Boy Willat/iStock via Getty Images

paper

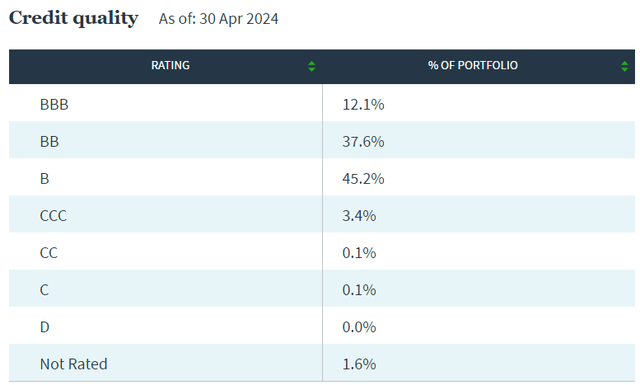

Ten months ago, we I have written Article about Nuveen Floating Rate Interest Fund (New York Stock Exchange:JFR) and other Nuveen Leveraged Loan CEF absorption articles. Nuveen’s platform was accomplished through this corporate action, and JFR moved forward as Nuveen’s flagship CEF in the leveraged loan space. We cover the stock with a “Buy” rating, and the fund delivered the following results:

Previous evaluation (author)

This investment vehicle has delivered a total return of over 19% since our review, significantly outperforming the S&P 500.

In today’s article, we revisit this stock in light of very tight corporate spreads and highlight why CEFs are no longer an attractive entry point but rather a stock to hold for exposure to floating rate loans.

Collateral Structure – Overweight Single B Credit

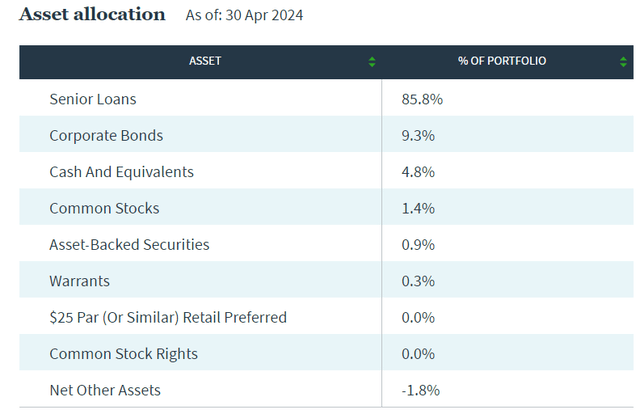

The fund contains 457 stocks with a short duration of 0.22 years. The bulk of the portfolio is made up of floating rate loans, but it also contains a small amount of fixed rate bonds.

Corporate bonds currently make up 9.3% of the fund, with the remaining allocations being quite small.

The fund focuses on single-B credits, which account for more than 45% of the fund’s holdings.

The fund has a very low allocation to the riskiest credits, i.e. CCC rated stocks, making up just 3.4% of the CEF. What is interesting is the large allocation to BBB rated stocks, which is somewhat unusual for a high yield fund.

analysis

- Total assets under management: $1.2 billion.

- Sharpe ratio: 0.36 (3 years).

- Standard deviation: 6.7 (3Y).

- Yield: 11.6% (30-day SEC yield)

- Premium/Discount to NAV: -6%.

- Z statistic: 1.66.

- Leverage ratio: 37%.

- Structure: Leveraged Loan

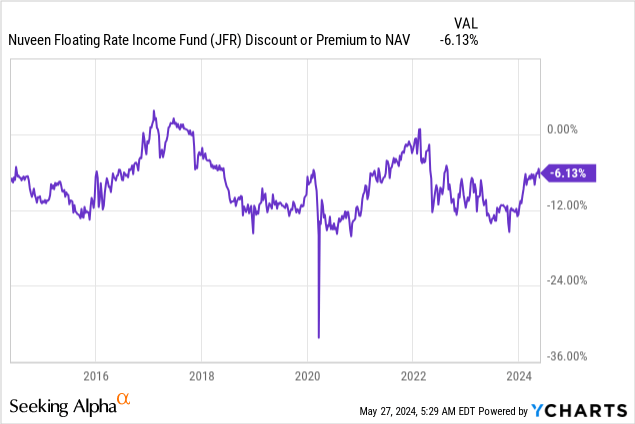

Corporate spreads are too tight

As a rule of thumb, buy bonds when spreads are wide and sell when spreads are very narrow. JFR is a special case because it is structured as a floating rate loan, effectively passing on the higher interest rates to investors. That said, the fund is priced by the risk-on environment in the market, and in the current credit environment, only a soft landing is priced.

