JHVEPhoto

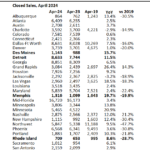

Shopify Inc. (NYSE:SHOP) (TSX:SHOP:CA) has been an underperformer in the latest earnings season compared to its closest e-commerce and payment processing solution peers like Amazon (AMZN) and PayPal (PYPL). Despite outperforming both sales and earnings metrics in Q1, the positive results were largely overshadowed by concerns pertaining to diminishing profit margins as management commits to higher opex spend.

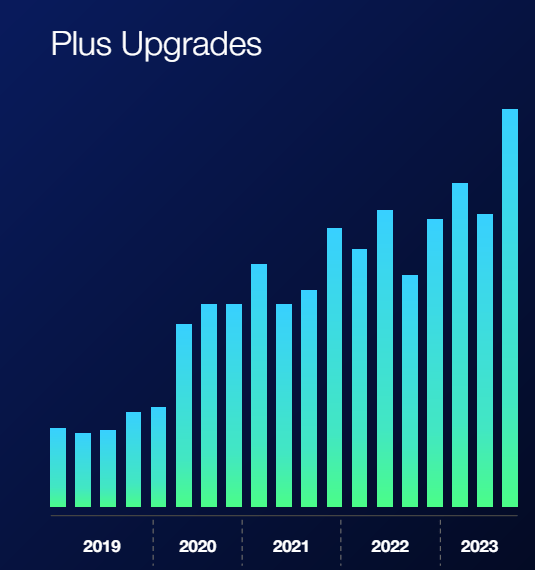

More importantly, we believe the lesser-than-expected tailwind from Plus plan price changes that went into effect earlier this month was likely a primary driver of Shopify’s post-earnings downward valuation adjustment. However, consistently higher growth in Plus plan adoption, alongside the subscription cohort’s disproportionate impact on Shopify’s financial performance, remains accretive. Specifically, Plus adoption remains a key gauge for Shopify’s penetration of broader commerce and payment processing opportunities both online and offline, as multichannel platform adoption continues to gain momentum.

Meanwhile, Shopify’s increasing implementation of AI tools, such as Sidekick and Magic, for merchants also unlocks additional productivity gains, which reinforces the ecosystem’s unique value proposition. Taken together, we believe the stock’s recent selloff has resulted in a valuation that underappreciates Shopify’s expanded growth prospects driven by multichannel penetration, alongside AI-driven total addressable market (“TAM”) expansion.

The Outsized Contributions from Shopify Plus

Shopify Plus is currently the company’s most expensive premium subscription curated for larger merchants in the enterprise segment. The premium subscription combines commerce management and payment processing tools for multichannel platforms that span both online and offline, and across B2B and DTC business models. In addition, key Shopify APIs curated for the sales to checkout process, such as Shop Pay and Shopify Payments, Plus also includes POS Pro, B2B on Shopify and Shopify Markets. These tools have not only been key to fostering Plus adoption by satisfying larger merchants’ growing multichannel presence, but also deepens Shopify’s penetration into commerce opportunities beyond online stores.

For instance, offline POS Pro locations continue to forge high double-digit percentage growth across large merchants with 20+ locations. This has been a key driver for continued offline market share gains, with sustained acceleration in offline GMV growth to 32% y/y in 1Q24 (4Q23: +28% y/y). B2B is another key opportunity for Shopify, as the company targets further penetration into a $450+ billion TAM in this cohort. Meanwhile, Shopify Markets also furthers the company’s reach into cross-border opportunities by facilitating international transactions for global merchants at scale.

And Shopify Plus’ outsized contributions to the company’s financial performance has been consistent. It is estimated that Shopify has acquired about 28,000 Plus subscribers (or ~1% of 2 million merchants) since launch in 2017, up from 7,100 disclosed in 2019 and 10,000+ disclosed in 2020. Comparatively, the remainder of Shopify’s non-Plus merchants has grown at a slower pace of about 1 million in 2019 to 2.1 million in 2021 when the metric was last disclosed.

