michael vie

For the past few quarters, I’ve been working with Palantir Technologies (New York Stock Exchange:P.L.T.R.) And in the last few articles I have rated the stock as a “Hold” and advised to be quite cautious. I wrote an article Why it’s hard to justify Palantir’s stock price: Meanwhile, Palantir still rose about 8%, underperforming the S&P 500, which is up about 16% over the past six months.

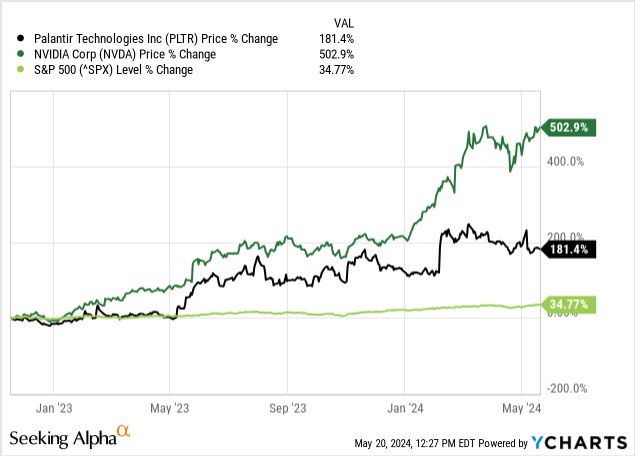

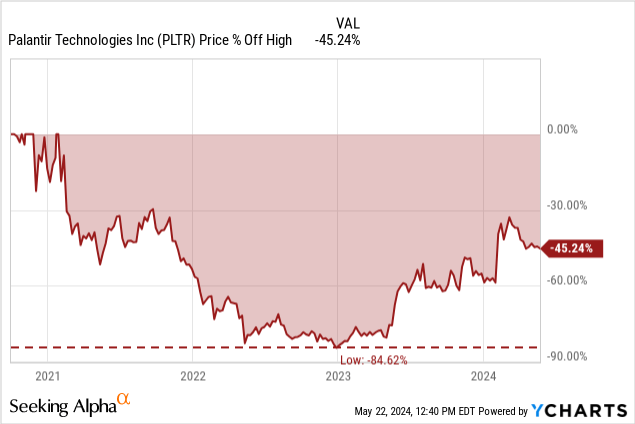

Since bottoming out at around $7 less than a year ago, the company’s shares have more than tripled in just a few quarters. Over the past 18 months, Palantir shares have risen 181%. This performance is a reflection of the strength of NVIDIA Corporation (NVDA) increased 503% over the same period, while Palantir outperformed the S&P 500 (spy) has already delivered strong performance over the past 18 months.

This also raises the question of whether I’ve always been wrong about Palantir in recent quarters, or if the stock is just becoming increasingly overvalued and we’re witnessing the typical late stages of a huge stock market bubble. raise

First quarter results

To answer this question, we must first look at Palantir’s reported results and acknowledge that, despite potential criticisms (more on that later in this article), Palantir continues to report impressive financial results and is not only growing revenue at a high pace, but also continuing on its path to profitability.

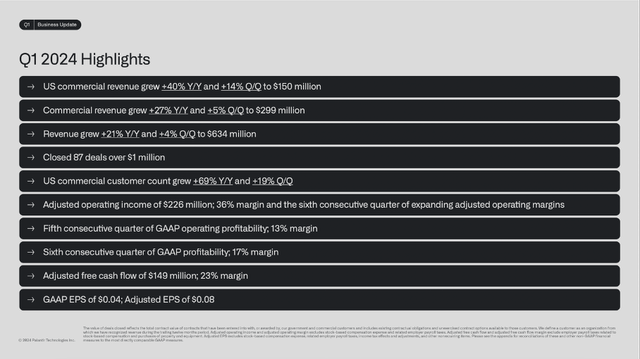

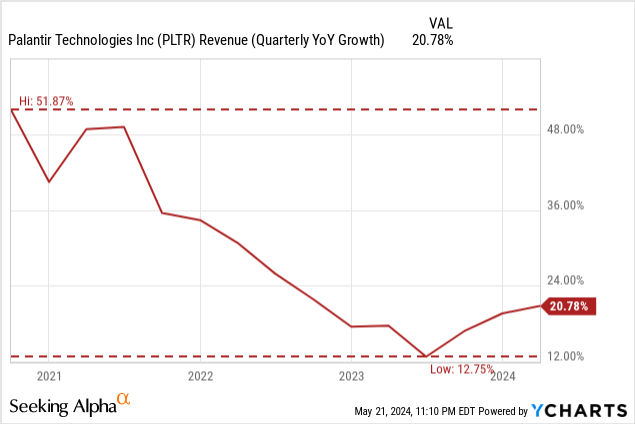

On May 6, 2024, Palantir reported its first quarter results, reporting revenue growth of $634.3 million in Q1’24 from $525.2 million in Q1’23, resulting in a 20.7% increase in sales. And Palantir is on its way to (even) greater profitability, with operating income surging from $4.1 million in the same period last year to $80.9 million in the current quarter. Diluted net income per share quadrupled from $0.01 in the January ’23 quarter to $0.04 in the January ’24 quarter.

