TayaCho/E+ via Getty Images

Last weekend, Wells Fargo suffered a major list A list of potential and logical acquisition targets in the biotechnology sector. They focused on mid-cap stocks for a variety of reasons. One of the companies in the report was Viking Therapeutics Inc.movie)which is also on the list of potential biotech acquisitions, but I recently covered this mid-sized GLP-1 company in this article. articleand I was not alone (I, II) debated it on Seeking Alpha before coming to that conclusion.

Today I’ll introduce three other companies on Fargo’s list that I hold in my portfolio and that would be logical and strategic acquisitions for big pharma.

Let’s start with the concerns about gene editing. Intellia Therapeutics, Inc.NTLA)Wells Fargo isn’t the only one to point out the company’s potential these days. Cantor Fitzgerald is Re-examination Earlier this month, Intellia Therapeutics alsoShout Out“A post from a Seeking Alpha forum surrounding the question of which gene editing related product will gain FDA approval next.”

Company Information Session in May 2024

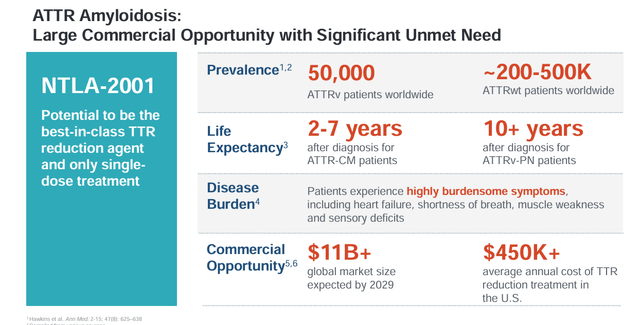

With a market cap of approximately $2.4 billion, Intellia would be a small acquisition for a big pharma company. The company’s most advanced gene editing candidate is NTLA-2001, which is being evaluated for the treatment of transthyretin (ATTR) amyloidosis. The disease affects 250,000-550,000 people worldwide. There are several products approved on the market for the treatment of ATTRv-PN and one for ATTR-CM. However, they all require lifelong medication. NTLA-2001 targets both variants of ATTR and could be a one-time treatment. Management estimates this potential market to be over $10 billion by fiscal year 2029.

Company Information Session in November

The company has just initiated a pivotal Phase 3 trial, MAGNITUDE, evaluating NTLA-2001 for the treatment of ATTR-CM. The trial will evaluate over 750 subjects. The first subject in this program was recently dosed. The company is currently:Preparation” This program is currently in Phase 3 trials evaluating candidate drugs for ATTR-PN. Regeneron Pharmaceuticals Inc.Regn) The company is covering 25% of the costs and profits of the effort. The company is funded through 2026, and if all goes well, NTLA-2001 could be approved in 2027. The potential size of the ATTR market could logically attract the interest of larger entrants.

Albinus Co., Ltd. (South Vietnam) It was also listed by Wells Fargo. The clinical-stage development company currently boasts roughly the same market cap as Intellia ($2.4 billion) and has secured funding to fund all planned activities through 2027. The company has several drug candidates in its pipeline that stem from its proprietary PROTAC® platform. This technology enables Albinus to manufacture protein degraders and harness an individual’s natural protein processing system to degrade and remove disease-causing proteins.

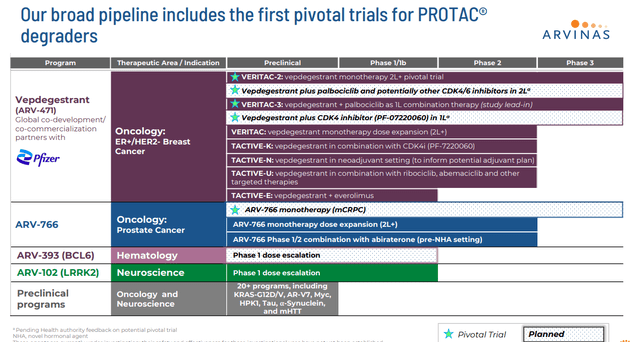

The company’s most advanced pipeline asset is a compound called Vepdegestrant or ARV-471, a PROTAC® protein degrader that targets the estrogen receptor (ER) and is currently being evaluated for the treatment of women with locally advanced or metastatic ER-positive/human epidermal growth factor receptor 2 (HER2)-negative (ER+/HER2-) breast cancer.

January 2024 Company Information Session

As can be seen in the chart above, the company has several other compounds in its pipeline, several of which are in Phase 3 development. Oncology has been one of the hottest areas for M&A for many years, and given the growth of the global oncology market, that trend is likely to continue. Estimation It is expected to reach $220 billion by 2024.

ARV-471 is being evaluated as monotherapy and in combination with the CDK inhibitor IBRANCE. Pfizer Japan Inc(Personal consumption tax). Importantly, Pfizer is putting its money where its mouth is with this collaboration, making an upfront payment of $650 million and an equity investment of $350 million within the collaboration agreement. The arrangement also splits profits and costs equally. Two Phase 3 studies, VERITAC-2 and VERITAC-3, are currently enrolled, with the first study expected to be completed by the end of 2024.

Cantor Fitzgerald Called In March of this year, the company announced Albinus as one of its lead biotech targets in the oncology field, as well as the ARV-471/Ibrance combination therapy. Earned It also received Fast Track status in February of this year. Indicated Positive results from the Phase 1 trial are expected in the second half of 2023. Clearly, Pfizer would be the most logical acquisition target for Albinus, given the deep partnership between the two companies. Novartis AG (NVS) Also I input it Notably, last month Novartis signed a licensing agreement with Albinus for an upfront payment of $150 million.

