Dragon Claw

Infrastructure Cap REIT Preferred ETF (NYSEARCA:PFFRPFFR is exactly what it sounds like: a REIT Preferred Stock ETF. PFFR’s dividend yield is a solid 7.9%, making it worth buying. Because this fund focuses on a small market niche, position sizes should be kept relatively small. At least in my opinion it’s small.

PFFR – Fundamentals

- Investment Manager: Infrastructure Capital Advisors

- Fundamental Index: Indxx REIT Preferred Stock Index

- Dividend Yield: 7.86%

- Expense ratio: 0.45%

- Total Revenue 5-Year CAGR: 1.26%

PFFR – Overview and Analysis

Indexes and Portfolios

PFFR is a REIT Preferred Stock Index ETF. The preferred stocks in this fund behave very similarly to high yield corporate bonds. They offer investors high yields, albeit with risk, but little potential for significant capital gains over the long term. These characteristics and trade-offs make them especially interesting for income investors and retirees, but may be too risky for more conservative, risk-averse investors.

The PFFR’s underlying index is very simple and includes all US REIT preferred stocks that meet basic inclusion criteria. It excludes securities that yield less than 3.0%. There aren’t many of these stocks around today, but there were plenty when interest rates were zero. It is a market-cap weighted index, with issuer and subsector caps intended to ensure diversification.

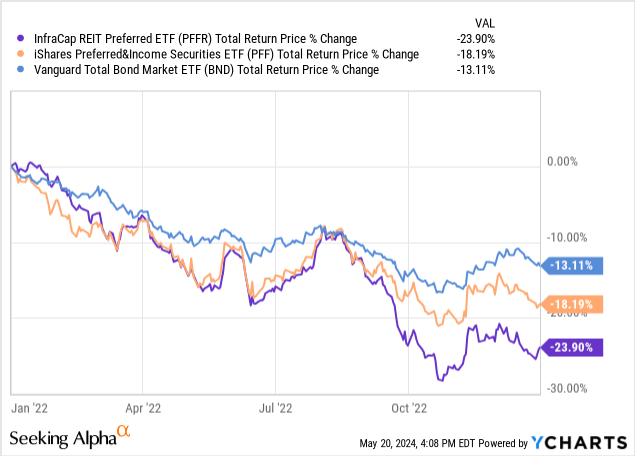

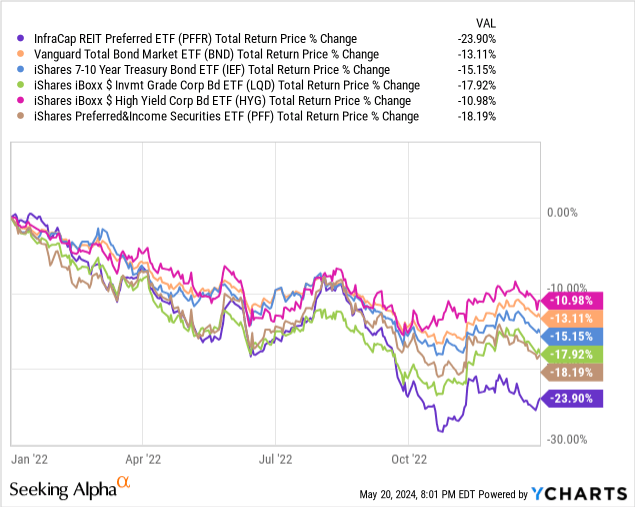

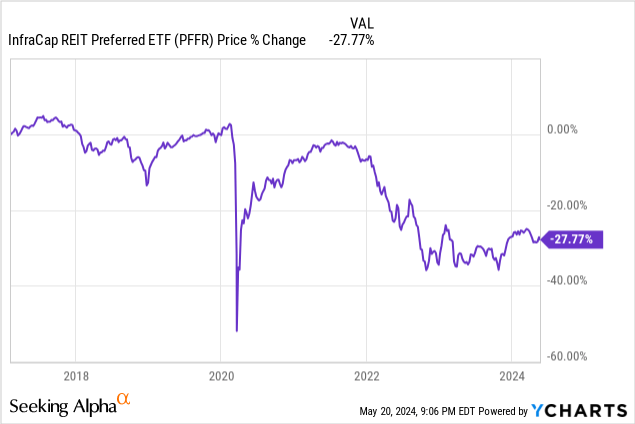

PFFR is a very niche fund that invests in REITs, which are a subsegment of preferred stocks, which are a subsegment of the bond market. As such, diversification is very low and the fund’s performance may differ materially from that of a broader bond or preferred index. Significant underperformance is possible. As an example, the fund experienced significant losses and underperformance in 2022. The losses were due to a combination of falling bond prices due to rising interest rates and weakness in the real estate industry. The underperformance was primarily due to the latter.