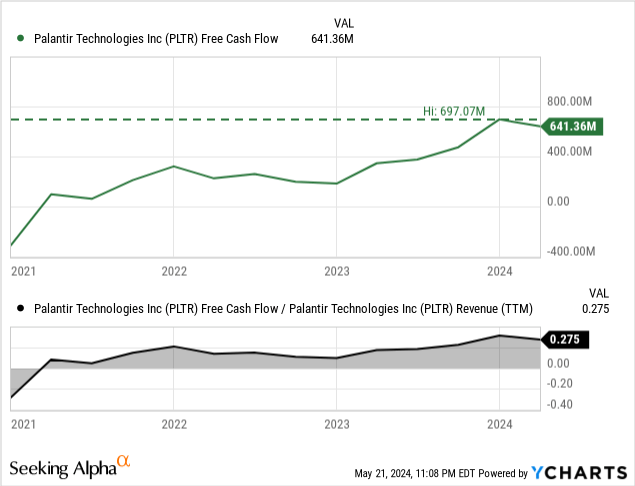

The picture is a little different when you look at adjusted earnings per share. Adjusted earnings per share increased 60% from $0.05 in the year-ago quarter to $0.08 in the quarter. Adjusted free cash flow alone decreased from $188.9 million in the first quarter of 2023 to $148.6 million in the first quarter of 2024, a 21.3% year-over-year decline.

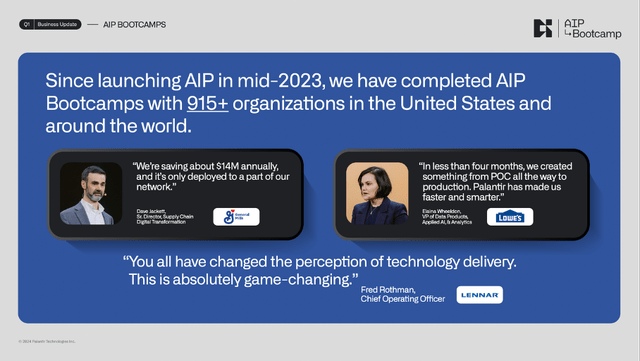

Commercial revenue increased 27% year-on-year from $236 million in January 2023 to $299 million in January 2024, and the number of commercial customers increased from 280 to 427 compared to the previous year. However, government revenue only increased by 16%. Year over year, he made $289 million in the same period last year, and this quarter he made $335 million. And bootcamps clearly work and appear to be a good strategy for driving revenue growth. Since he launched AIP in mid-2023, Palantir has conducted his AIP Bootcamp with over 900 of her organizations in the United States and around the world.

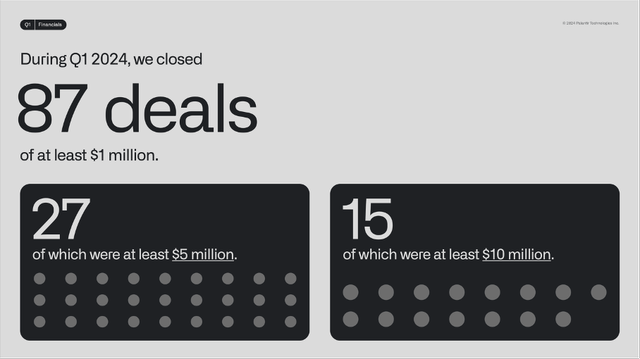

And during the fourth quarter, Palantir closed 87 deals of $1 million or more, including 27 deals of $5 million or more and 15 deals of $10 million or more.

Outlook for 2024

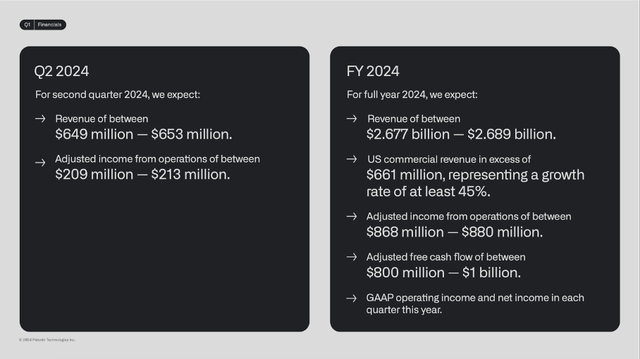

Looking at management’s expectations for fiscal 2024, full-year revenue is expected to be in the range of $2.677 billion to $2.689 billion. This represents a year-over-year growth of 20% to 21% compared to fiscal 2023 revenues. Adjusted operating income is expected to be between $868 million and $880 million. Compared to adjusted operating profit, this is a year-over-year growth of 37% to 39%.

