eyegelb

We’re nearing the end of the Q1 Earnings Season for the precious metals sector, and one of the first companies to report its results was Fortuna Silver (NYSE:FSM). Overall, the company saw a significant decline in silver production to start the year, with silver production sliding 32% year-over-year. Fortunately, this was offset by a 49% increase in gold production which enjoyed the strongest year-over-year gains, as of Q1 2023, allowing Fortuna to report higher revenue and continued free cash flow generation. In this update, we’ll dig into the Q1 results, recent developments, and how the stock’s valuation stacks up vs. peers:

Fortuna Silver Exploration – Company Website

All figures are in United States Dollars unless otherwise noted and “G/T” refers to “grams per tonne” of gold.

Fortuna Silver Q1 Production & Sales

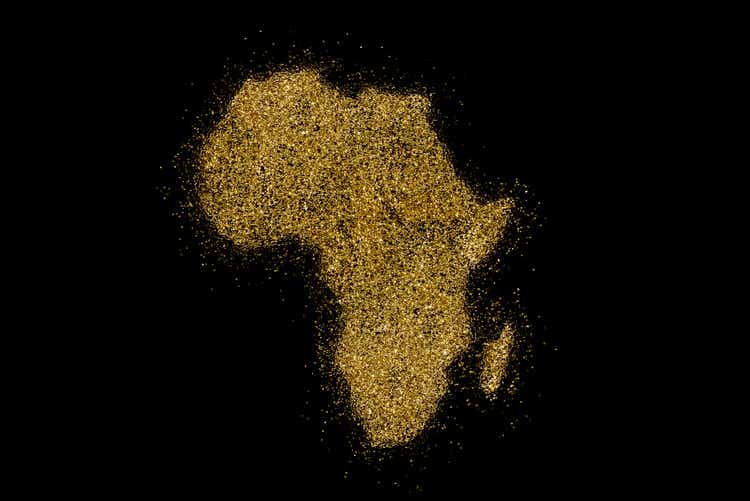

Fortuna Silver (“Fortuna”) released its Q1 results earlier this month, reporting quarterly production of ~1.07 million ounces of silver and ~89,700 ounces of gold. This translated to a 32% decline in silver production, impacted by lower throughput, grades, and recoveries at its San Jose Mine in Mexico. Fortunately, gold production spiked over 50% year-over-year to ~89,700 ounces (Q1 2023: ~60,100 ounces), benefiting from commercial production at its new Seguela Mine in Cote d’Ivoire which more than offset lower gold production from Lindero and San Jose. The result was that Fortuna reported gold-equivalent production of ~112,500 ounces (including its base metals production from Caylloma) or ~104,000 ounces using strictly gold and silver, with a 75/1 gold/silver ratio.

Fortuna Silver Quarterly Metals Production – Company Filings, Author’s Chart

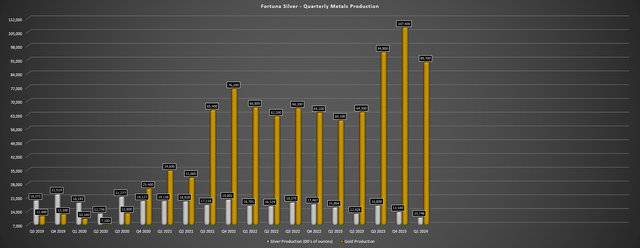

Starting with San Jose, silver and gold production plunged 42% and 45% year-over-year, respectively, on lower throughput and grades (~181,000 tonnes at 147 G/T silver and 0.90 G/T gold), translating to production of ~759,000 ounces of silver and ~4,500 ounces of gold. Fortuna noted that this was impacted by reduced operational flexibility with reserves more scant and dispersed in the Trinidad deposit, which also increased mining costs. Unfortunately, the lower production combined with a stronger Mexican Peso resulted in all-in sustaining (AISC) costs spiking to $24.24/oz, a 56% increase year-over-year.

