MesquitaFMS/E+ via Getty Images

Investment Thesis

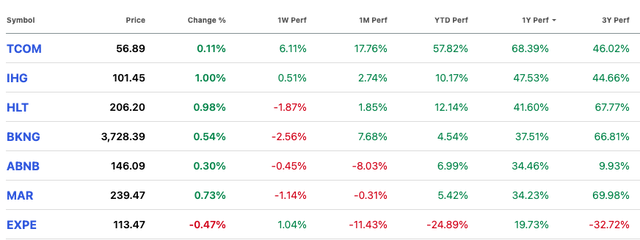

The slowdown in consumer spending initially seemed like a headwind for Expedia.Nasdaq:experienceThe company’s shares fell after reporting earnings, and rivals including Booking and Airbnb also predicted slowing consumer demand.

But Expedia is unique. challenge. New CEO A new leader with deep industry and Expedia expertise has been appointed to ensure a smooth transition. Two executives and Layoffs in Austin Adding more uncertainty: The outgoing CEO’s continued involvement as chairman and director helps bridge the gap, but it remains unclear what the long-term strategic impact of these changes will be.

Further compounding these uncertainties are potential margin pressures due to declining average ticket sales, ongoing integration struggles following VRBO’s move to the Expedia platform, and a competitive environment in which Expedia remains a “distant second” to Booking.com. Airbnb is dominating in each of these sectors, which has resulted in its stock price underperforming relative to its peers.

Considering these factors, I am inclined to rate the stock a “Hold.” The company faces not only economic headwinds, but also internal strategic challenges and a fiercely competitive environment that requires strong leadership. Therefore, I do not believe it is a “value” or “growth at a fair price” company. Until Expedia weathers these uncertainties, there are currently better positioned companies in the industry.

Corporate strategy challenges exacerbate weak spending forecasts

Expedia shares fell about 18% following the report. Revenue On May 2, the company cut its full-year growth outlook despite the better-than-expected revenue, citing weaker-than-expected booking trends, particularly on its VRBO vacation rental platform.

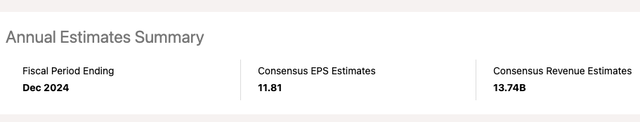

Expedia beat expectations on both first-quarter revenue and earnings per share, but management said it would continue to push back on second-quarter results and Guidance revised downwardsAnalysts remain cautious, with consensus analysts expecting Seeking Alpha’s December 2024 revenue to grow 7% year over year and EPS to grow 21.93%.

Overall, the company reported mixed results for the first quarter. Financial results announcement, Revenue grew 8%, but total bookings only grew 3%. VRBO is struggling to recover, while Hotels.com faces challenges during integration, and B2B and Expedia are doing well. The company is focusing on improving pricing strategy and product to drive customer acquisition. The company is bullish on personalization and AI for new markets, but the full effect of international expansion will take time to be realized. Cost-cutting measures have freed up capital for marketing, and hotel growth outside the US looks solid.

Our international investments are going well, but they are a small part of our overall B2C business. So the short answer is that the hotel division is growing more outside the U.S. because of tailwinds.”

Expedia has pledged to invest in growth areas and improve cost efficiencies, but questions remain about its ability to deliver under new management.

Management Evaluation

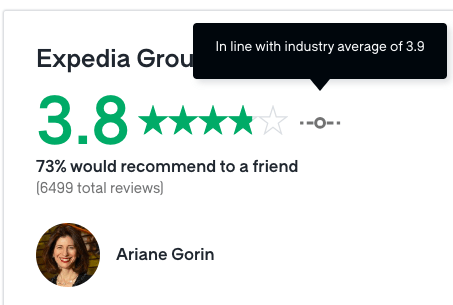

Expedia is going through a period of transition following the recent departure of its CEO. Peter Kahn In just four years, management control Ariane Golanis a veteran Expedia executive with more than 10 years of experience with the company. Her appointment comes at a time of recent staff reductions. Reduce workforce by 9% Similar measures will be taken in 2020 and 2023. Full compensation She appears to be similar to her predecessor, but details have yet to be released so it’s impossible to fully judge her alignment with the company’s long-term success, but the fact that she’s been with the company for over a decade seems like a good fit for the company’s future.

