Klaus Wedfeldt/Digital Vision via Getty Images

CPI was lower than expected

This week, all eyes were on April’s CPI data, which was slightly lower than expected. This seems to have been expected by almost everyone except me.yes, this is how I say it I was wrong. I make no apologies for closing out positions in my trading account and putting most of my cash into CPI. Even though I had minimal hedging, it wasn’t too painful to exit. That’s what insurance is for. I’m still cautious and currently hold about 35% cash. I intend to maintain that level for the rest of May. This means that if you want to trade, you will need to exit your current trade in order to participate in a new trade. I just wanted to get this down on paper, as I’ll cover later in this article. Trying to be as realistic as possible, I pointed out the possibility that the CPI could go even higher, but it has since gone even lower. Now let’s move on.

With the exception of retail, economic indicators improved and stock prices rose.

The Department of Commerce’s Census Bureau reported on May 15 that retail sales for March had been slightly revised downward to 0.6%, while retail sales had previously been reported to have increased 0.7% in April. announced that its retail sales remained unchanged. Many consumer stocks sold off in response to this data. Now that a few days have passed, you can sift through the different names and choose some good deals. Some very strong stocks were abandoned. Therefore, I first want a service-focused stock, preferably an “asset-light” name. Let’s start by looking at travel and entertainment stocks. Middle class and above consumers are still traveling and going out.

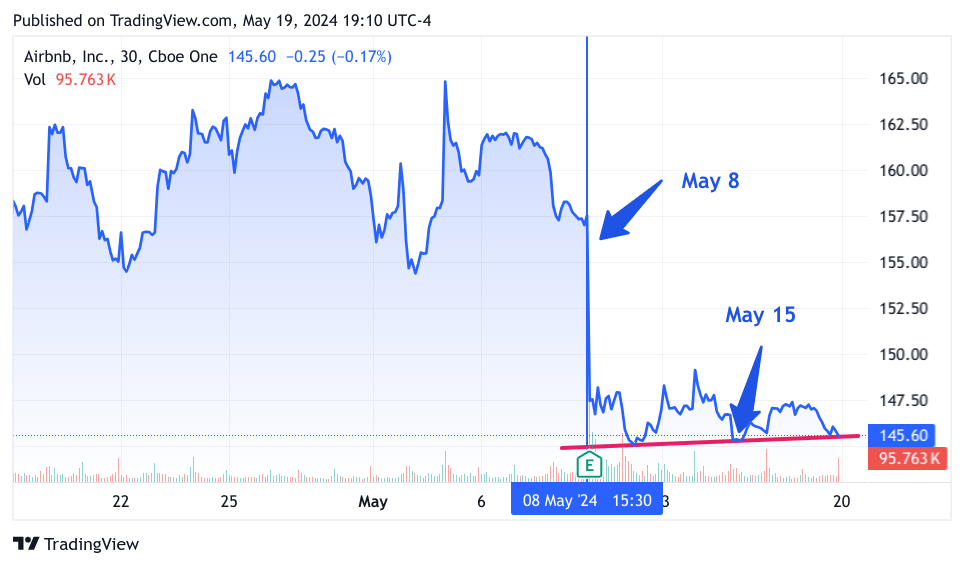

First, let’s review Airbnb (ABNB)

So on May 8th, ABNB reported what was by all accounts a great quarter. The stock sold off after a weak outlook for the second quarter. It’s common for growth stocks to backtrack on guidance, underpromise, and then exceed expectations. The same thing is happening here. Airbnb’s first quarter revenue was $2.14 billion, an 18% increase from the same period last year. The company expects second-quarter sales to be between $2.68 billion and $2.74 billion, compared with the average analyst estimate of $2.74 billion, due in part to currency exchange rates and the timing of Easter. became. Is it as bleak a prediction as is being reported in the media? Profits also exceeded analysts’ expectations by 77%.Let’s take a look at the 1 month chart

TradingView

There is a significant drop on May 8th after the earnings announcement, followed by a slight recovery by May 15th when retail sales are announced. Still, we see higher lows, as shown by the red line. I think there is an opportunity to go long ABNB and enjoy the stock’s rebound as market participants look back at the numbers and reconsider dumping this great name.

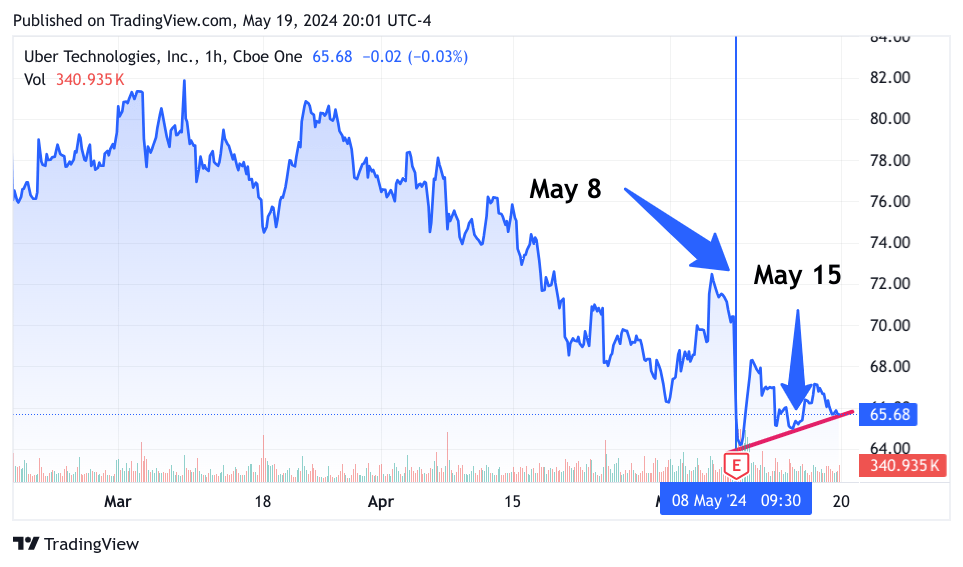

Next is Uber Technologies (Uber)

