Thierry Dessogne

ESEA is doing well

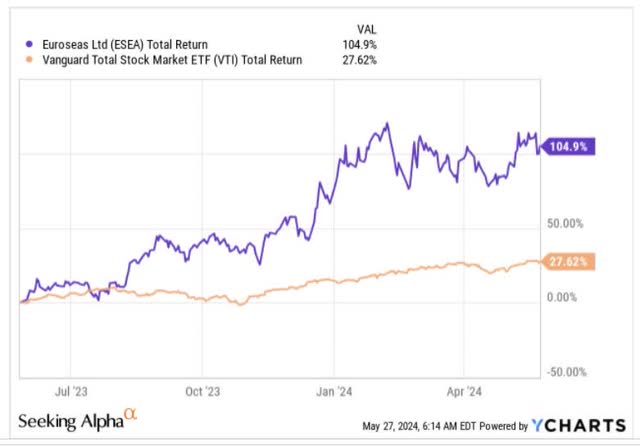

Over the past year, the overall stock market has recovered well, delivering a 28% return. But how has Euroses Ltd. performed?Nasdaq:ESEA), Greek shipping company ESEA, which operates in the container shipping sector, outperformed the broader stock market by about 3.8 times over the same period.

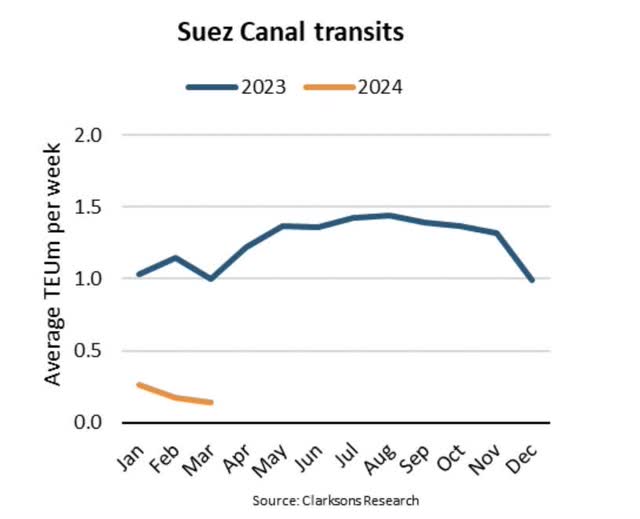

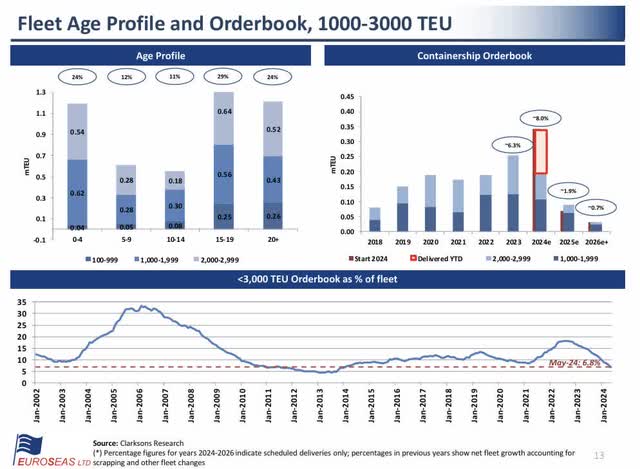

A surge in Houthi rebel attacks on ships transiting the Red Sea this year has disrupted maritime traffic in the Suez Canal. Compared to last year, average weekly traffic in 2024 is down significantly, with the resulting rerouting causing an additional 10% increase in vessel demand. Ten%This situation has led investors to slow the pace of ship recycling. This is expected to decline in FY24 as vessels age. This is very positive for ESEA, especially given the slow pace of new capacity additions in the sub-3,000 TEU space through FY25 (more on this below). Overall, Clarksons forecasts that containership trade demand is expected to grow 9.2% this year, versus the previous forecast of 5.5%.

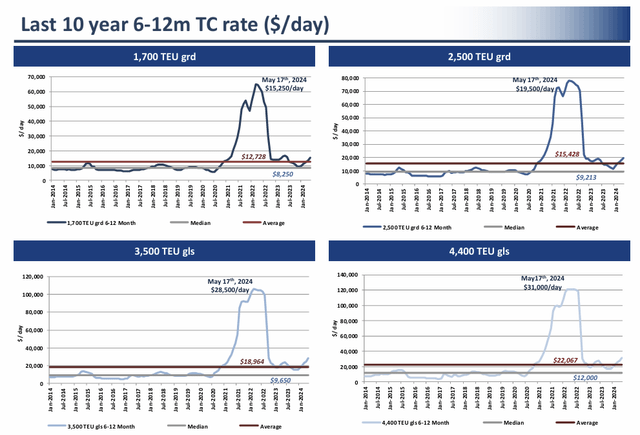

Nevertheless, time charter rates have already risen this year due to changing supply and demand positions, and ESEA management said: 73% Since the Dec. 21 low, interest rates have risen.