Moving to Lindero, production was down year-over-year at its Argentinian mine as well, with the heap-leach asset producing ~23,300 ounces vs. ~25,500 ounces in Q1 2023. This was related to lower grades (0.60 G/T of gold vs. 0.71 G/T of gold) and we saw Lindero’s AISC spike to $1,634/oz with elevated sustaining capital related to the heap-leach expansion project. As it stands, the project is only 35% complete (~$52 million cost), meaning this will continue to weigh on AISC at Lindero near-term. On a positive note, 2025 should be a lower-cost year for Fortuna, with San Jose potentially offline (highest-cost asset) and more normalized sustaining capital at Lindero.

Fortuna Silver Quarterly Production by Mine – Company Filings, Author’s Chart

Looking at its West African operations, Yaramoko had a better quarter year-over-year with gold production of ~27,200 ounces (Q1 2023: ~26,400 ounces) with ~108,000 tonnes processed at 8.79 G/T of gold, up from ~140,000 tonnes at 5.9 G/T of gold. The higher grades, combined with lower sustaining capital, contributed to a more respectable AISC figure of $1,373/oz (Q1 2023: $1,509/oz). It’s also worth noting that this would have been a stronger quarter if not for a planned mill shut, which affected throughput in the period. The other positive from Yaramoko was that Fortuna shared it’s having success adding high-grade mineralization near the boundaries of the 55 Zone, suggesting the potential to sustain a 100,000 ounce production rate here next year, significantly better than the sub ~60,000 ounce production profile envisioned in the 2022 TR.

Yaramoko Mine – Google Earth

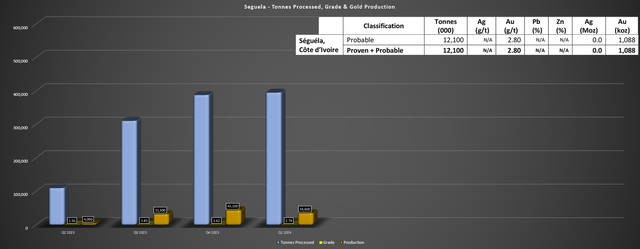

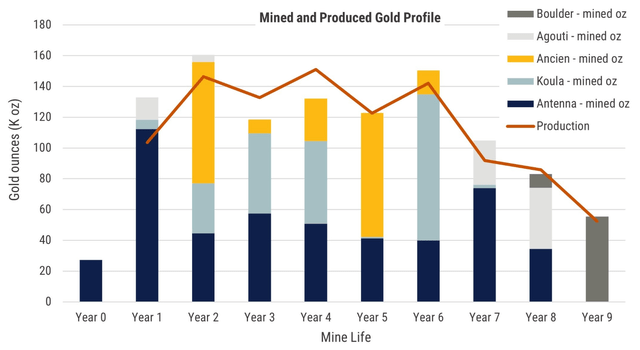

Finally, Seguela has grades revert back towards reserve grades, but still put up a solid quarter with ~34,600 ounces of gold produced on the back of ~395,000 tonnes processed at 2.79 G/T of gold. This solid performance contributed to industry-leading AISC of $948/oz and the company continues to enjoy far higher throughput rates than nameplate levels. Overall, these strong throughput rates, combined with consistent resource expansion and new discoveries suggest a longer mine life and the ability to pull forward high-grade ore (Sunbird) vs. the 2021 DFS which saw a significant production cliff in Year 7 after higher-grade Ancien and Koula ounces were exhausted, with post Year 6 mill feed coming from lower-grade pits like Agouti, Antenna (Stage 3/4), and Boulder.

