jiefeng jiang/iStock via Getty Images

Investment Thesis

NVIDIA Corporation (Nasdaq:NVDA) continues to deliver impressive results. The previous target was $1,165This highlights the company’s strong foothold in the fast-growing AI and gaming industries. Ongoing technical analysis introduces new price forecasts that reflect the company’s sustained uptrend and solid market positioning.

We have updated our target price to reflect growing investor interest and strategic advancements in key technology areas and maintain a strong buy rating on NVDA. This dynamic outlook prompts regular updates to adapt to Nvidia’s evolving market impact and investability.

Another quarter Exceeding profit expectations The solid guidance underscores why Nvidia is a hot topic amid the AI boom, having risen more than 500% in the past year and outperforming the S&P 500.SP500) Up 36%, still a hot stock This despite boasting a premium valuation in the fast-growing semiconductor sector.

The company’s revenue and cash flow continue to break records despite growing concerns that demand for AI chips will soon fade, and Chief Executive Officer Jensen Huang has been positive about the company’s long-term outlook and growth metrics, arguing that the market is too strong.

The stock price broke through the psychological $1,000 per share mark as executives reiterated that more people and businesses want to deploy NVIDIA’s powerful chips in their data centers to make money and save money. True to their word, NVIDIA delivered another record-breaking financial performance, beating all expectations. First Quarter.

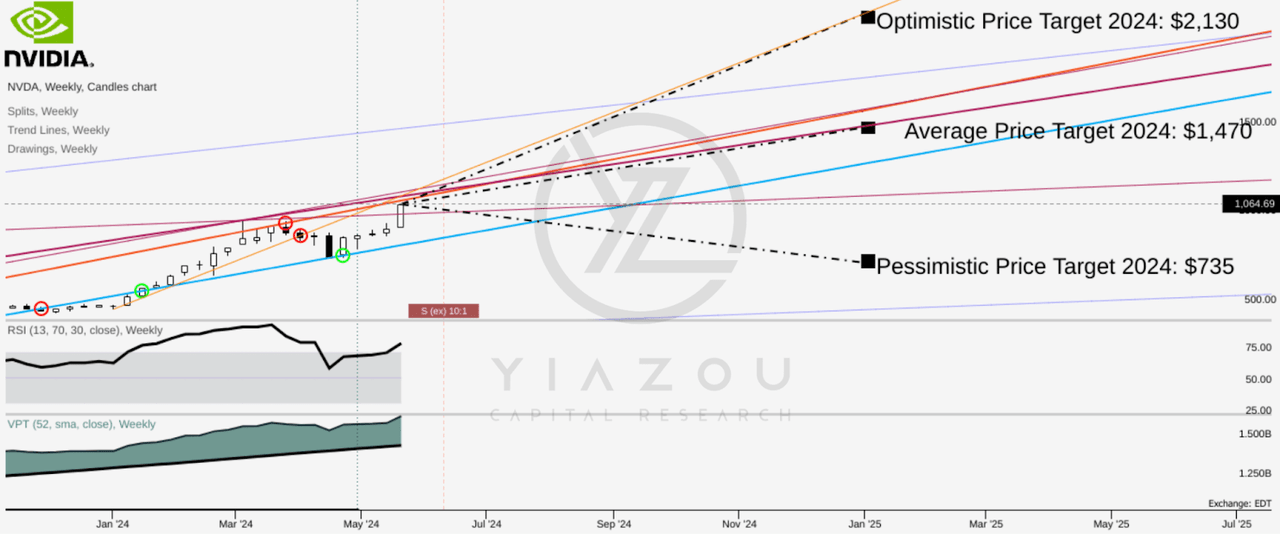

NVDA is in the midst of growing momentum and an upcoming 10:1 split, with a pre-split target of $2,130.

NVIDIA shares are currently trading at $1,065 and are experiencing strong bullish momentum. Importantly, the stock split (10:1) announced in June will significantly impact the stock’s affordability and average trading volume. Drawing the trend lines of the recent movements (red and green circles indicate breakouts) provides an optimistic outlook. Target price: $2,130 ($213 after splits) by the end of 2024. Similarly, the average target price is $1,470 ($147 after splits).

