revenue from just $72 million in several quarters to a record level of $78 million in the third quarter of 2024.

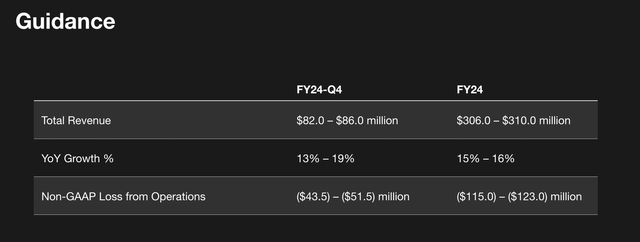

The company now expects fourth-quarter revenue to top $82 million. The consensus forecast is $84 million for nearly 17% growth, with C3.ai disrupting the market with arguments that customers agree to 3-year subscription agreements and 10% growth versus a fully consumable pricing model. Revenues had a consumption-neutral aspect over a period of ~12 quarters. However, the revenue trends may differ from the monthly consumption model.

Although the company is showing signs of recovery, C3.ai faces the same issues: Palantir Technologies (PLTR). The AI data software company has a long list of customer engagements and pilot tests, but even as customer engagements and pilot deals surged 80% to around 30 deals, more than doubling year-over-year, revenue The outlook does not aim for significant growth of more than 20%. quarter.

recently needham conferenceCEO Tom Siebel highlighted some of the big benefits that generative AI software tools bring to customers:

…a large US law firm trained its enterprise learning model on – you can understand this by looking at the corpus. second government. So I loaded all S1, all 10-K, and all 10-Q to train the enterprise learning model. So when this law firm wants to write the next S1 for the next person to go public, whether it’s Databricks or Anthropic or whoever, they’re going to enter their name, address, financials, and risk factors. , a carriage (ph) return produces the first draft of S1 in 1 hour. Well, it used to take her 7 employees 2 weeks.

The big disconnect is still in the revenue from these deals, which save customers the jobs of up to seven employees over several weeks, but C3.ai’s revenue hasn’t increased significantly.

Growth in 2025 will be slow

Investors want to see fourth-quarter revenue beat the consensus target of $84 million. Such total quarterly earnings would be $6 million more than his previous high of $78 million for the third quarter.

Source: C3.ai FQ3’24 presentation

Analyst consensus targets for FY25 are modest quarterly revenue growth, but adjustments are being made for more substantial growth through a combination of consumption models and enhanced pilot testing. C3.ai is targeting revenue of $86 million in the first quarter, which will rise modestly to $93 million in the third quarter, but the company believes that its AI demand will skyrocket due to consumption models. This is expected to exceed the 10th quarter.

Another important number is quarterly cash burn or net loss. C3.ai ended the quarter with a cash balance of $723 million. cash burn If revenue growth is fast enough, the level doesn’t matter that much. Nevertheless, the company expects to have free cash flow in the fourth quarter of 2025 and 2025 after having negative free cash flow of $106 million through the first three quarters of 2024. The outlook is for cash flow to be positive.

Guidance for the fourth quarter was for an operating loss of $47.5 million at the interim point. This huge loss is more than double the previous quarter’s loss, and the market will be hoping that C3.ai can return to breakeven with a loss rate of over 50% of revenue.

The main big issue regarding C3.ai and the AI software sector as a whole is the following statement from outgoing CFO Juho Parkkinen: 2024 Q3 Financial Report:

But we are still planning for 25 years. So we think the opportunity is huge. We’re very excited about the generative AI opportunity, but it’s too early to provide any guidance on what our 2025 revenues will look like. However, we are confident that he will be free cash flow positive in 25 years.

On the one hand, C3.ai is predicting a large-scale generative AI opportunity, with analysts predicting that the company will be in the fourth quarter after reaching an estimated $84 million in the April quarter reported on May 29. It doesn’t even predict quarterly revenue could exceed $100 million. The challenge for the technology industry is that great opportunities are yet to be fully realized.

With current FY25 revenue targets of just $368 million and conservative assumptions that continued operating losses will reduce cash balances to $500 million, the company’s stock would trade in the following range: Investors are looking to buy C3.ai at the lower end of the range.

- 5x EV / 2025 revenue of $368 million = $20.

- 8x EV / 2025 revenue of $368 million = $29.

remove

Importantly, C3.ai is trading in a range where software companies typically trade with strong gains based on EV/S targets. C3.ai, Inc. isn’t even close to profitability yet, and its AI software story hasn’t generated enough growth to warrant a premium valuation.

Investors will no doubt be watching for signs of an inflection point in the sector.