Tom Werner/Digital Vision via Getty Images

investment thesis

Brinker International Inc. (New York Stock Exchange:eat) is well positioned for good growth in both the short and long term. A company’s sales should benefit from improving key performance indicators such as customer satisfaction, turnover, and turnover. The social media buzz is all moving in the right direction, which should help restaurant foot traffic recover in FY25 and beyond. Additionally, the company should benefit from advertising efforts that are proving popular among customers, as well as a focus on offering value-for-money meals. The company’s strong execution should help offset declining foot traffic due to an inflationary environment.

On the margin front, the company will benefit from a favorable price/cost environment going forward. Additionally, cost-cutting measures through streamlining operations and improved operational efficiency will also benefit margins. While the company is trading at a slightly higher price than its historical average, I “I believe this is justified, given the company’s improving performance and above-market same-store sales. The company is expected to achieve double-digit EPS growth over the next few years, which should support continued growth in the stock price. Therefore, I continue to maintain my Buy rating.”

Brinker earnings analysis and outlook

my Previous articleIIn August, I wrote about the outlook for future sales growth for the company, which continues to benefit from price increases, improved menu mix, increased advertising and guest satisfaction measures despite a challenging macroeconomic environment. explained. The company has reported several quarters since then, with similar trends. The stock price has also risen ~95% since then, vindicating my stance.