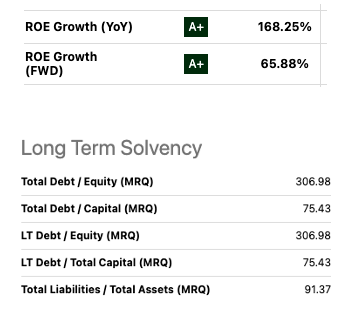

CFO Julie Wellen He has served as Expedia’s CFO since 2022 and as a director since 2019.Wisma) As CFO, she oversees Expedia’s financial health. ROE has increased during her tenure and is expected to continue to increase. However, the company’s high debt levels are a concern and require monitoring.

Find Alpha

The company’s leadership transition comes at a time of uncertainty. The new management team has yet to articulate a detailed strategic plan outlining their efforts. Additionally, employee sentiment appears to have softened as reflected on Glassdoor. Given these factors and the unknowns surrounding the new leadership team, we need to take a closer look at the long-term effectiveness of the company’s management team. For this reason, we are willing to give the company’s management a rating of “Failed to Meet Expectations” until more details are known about the company’s strategy.

Glass Door

Corporate Strategy

In Expedia’s recent earnings report, a multi-pronged strategy was announced to weather the travel crisis. Restoring customer loyalty is a major focus, with plans for price-led marketing and strengthening core products such as Hotels.com and VRBO. Additionally, the company aims to capitalize on recovering international markets and leverage AI to personalize travel experiences. Cost-cutting measures, including job cuts, will free up resources for marketing and growth initiatives. However, no specific details were revealed about these growth initiatives. To me, this creates uncertainty during a transitional period. Here is a table where you can compare Expedia’s corporate strategy with its competitors:

|

Expedia |

Booking Holdings (back) |

Airbnb (ABNB) |

trip advisor(trip) |

|

|

Market share (hotel reservations) |

15% |

27% |

13% |

Ten% |

|

Corporate Strategy |

It focuses on bundled travel packages and brand diversification. |

Focus on aggressive global expansion and marketing, and maximizing partnerships with hotels |

Disrupting traditional hospitality with a unique stay and expanding it into an experience |

We are focusing on the Asia Pacific market, growing our mobile presence and expanding our vacation rentals. |

|

Competitive Advantage |

Extensive network of travel suppliers, brand recognition and loyalty programs (OneKey) |

Largest online accommodation marketplace, strong mobile presence and efficient marketing |

Unique Accommodation Options and a Growing Experience Marketplace |

Strong brand recognition in Asia, competitive pricing and focus on mobile users. |

Source: Company websites and presentations

market share: Statista (2023)

evaluation

Expedia shares fell about 18% after reporting earnings in early May and are currently trading at about $110.31.

We adopt a conservative discount rate (r) of 11%, which represents the hurdle rate that an investor would expect to receive, taking into account the time value of money and the inherent risks of that investment. To calculate this, we used a 5% rate for the time value of money and an average market premium of 6%.

I then used a simple 10-year two-stage DCF calculator to reverse the formula and come up with an implied FCF growth rate of approximately 1.5%.

$110.31 = Total^10 FCF (1 + “X”) / 1+r) + TV FCF (1+g) / (1+r)

*Book value was not included in the calculation

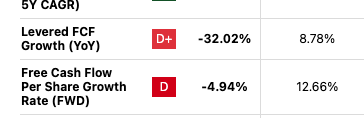

That is, the market currently expects Expedia’s FCF to grow 1.5% this year. However, Expedia’s forecast FCF growth rate is -4.94%, so the valuation seems slightly overvalued and even lower than the industry average.

Find Alpha

Technical Analysis

The stock price is under significant pressure due to several factors, including new management, cost-cutting strategies, and uncertainty about growth opportunities. In addition, the current impact of high interest rates is gradually affecting the economy, which I believe will put significant pressure on consumer discretionary stocks and affect their momentum. Based on technical analysis, I believe the stock price will fluctuate between $104 and $123. I will revise my investment thesis as necessary.

The company’s next earnings report is expected to be released on August 1st.

remove

Expedia may seem like a bargain with its recent share price decline, but multiple headwinds make it a cautious hold. The new CEO takes over a company facing slowing consumer spending and a competitive environment. While cost cuts have freed up resources for marketing and AI initiatives, the overall strategy is unclear. Low employee morale and negative free cash flow growth add uncertainty. Therefore, we do not view the recent share price decline as a “value” or “growth at a fair price” opportunity. We suggest a wait-and-see approach and wait until Expedia overcomes these challenges and presents a more attractive growth plan before jumping in.