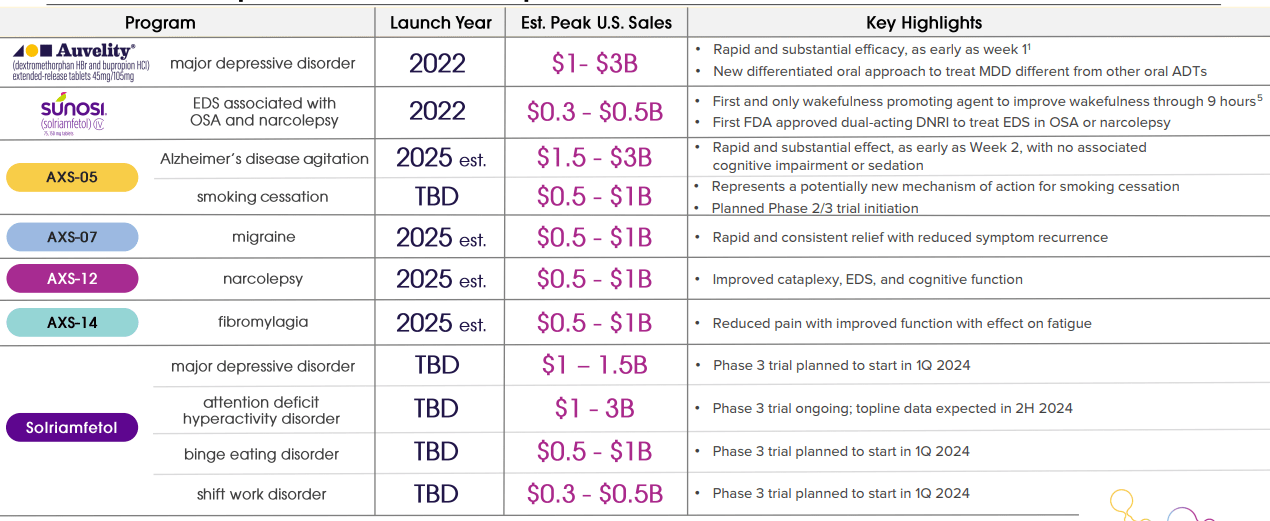

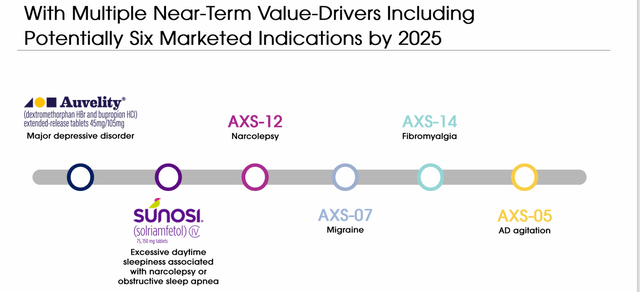

Then we moved to the field of CNS (Central Nervous System) and finally Axsome Therapeutics, Inc.AXSM) It’s a slightly larger company than the first two, with a market cap of just over $3.5 billion. And unlike Arvinas and Intellia, Axsome is a commercial-stage biopharmaceutical with two drugs already on the market, both approved in 2022. One is Sunosi, which treats sleep disorders related to narcolepsy and obstructive sleep apnea. The other is Auvelity, which is approved to treat major depressive disorder (MDD). Auvelity’s net product sales rose 240% year-over-year to $53.4 million in the first quarter. Sunosi’s revenue was slightly more modest, up 64% year-over-year to $21.6 million.

February 2024 Company Information Session

Additionally, the company has several late-stage compounds in development for other central nervous system disorders, as seen above. The company’s next FDA approval is likely to be AXS-12, targeting narcolepsy, which has met key approval criteria. the last stop The company received approval in a Phase 3 trial in late March. The company also has promising late-stage candidates targeting Alzheimer’s-associated migraines (AXS-07) and agitation (AXS-05). If all goes well, the company could have as many as six approved drugs on the market by 2025 or beyond.

February 2024 Company Information Session

Given Axsome’s product portfolio and pipeline depth, we expect major pharma companies to at leastKick the tires.” After purchase Bristol Myers SquibbBe Me) Axosome Therapeutics, which acquired Karuna Therapeutics (KRTX) at the end of 2023 for $14 billion, was a short position at Cantor Fitzgerald. list Potential CNS transactions. Axsome ended the first quarter with just over $330 million in net cash on its balance sheet. Management said in the quarterly earnings call: press release This should be enough to put the company into a profitable position without further recapitalization.

Acquiring one of your portfolio holdings at a large acquisition premium is a great way to start a trading day. But because purchases are rare, and very rare, it’s important that investors also like the company as a standalone. 2 weeks ago, Cytokinetics Inc.CYTK) It was supposed to be a top 10 biotech acquisition target, but last week its CEO decided to go it alone, and then the company failed to raise a major round of funding, and its stock price fell sharply. I covered these events in this article. article last week.

The three companies featured in this article are the ones I primarily Covered Calls Holding stock. I’d be happy to see one of these companies acquired at a 90% acquisition premium one day, but even if that doesn’t happen I think the long-term outlook is favorable.