hapa bapa

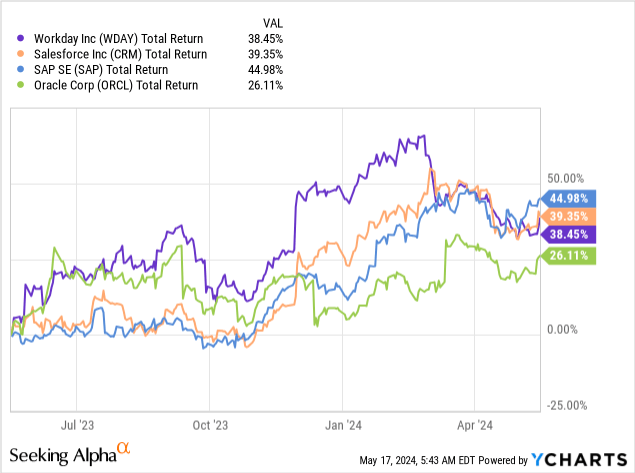

Workday Co., Ltd. (Nasdaq:weekdays) The stock has risen more than 38% over the past year and is currently trading near all-time highs. Most loss-making momentum stocks in the technology sector are still down significantly from late 2021, but At the high end, WDAY seems to be an exception.

The company is scheduled to announce its first quarter results later this week, and expectations are high that the company will outperform expectations.

While it could easily go either way when it comes to quarterly earnings, there are some key areas investors should keep an eye on. As a company that prioritizes non-GAAP numbers and is expected to grow in the mid-teens, WDAY’s stock price could swing wildly in either direction, even if quarterly results meet analyst expectations .

All about margins

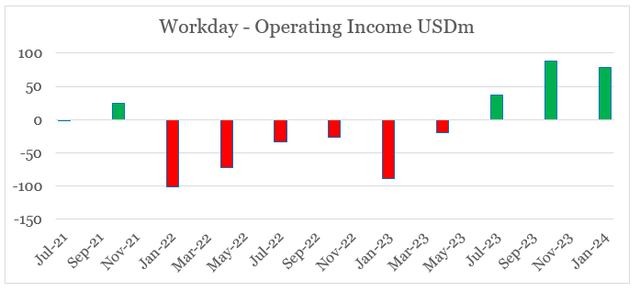

About a year ago, I Detailed article on Workday profitability and the need for management to focus on GAAP margins. Since then, the company has reported strong operating results for his third consecutive quarter, which is encouraging.

Created by the author using data from Seeking Alpha

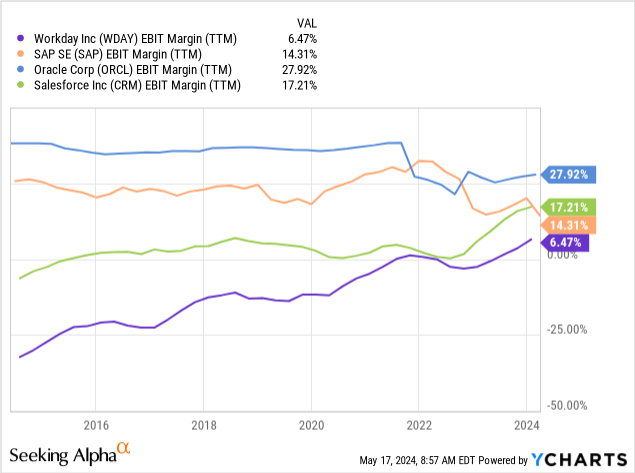

As a result, the profitability gap with its major peers has narrowed in recent months, and WDAY’s operating margin is now in the mid-single digits.

