Matteo Colombo

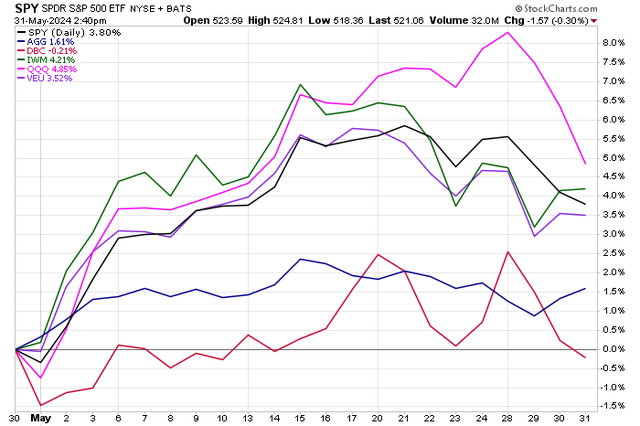

Stocks rebounded in May. Huge losses in April. S&P 500 (SP500) has given up some of its gains over the last three sessions, but is up nearly 4% for the month. Its relative strength is Nasdaq stocks – Invesco QQQ Trust ETF (Hehehehe) rose nearly 5%. In the small cap space, the iShares Russell 2000 ETF (International Hydrology) rose more than 4%, outperforming the return of large-cap stocks, which may come as a surprise to readers.

Overseas, Vanguard FTSE All World (ex US) Index Fund ETF share (european union) performed well, rising more than 3% as the US Dollar Index broadly stabilized. Emerging markets showed signs of movement, particularly China, which saw a big rally in early May before suffering a sharp 10% correction, with the iShares MSCI Emerging Markets ETF (Electronics and Information TechnologyStill, developed markets outside the United States The market performed well, with European and Japanese stock markets performing strongly.

In the bond market, the yield on the 10-year US Treasury note oscillated around 4.5%. The Federal Reserve was noisy throughout the month, and inflation data was broadly in line with economists’ expectations. April CPI or the PCE dataset. Overall, the iShares Core US Aggregate Bond ETF (AGG) recorded a total return of about 1.5%. Invesco DB Commodity Index Tracking Fund ETF (E-book).

Stocks and bonds rise in May, small caps perform well

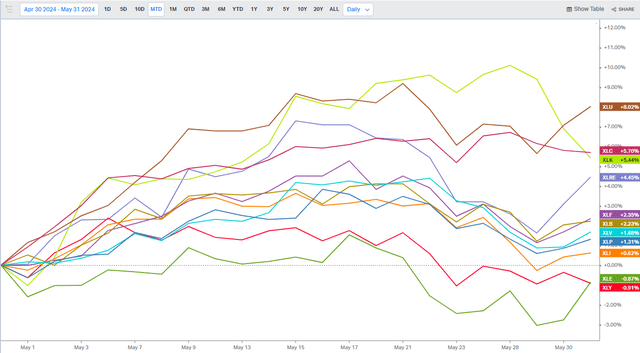

By sector, public utilities (R) was a shining star. Power Generation Group The AI darling is the latest AI company to take the crown from a technology company. Meanwhile, at the back of the pack is the energyXL) and Consumer Goods (XLY). Crude oil prices (CL1:COMOil prices have edged higher in recent weeks but still ended May below $80 a barrel versus West Texas Intermediate (WTI) futures. Gasoline futures, however, settled near a three-month low, which could provide some relief at the pump for summer travelers.

Will that help consumer activity in the coming months? It’s tough, but consumer stocks have struggled and have been in the spotlight for better or worse during earnings season. This period has seen a lot of spikes and crashes among small and mid-sized retailers. Technology stocks ended May on a weak note, dropping about 4% late last week. This was due to the fact that NVIDIA Corporation (NVDA) released a record-breaking first quarter report that included a dividend increase, a share buyback announcement, and news of a stock split.

Utilities lead the way in May, discretionary and energy decline

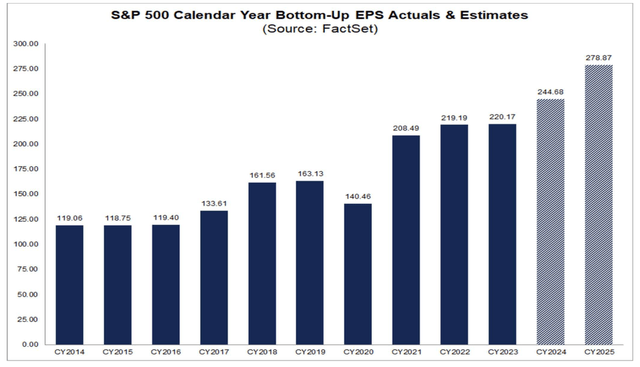

Putting all this together, the S&P 500 is currently trading at nearly 21 times forward earnings. That sounds expensive, and it is. But we’ve also seen forecasters raise their full-year 2024 EPS forecasts for large domestic stocks, which is very rare. So while the SPX is up big time since the start of the year, a lot of that gain is due to good old-fashioned realized and forward earnings growth, not just expanding multiples.

