JHVE Photo

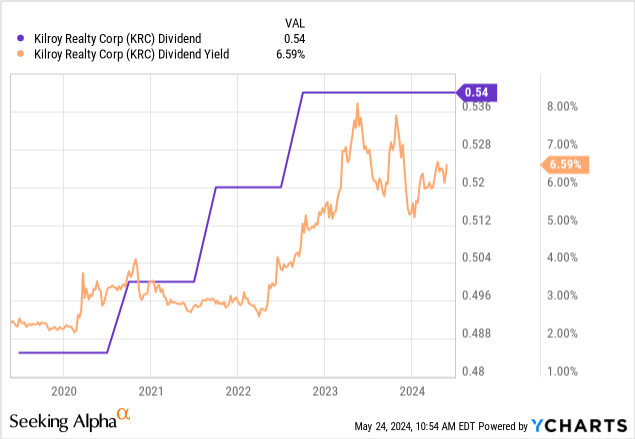

Kilroy Real Estate (New York Stock Exchange:Korea RC) is down 18% so far this year as market expectations of a potentially dovish Fed rate cut in 2024 have been replaced by fears of a return to higher interest rates for a longer period. If interest rates reach zero in 2024, REITs will continue to trade at historically low multiples. KRC forecast its funds from operations (“FFO”) for the first quarter of fiscal 2024 at $1.11 per shareThe company beat market expectations and up 2 cents from the prior quarter, now expects full-year 2024 FFO of $4.15 to $4.30 per share. That’s the midpoint, up 5 cents from its previous outlook for full-year FFO of $4.15 to $4.30 per share. $4.10 to $4.25 per shareKRC last paid a cash dividend quarterly. $0.54 per share,No change Compared to the same period last year, the dividend was $2.16 per share, for an annualized dividend yield of 6.65%.

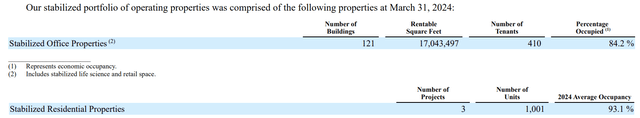

Kilroy Realty First Quarter Fiscal Year 2024 Form 10-Q

KRC is an internally managed REIT with a stable portfolio of 121 office buildings leased to 410 tenants covering 17 million rentable square feet. Occupancy rate: 84.2% As of the end of the first quarter. The REIT also owns three stabilized residential properties with 1,001 units and 93.1% occupancy. Importantly, KRC is trading at a multiple of 7.68x to the median of its 2024 FFO range, down significantly from a multiple of roughly 17x in the first quarter of 2021. The drop is significant, and the new multiple reflects KRC’s fight against inflation that has pushed interest rates to a 22-year high of 5.25%-5.50%, a central headwind for the REIT’s total return profile, which has been stable in dividends since 2022.

Leasing momentum and occupancy rates

KRC’s first quarter leasing numbers were strong; 400,000 sq. ft. The number of leases signed was the highest since 2017. GAAP rents increased 8.6%, while cash rents fell 2.9%. Occupancy was 84.2%, down 80 basis points from 85% in the previous quarter, maintaining the negative trend that has been an anchor for short office transactions since the pandemic caused companies to shift to hybrid work models. The portfolio was 85.7% leased as of the end of the first quarter, and occupancy could stabilize if KRC maintains leasing momentum in the second and third quarters.

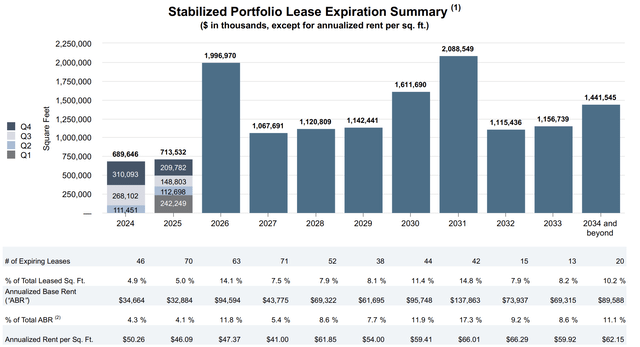

Kilroy Realty First Quarter Fiscal Year 2024 Supplemental Report

REITs 689,646 square feet The leases expiring in 2024 are for 713,532 square feet, and the leases expiring in 2025 are for 713,532 square feet. This represents 4.3% and 4.1% of annual base rent, respectively. Current leasing momentum is good, and KRC is forecasting occupancy at 82.5% to 84% at the end of 2024. Last covered The lower end of the REIT and KRC’s occupancy guidance means that their portfolios are roughly in line with the overall U.S. office vacancy rate. 18.8% As of April. This rate is up 210 basis points from a year ago and could reach 20% in 2024. Longer term, this rate is likely to stabilize due to a continued decline in new office supply, office-to-residential conversions, and return-to-the-office mandates.