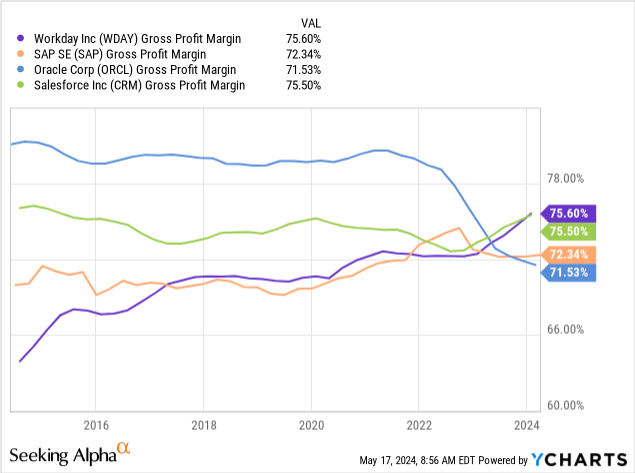

Gross margins have also improved over the past year. This is another reason why shareholders believe Workday’s management has improved its performance. Follow Salesforce instructions (CRM) by prioritizing profitability over growth at all costs.

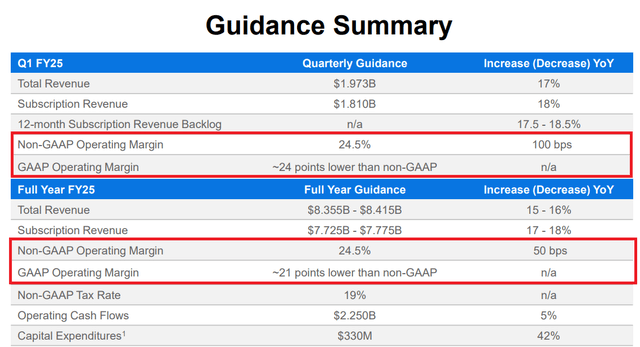

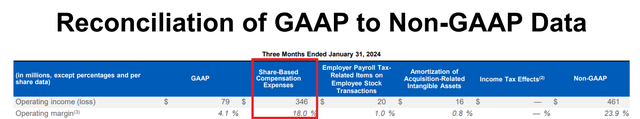

Nevertheless, the company could easily slip back into a GAAP operating loss in the first quarter of 2025, with current guidance for non-GAAP operating margins of 24.5% and 24% lower on a GAAP basis.

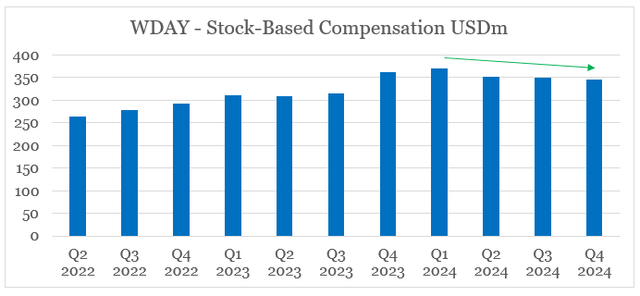

The significant difference between the GAAP and non-GAAP numbers is almost entirely due to stock-based compensation, which should increase significantly if the aforementioned guidance proves accurate.

This is unlikely to be well-received by shareholders, as WDAY’s management is gradually reducing its reliance on stock compensation, which currently amounts to about $350 million per quarter.

Created by the author using data from Seeking Alpha

With this in mind, WDAY shareholders should not rely solely on non-GAAP numbers. A large increase in stock compensation could be viewed unpopularly by the market as evidence that the company cannot meet its growth goals without a generous compensation package.

Revenue Growth and Multiples

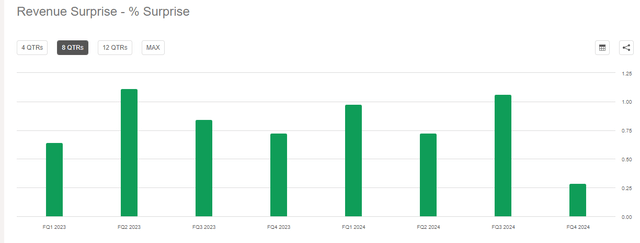

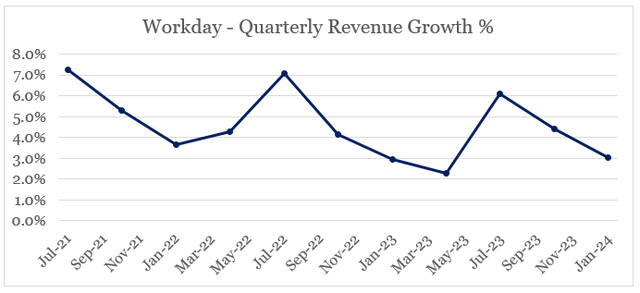

Workday’s quarterly revenue forecast trends have been very low in recent years, around 1% (see below). However, it declined significantly last quarter, which could be an early sign that the company’s abnormal growth is normalizing.