Data by YCharts

For the reasons stated above, PFFR is a much riskier choice than average, and in my opinion position sizes should be kept relatively small to minimize the risk of significant underperformance at the portfolio level.

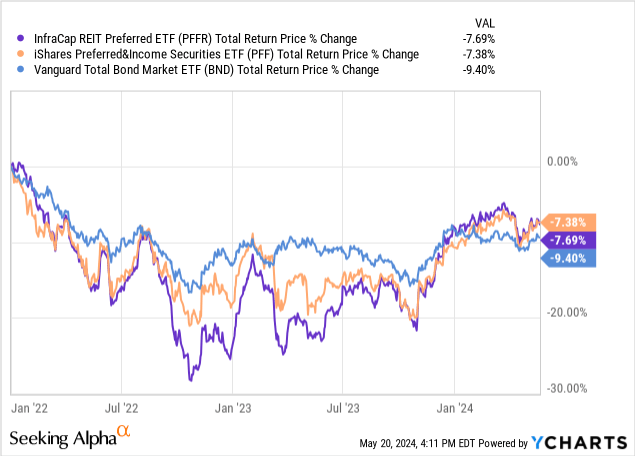

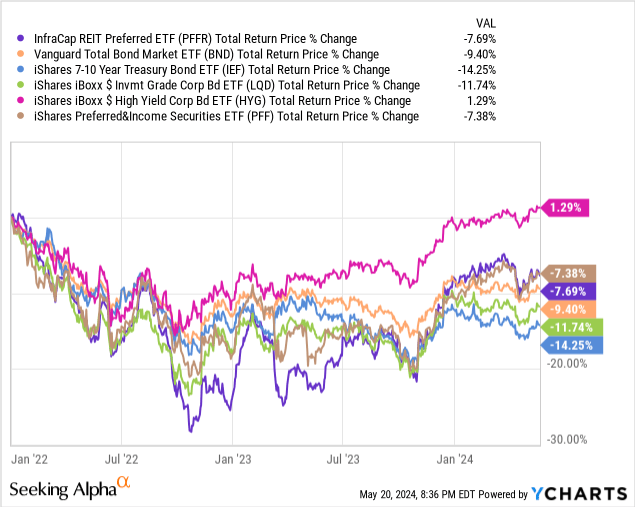

On a more positive note, the performance decline was short-lived and the fund has posted returns in line with its peers from 2022 onwards. However, it is still down as interest rates rise/remain high.

Data by YCharts

PFFR invests in over 100 securities and is diversified across market niches with the top 10 holdings making up 20% of the portfolio, but overall it remains a niche, undiversified fund.

PFFR

Credit Risk Analysis

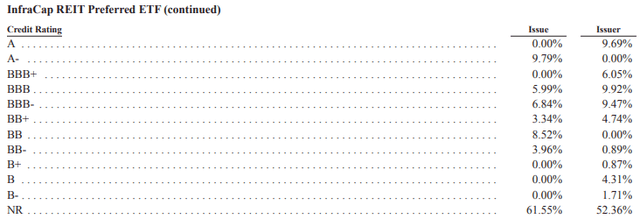

PFFR’s overall credit quality appears to be poor. The majority of the company’s securities do not have a credit rating. The average rating of its rated securities is BBB-, which is the lowest level of investment grade. Because unrated securities tend to be riskier than average, it is very likely that the average PFFR security has the risk of BB-rated, and possibly B-rated preferred stock.

PFFR

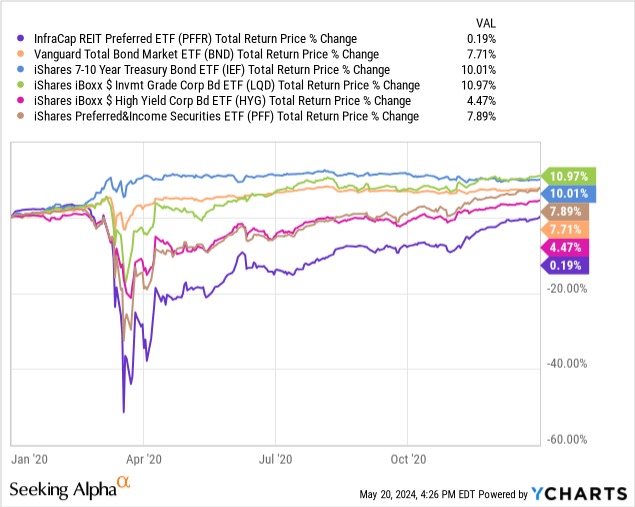

For the reasons stated above, significant above-average losses are to be expected during economic downturns and recessions. As an example, the fund experienced a 50% drawdown in early 2020 at the start of the coronavirus pandemic. Losses were much higher than most bonds and bond sub-asset classes, including preferred stocks (more broadly). PFFR began to recover by late March but lagged behind its peers through the end of the year.

