Savings account interest rates have become a prominent topic in recent years due to central bank policy changes and rising inflation.

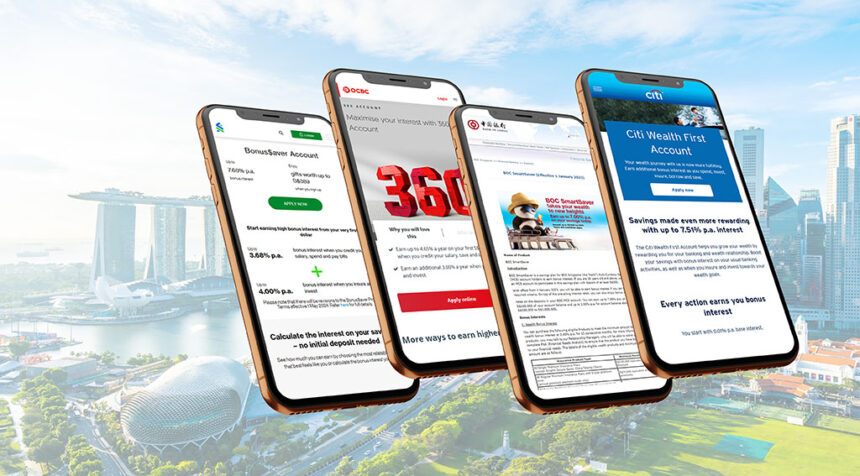

In Singapore, banks are adjusting their offerings by offering more competitive interest rates to attract customers. Some savings accounts, such as the Standard Chartered Bonus Saver account and the OCBC 360 account, have increased interest rates, with some reaching as high as 7.68% (annual).

These so-called high-interest savings accounts are distinguished from regular savings accounts primarily by their higher yields. For smart savers, these accounts offer the appeal of generating greater returns on savings without the risks associated with investing in stocks and bonds. However, certain requirements and conditions are also required, such as maintaining a minimum balance, depositing a minimum amount each month, and paying a certain amount via the relevant debit or credit card.

Today, we explore some of the top high-yield savings accounts in Singapore, dig into the details of these accounts, and provide insight into their features and eligibility criteria.

Standard Chartered Bonus Saver Account

The Bonus$aver account provided by Standard Chartered Bank is offer High interest rates with bonus interest rates of up to 7.68% per year To qualify for bonus interest rates, customers must meet certain criteria each calendar month. This includes being the primary account holder, having a linked Bonus$aver card, and performing transactions in categories such as card spending, payroll deposits, bill payments, insurance purchases, and investments. It is included.

Here is an overview of the interest rates offered in the different categories:

- Salary Credit: Earn 2% bonus interest on a minimum salary credit of S$3,000 per month.

- Card spend: up to 1.45% per year (including current interest rate of 0.05% p.a.) on eligible spend on a minimum of S$2,000.

- Bill Payments: Earn 0.23% annual bonus interest when you make 3 or more eligible bill payments of at least S$50 each via GIRO or Online Banking.

- Investments: Earn 2% annual bonus interest on investments in eligible trust funds with a minimum subscription of S$30,000.and

- Get insured: Buy a qualifying policy with a minimum annual premium of S$12,000 and earn 2% bonus interest per annum.

Bonus$aver accounts also feature multi-currency functionality that allows customers to trade in foreign currencies, provided sufficient funds are available, and funds are debited directly from the relevant foreign currency balance. This feature supports 14 currencies with 0 SGD fees for overseas transactions and promises competitive foreign exchange (FX) rates.

As part of the sign-up promotion, applicants who apply for both a Bonus$aver account and a Bonus$aver World Mastercard credit card and deposit and maintain S$50,000 in new funds will receive gifts worth up to S$389. are eligible to receive it. . Additionally, those who deposit their salary within the first two months after account opening will be given an additional S$100 cashback.

OCBC 360 Account

OCBC 360 account Offers Customers have the opportunity to earn up to 4.65% per year on the first S$100,000 in their account by meeting the criteria in the Salary, Savings and Spending categories. Also, when the customer completes certain transactions in the “Insurance” and “Investment” categories, he can additionally earn 3% per annum.

