Yagi Studio

Applovin’s advertising thesis remains strong

So, is APP stock a buy?sell or hold?

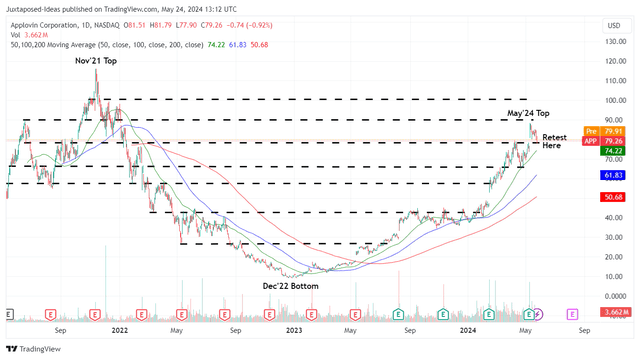

APP 2 year stock price

At the moment, APP has given up some of its recent gains after an impressive Q1FY24 earnings report, but it is still trading well above its 50-, 100-, and 200-day moving averages.

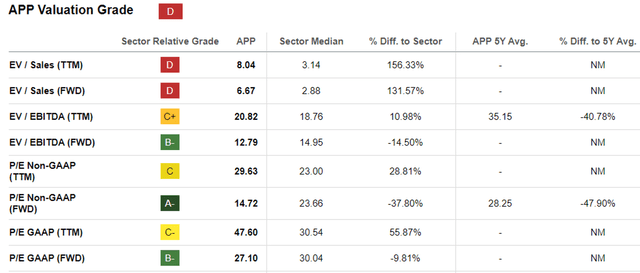

APP Evaluation

Nonetheless, we believe APP is still fairly valued at a FWD EV/EBITDA valuation of 12.79x and a FWD P/E GAAP valuation of 27.10x.

This is a very profitable trade desk (TTDD) 44.25x/130.31x, Perion Network (Peri) was 4.84x/12.59x before the recent adjustment. Bing changesand profitable Digital Turbine Inc.Apps) were 5.96x/NA, respectively.

This is especially true when comparing APP’s projected sales/earnings growth to 2026 with TTD’s +21.6%/ +22.9%, PERI’s +16.2%/ -30.1% and APPS’s -2.8%/ -22.8%, suggesting that the former’s accelerated earnings growth is indeed undervalued.

Readers should also note that generative AI is expected to enter the ad tech space, with the ecosystem expected to benefit from “faster content creation.” More effective advertising campaignsand improved advertising revenues,” naturally accelerating the growth of a market leader like APP.

This is especially true for Global advertising technology market size It is expected to exponentially grow from $987.52 billion in 2023 to $2.81 trillion by 2030, expanding at a staggering CAGR of +16.1%.

As of now, with Q1 2024 GAAP annualized EPS of $2.68 (up 36.7% QoQ and 6,800% YoY) and a FWD P/E GAAP valuation of 27.10x, it’s clear that APP is trading above our fair value estimate of $72.60.

Still, with fiscal 2026 GAAP EPS estimates of $4.66, it’s clear that the stock still offers excellent upside potential of +59.2% relative to our long-term target price of $126.20.

Combining solid shareholder returns with an attractive risk/reward ratio, we initiate a Buy rating on APP, but there is no specific entry point as it will depend on each individual investor’s dollar-cost averaging and risk tolerance.

Currently, the stock is retesting the previous resistance level of $80 and interested readers may wish to watch the move for a bit more time before buying further following the gradual pullback to the previous trading range of $66 to $74 for an improved margin of safety.