And finally, adjusted free cash flow is expected to be between $800 million and $1 billion. While Palantir has provided very narrow guidance for revenue and operating income, the range for free cash flow is expected to be much wider, reflecting management’s difficulty in making assumptions.

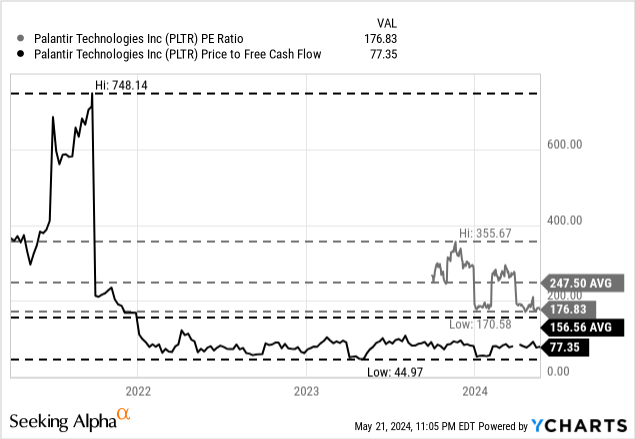

Calculating Intrinsic Value

One of the main arguments against Palantir is that the stock trades at an extremely high valuation multiple, at least in the medium term (probably the next 5-10 years). As of this writing, Palantir trades at 177x earnings, and no one would argue that such a high valuation multiple is not sustainable. However, one could argue that not only can Palantir grow revenues rapidly (more on growth expectations later), but it can also improve margins, which would allow earnings per share to grow at a much faster pace and the P/E ratio to fall rapidly.

However, looking at next year’s expected earnings per share ($0.33), the forward P/E ratio is 64x, which is still a very high valuation multiple. And we can also shift our attention from the P/E ratio (which is definitely not the best metric here) to the price-free cash flow ratio. As of this writing, Palantir trades at 77 times free cash flow, and such a valuation multiple still appears too high for an acceptable metric.

And while an argument can be made for earnings per share that improving margins will contribute to growth over the next few years, this argument is much harder to make for free cash flow.

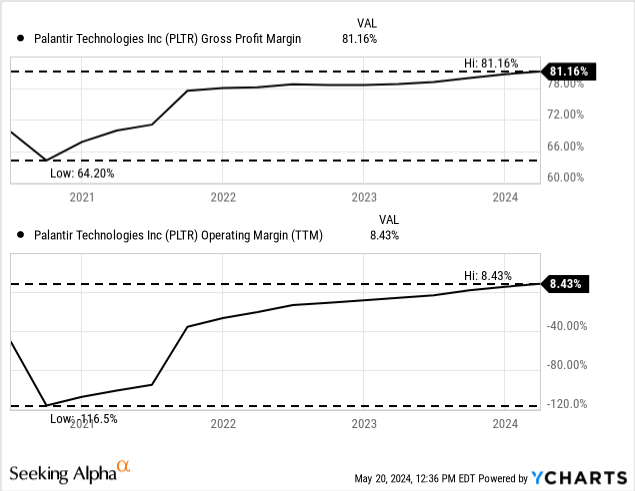

Over the past four quarters, Palantir has recorded nearly a third of its revenue as free cash flow. While an operating margin of 8.4% (TTM’s number) is not an impressive number, and many companies can achieve similar or better operating margins, a free cash flow/revenue ratio of 27.5% is impressive and, to be honest, There is not much room for improvement (already high at 31%, and the free cash flow/earnings ratio is likely to fall again in the coming years, especially in difficult economic times).

And you should use discounted cash flow calculations here as well. We use the past four quarters’ adjusted free cash flow ($691 million) and diluted shares outstanding (2.4 billion shares as of March 31, 2024) as the basis for our calculations. And as always, we’re using a 10% discount rate and assuming 6% growth into perpetuity in 10 years. For Palantir to receive a fair valuation, it would need to grow its free cash flow by 22% annually over the next 10 years.

As we pointed out above, it seems highly unlikely that the ratio of free cash flow to sales will be higher than it is now, so that growth will have to come from top-line growth alone. And this raises the question of whether Palantir can grow at such a fast pace. Analysts are predicting Revenue is expected to grow at a CAGR of 17.39% over the next 10 years (although these forecasts are primarily based on the opinion of a single analyst).