The same is true when looking at a company’s actual quarterly earnings growth, accounting for seasonality. Typically, the highest growth rates are reported in the second quarter of each financial year (ending in July), declining from 7.3% in calendar year 2021 to 7.0% in 2022 and 6.1% last year. The same trend applies to first quarter results, which are typically the lowest point in growth. Therefore, a quarterly revenue growth rate of 2.3% or less would support a downward trend in Workday’s revenue.

Created by the author using data from Seeking Alpha

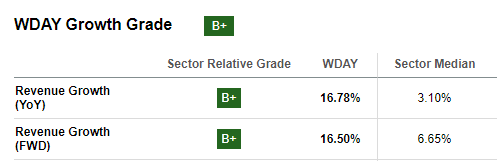

At the same time, analysts remain very optimistic that the company can maintain its historic growth of over 16% and can expect similar results next year.

Searching for Alpha

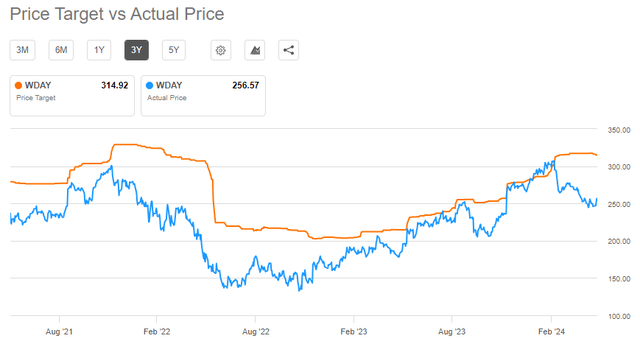

Despite WDAY’s stock price falling sharply in recent months, sell-side analysts remain reluctant to downgrade the company, resulting in a wide discrepancy between the consensus price target and the actual stock price. ing. The last time this happened was at the end of 2021, after which Workday’s stock price plummeted.

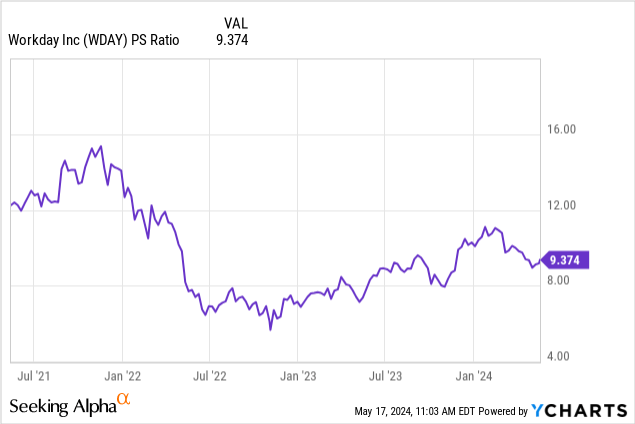

In 2021, WDAY was trading at 12x sales, which is significantly higher than its current multiple of approximately 9x sales, which could create the illusion that the downside this time is limited. be.

However, I warned Coming into February of this year, Workday continues to trade at a significantly higher price than its software industry peers, with double-digit projected growth rates supporting this premium valuation. As such, it is critical that the company maintains its current growth trajectory and assures the market that the company will continue to grow at a similar rate into the foreseeable future, even as the stock trades at a historically lower multiple.

conclusion

Workday is currently trading at a much lower multiple than it was in the second half of 2021, which may give investors a false sense of security that the market is being conservative. This is not true, and expectations are very high for Workday to deliver despite the current lower multiple based on past performance. In terms of profitability, GAAP numbers will be very important this time around, and any suggestion of revenue growth below 16% in fiscal 2025 could have a severe impact on WDAY’s stock price.