The pessimistic price target was $735 ($73.5 after the split). These price targets are projected onto the Fib retracement (pessimistic) and extension (optimistic and average) levels. The Relative Strength Index (RSI) is at 67.43, Bullish Momentum Continues This rally in stock prices will continue until the index hits 90. However, if the index rises above 70, selling pressure may start to pick up again.

Finally, weekly volume price trends are trending well above their one-year moving averages, suggesting there is room for the stock to move significantly higher in the near term.

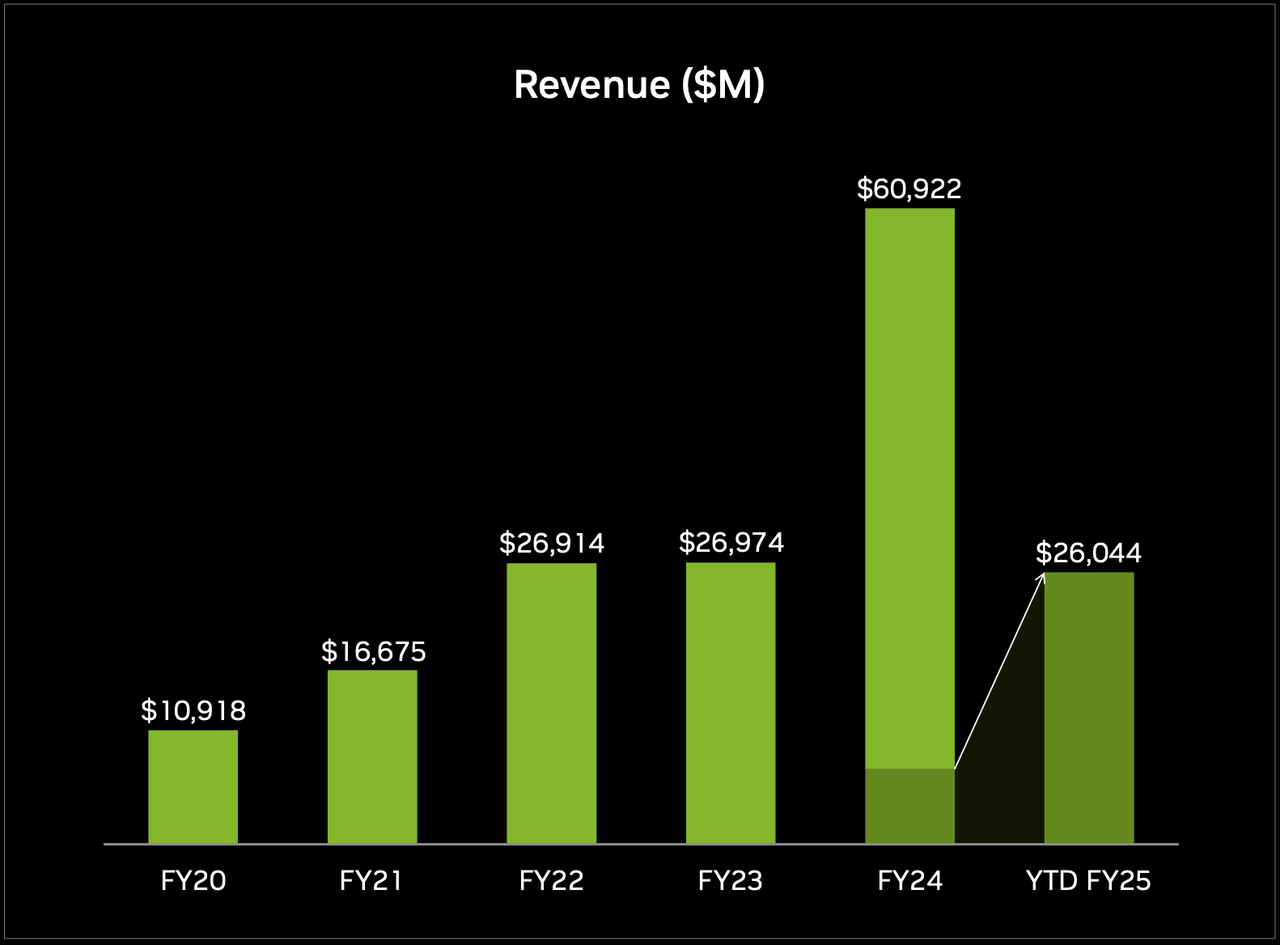

First-quarter revenue surges 262% to $26 billion on explosive data center sales and rising GPU demand

Revenues for the first quarter of fiscal 2025 increased 262% A record $26 billion The company beat consensus estimates of $24.7 billion. The strong revenue growth was fueled by data center revenues increasing 427% year over year to $22.56 billion. Management attributed the increase to increased shipments of the company’s Hopper graphics processing units, which continue to drive strong demand from cloud providers for data centers.

The Nvidia Hopper GPU computing platform is also seeing strong interest in large-scale language models (LLM) and generative AΙ applications, and this demand has led management to expect second-quarter revenue to hit a new milestone of $28 billion, positioning the company for continued growth.

Amid strong revenue growth, NVIDIA increased its adjusted earnings 461% to $6.12 per share, beating consensus estimates. Meanwhile, operating expenses increased 43%, but the impact on net income run rate was minimal as net income increased 461% to $15.24 billion.

Nvidia shifts to AI dominance: Data center sales up 427% as Hopper GPUs power tech giant’s AI expansion