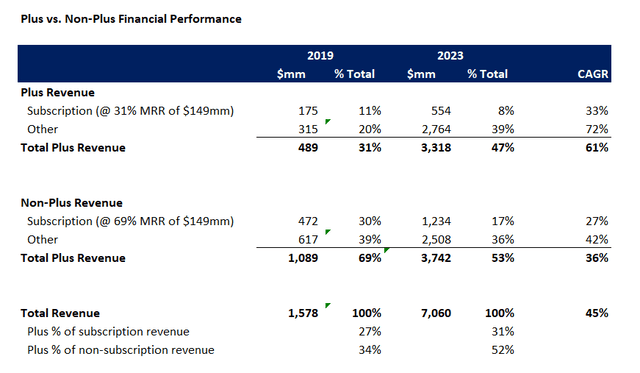

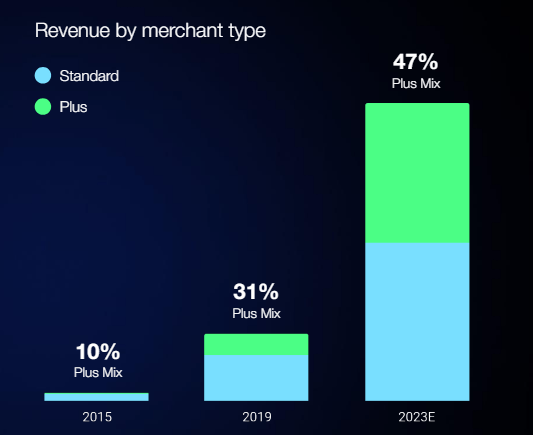

More importantly, Shopify Plus currently accounts for the bulk of Shopify’s GMV and revenue growth. Based on Shopify’s latest Investor Day disclosures, Plus merchants accounted for 47% of 2023 revenue ($3.3 billion), up from 31% ($489 million) in 2019. This represents an outsized Plus revenue CAGR of 61% between 2019 and 2023.

Shopify Investor Day Presentation 2023

Plus merchants also contributed greatly to Shopify’s MRR. The cohort demonstrated a 31% contribution rate to MRR of $149 million exiting 2023, thanks to adjacent non-subscription revenues acquired through variable platform fees and B2B transaction fees. This implies a 33% CAGR in Plus-driven subscription revenue since 2019 when the cohort contributed 27% to $53.9 million MRR at the time.

Comparatively, non-Plus merchant revenue contributions grew at a 36% CAGR between 2019 and 2023. Much of this divergence was driven by the outsized growth in non-subscription revenue generated from Plus members. Recall that Plus merchants also pay variable platform fees and B2B transaction fees in addition to the subscription rate. Specifically, Plus-driven non-subscription revenue has grown at an implied 72% CAGR since 2019. The impressive growth trajectory continues to highlight the unique value proposition of the Plus subscription’s comprehensive offerings, and their strong uptake by the enterprise-heavy merchant base. It also plays favorably with Shopify’s mission to grow with their merchants, as highlighted by the accelerating pace of subscription up-tiering to Plus recently.

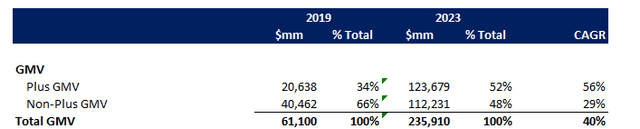

Shopify Investor Day Presentation 2023

Plus subscriptions also contribute more to Shopify’s GMV growth. Although the company has not separately disclosed GMV contributions from their respective offerings, we believe Plus merchants account for more than half of this metric. Specifically, non-subscription revenue – such as B2B transaction fees and variable platform fees – can be viewed as a function of GMV. Hence, by applying the 52% mix of Plus-driven non-subscription revenue in 2023 to $235.9 billion in GMV, it is estimated that Plus merchants contributed to $123.7 billion in the prior year. This represents 56% CAGR since 2019 when Plus merchants were estimated to have contributed $20.1 billion to total GMV, outpacing the 29% CAGR observed in estimated non-Plus GMV contributions.

The outsized contributions from Plus merchants continue to highlight strong prospects for Shopify’s deeper penetration into opportunities beyond e-commerce and SMBs. Specifically, offline and B2B opportunities, alongside other supporting merchant services currently addressed by products such as Markets, POS Pro, and B2B on Shopify are key bridges to TAM expansion. As mentioned earlier, B2B opportunities are expected to generate $450+ billion in TAM expansion for Shopify beyond e-commerce, while merchant services is expected to bring about another $130+ billion. Paired with recent momentum in generative AI, with which Shopify seeks to penetrate innovative products like Sidekick and Magic, the company remains well-positioned for acceleration.

Implications of Plus Price Increase

As a result of its unique value proposition, management announced a price increase on Plus subscription and variable rates earlier this year. These changes were announced shortly after the first Standard plan price increase in 12 years, which was met with nominal churn and mostly accretive results on the company’s growth and profitability.