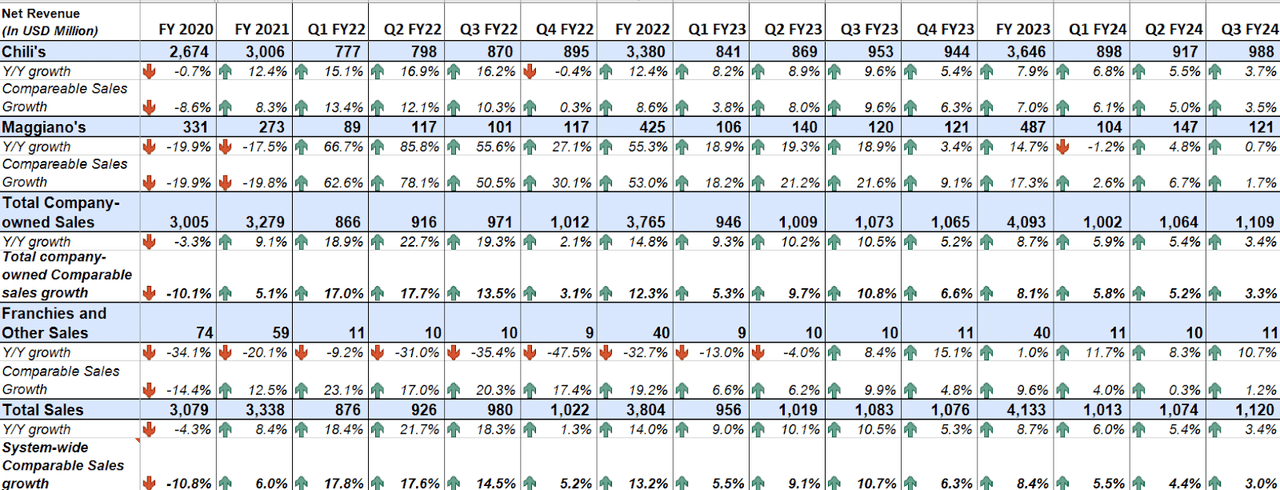

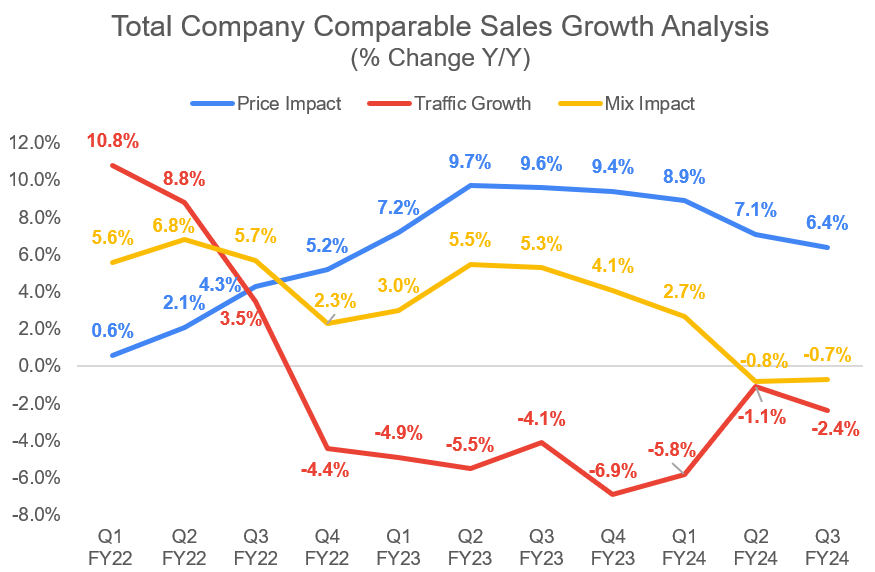

In the third quarter of fiscal 2024, the company’s revenue growth continued to benefit from menu price increases at both Chili’s and Maggiano’s restaurants. Additionally, the company also experienced increased brand awareness due to improved advertising execution and improved menus, which led to increased customer satisfaction, which helped offset negative customer traffic. As a result, revenue increased 3.4% year-over-year to $1.12 billion. On a comparable same-restaurant basis, company-owned total sales increased 3.3% year-over-year, with a 640 basis point benefit from price increases partially offset by a 70 basis point headwind from changing mix and a 240 basis point headwind from lower customer traffic.

EAT Historical Revenue (Company Data, GS Analytics Research)

EAT’s internal comparative sales analysis (company data, GS Analytics Research)

Looking ahead, I am optimistic about the company’s growth prospects.

The company’s guest traffic was down 2.4% QoQ, but excluding weather effects (~1% YoY) and less virtual brand emphasis (~2.5% negative impact on Chile traffic) traffic trends were much better.

Management also noted that several key performance indicators, such as problem customer dining, employee turnover and social media buzz, are trending in the right direction. Below is a related excerpt from CEO Kevin Hochman: Final financial report,

Our key KPI, dine-in guests, was challenged, with dine-in GWAP dropping to 3.3% for the quarter, the lowest ever since we began tracking the metric. ”

“A big thing that got us excited this quarter is we saw the highest level of buzz since we started tracking it. This means that when we ask our guests in the third person which brands they’ve heard good things about while dining out in the past few weeks, they say Chili’s more often than ever before. So it’s very encouraging that people are thinking of us in a good way.”

What I can say is that we’re very encouraged by the buzz from PR that you’re probably seeing on social media. I think there is a lot of discussion about value. For example, during yesterday morning’s launch, Chili’s 3 For Me Smasher Burger became her #1 trending topic on Twitter. ”

I want to commend our 12 regional vice presidents who have been at the forefront of this effort, driving industry-leading manager turnover rates by another quarter and significantly improving hourly turnover rates.”

The company saw the positive trends from the third quarter continue in April, and given the favorable trends in key performance indicators, it expects the positive momentum in comp sales to continue into the fourth quarter and FY25.

The company also does a good job of communicating the great value it offers, and this value message resonates with consumers who have been hit hard by the inflationary climate. I expect the company’s strong execution and compelling value proposition to gain share and outpace industry revenue growth in the medium to long term.

Brinker margin analysis and outlook

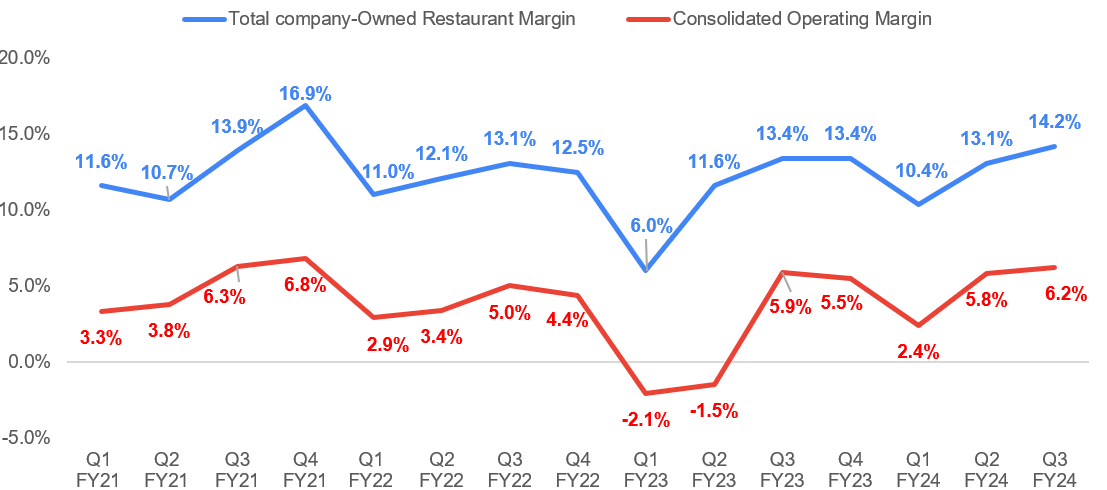

In the third quarter of FY2024, the company’s profits expanded due to menu price increases and easing inflation, thanks to a 20bps tailwind from strong labor costs and a 170bps tailwind from strong food and beverage costs compared to the previous year. . This allowed the company to offset 3.7% year-on-year wage growth. As a result, the overall profit margin for company-owned restaurants increased by 80 bps year-on-year to 14.2%, and the company-wide operating profit margin increased by 30 bps year-on-year to 6.2%.