Development, Liquidity and Leverage

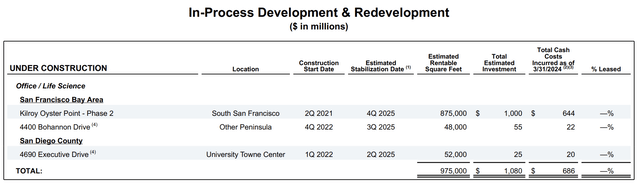

Kilroy Realty First Quarter Fiscal Year 2024 Supplemental Report

KRC currently has dividend coverage of 195% from the midpoint of its 2024 FFO guidance, so The dividend yield is safe and sustainable. Total returns will come from the realization of this yield and potential capital accretion from the partial recovery of the multiple to FFO. KRC’s development and redevelopment spending is high, with the REIT forecasting total development spending of $200 million to $300 million in 2024. All under-construction properties are expected to be operational by the end of 2025, which will add an additional 975,000 square feet of rentable area.

Kilroy Realty First Quarter Fiscal Year 2024 Supplemental Report

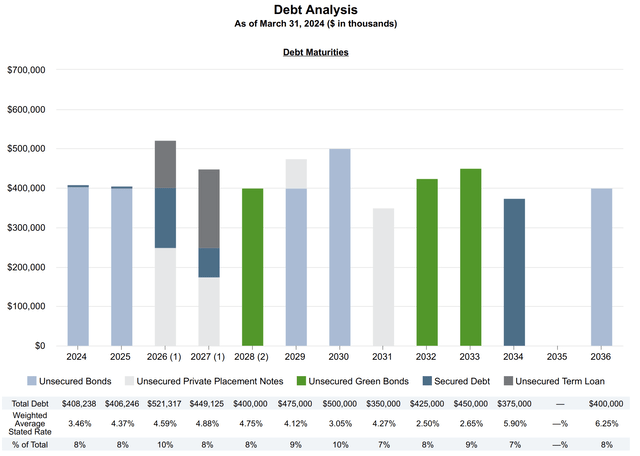

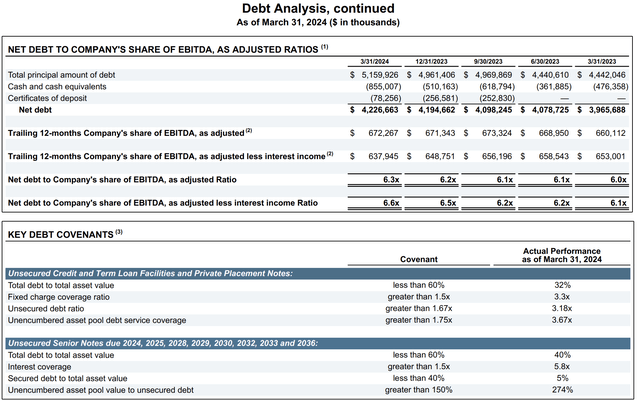

KRC’s cash and short-term investments at the end of the first quarter were $900 millionand an additional $1.1 billion is available under the unsecured revolving credit facility, with $408 million of debt due in 2024 and a roughly equal amount due in 2025. KRC’s debt maturity schedule is roughly evenly spread, with pre-extension option maturities extended through July 2028 due to a restructuring of its revolving loan.

Kilroy Realty First Quarter Fiscal Year 2024 Supplemental Report

While the REIT is in compliance with its debt covenants, its net debt to adjusted EBITDA ratio has deteriorated, standing at 6.3x as of the end of the first quarter, up from 6.0x in the same period a year ago. While the REIT’s declining occupancy rates represent a structural headwind, I remain comfortable on the long side due to two core drivers of the bull case: recent strength in rental volumes and current strong dividend distribution coverage. However, interest rate cuts are on the way, which should be a key positive catalyst for the REIT.