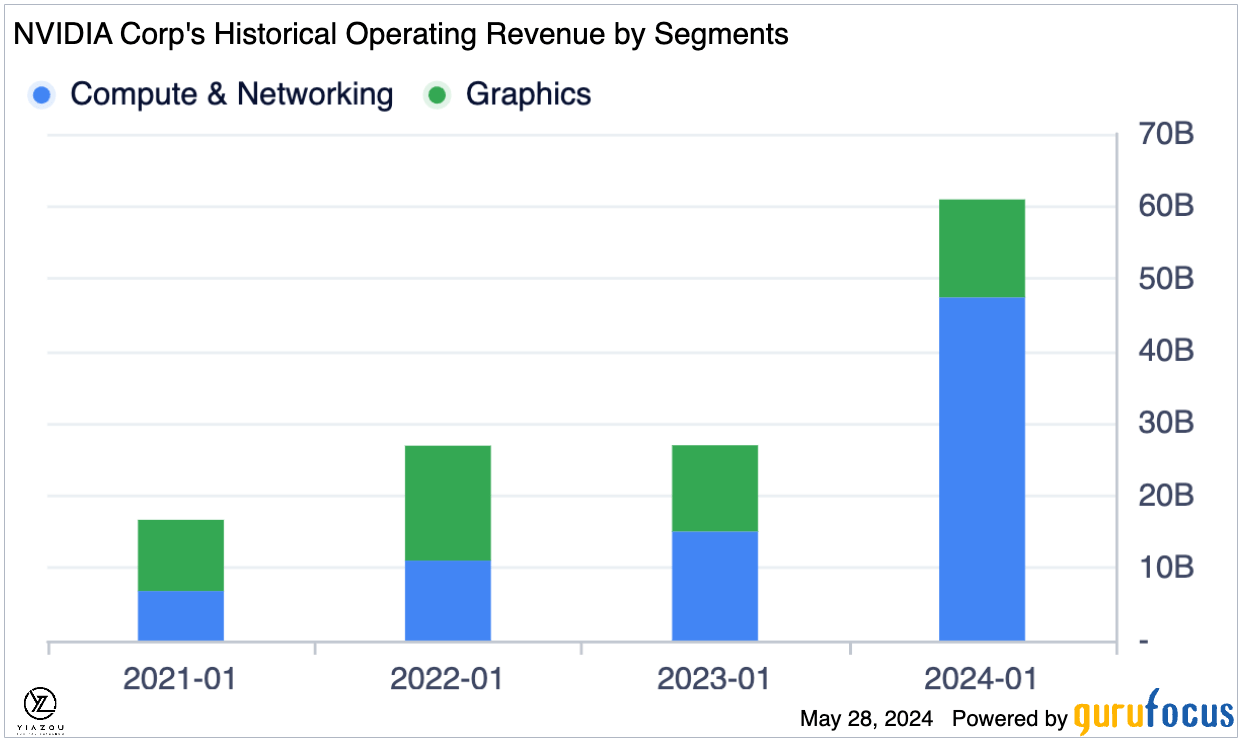

Until now, Nvidia was best known for making chips and hardware used in gaming consoles, with gaming revenue making up a significant portion of the company’s total revenue. But with the advent of AI, data centers have emerged as a core business segment, accounting for more than 86% of total revenue last quarter.

In the first quarter, the GPU superstar posted a 427% increase in data center and computing revenue, driven by robust demand for its Hopper graphics processors, which are increasingly being used in data centers. Similarly, Amazon (Amazon), Microsoft (MSFT), Google (Google) is leveraging AI chips to enhance its AI infrastructure on a large scale.Meta) plans to add another 200,000 H100 GPUs to its latest LLM, reaching its goal of 350,000 GPUs 2024 will highlight strong market demand.

During the quarter, NVIDIA acquired Amazon Web Services, Google Cloud, Microsoft (MSFT), Oracle (Orks) The strategic partnership will see the company supplying advanced generation AI chips that will be used to power the capabilities and processing power of data centers at the heart of the multi-billion dollar cloud computing business.