Seguela Operating Metrics & Reserve Grade – Company Filings, Author’s Chart

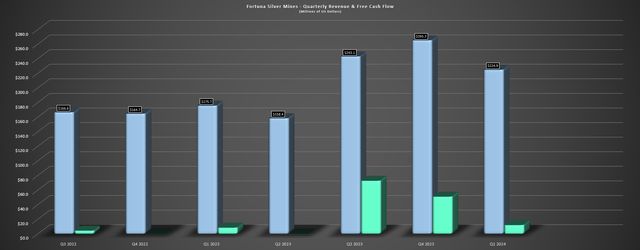

Given the solid performance from its West African mines, revenue increased 28% year-over-year to $224.9 million, operating cash flow increased to $48.9 million (+17% year-over-year) despite negative working capital movements, and free cash flow came in at $12.1 million. Free cash flow benefited from new contribution from its low-cost Seguela Mine and lower capex ($41.4 million vs. $59.7 million) following the completion of Seguela construction, partially offset by elevated capex at Lindero (heap-leach expansion). And given the better financial results, Fortuna paid down $40 million of debt and is now sitting on just ~$37 million in net debt (excluding $45 million in convertible debt) and ~$88 million in cash.

Fortuna Quarterly Revenue & Free Cash Flow – Company Filings, Author’s Chart

Costs & Margins

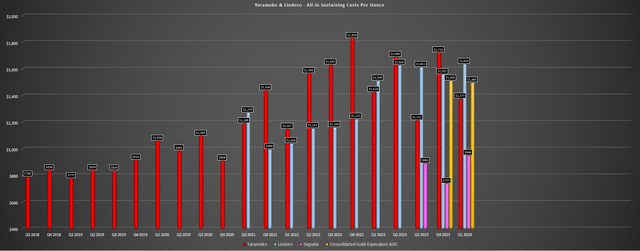

Looking at costs and margins, Fortuna’s Q1 2024 AISC improved 1% year-over-year to $1,495/oz (Q1 2023: $1,514/oz), with higher sustaining capital at Lindero and a higher royalty rate at Yaramoko (*), offset by lower-cost ounces from Seguela that benefited its cash costs. This translated to AISC margins of $592/oz with Fortuna enjoying a record average realized gold price of $2,087/oz in the period. And given the strength in gold and silver prices thus far in Q2 with gold averaging ~$2,350/oz and silver averaging ~$28.20/oz quarter-to-date, Fortuna has another strong quarter on deck from a margin expansion standpoint, and will lap easy comps that will result in a significant improvement in its financial results, with Q2 2023 AISC of $1,799/oz.

(*) Yaramoko’s royalty rate increased to 7% when gold is above $2,000/oz vs. 5% previously, with the Government of Burkina Faso increasing the royalty rate late last year. (*)

Fortuna Silver AISC (Lindero, Yaramoko, Seguela) – Company Filings, Author’s Chart

Recent Developments

As for recent developments, the sharp rise in the silver is certainly a positive development for Fortuna with a relatively small silver asset in Peru (Caylloma) and a larger and higher-cost (albeit shorter life asset) in Mexico at San Jose. However, while the silver price certainly helps its San Jose Mine near term, it still looks like this asset will head into care & maintenance unless the company decides it’s going to build a mine plan around much higher silver prices and mining more marginal ore. Hence, while there’s no question that the higher silver price has improved Fortuna’s cash flow profile this year (especially at San Jose, where AISC is expected to come in above $21.00/oz), it’s tough to optimistic about how this helps from a bigger picture standpoint with this asset likely to head offline in the next year.