Looking at historical growth rates, Palantir has grown its revenue at a CAGR of 30% over the past five years and 27% over the past three years. This should be enough to show that Palantir is worth a lot at this point. But we also have to see that quarterly revenue growth has slowed in recent years. It’s only in his last three quarters that revenue growth accelerated again (and it remains to be seen whether this trend will continue). However, revenue growth in recent quarters has been clearly below the rate needed for Palantir to be fairly valued. And while the past few quarters likely haven’t been the worst economic environment for a company, it begs the question of how fast Palantir could grow in a different economic environment.

But even if Palantir were able to grow its sales by 22% over the next 10 years, another big problem would remain (and this is one I’ve pointed out in several articles). Palantir has rapidly diluted its outstanding shares over the past few years and continues to do so. Over the past 12 months, Palantir has increased the number of shares outstanding by 8.3%, but assuming similar dilution occurs over the next few years, Palantir would need to increase its sales annually to be fairly valued. Must grow by 30%. And always remember, this assumes Palantir can keep free cash flow conversion close to 30% of revenue (which is a big challenge in my opinion).

emotions

One last point, Articles about NVIDIAI want to mention this again here because it is very important and explains the current sentiment in the stock market. In the article, at the end of the calculation of intrinsic value, I wrote:

and finally, Here we calculate using a discount rate of 10%. For those who don’t already know this (because sometimes I have to elaborate on something that otherwise seems obvious): A 10% discount rate is (under the assumptions above) It shows that investing in Nvidia will give you a 10% return on investment. Every year. This means your investment grows by 10% in the first year and by another 10% the following year. It takes him just over seven years to double his investment. I say this because people who are very bullish on NVIDIA are probably assuming that they will double, triple, or even quadruple their investment in the next few quarters. An annual interest rate of 10% is a very good number, but it is not compatible with the dream of getting rich quickly.

And the same goes for Palantir. Even if we assume Palantir is fairly valued here, it has a 10% annual return on investment. And if we assume Palantir can’t achieve the 23% to 30% sales growth it needs, Palantir’s return on investment drops to single digits.

However, the fact that investors cannot understand this is characteristic of this final stage before the stock market peaks and the bubble bursts. This also hints at new hype and bubbles for Palantir. Investors (or speculators) aren’t buying Palantir based on fundamental analysis, they’re buying it out of irrational exuberance and the expectation of extraordinary returns in a short period of time.

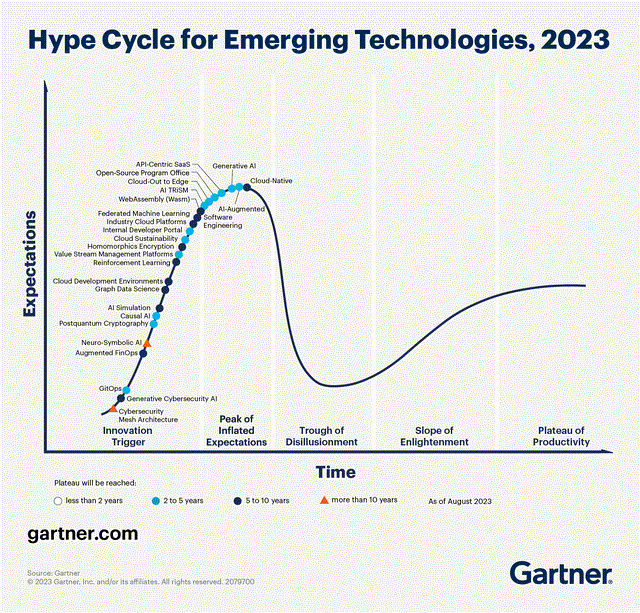

Like NVIDIA, both companies are profiting from the hype surrounding artificial intelligence, although their business models are completely different. And while the hype didn’t lead to much higher growth rates for Palantir in contrast to NVIDIA, Palantir’s stock price rose significantly. Gartner’s Emerging Technology Hype Cyclewe see artificial intelligence and generative AI reaching the height of inflated expectations, and I would argue that Palantir is profiting from that hype and that its stock price reflects that hype. I think that I want to do it.

Conclusion

In my opinion, the conclusion is the same as in my previous article: Palantir is too expensive to be a good investment at this point. In particular, ongoing high dilution remains a big issue, and Palantir’s free cash flow needs to grow at about 30% to be fairly valued. And while Palantir has been able to grow at such a high pace in the past, I don’t think it can grow revenue by 30% over the next few years. And the free cash flow to revenue ratio is already close to 30%. I don’t see any “margin improvement” that would translate to increased free cash flow.

And the fact that Palantir is still trading at 45% below its all-time high doesn’t change my valuation — it just highlights that Palantir was even more overvalued before and is not worth investing in in 2020 and early 2021.