Corporate Spreads (Federal Bank)

The chart above shows the ICE BofA Single B US High Yield Index option adjusted spread levels, currently at 293 bps. Note that the current levels are below the lowest achieved prior to the Corona pandemic. We are witnessing the tightest high yield spreads in the last 5 years.

we, Crash Landing The point I make in this article is that when spreads are at the low end of their ranges, there is only one way they can go up – whether that is through a sharp repricing or a gradual upswing remains to be seen.

Analysts at Morningstar have also sounded the alarm about U.S. credit spreads.

But even in a soft-landing scenario, we believe corporate credit spreads have become too tight and should be underweight. Over the past 24 years, the Morningstar U.S. Corporate Bond Index spreads have been below their current level of +86 basis points only 2% of the time, and the Morningstar U.S. High Yield Bond Index spreads have been below their current level of +302 basis points only 3% of the time. By comparison, the tightest investment-grade and high-yield credit spreads were in 2007, at +80 and +241 basis points, respectively.

Today’s spread levels are a warning sign for investors looking to enter this space. Investors should wait for prices to re-adjust rather than buying the spread here. JFR is a fund to own as it does a very efficient job of passing on high interest rates to investors, but it is no longer an attractive entry point.

There are times to buy CEFs, times to hold them and times to sell them. Currently, while rising risk-free rates make it still attractive to hold the stocks, the environment no longer offers an attractive entry point.

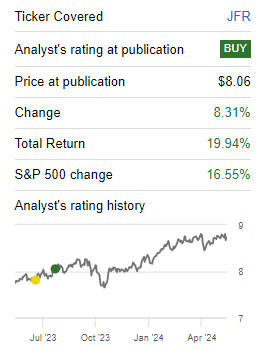

Discount to NAV – Risk-On Analysis

CEFs have seen their discount to NAV narrow by more than 6% over the past six months.

On average, CEFs used to trade at a -12% discount to NAV, except during periods of active markets where funds trade flat to their net asset value, we saw them trade “flat” in 2021, then quickly revert back to a larger discount to NAV as the Fed began to introduce volatility by raising interest rates.

What is interesting is that even though yields on this vehicle have started to rise on the back of rising interest rates, the market is still valuing CEFs as a risk-on vehicle, trading at a larger discount to NAV beyond 2022. This trend is expected to continue, with CEFs seeing a wider discount in the next risk-off event.

The distribution is very good

JFR continues to be a fund to own thanks to its very high dividend yield, which is almost universally supported.

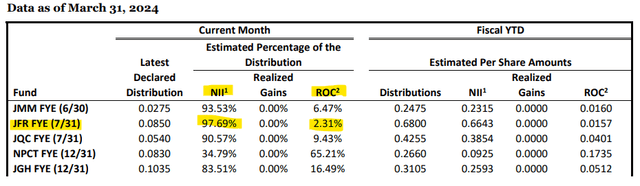

Distribution range (Article 19a)

As of its March 2024 Section 19a Notice, CEF is only using a very small 2.3% figure for its ROC, indicating it is a name that does not over-distribute.The high interest rate environment coupled with CEF’s high leverage ratio is responsible for the high dividend yield generated by this fund.

As long as interest rates remain high, this fund will continue to pass the benefits along to investors well, which is why we rate it a Hold. That said, you should be careful with the fund’s leverage and understand that in a risk-off scenario, it will fall more than non-leveraged products (such as ETFs in the leveraged loan space).

Conclusion

JFR is a leveraged loan CEF. The fund is currently Nuveen’s flagship product in the leveraged loan space, yielding 11.6%. The CEF has delivered nearly 20% total returns since merging with other Nuveen loan CEFs and is currently overinvested in a very tight credit spread environment. The fund’s positive movement is also supported by a 6% tightening in its discount to NAV, which serves as a risk-on financial analysis. In today’s environment, with single-B spreads at a 5-year low, JFR is no longer attractive to buy, but the CEF remains a fund to own with a very high and supported dividend yield. Therefore, we are changing our rating on this stock to Hold from Buy.