Data by YCharts

Overall, PFFR’s credit risk appears to be fairly high, higher than most bonds and bond sub-asset classes, including most other preferred and high-yield corporate bonds. Given that it has largely recovered from pandemic losses within a year, I don’t think the fund’s credit risk is excessive. More risk-averse investors may disagree.

Interest Rate Risk Analysis

Preferred stocks, like bonds and other fixed-income securities, are subject to interest rate risk. Unlike these other securities, detailed information about preferred stock duration and interest rate risk has been difficult to find, let alone calculate or estimate on your own. Some preferred stocks have very long maturities, some are perpetual, some have fixed coupon rates, some have floating coupon rates, and some have fixed to floating coupon rates. The situation is complicated and unclear.

PFFR recorded above-average losses in 2022, the year the Fed began raising rates. The results are consistent with above-average interest rate risk, but also point to weakness in the real estate sector. think Sector weakness was the key, but that’s just my speculation.

Data by YCharts

On a more positive note, PFFR has posted strong returns ever since, and the fund has actually Slightly It has outperformed the average bond since 2022. However, like most bonds, it is still falling.

Data by YCharts

Considering the above, we think it is reasonable to assess PFFR’s interest rate risk as moderate/average, although there is significant uncertainty.

Dividend Analysis

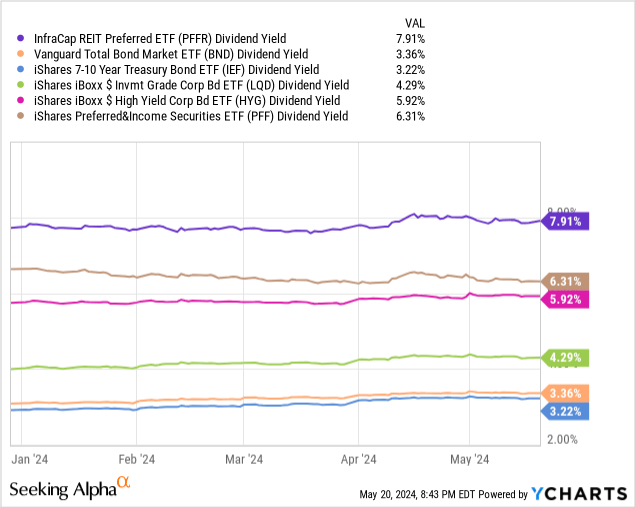

PFFR’s dividend yield of 7.9% is quite high in absolute terms and is higher than the dividend yields of most other bonds and bond sub-asset classes, including most preferred stocks and high-yield corporate bonds (with exceptions).

Data by YCharts

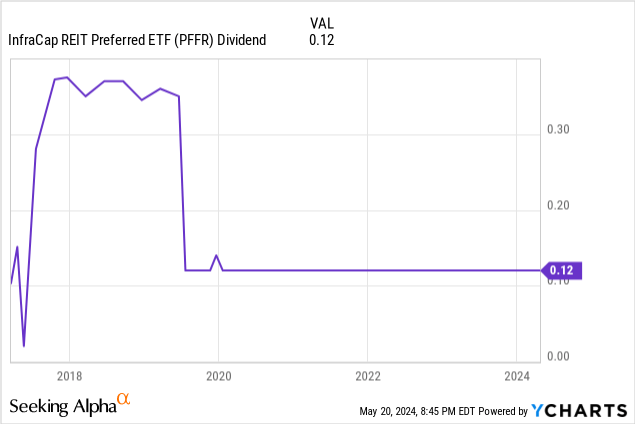

PFFR’s dividend has been stable since the beginning of 2020, shortly after the fund transitioned from quarterly to monthly dividend payments. Dividends have fluctuated prior to that time, with no clear trendline.