As of May 17, ESEA’s rates for charters under one year were well above the 10-year average, and ESEA appears well positioned to benefit from this momentum. 7 Their vessels’ time charterparties are expiring this year, and ESEA’s charter coverage to 2024 is currently at a fairly high 88%, providing useful visibility.

Global GDP growth rate 3.2% This year, cargo volumes are expected to grow at a slightly higher average growth rate. 3.5% Growth, particularly in the first half, benefited from a low base last year.

As things stand, there is no sign of a resolution to the Red Sea crisis. recentlyWe have seen the UN ocean agency speak out in strong terms to address the situation, but it remains to be seen whether anything concrete will come out of it.

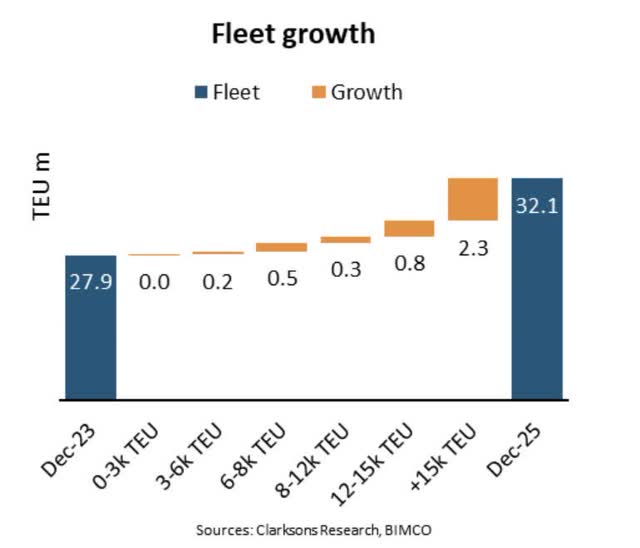

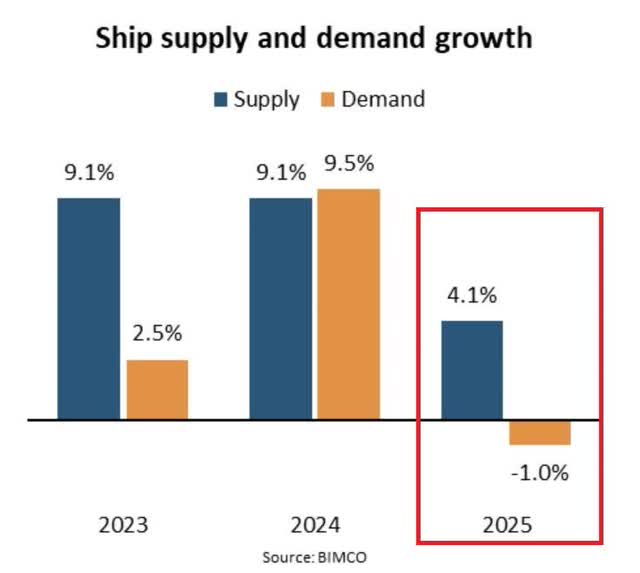

There is every reason to believe that without these developments in the Red Sea, container shipping rates would likely have remained low, especially with increased supply coming into the market. By FY25, the container ship fleet in the system is expected to grow by about 15 percent, reaching a total of 32.1 million TEU by the end of next year.

However, it is important to note that ESEA’s fleet is made up of only feeder and intermediate vessels and is therefore unlikely to face the same supply-side pressures as its larger peers.twenty two It is important to note that at present this is mainly made up of vessels with a combined capacity of less than 3K TEU, with very little new projected capacity in this sector (see image above) and the majority (75%) of capacity growth expected to come from vessels with a capacity of 12000 TEU and above, which is not an area that ESEA is concerned with.

If Red Sea tensions ease over the next 12 months (still a big assumption), the container shipping industry could face worsening supply-demand conditions by FY25, especially given the momentum of fleet expansion across the industry. For reference, the backlog of the fleet is still fairly high at over 21%, but is very small at less than 7% in the 1000-3000 TEU range. This should provide some support, especially to charter rates. 50% The fleet is already over 15 years old and is quite outdated.