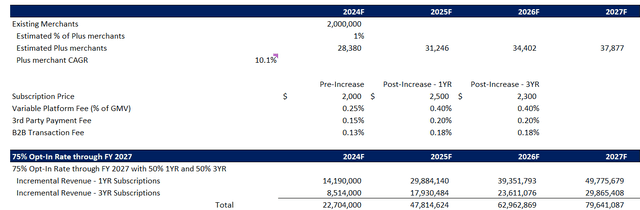

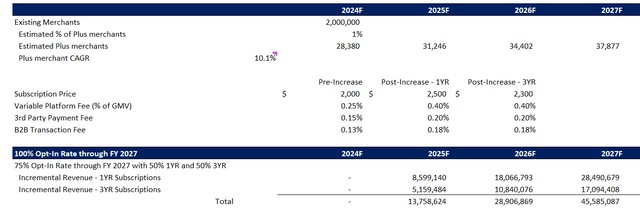

Specifically, the monthly subscription rate for Plus increased from $2,000 to $2,300 for three-year plans and $2,500 for one-year plans. The variable platform fee has also increased from 0.25% of GMV to 0.40%. Meanwhile, B2B transaction and third-party payment take-rates increased to 0.18% and 0.20%, respectively, which represent a 5 basis point jump from previous rates. The new Plus pricing structure went into effect earlier this month.

However, management does not expect a significant jump in growth from the recently announced changes to Plus pricing structure. Existing Plus merchants had the option to lock-in their lower rates for another three years if they extended before April 24. And based on commentary from the latest earnings season, it appears most have done so. While this underscores stickiness and value to Shopify’s Plus offering, it also implies delayed realization of the relevant price increase’s full impact compared to the extent of accretion observed on Standard plan rate changes implemented last year. Recall that incremental subscription revenue essentially comes at zero marginal cost at scale. This was evident in the pace of subscription solutions gross margin expansion observed since Standard plan price increases went into effect last year.

Specifically, management disclosed that the “majority” of existing Plus merchants had locked-in on the lower rates through a three-year contract extension. Admittedly, the elevated proportion of Plus extensions by existing merchants reinforces confidence in the premium product’s demand environment. However, this has also resulted in expectations for a lesser-than-expected benefit to 2024 growth from recently announced price changes. With the majority of existing Plus merchants opting for contract extensions at the lower rate, much of the incremental price change tailwinds will depend on newly acquired accounts on the premium subscription. The adverse growth impact when paired with expectations for a higher 2024 operating cost structure were likely to blame for the stock’s post-earnings correction.

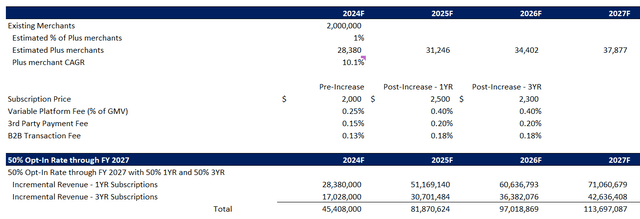

But on a net basis in the long-run, the latest Plus plan price changes are expected to become incrementally accretive to Shopify’s profitable growth trajectory, nonetheless. We have performed a sensitivity analysis that considers a 50%, 75% and 100% contract extension rate on existing Plus merchants to gauge the anticipated revenue tailwind ahead of price changes that went into effect in early May.

i. 50% Extension Rate

Assuming that 50% of the estimated 28,000 existing Plus merchants opt into a three-year contract extension to lock-in lower rates, Shopify is expected to benefit from a minimum $45.4 million revenue tailwind this year from subscriptions alone. This is estimated by assuming that about 14,000 (or 50%) existing Plus merchants through 2024 will graduate to the new price structure, with half of which adopting the one-year plan at $2,500 per month, and the other on three-year plans at $2,300 per month. This translates to 7,000 existing Plus merchants paying an incremental $500 per month and another 7,000 existing Plus merchants playing an incremental $300 per month.

Assuming the number of Plus merchants continue to grow at a 10-year CAGR of 10.1%, the incremental revenue tailwind from Plus price increases is expected to expand at a 36% CAGR over the same period. The growth assumption applied on Plus merchant count growth is in line with industry forecasts, considering the increasing adoption of multichannel platforms and the pace of growth across SMBs.

