Matteo Colombo/DigitalVision (via Getty Images)

introduction

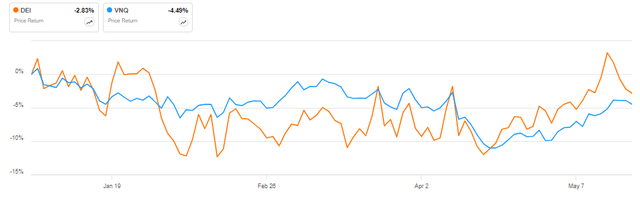

Douglas Emmett Co. (New York Stock Exchange:day) is Vanguard Real Estate Index Fund ETF stock (VNQ) So far in 2024, the company’s stock price is down in the low single digits.

DEI vs VNQ in 2024 (Recruiting) alpha)

Looking ahead, we expect the REIT to track the sector average, although the strong performance of the company’s residential portfolio is not enough to offset headwinds in the office market. Additionally, the majority of the company’s interest rate swaps expire in the next two years, putting pressure on shareholders’ cash generation.

Company Profile

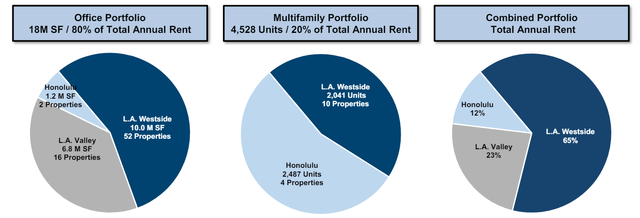

Access results for all companies here. Douglas Emmett is an office REIT with significant multifamily exposure. Office accounts for 80% of annual rent, with the remaining 20% coming from multifamily real estate.

Portfolio Overview (Douglas Emmett Q1 2024 Investor Presentation)

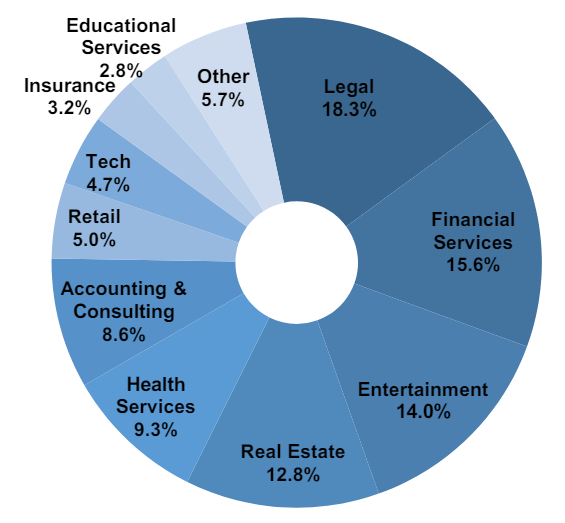

From a geographic perspective, 88% of annual rent comes from California. The remaining 12% is paid from real estate located in Hawaii. The tenant base is highly diversified, with the industry’s largest exposures being legal (18.3% of annual rent), financial services (15.6%), and entertainment (14%).

Tenant Industry Composition (Douglas Emmett Q1 2024 Investor Presentation)

Operational overview

Reported by Douglas Emmett Lease fee Available for office and residential use. For offices, lease rates in the first quarter of 2024 decreased by 2.7% year-on-year to 80.8%, while residential lease rates decreased by 0.4% year-on-year to 98.9%. It is clear that the company’s office portfolio, which was already in a difficult state, will further weaken.

FFO First quarter sales were $0.45/share, down 4% year over year due to lower rental income and higher interest expense. Net operating income This was an increase of 0.3% year over year. A 0.1% decrease in the office portfolio was offset by 2.5% growth in the multifamily portfolio.

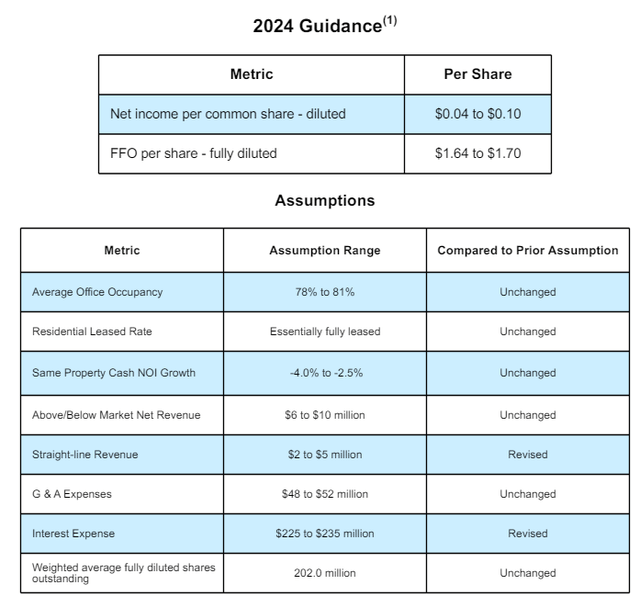

Outlook for 2024 remains unchanged

The company maintained its 2024 outlook, offsetting higher-than-expected revenue with higher interest expense.

2024 Outlook (Douglas Emmett’s 2024 Q1 Earnings Package)

As a result, Douglas Emmett expects to generate FFO of approximately $1.67 per share in 2024, representing a 10% year-over-year decline.