Data by YCharts

PFFR’s dividend stability is at least partially a management choice. ETFs can choose a stable dividend, just like CEFs, but in practice they rarely do so and there are several legal/regulatory considerations (ETFs are generally required to distribute income and realized capital gains to shareholders). PFFR has chosen a stable dividend, but most ETFs do not.

Steady dividends are of course a plus for investors, especially retirees, as they make retirement planning easier.

While the picture is complicated, PFFR’s dividend appears sustainable.

The latest figures show that coverage is 74%. terribleBut it is clearly below desirable levels, and coverage has been much lower in the past.

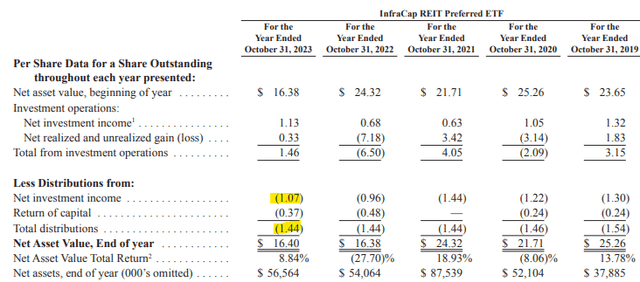

PFFR

Some REITs are able to classify their dividends as ROC for tax benefits, so the figures above understate PFFR’s “real” income. Based on my calculations and the fund’s holdings, the fund’s coverage ratio is 92%, which is a much more sustainable figure.

In my opinion, analyzing a fund’s share price can tell you a lot about the sustainability of the dividend. A falling share price indicates an unsustainable dividend and vice versa. PFFR’s share price remained stable from 2017 to 2021 despite falling interest rates. From 2022 onwards, the share price plummeted as interest rates rose. The results seem roughly consistent with a slight ROC / unsustainable dividend, but with the wide fluctuations in interest rates it’s difficult to know for sure.

Data by YCharts

Either way, PFFR offers investors a strong and stable dividend yield of 7.9%, and the dividend appears to be broadly sustainable.

Achievements

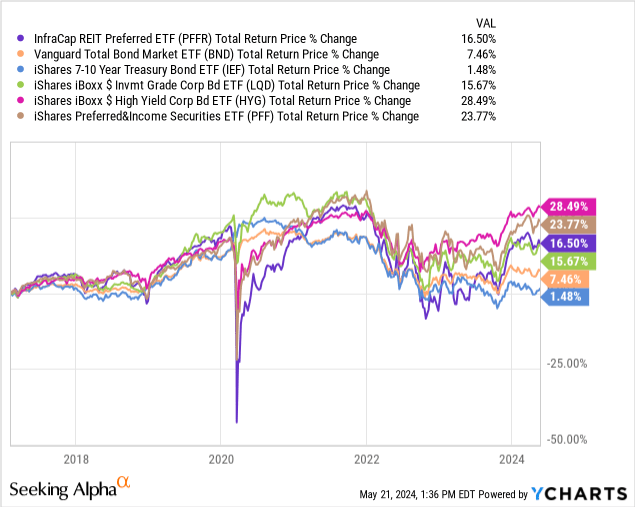

PFFR’s performance track record appears to be satisfactory, albeit with some complexities.

Long-term returns have been around average. Returns have been boosted by the fund’s above-average dividends but have been marred by above-average losses during the pandemic and in early 2022.

Medium-term returns are similar to those above.

With interest rates remaining stable at relatively high levels, short-term returns have been much stronger.

The last two down markets, early 2020 and 2022, saw larger losses than average.

The return details are as follows:

Data by YCharts

In my opinion, the expected returns for this fund are quite high as the dividend yield is quite high. These ultimately depend on many factors including interest rates (fluctuations), default rates, credit spreads, and broader economic and industry conditions. I am quite bullish, especially considering the fact that some of the previous losses and underperformance were due to idiosyncratic factors (REITs are negatively impacted by much higher interest rates than average).

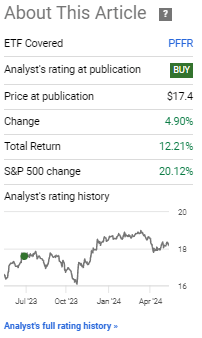

Lastly, I wrote a similarly bullish article on PFFR in mid-2023. Since then, the fund has performed very well, delivering double-digit annualized returns — not bad for a preferred stock ETF.

PFFR Previous post

Conclusion

PFFR is a REIT preferred stock ETF. In my opinion, PFFR’s dividend yield is high and stable at 7.9%, making this fund a buy. Since this fund focuses on a small market niche, position sizes should be kept relatively small.