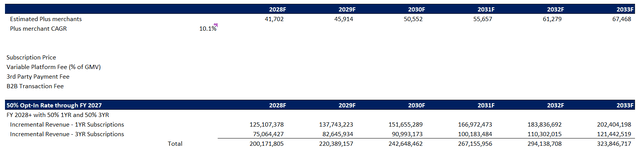

And from 2028 and beyond, when the price increase enters full realization following the expiry of 2024 contract extensions, the incremental revenue tailwind is expected to grow at a five-year CAGR of 10% through 2033. This is expected to be the same across all three sensitized scenarios, given the estimated portion of existing Plus merchants opting for a three-year contract extension to delay price increases ends after 2027.

ii. 75% Extension Rate

Meanwhile, at a 75% uptake rate on three-year contract extensions across existing Plus merchants today, Shopify is expected to benefit from a minimum $22.7 million revenue tailwind this year from subscriptions alone. This is estimated by assuming that only about 7,000 (or 25%) existing Plus merchants through 2024 will graduate to the new price structure, with a 50/50 adoption rate across the one-year plan at $2,500 per month and three-year plan at $2,300 per month.

By applying the same Plus merchant count growth estimate of 10.1% discussed in the earlier section, the incremental revenue tailwind from relevant price increases is expected to expand at a three-year CAGR of 52% through FY 2027E. Despite a lower incremental revenue tailwind under the scenario, the price changes continue to place an accretive impact on the Plus cohort’s outsized contribution towards Shopify’s growth trajectory.

iii. 100% Extension Rate

Assuming 100% of existing Plus merchants have opted for a three-year contract extension to lock-in lower rates, Shopify is expected to see a nominal benefit from the recently announced price changes for the premium plan. Much of the incremental revenue tailwind attributable to price increases will derive from new Plus merchant additions, which will become more evident in the 1+ year horizon.

Taken together with incremental revenue tailwinds from variable fees, the latest Plus plan price increase remains accretive to Shopify’s financial performance despite delayed realization. This is expected to further complement the company’s growing penetration of commerce opportunities beyond online storefronts.

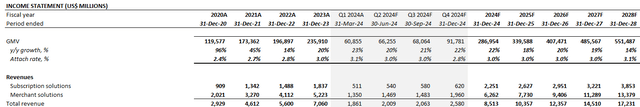

Fundamental Considerations

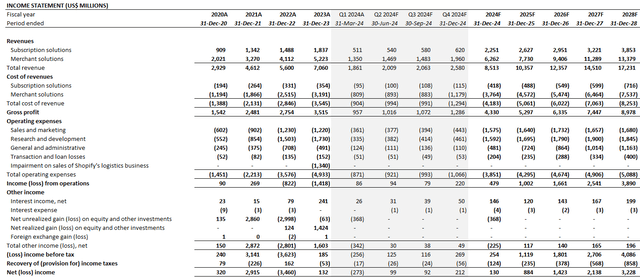

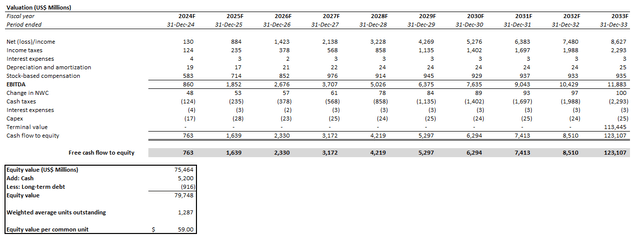

Adjusting our previous base case forecast for Shopify’s actual 1Q24 outperformance and forward outlook with the foregoing analysis, we expect the company to grow revenue by 21% y/y to $8.5 billion in 2024. Given the net accretive nature of recent price increases to both of Shopify’s top and bottom lines, the company is also expected to maintain its current pace of attach rate expansion beyond 3% in the long-run. This would complement expectations for further GMV growth at Shopify, reinforced by its foray in opportunities beyond e-commerce at scale.

Much of the company’s revenue growth is expected to be dominated by subscription adds and relevant price increases in the near-term. However, this trend is expected to reverse, with merchant solution revenues expected to accelerate and further its sales mix dominance as adjacent services adoption continue to scale. This is also expected to benefit GPV growth in the long-run, and normalize the headwind from lower payments attach rates currently observed.

