Utock

Acquiring a company and breaking into the big leagues through inorganic growth is always attractive until the post-acquisition truth is revealed. It usually takes years for management to recognize (and admit) it. probably overpaid and now You need to write down some of the goodwill and intangible assets. Interestingly, Semtech (Nasdaq:SMTC)’s management realized this relatively quickly (less than a year) with regard to its acquisition of Sierra Wireless. Unfortunately, it appears they realized it a little too late.

hopes and dreams

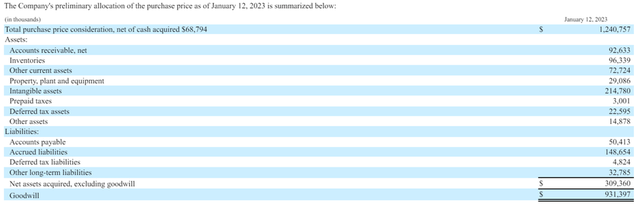

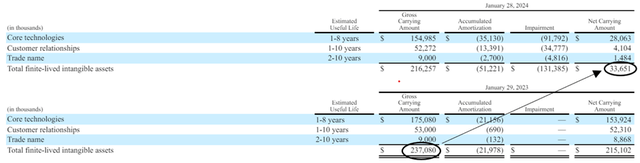

At the time it paid US$1.3 billion for just US$94.6 million in net tangible assets, it was probably assumed that the acquisition would launch the company into a completely different business field. Although the multiple was much higher than the acquisition price we were comfortable with, management must have done the analysis and developed a potential business plan to support the acquisition. The decision at that time.

10K filing

Desperate efforts to save the ship

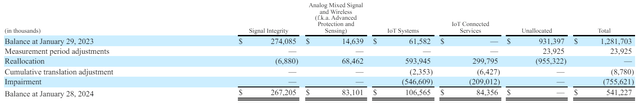

The decision to write off a significant portion of its goodwill and intangible assets so quickly was also likely based on several insights gained over the past year: The company recorded non-cash goodwill impairment charges totaling $755.6 million before tax for fiscal year 2024, citing declining revenue projections for its acquired businesses (specifically its IoT Connected Services, IoT Systems – Modules and IoT Systems – Routers reporting units), and current macroeconomic conditions, including interest rates.

10K filing

10K filing

What’s even more interesting is that multiple tests recorded impairments during this year, increasing the likelihood of further impairments next year. Again, the company has not ruled out this possibility, so we cannot rest assured.

Chained to a weight, the promised fuel tank is gone.

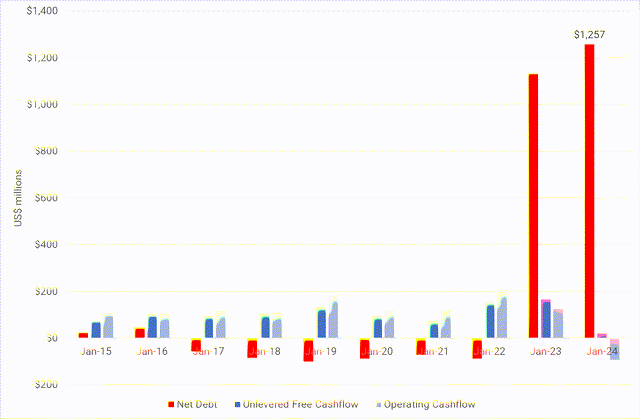

The business will end up on the balance sheet at a much lower percentage than was originally invested in, but the debt acquired to fund the acquisition will still be there, adding to the losses for a company that is struggling to improve margins and, as a result, will tend to see weaker revenue growth. conclusion.

Seeking Alpha

Seeking Alpha

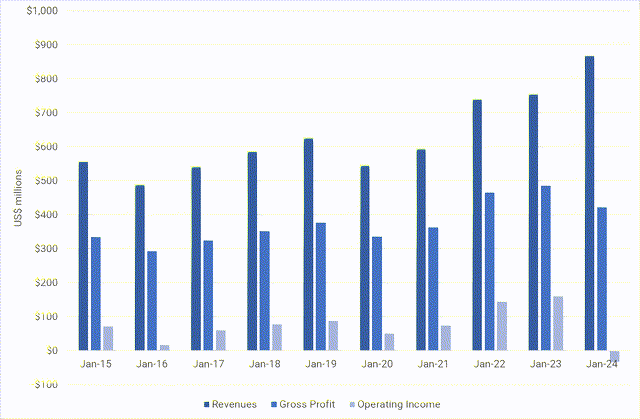

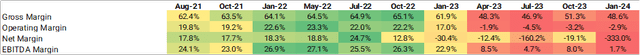

Average revenue growth since 2015 has been 5% per year, and gross profit growth has slowed further to 2.6% per year. Some might argue that profitability growth could return to the levels the company was achieving before the acquisition. This is a plausible argument since gross profit, operating profit, and net profit grew at annualized rates of 4.8%, 10.6%, and 10.4% from 2015 to 2022.