UBER also reported on May 8 that it is understanding a more complex earnings situation. I’m not surprised that UBER was sold, but it did write off some of its overseas investments, and gross bookings declined slightly, along with increased litigation costs. Sales increased 15% year-on-year to $10.1 billion, but no one wants to see an unexpected huge loss of $654 million, but UBER is not staying silent.The company’s Uber Eats is Taiwan’s Mr. M acquired food delivery business Food Panda for $950, and Uber Eats contracted with Costco to deliver products. Uber also just announced new shuttle his services to airports, concerts, and stadiums. Instacart (cart) uses Uber Eats for restaurant delivery. So I think this is a one-time thing. In my opinion, UBER can be acquired in a trade with the expectation of a very nice recovery. Let’s take a look at the 1 month chart.

TradingView

We see a very similar pattern. It crashed on May 8th and rebounded by May 15th. The red line shows higher lows as the stock resumes its recovery. I think this is a great entry point not only for investing but also for trading.

Finally, affirm (AFRM)

AFRM reported a 51% year-over-year increase in revenue, but a quarterly loss of 41 cents, representing a positive earnings surprise of 38.57%. However, AFRM is heavily sold, with many analysts pointing to downward revisions to Shopify’s guidance (shop) and AFRM sold accordingly. SHOP is only his 10% of his GMV (gross merchandise value), so it won’t have much impact on AFRM’s stock price. So far, the idea that AFRM has significant credit losses is false, as the 2024 amortization rate has fallen to just 2%. Finally, AFRM raised its guidance for the current quarter. Let’s take a look at the 3 month chart.

TradingView

Similar to ABNB and UBER, AFRM also reported on May 8th and like the previous two days, AFRM fell further from May 15th, but throughout the week AFRM improved. Perhaps market participants are already reconsidering their negative impressions of AFRM.

I’m already a long-term investor in AFRM and UBER, and have some trades in UBER as well. I’m going to return to AFRM for trading and consider starting a position in ABNB for investing.

Why am I still on guard?

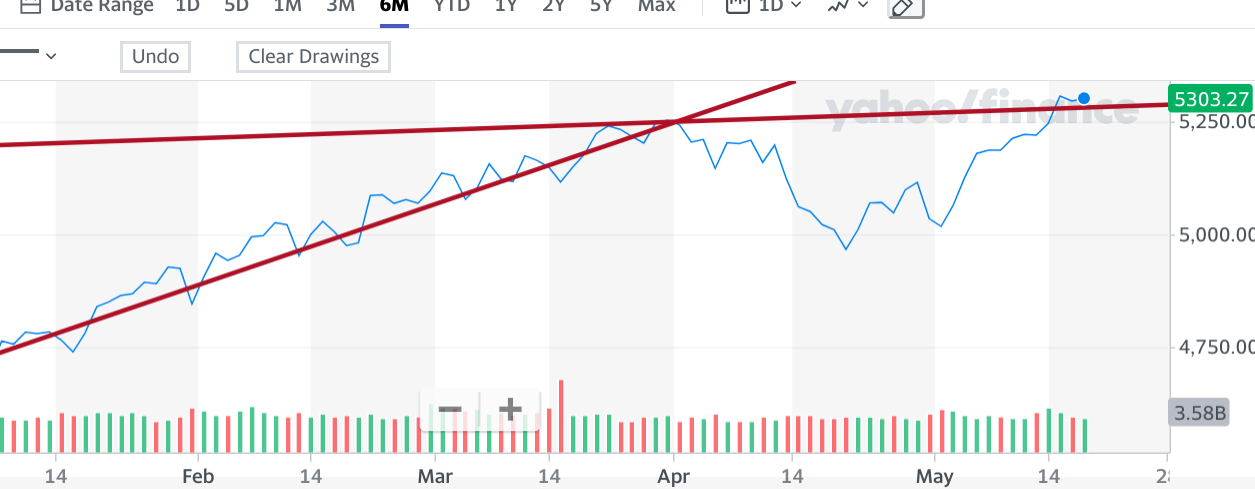

Now, as for why I’m still cautious about the market, take a look at this chart I shared with my investment group. This is a six-month chart of the SPX index, or S&P 500. I just wanted to explain how the SPX index trades. This chart was provided by Yahoo Finance.

Yahoo Finance

trading view

This is a very simple chart. The steepest slope is the rise with a very strong upward movement. The second nearly flat line shows that the previous peak leading to the current peak has barely moved upward. We are concerned that this may be a false breakout. It’s simple, so I’m going to keep a lot of cash for now and see if it drops further.