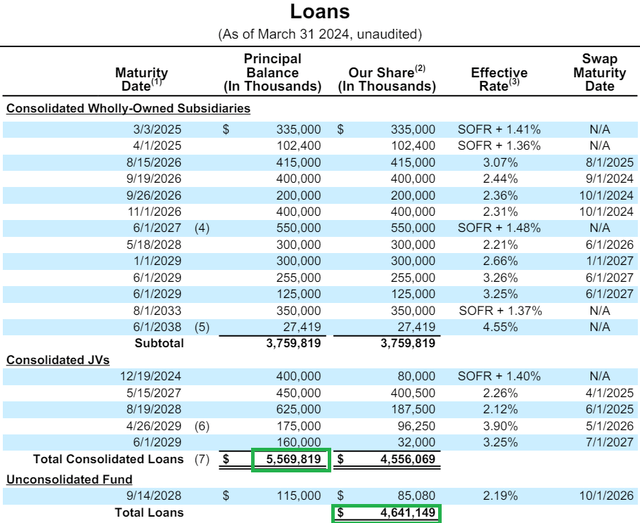

Debt status

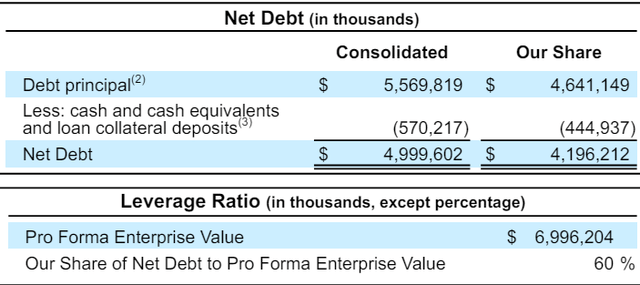

The company ended the first quarter of 2024 with consolidated net debt of $5 billion, which translates to approximately $4.2 billion when accounting for the REIT’s pro rata share in the joint venture.

Debt Summary (Douglas Emmett’s 2024 Q1 Earnings Package)

Using the more insightful net debt figure of US$4.2b, it would imply that net debt accounts for 60% of Douglas Emmett’s enterprise value.

Leverage and Net Debt Summary (Douglas Emmett’s Q1 2024 Earnings Package)

Most of the company’s debt has variable interest rates, but it uses interest rate swaps extensively to fix interest costs.As a result, 68% of the company’s debt has effectively fixed interest rates through the use of interest rate hedges; extremely low The level of the fixed interest portion of the debt is just 2.66%. The downside is that 63% of swaps hedging interest costs expire in 2024-2025. The remaining 32% of the REIT’s debt is floating rate, with a spread of about 1.4% over the secured overnight financing rate (SOFR), which is currently about 5.3%, and a spread of up to 7% on Douglas Emmett’s floating rate. Become. debt.

In summary, we can say that only about 25% of the company’s total debt is fixed at around 3% over the medium term, and swaps for this portion of the company’s debt mature in 2026-2027.

| Type of debt | Percentage of total debt | hedge expires |

| variable interest rate | 32% | Not applicable |

| Floating Rates and Short-Term Hedging | 43% | 2024-2025 |

| Floating rate with medium term hedge | twenty five% | 2026-2027 |

Source: Authors’ calculations

Market suggested cap rate

In the first quarter of 2024, the company produced approximately $141.1 million. Cash net operating income Income from real estate portfolio (this amount does not include NOI from minority interests in joint ventures). Therefore, we can estimate that Douglas Emmett will generate cash NOI of approximately $565 million in 2024 on an enterprise value of $7 billion, resulting in an implied market cap rate of 8.1%. Although rents are rising by about 3% to 5% every year, we expect NOI growth to slow due to oversupply in the office market.

Assuming the fair market capitalization of the company’s residential portfolio is approximately 6.8% (which is itself a conservative assumption, but is consistent with peers such as Independent Realty Trust, Inc.).IRT) and NexPoint Residential Trust, Inc. (NXRT)), it can be inferred that the market is saying that 80% office exposure is currently trading at a market capitalization of 8.5%, which in itself is less attractive for office REITs with depressed occupancy rates. Not the target.

risk

With net debt accounting for 60% of company value, preserving cash to reduce leverage is a key management priority. This is evidenced by the fact that the dividend for Q1 2024 is only 51.6%. The company’s cash flow could be under significant strain in the coming years as interest rate hedges expire. So a delay in the Fed’s interest rate cuts, now widely expected to begin in September, would hurt Douglas Emmett.

From an operational perspective, the situation is highly polarized, with strong performance in the residential portfolio offset by lower occupancy in the office portfolio. At some point, we expect Office’s performance to stabilize, but with a market capitalization of 8.1%, such stabilization may already be priced in.

Conclusion

I like the residential exposure slope that Douglas Emmett offers, but it’s only 20% of the company’s annual rent. Additionally, I believe that a significant portion of vacant office space will eventually be repurposed for other uses, with housing being the first choice. Therefore, the company’s experience in the residential sector may give it a lead over its competitors when it comes to such redevelopment.

However, as it stands, the 8.1% market capitalization is not attractive enough for me to rate the stock a buy, given the very difficult nature of the office market. Therefore, I am neutral on the stock.

thank you for reading.