Summary – Why ESEA Stocks Shouldn’t Be Buying Now

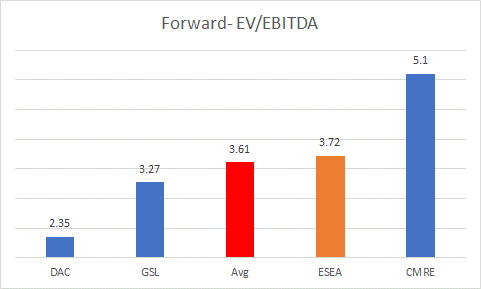

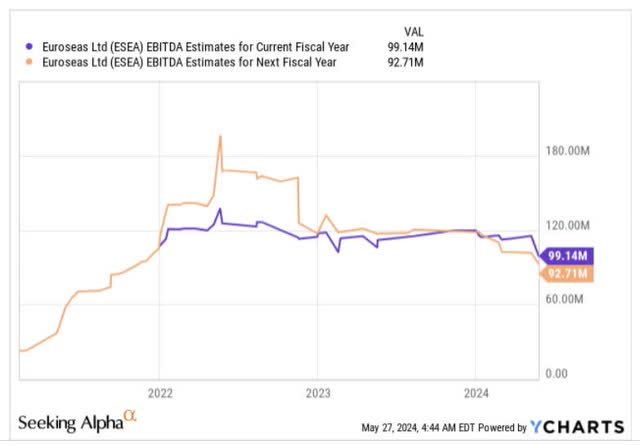

So far, we’re relatively favorable on ESEA’s prospects, but we don’t believe it offers significant value at this level, especially considering future EBITDA expectations. According to YCharts, ESEA is currently priced at 3.72x forward EV/EBITDA, which is a 56% premium to the long-term average.

Also keep in mind that the current share price of 3.72x is higher than the industry average. I would be comfortable paying a premium if I could see healthy EBITDA growth through FY25, but this is unlikely as the overall industry supply and demand dynamics are likely to tilt in FY25 (ESEA may be better positioned than peers due to its focused vessels, but rates may not be as stable as they are currently).

Sellers seem to be quite conscious of this right now, and it’s reflected in their guidance for FY24 and FY25. After reaching adjusted EBITDA of $123.6 million, the YCharts consensus for ESEA is currently expecting a two-year CAGR decline of -13%, which is not a very good selling point when the stock is trading at a premium of over 50%.

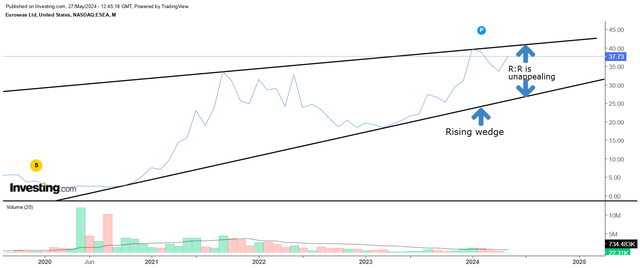

Meanwhile, on the weekly chart of ESEA, Rising Wedge This pattern is at risk of reversing as it moves higher, and even if you want to discount the possibility of a reversal, with the stock currently well off the lower end of the wedge and only around 7% off the upper end, the risk/reward situation doesn’t look very attractive.

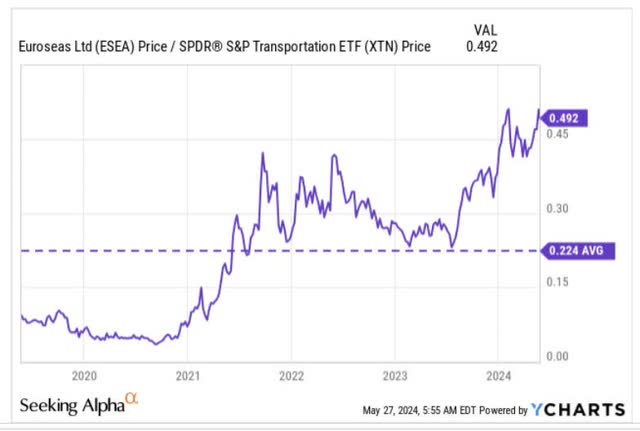

Finally, a relative strength chart that takes into account ESEA’s positioning relative to other transportation stocks (which can be used to identify promising rotation opportunities within a given sector) also shows that current ratios appear to be rather over-inflated, with the stock currently trading at more than double its long-term average. This relatively overbought stance could dampen rotational interest in ESEA.