S&P 500 EPS to rise, approaching $280 (estimated) by 2025

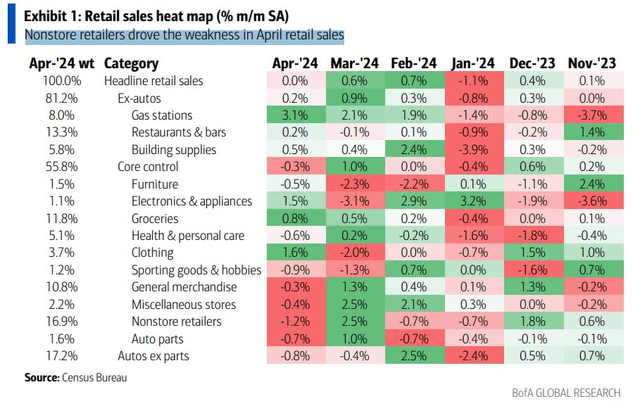

But could challenges lie ahead? A real slowdown in consumer spending could be in the cards, with retailers, restaurants and travel companies announcing plans for price cuts. April Retail Sales Report Spending trends proved soft, with particular weakness seen among non-store retailers (online retailers), but most categories saw significant declines compared to the strong spending trends seen in February and March.

This is good news because households taking their foot off the gas could mean lower inflation in the coming months — exactly what Chairman Powell and the FOMC want to see before cutting rates.

Retail sales slump in April

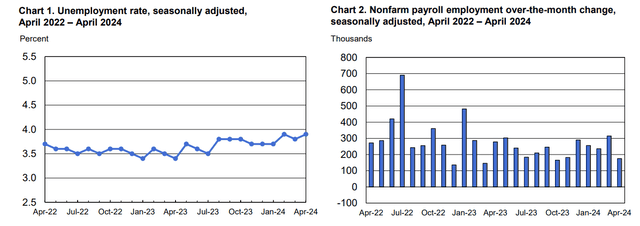

The Federal Reserve is also closely monitoring developments in the labor market. April Employment Report The pace of hiring is much slower than the 300,000+ NFP increase in March, another sign that the economy is cooling. Next week will provide important clues about the state of the labor market through several reports, including the ISM PMI Employment Subindex, the March JOLTS survey, the May ADP Private Payrolls, and of course the Labor Department’s May Nonfarm Payrolls report.

US job growth slows in April

UK Health and Safety Executive

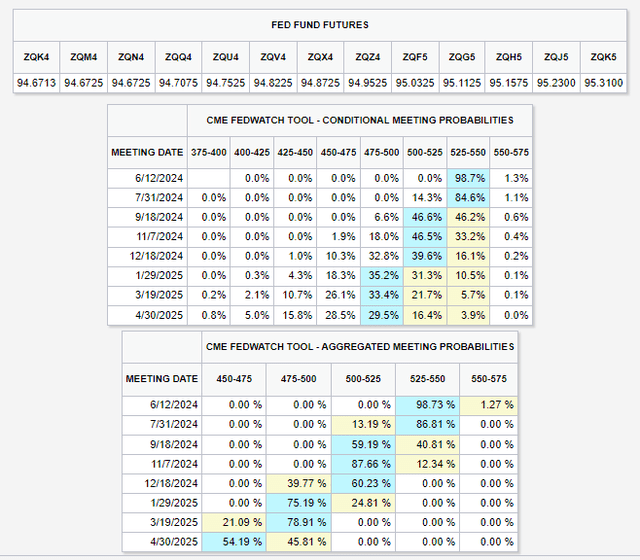

As things stand, markets are pricing in a modest rate cut of 0.25 percentage points or more from the Federal Reserve this year. When that will happen is highly uncertain, but an easing is likely to be announced at the September 18 meeting, less than two months before the general election. Could a July rate cut be possible? Yes, but only if inflation is very low in May and June. Any increase in consumer prices could see the initial easing delayed until 2025.

28 basis points of rate cuts priced in by 2024

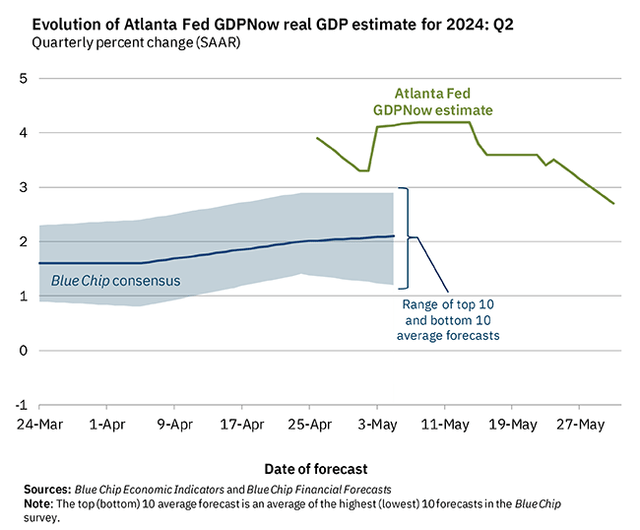

The conditions for growth are good. Not too hot, not too cold. Real GDP grew 2.7% in the second quarter, down from over 4% in early May, according to the Atlanta Fed’s GDP Now tool. Most signs point to a significant macroeconomic slowdown compared to the blistering pace of growth in the second half of 2023.

Second quarter GDP expected to fall below 3%

Conclusion

After the “Dow 40K” frenzy a few days ago, stocks have pared their gains towards the end of May. However, the advice to “sell in May and call it a day” proved to be a disaster, as both large and small caps posted impressive gains. With earnings announcements all but behind us and Fed members in a blackout period, the focus has shifted to macro data and technical price action over the coming week.