EAT’s past directly operated restaurant operating profit margin and consolidated operating profit margin (corporate data, GS Analytics research)

Going forward, the company will continue to benefit from price increases that offset inflationary headwinds. Last quarter, 6.4% year-on-year pricing more than offset flat commodity inflation and his 3.7% wage increase. Moreover Last quarter’s earnings report“In a statement, management noted recent menu price increases of up to 3%. I believe the effects of recent and past price increases will offset each other and be sufficient to offset any inflationary pressures going forward.”

The company is also doing a great job of simplifying operations and improving kitchen processes. For example, the company recently discontinued its double-patty SKU, which consisted of two 3.6-ounce patties, and replaced it with a 7.5-ounce single patty already used in other burgers. These efforts simplify staff work and improve product consistency. It also reduces waste as there is no wastage of thin patties.

The company is currently rolling out these simplifications across its burger portfolio and plans to roll out similar improvements to fajitas in the future. These operational improvements should not only reduce costs, but also make staff’s lives easier and ensure consistency in product quality.

Overall, I’m optimistic about the company’s earnings improvement prospects given favorable pricing/costs and operational improvements.

Evaluation and conclusion

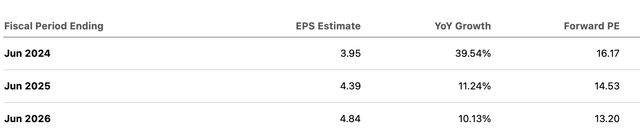

Brinker International is trading at 14.53 times the consensus EPS estimate of $4.39 for fiscal year 2025 (ending June 2025). Over the past five years, the stock has traded at an average forward P/E of 13.79.

EAT consensus EPS forecast and future PER (in search of alpha)

EAT’s stock price has nearly doubled since I last rated it a buy, and its price-to-earnings ratio (P/E) is slightly higher than historical levels. We think this premium is reasonable given the company’s recent strong performance. Since the last review, the company has announced its first quarter 2024, second quarter 2024, and third quarter 2024 results, beating EPS estimates in all three quarters despite a challenging macro environment. , outperforming its peers.

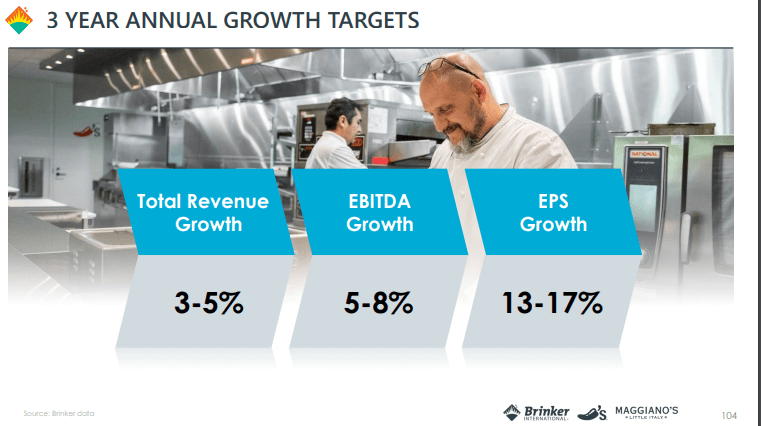

The company announced a strategic plan last year that targets double-digit EPS growth over the long term, and the plan certainly appears to be working.

EAT Growth Targets (EAT June 2023 Investor Presentation Slides)

“I believe the stock will be able to sustain a higher valuation multiple than in the past as it continues to maintain strong operating performance and improving margins. This, combined with double-digit EPS growth (per consensus estimates and management commentary), positions EAT stock to deliver double-digit CAGR over the next few years. Therefore, I maintain a Buy rating on the stock.”

risk

- I expect the current momentum in comp sales and profits to continue. However, if a company performs poorly or underperforms its industry, the P/E ratio can decline.

- Although commodity and labor price inflation has calmed down recently, if inflation accelerates for some reason and companies’ price increases cannot offset it, companies’ profit margins and EPS growth will deteriorate, which will have a negative impact on stock prices. may give.

remove

In my view, Brinker International should continue to deliver good and sustainable revenue and margin growth in both the near and long term. I expect improving key performance indicators and effective advertising efforts to continue to drive same-store sales growth and contribute to market share growth in FY25 and beyond. Margins should benefit from a favorable price/cost environment and cost-cutting measures. While EAT is trading at a slightly higher price than its historical average, investors should note that this valuation is justified given the company’s improved execution. I believe that consistent good execution, positive growth outlook, and strategic plans targeting double-digit EPS growth will position EAT shares for further upside. Therefore, I maintain a buy recommendation on EAT shares.