Meanwhile, subscription gross margins are expected to maintain improvements contributed by plan price increases observed over the past year. This metric is expected to benefit from further expansion in the longer-term, as recent Plus plan price increases become incrementally accretive. This is expected to offset the higher operating expense spending structure in the near-term to support Shopify’s marketing efforts and innovative investments, such as the upcoming in-person Summit event and ongoing generative AI developments.

More importantly, management has reiterated their commitment to an 18-month payback period on forward investment opportunities. This is expected to maintain Shopify’s current cost-returns spread that is underpinning its valuation prospects. As such, we believe recent efforts pertaining to improved value proposition aimed at reinforcing up-tiering to premium subscriptions and price changes will bolster durability to Shopify’s longer-term growth and margin expansion trajectory.

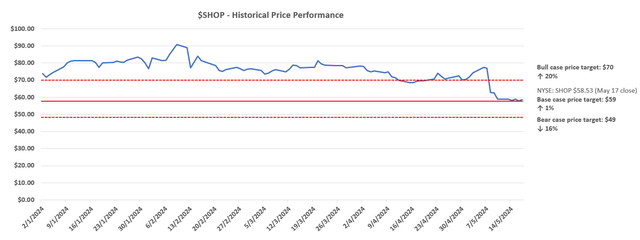

Price Consideration

We believe Shopify’s current outlook sustains a price of $59 apiece, which is consistent with the stock’s performance at current levels.

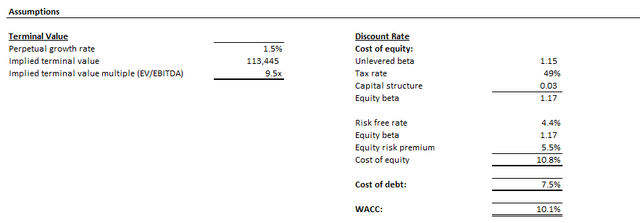

The base case price target is derived using the discounted cash flow (“DCF”) approach, which we believe to be a fair representation of the company’s intrinsic value considering its fundamental outlook. The DCF analysis considers cash flow projections over a 10-year discrete period in line with the base case fundamental analysis discussed in the earlier section. A 10.1% WACC in line with Shopify’s capital structure and risk profile relative to the risk-free benchmark Treasury yield is applied, alongside an implied perpetual growth rate of 1.5% on steady-state terminal cash flows.

We believe there is potential for the stock to appreciate further in the upside scenario, driven primarily by stronger than expected Plus uptake. Specifically, strong Plus uptake would imply positive progress in penetrating opportunities beyond e-commerce, which is additive to Shopify’s long-term outlook. And the opportunity persists, with Shopify only capturing 1% share of global retail dollars to date, while multichannel platform adoption accelerates.

Shopify Investor Day Presentation 2023

This tailwind is reinforced by the outperforming pace of growth already observed across Shopify merchants. Specifically, Shopify merchants’ pace of GMV growth outperforms the global e-commerce segment by 1.5x to 2.25x on average. This is reinforced by Shopify’s unique value proposition presented in its comprehensive ecosystem of commerce solutions and competitive total cost of ownership advantage for merchants. And this continues to improve with the company’s steadfast commitment to product innovation. Paired with a 50% customer acquisition cost improvement realized recently at Shopify, the company remains well-positioned for further market share gains, underpinning value appreciation in the stock from current levels.

Conclusion

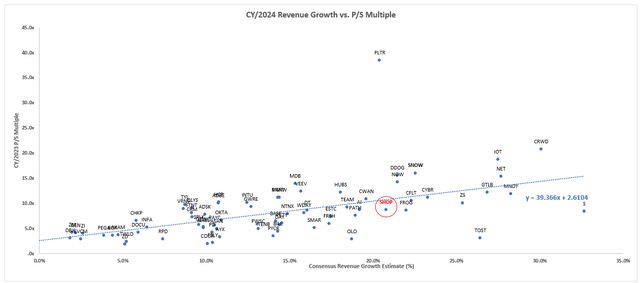

Currently trading at 8.8x estimated sales, Shopify remains undervalued on a relative basis to its software and e-commerce peers with a similar growth profile.

And based on the foregoing analysis, the stock also remains well-positioned for further upside potential on an intrinsic basis as Plus accretion across both of Shopify’s top and bottom lines accelerates. We believe the Shopify’s latest valuation correction is potentially pushing the stock into oversold territory, especially ahead of a seasonality slowdown in the coming months that is expected to exacerbate a softer price increase benefit and higher cost profile in the near-term. Related volatility could potentially represent an opportunity for longer-term upsides from current levels.