However, as we have seen in the past few quarters, lower post-acquisition margins, higher interest expenses (on an absolute and relative basis) are now differentiating factors. The results are quite disappointing, and we believe that the optimism reflected in the stock price from December 2023 onwards is likely based on technical analysis that showed the stock to be oversold.

SeekingAlpha and analyst calculations

Mounting debt burden

As of the last reporting date, the Company had $622.6 million outstanding under its term loan. Its revolving credit facility had an outstanding balance of $215.0 million and available unused borrowing capacity of $282.2 million, of which $162.5 million of the facility’s borrowing capacity is scheduled to mature on November 7, 2024 and $337.5 million is scheduled to mature on January 12, 2028.

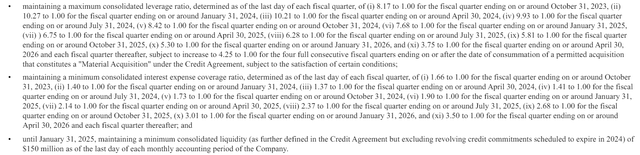

The company The Credit Agreement has been subject to at least three amendments since January 2023. The discussion is centered on Raising the upper limit of consolidated leverage ratio, Lowering the minimum consolidated interest coverage ratio clause and change price In particular, these covenants are outlined below and we would like to highlight the fact that as of the previous reporting period the carrying amount turned negative, so if the situation does not improve on the liquidity front, it is very likely that you will need to approach lenders again (even if you have already done so).

10,000 filings

It is also important to mention that SMTC’s loans are based on floating interest rates and margins (which vary for each type of facility) and if the company chooses to roll over its interest payments, the price will be set at the upper end of the agreed range. This distinguishes the company from many other listed companies that were able to secure medium-term loans at relatively low fixed rates from 2020 to 2022, which obviously puts the company in a more difficult position.

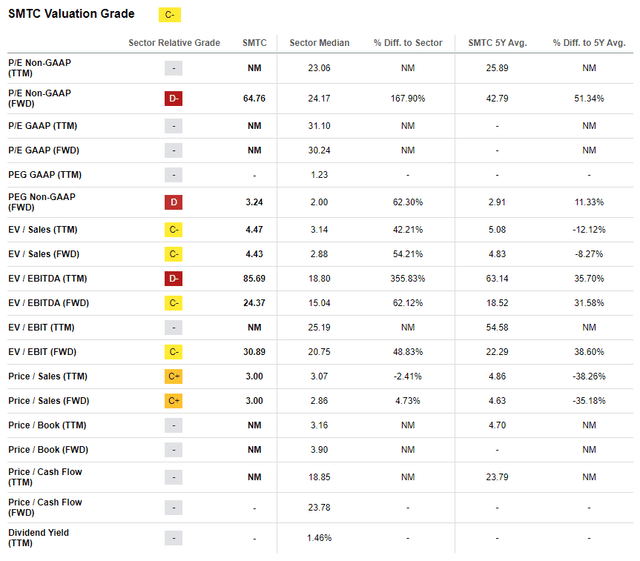

evaluation

This company ranks low on the SA metric, and until we have some clarity on its future prospects, it is very difficult to value the company using DDM or FCFE forecasts. It may be tempting to compile all sorts of growth scenarios, but I believe they are speculative and unfair to consider until the reported numbers establish a recently established baseline. are thinking.

Seeking Alpha

rising risk

Clearly, all is not lost and once management has overcome the challenges of post-acquisition business adjustments, they may be able to focus more on growing the business. Cash availability will certainly increase as margins improve or return to previous levels. One thing that may be worth mentioning here is that these liquidity and profitability challenges make SMTC a suitable acquisition target, especially now that it has its own IP as well as the one it acquired through its Sierra Wireless acquisition.

conclusion

We look forward to management’s plans on how they plan to effectively address the current situation. If the next earnings release does not show a credible turnaround in fortunes, we expect the price decline from current levels to be very sharp and sustained. We prefer to park on the sidelines and wait for this fog curtain to clear a bit before moving forward with our SMTC shareholding.