Gorodenkov

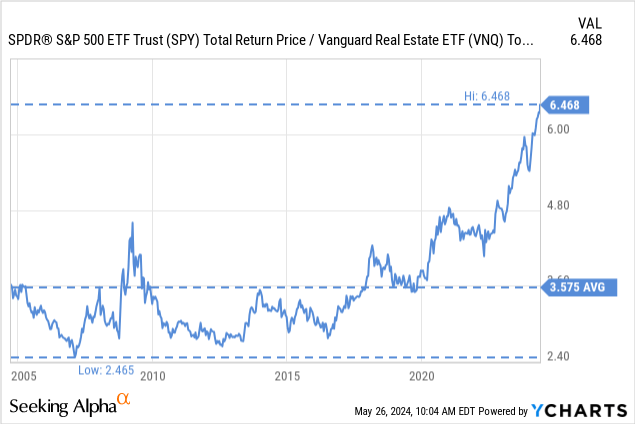

Rising interest rates have significantly reduced investor interest in utilities (R) and Real Estate (Vietnam), and currently these two sectors Represent Just 2.3% and 2.2% of the S&P 500 indexspy) This is Real estate has the lowest weighting in the index, while technology companies (XLK) is approaching its all-time high. During the dot-com era, tech stocks Reached Information technology is currently listed with a weighting of 29.2%, while making up more than 35% of the S&P 500. Still, it’s unclear whether some tech companies are not hitting record levels. Reclassified Alphabet (Google)(GoogleIn any case, if we compare the total return price ratios of the popular S&P 500, Given the ETF credibility placed in the Vanguard Real Estate ETF, it’s clear that real estate has rarely been more out of favor relative to the rest of the market. If Warren Buffett is right when he says you should “be greedy when others are fearful and fearful when others are greedy,” now may be a great time to look for opportunities in real estate.

This is not to say that there aren’t legitimate reasons to be concerned about the real estate sector, especially as some sectors face strong headwinds. We are particularly concerned about offices, given the enormous pressure that working from home is putting on this asset class. Estimation Office space availability at the end of 2023 was roughly 25% of existing supply. This makes the subsector nearly uninvestable, with one important exception, in our view: Alexandria Real Estate (New York Stock Exchange:teeth) has made the case that it is a unique company with a strong competitive advantage. It has been over a year since our last survey. articleThe company recently reported its first-quarter results, and with the stock price trending lower, I thought it would be a good time to revisit my investment thesis.

A strong competitive advantage

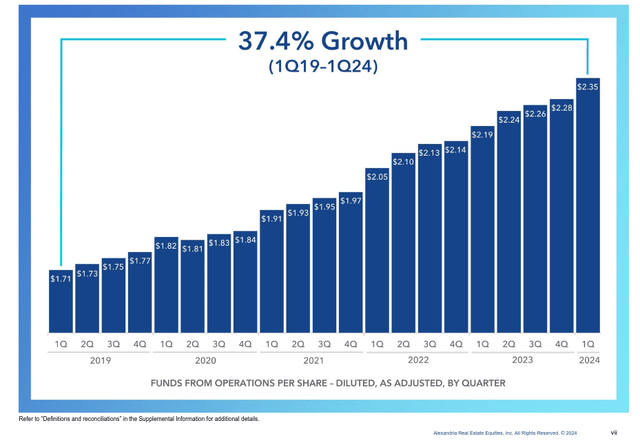

At a time when many office REITs are struggling and seeing their funds per share and occupancy rates decline, Alexandria continues to experience impressive growth, which we believe is a testament to the company’s strong competitive advantages.

The company’s strengths lie in its ownership of the most attractive mega-campuses in life sciences, its prime locations near universities and research centers, and its strong relationships with the most important companies in the industry. For most of its clients, the cost of space is only a small percentage of their costs, but it has a significant impact on employee productivity. As such, clients are willing to pay significantly higher rents to be located on Alexandria’s highly attractive mega-campuses.

The company also has the valuable know-how and accumulated knowledge to develop best-in-class life science facilities. Earnings Report “No one is going to be laid off because we chose the Alexandria building,” said Joel Marcus, chairman of the board and founder.

Alexandria Investor Presentation

Life Sciences Fundamentals

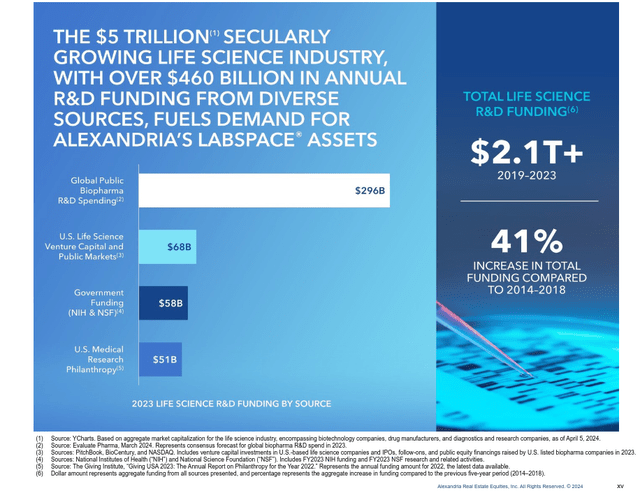

Alexandria has argued that the fundamentals of its industry are different from the drivers of general office space demand. More specifically, demand for the type of real estate it offers is strongly correlated with biopharmaceutical research and development spending. Luckily for the company, this R&D spending is growing rapidly.

