Daku

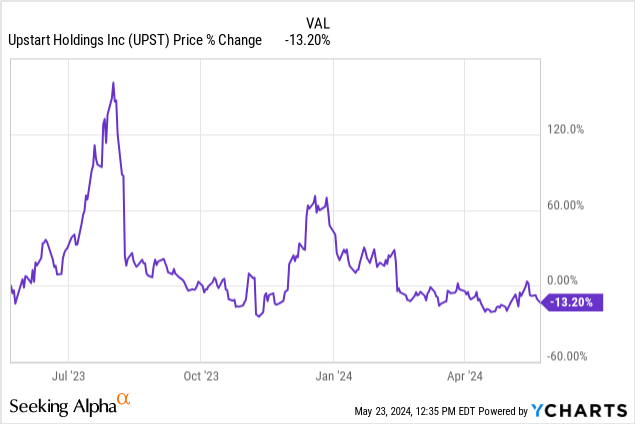

Upstart’s (Nasdaq:UPST) shares initially surged after the fintech company reported first-quarter results that showed revenue and profits that beat expectations, and the company sees a stabilizing revenue base and bright prospects for the future. The company’s performance is improving, especially when it comes to loan demand. With the Federal Reserve approaching a turning point for interest rates, I believe Upstart is a very promising investment for growth investors. While the stock is not cheap, the company is likely to see earnings accelerate in a low-interest rate world. This translates into a very attractive risk profile in my opinion.

Previous evaluation

Upstart is an interest rate-sensitive credit stock for investors, which is why I recommended the stock in my previous report on the company in February 2024. Get in before interest rates dropUpstart is growing revenue again but faces near-term profitability challenges. Upstart is expected to be a big beneficiary of the Fed’s interest rate shift in fiscal 2024 and 2025, and the company’s revenue outlook should brighten as consumer loan originations resume.

Startups Exceed Expectations

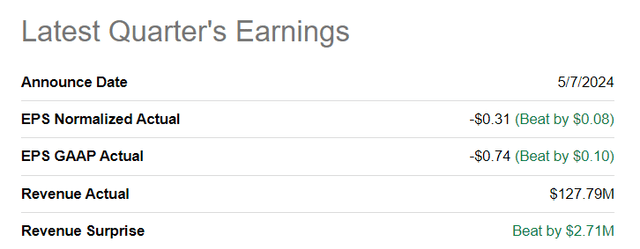

The AI startup filed its first quarter earnings report, beating expectations on both revenue and earnings. The company reported adjusted earnings per share of $(0.31) on revenue of $127.8, beating the average estimate by $0.08 per share. Revenue beat the average estimate by $2.7 million.

Upstart’s business is on the mend

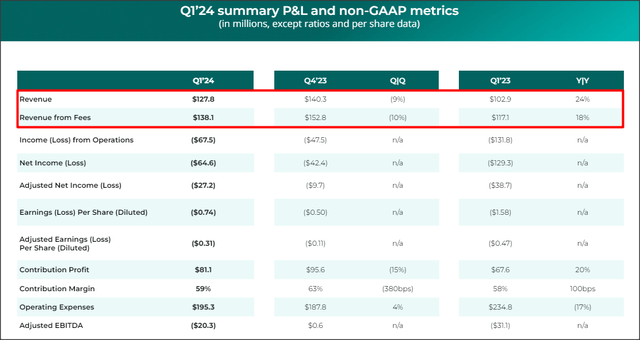

Upstart’s first quarter revenue was $127.8 million, representing a solid 24% growth year over year. Last quarter, Upstart saw revenue growth of -4% year over year, signaling further stabilization of the company’s business, a trend I noted in my last report on the company earlier this year.

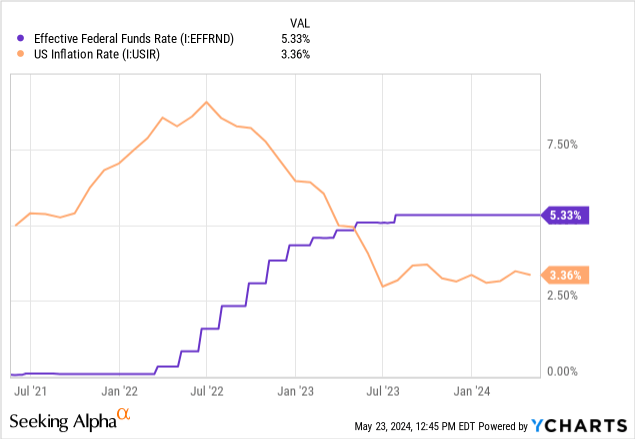

While Upstart is still fundamentally struggling with operating margins (Upstart posted an operating loss of $67.5 million in the first quarter), its return to positive revenue growth strongly suggests the company’s position is improving. While Upstart still posted a significant loss in the first quarter, the company’s net loss was nearly halved compared to the same period last year. The reason is that the market is no longer expecting an increase in the federal funds rate, which would make loans more costly for consumers. With the Federal Reserve slowly but surely approaching a point where it will also have to lower the federal funds rate, Upstart remains a very attractive countercyclical investment for fintech investors.