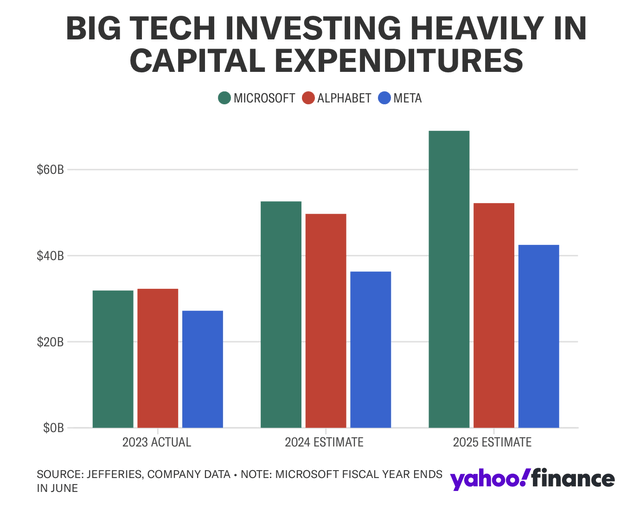

Strong demand for AI cloud services is also evident in the large capital expenditures of major technology companies, such as Microsoft, which has increased its capital expenditures. $14 billion In the first quarter, Alphabet $12 billionAmazon It spent $14 billionAs big tech companies continue to increase spending in response to other big tech companies’ AI implementations, Nvidia is one of the biggest beneficiaries of this trend.

Finally, in addition to pursuing growth opportunities in the cloud, Nvidia is Partnership Johnson & Johnson (J.N.J.) will test AI capabilities in a connected digital ecosystem for surgery. The strategic partnership aims to rapidly provide real-time insights to assist healthcare professionals during and after a procedure.

NVIDIA’s “Blackwell” GPU takes on Apple

Chip giant Apple is trying to better compete as a growing number of companies seek to take its market share by providing chips that power data centers.AAPL) has announced plans to use its years of chip design experience to manufacture chips, as it looks to capitalize on the huge opportunities in the data center sector.