Criteria to unlock bonus interest in the ‘Salary’, ‘Savings’ and ‘Spending’ categories include depositing a minimum salary of S$1,800 through GIRO, FAST or PayNow. Increase your account balance by at least S$500 every month. Pay S$500 with your selected OCBC credit card.

Those who extend beyond these three categories can look forward to additional benefits by purchasing eligible investment and insurance products from OCBC, with a maximum combined effective interest rate (EIR) across all categories of 7.65% p.a. You can

Below is a breakdown of the maximum total EIR across all categories for the first S$100,000.

- Salary Credit: Minimum salary credit of S$1,800 through GIRO, FAST or PayNow with bonus interest of 2.5%.

- Save: Earn 1.5% annual bonus interest when you increase your average daily balance by at least S$500 every month.

- Spending: Earn 0.6% annual bonus interest when you top up at least S$500 every month on selected OCBC credit cards.

- Insure: Earn a bonus interest rate of 1.5% per annum on eligible insurance products purchased from OCBC; and

- Investments: When you invest in OCBC’s eligible investment products, you will receive a bonus interest rate of 1.5% per annum.

BOC smart saver

BOC SmartSaver is a savings plan offered by Bank of China Singapore (BOC) for Multi-Currency Savings Account (MCS) account holders.plan I allow it Participants can earn bonus interest on deposits into their MCS accounts, up to 7% per annum on the first S$100,000 of the account balance and up to 1% per annum on balances between S$100,000 and S$1,000,000.

There are various ways to earn bonus interest on your account.

- Wealth Bonus Interest: By purchasing eligible insurance products, participants will earn bonus interest of 2.40% per annum for 12 consecutive months on the first S$100,000 of their MCS account balance.

- Card Spending Bonus Interest: Account holders can enjoy bonus interest ranging from 0.5% to 0.8% per annum when they spend at least S$500 on debit or credit cards during a calendar month.

- Payroll Deposit Bonus Interest: Participants can earn bonus interest ranging from 1.9% to 2.5% per year based on the amount of payroll deposited into their account.

- Payment bonus interest rate: Earn bonus interest rate of 0.9% per annum when you complete three bill payments of at least S$30 each via GIRO or Internet Banking/Mobile Banking bill payment facility. This bonus is only applicable to the first S$100,000 of your MCS account balance.and

- Additional Savings Interest: Additional bonus interest of 0.6% per annum is available on account balances over S$100,000 if any of the criteria for card spend, salary deposits or bonus interest paid are met. However, the upper limit is S$1,000,000.

Applications for BOC SmartSaver can be made online or in person at a BOC branch. The program has terms and conditions including a minimum initial deposit of S$200, an average monthly balance requirement of S$1,500 to enjoy the bonus interest, and a service fee of S$3 if the average monthly balance falls below S$200. It is attached.

City Wealth First Account

City Wealth First Account teeth Tailored to help individuals build wealth by rewarding banking and asset relationships, it promises total potential interest of up to 7.51% per year. It offers a variety of features aimed at maximizing savings and providing convenient banking solutions.

Account holders start with a base interest rate of 0.01% per annum on average daily balances and can earn additional bonus interest through a variety of qualifying transactions.

- Spending: Earn an additional 1.5% annual bonus interest when you spend a minimum of SGD 250 (or foreign currency equivalent) on eligible retail transactions per calendar month using your Citibank Debit Mastercard.

- Investments: Purchase at least S$50,000 of new lump sum investments (or combination of lump sum investments) within a calendar month and receive an additional 1.5% annual bonus interest.

- Insure: Bonus interest at the rate of 1.5% per annum is available when purchasing a new single premium insurance policy (or multiple single premium policies) with total calendar month premiums of at least S$50,000.

- Borrow: Bonus interest rate of 1.5% per annum on new home loans of at least S$500,000.and

- Save and Earn: Add an additional 1.5% bonus interest when you increase your account’s average daily balance by at least S$3,000 from the previous month’s average daily balance.

In addition, account holders will have access to a range of benefits, including a seamless mobile and online banking experience with instant payments, money transfers, and real-time balance updates. Free Citibank Debit Card. Access both Singapore Dollars and multiple foreign currencies with no exchange fees or transaction processing fees. Free ATM withdrawals. Telephone banking access is also available.

Featured image credit: Edited from free pick