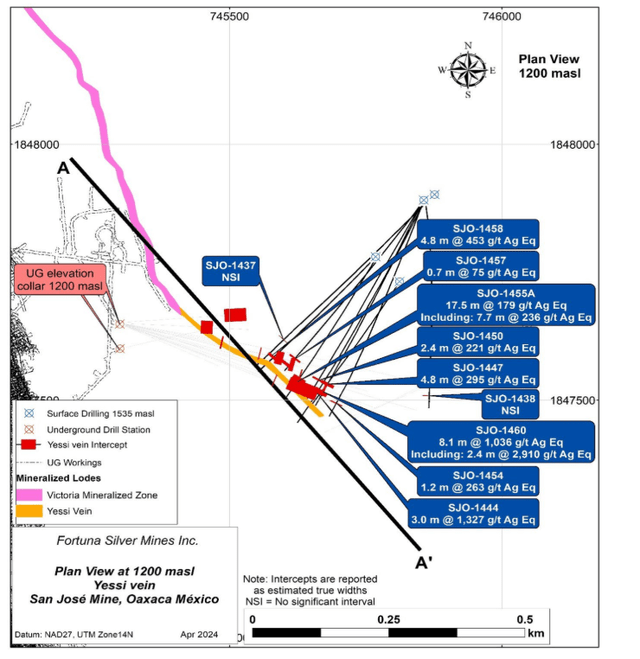

“The San Jose mine has a small footprint. We are currently updating our mine closure plans. But we really will have a better idea of which of the three avenues or three options we have will take. And we need a bit more time. We always have to be hopeful in this business, and we remain hopeful that Yessi (vein) will provide opportunities, but that still needs to be proven.”

– Fortuna Silver, Q1 2024 Conference Call

As discussed in its Q1 2024 Conference Call, the exploration results at the Yessi Vein are promising and the company is looking at moving into care and maintenance and focusing on exploration, going into full closure, or reassessing the mine plan based on higher metals prices. Typically, the latter option has not been the best choice, given that it means chasing lower grade ore. However, if the company can build up resources at Yessi (which is not part of its reserves that continue to decline in tonnage/grade), this would be an opportunity to mine superior material than the grades of its existing reserve base and keep the operation going, ultimately preventing it from reverting into primarily a gold producer next year.

Yessi Vein Drilling (San Jose) – Company Website

As it stands, it’s not clear what path the company will take, but we should have a better idea by year-end. However, the higher gold/silver prices certainly don’t hurt the outlook for San Jose, and the higher gold price have set the company up for much higher cash flow generation this year, with the potential to generate upwards of $300 million in operating cash flow in FY2024. Finally, while the Mexican Peso continues to be a thorn in the company’s side, it’s become less of a headwind, with West Africa becoming a dominant portion of the production profile declining production from San Jose, lowering the impact of the Mexican Peso strength on its business.

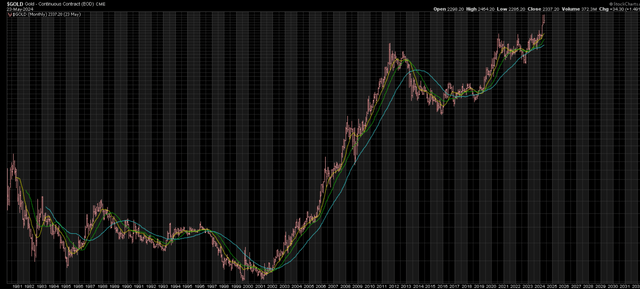

Monthly Gold Price Chart – StockCharts.com

MXN/USD – XE.com

As for other developments, Seguela continues to operate at well above nameplate capacity, with throughput averaging 195 tonnes per hour or ~4,700 tonnes per day, well above nameplate capacity of ~3,700 tonnes per day. This suggests that Seguela could consistently operate 15% above its expectations, which is an opportunity to improve the production profile and NAV at this asset given that there’s no shortage of ounces being delineated across the property. Overall, the benefit of moving Sunbird into the mine plan (displacing lower-grade ounces) and higher throughput rates could mean maintaining a ~135,000 ounce production profile much longer than envisioned in its previous mine life and helping to lower its company-wide operating costs, given that Seguela is its lowest-cost mine by a wide margin.

Seguela Initial DFS Mine Plan – Roxgold

As for negative developments, Fortuna shared that Cote d’Ivoire has been experiencing a shortage of electricity to the national grid since mid-April, related to failures at two private power generation plants that supply ~25% of electricity to the national grid. Power from one plant has since been restored and Seguela is receiving energy from the grid daily, but with interruptions. And although the site has emergency backup power generation for critical processes, it’s possible that this could impact production near term if the situation worsens. For now, the company has chosen not to adjust guidance at the mine, but between the possibility of higher costs at Yaramoko (the Government of Ghana stopped export of electricity to neighboring countries, including Burkina Faso) it was a tough start to Q2 for its West African mines.