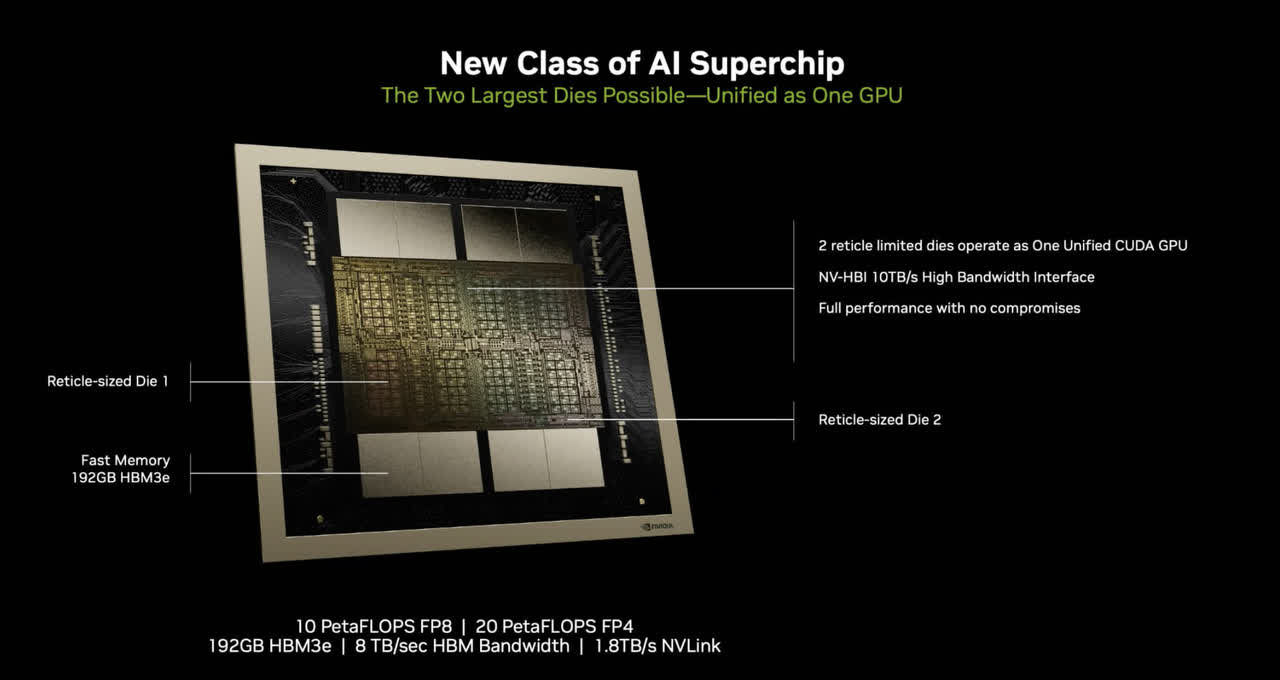

As a result, Nvidia has confirmed that it will launch its next-generation AI GPU, Blackwell, by the end of the year. The new AI-powered chip is expected to further strengthen and diversify the company’s revenue streams in this area. Blackwell is designed to be “backwards compatible” with the Hopper system. Finally, the design is intended to make the transition easier for Nvidia’s customers and attract more customers.

Diversifying beyond gaming: Leading the way in networking and revolutionizing the automotive industry with cutting-edge chips

In addition to pursuing growth opportunities in providing chips to data centers, Nvidia is diversifying its revenue streams into other areas, and the company continues to see strong sales from sales of networking components. $3.2 billion The company generated increased network revenue as more companies built clusters using tens of thousands of its chips.

While gaming no longer makes up the largest portion of the chip giant’s revenue base, it remains a key piece of the puzzle: Revenue from the segment grew 18% year over year, despite an 8% decline in the most recent quarter, highlighting that Nvidia’s gaming chips and hardware remain in high demand from gaming companies and developers.

Guru Focus

Additionally, as the chip giant continues to strengthen its prospects in the gaming industry, it has already announced new AI performance optimizations for Windows that will enable optimal performance on Nvidia GeForce RTX AI PCs and workstations.

A growing number of games incorporate Nvidia’s RTX technology, including Star Wars, Outlaw, and Black Myth Wukong. Similarly, the award-winning AI Rendering Technology Nvidia DLSS has already proven to improve graphics performance in games and apps, so demand is growing.