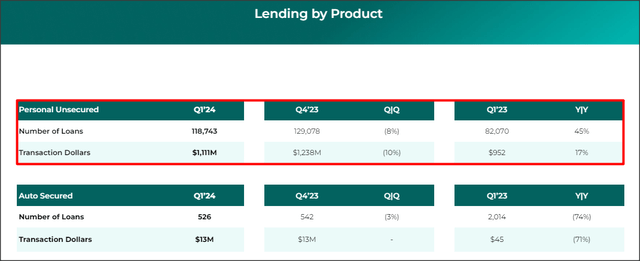

Upstart’s revenue recovery is being driven by increased demand for personal loans, which are core to the company’s value proposition. By transaction value, the personal loan division grew 17% year over year in the first quarter, with loan count increasing to 118,743, a growth rate of 45%. As the Federal Reserve lowers the federal funds rate, the cost of Upstart’s loan products (both unsecured personal loans and secured auto loans) will fall, which should lead to increased demand and stronger lending.

A key catalyst for Upstart’s growth in terms of both new loans and revenue relates to the Federal Reserve’s cut in the federal funds rate, which is a major factor in determining the cost of loans. With the Federal Reserve expected to cut the federal funds rate later this year, Upstart could see a strong catalyst to jumpstart its revenue growth rate.

In my opinion, the Fed will come under increasing pressure to lower the federal funds rate, especially since it is running well above the rate of inflation.

Upstart Rating

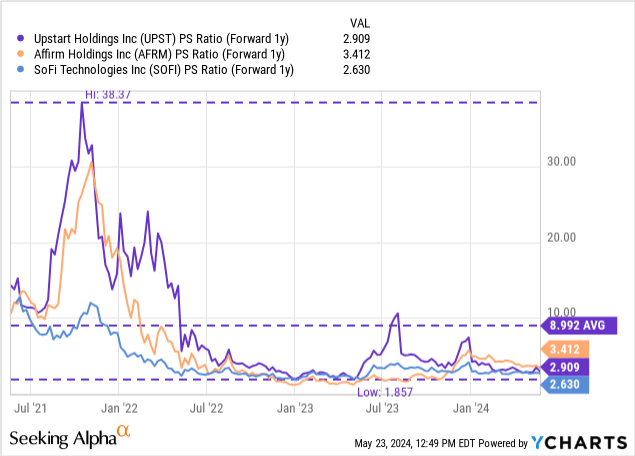

Upstart is currently expected to return to profitability in FY2025, which could be the first year the company achieves profitability. Because Upstart is not yet profitable, the only appropriate valuation ratios to use here are revenue-based. Based on projected FY2025 revenues of $717 million, the price-to-earnings ratio is 2.98x and the three-year average P/S ratio is 9.0x. Upstart was initially valued very highly as its sales were growing very fast before the Federal Reserve began tightening in FY2022.

A similar fintech company is Affirm Holdings.AFRM) and SoFi Technologies (Sophie) have P/S ratios of 3.4x and 2.6x, respectively. In my previous article on Upstart, I suggested a 4.0x P/R was a fair value multiple given the long-term growth outlook in a low interest rate world and the likelihood of sales growth reaccelerating. With a 4.0x sales multiple, Upstart’s fair value is around $33, down slightly from my previous estimate of $35.

The risks of Upstart

The biggest risk for Upstart is a possible delay in the Federal Reserve’s schedule for reducing the federal funds rate. If the Federal Reserve decides to postpone the cut in the federal funds rate, Upstart could be hit by the impact of delayed loan originations and may not see its revenue acceleration in fiscal 2024. This would result in severe headwinds for the company’s valuation factors.

Final thoughts

Upstart reported strong results in its first quarter earnings report, with profits and sales beating expectations and revenue returning to positive growth. The company struggled last year with declining loan demand in a high-interest rate world, but the medium- and long-term outlook is favorable as interest rates fall and loans become more affordable for consumers. I believe Upstart has great potential for revenue to accelerate in a low-interest rate world, which should be a strong catalyst for an upward rerating.