Valuation

Based on ~318 million fully diluted shares and a share price of US$6.13, Fortuna trades at a market cap of ~$1.96 billion and an enterprise value of ~$2.0 billion. This makes it one of the most expensive producers in the market today with a predominantly West African jurisdictional profile (90% of operating income generated in West Africa), especially when compared to B2Gold (BTG) which has nearly triple the scale (2026 production: ~1.25 million ounces of gold) vs. Fortuna which has a declining production profile with reserves near exhausted at San Jose (impact on gold and silver production) and grades normalizing at Seguela.

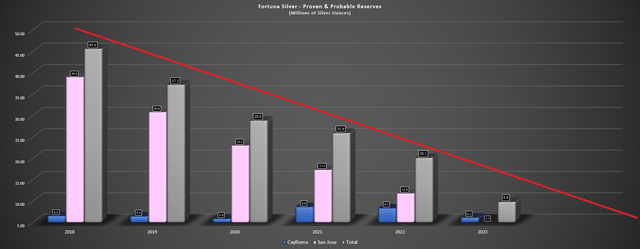

Fortuna Silver – Silver Reserve Base (Millions of Ounces) – Company Filings, Author’s Chart

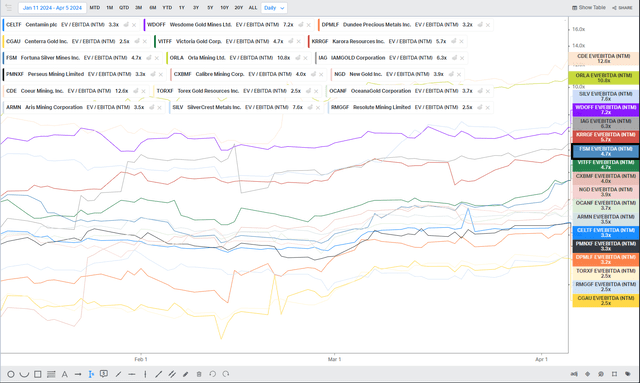

As for Fortuna’s valuation metrics on a P/NAV and P/FCF standpoint, the stock is now trading at ~1.65x P/NAV vs. an estimated net asset value of ~$1.19 billion and ~10x FY2025 free cash flow estimates even using a $2,225/oz gold price assumption to bake in the gold price holding near current levels. From a valuation per ounce of production standpoint, the company is trading at over $5,000/oz of production on 2025 estimates. And if we look at how Fortuna stacks up relative to peers, it now trades at a significant premium to its West African gold producer peers (Perseus, Resolute) on a forward EV/EBITDA standpoint and is trading more in line with primarily Tier-1 jurisdiction operations.

Finally, FSM is trading at a much higher forward EV/EBITDA multiple than BTG on peak production (2024-2026 period) vs. BTG on trough production and over a 50% higher FY2025 free cash flow multiple.

Junior & Mid-Tier Gold Producer Peer Valuations vs. FSM – Koyfin

None of this means that FSM can’t continue higher, but with the stock now extended short-term and trading at one of its richest multiples in years with no justification for that premium (gold will make up over 90% of future revenue), I don’t see any way to justify chasing the stock above US$6.10 here. Instead, I see this 140% plus rally as an opportunity to take some profits into strength. And if I were looking to put capital to work in the sector, I see B2Gold as the much more attractive option, trading at ~6x FY2025 free cash flow estimates with a ~6.0% dividend yield.

Summary

Fortuna had a decent start to the year in Q1, with Seguela continuing to perform above expectations, more than offsetting the plunge in silver/gold production at San Jose and lower output at Lindero. Meanwhile, the company is set to enjoy a surge in AISC margins in Q2 2024 as the company laps easy comparisons from Q2 2023. That said, Fortuna is now trading at ~1.65x P/NAV and is back to trading at ~10x FY2025 free cash flow estimates, a rich multiple for a company that has built itself into predominantly a West African gold producer. And as highlighted above, West African producers of greater scale with better assets trade at low single-digit FY2025 free cash flow multiples and deep discounts to NAV. In summary, I see FSM as fully valued short-term and I see this rally above US$6.10 as an opportunity to book some profits.