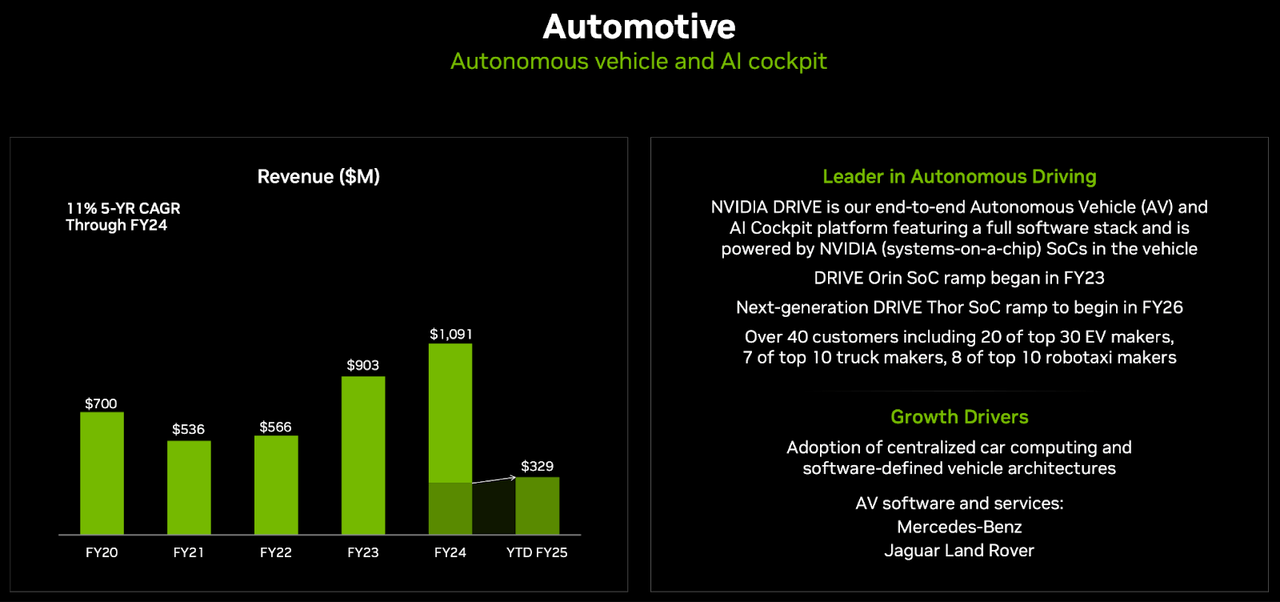

Similarly, Nvidia: Automotive Cars are becoming more and more advanced as entertainment and self-driving systems are integrated. New features require powerful chips, which Nvidia has proven it can produce. Chips for cars and advanced workstations are relatively small compared to data centers, but BYD is also a leader in chip manufacturing.OTCPK:BYDDF), XPeng (XPEV), Nuro, etc.

Finally, electric vehicle maker LucidLCID) and IM Motors have already integrated the Nvidia Drive Orin platform into their vehicles targeting customers in the European market. Strong demand for Nvidia’s solutions and products in the automotive industry therefore drove revenue growth of 17% to $329 million.

Conclusion

Nvidia’s stock price has risen more than 600% since the beginning of last year due to robust and accelerating demand for its graphics processing units used in AI models. The company remains a poster child for the AI revolution and is well positioned to benefit from this enthusiasm: Big tech companies such as Google, Amazon, Meta and Oracle have started buying and using the company’s generative AI chips, underpinning the company’s long-term revenue and profit growth prospects.

The GPU superstars show no signs of slowing down, and with demand for AI chips outstripping supply, GPUs remain a solid long-term investment as we enter the early days of the AI era. Approximately $2.4 trillion in 2023 Growing at a compound annual growth rate of 32.4%, Nvidia is well placed to leverage its powerful advanced GPUs to capture significant growth opportunities and create shareholder value.