During the conference call, executives viewed lab space as similar to a data center, housing expensive equipment, and said the need for space is dictated by the physical equipment, not necessarily the number of workers.

Alexandria Investor Presentation

First Quarter Results

A review of the company’s first quarter fiscal 2024 results shows little evidence yet that work-from-home is having a significant impact on the company. Alexandria reported a 7.6% year-over-year increase in NOI and very strong lease spreads. It also reported strong occupancy rates despite recent vacancies. GAAP and cash rent increases were 33% and 19%, respectively.

The company maintains a strong balance sheet with a weighted average debt maturity of over 13 years and a weighted average interest rate of just 3.86%.

growth

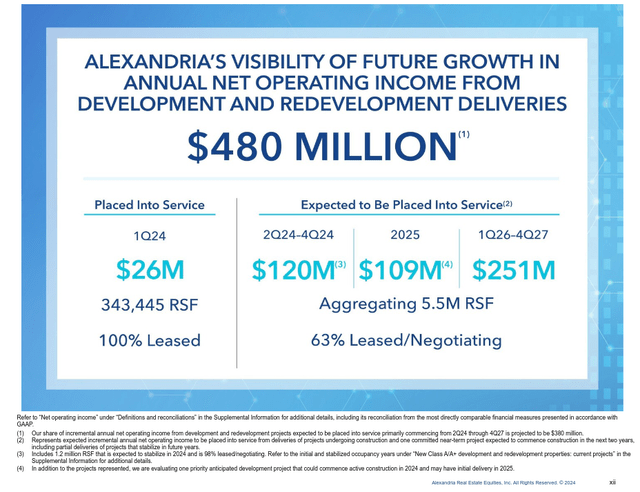

Alexandria is positioned for growth over the next few years, with the current pipeline alone expected to generate stable net operating income of approximately $480 million, with an additional $26 million expected from launches in the first quarter alone, and room for rent increases, with the portfolio’s cash rent to market capitalization at approximately 14%.

Alexandria Investor Presentation

When asked by the analyst whether the timing of interest rate cuts will impact tenants’ ability to secure financing and therefore their decisions to lease space, Joel Marcus explained that growth is less dependent on macroeconomic conditions. Here is his response:

No. And as Harry explained in the first quarter, Michael, you look at what happened. It’s event driven, it’s not directly correlated to the economic environment or interest rates, it’s just how the industry is behaving. And it’s not totally protected by that, because if something were to happen — if China were to decide to invade Taiwan — it would seize the market, interest rates would spike in a crazy way, or obviously there would be an immediate impact on everybody.

But I think the deferrals will remain the same even if someone hits a major milestone and becomes able to raise capital. There may be higher concessions for the method they choose to use, whether that be underwriting or overnight financing. But it will be a very small cost of capital issue for the company.

evaluation

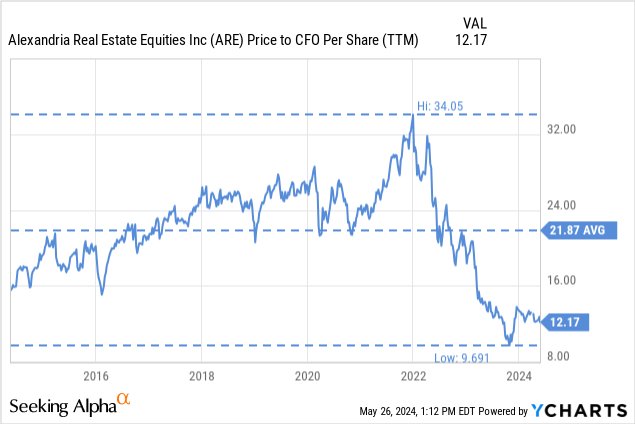

The easiest way to think about Alexandria’s current valuation is that if the multiple remains roughly constant, long-term investors should be able to generate a return roughly equal to the combined operating cash flow growth and dividend yield. Over the past decade, Alexandria has grown its operating cash flow per share by about 7% per year, and its current dividend yield is about 4.3%. Adding these together gives us 11.3%, which we think is an attractive potential return. At the midpoint, Alexandria expects FFO per share of $9.47, which would imply 5.6% year-over-year growth, giving a price/FFO multiple of about 12.5x. Similarly, the company is trading well below its 10-year average price-to-operating cash flow ratio.

risk

Nonetheless, there are important risks to consider, including very high office vacancy rates in most of its major markets. Thus far, Alexandria has maintained high occupancy rates and realized positive lease spreads, which we believe is the result of its strong competitive advantages and favorable locations. Still, at some point, the company’s pricing power may begin to decline as offices are converted into life science buildings, even when competing product is less desirable and of lower quality. These risks are mitigated by the company’s strong balance sheet, long-term debt, and strong foundation in the life sciences industry.

Conclusion

After reviewing the latest financial results, we continue to believe that Alexandria has a strong competitive advantage and fundamentals that set it apart from most other office REITs. The company is positioned for significant growth and should generate significant additional NOI over the next few years. The company’s shares are trading at a very attractive valuation compared to historical averages and we believe it is priced to deliver attractive returns for long-term investors. The company’s performance is less correlated to economic conditions and more correlated to research and development spending in the rapidly growing life sciences industry.