AleksandarNakic

As someone who enjoys investing in the stock market and playing the game of behavioral finance, I find it amusing how some of my fellow analysts, authors, commenters, and even pundits who are supposedly experienced investors often dismiss the notion of income investing. They claim that companies that pay dividends do not offer investors a chance to earn “more money” because the upside (capital gains from rising stock price) is limited. Then are those who feel that any “high yield” dividend (take your pick on the definition of what amounts to high yield, over 5%, 8%+, 10% or more?) indicates extreme risk and those stocks should be avoided at all costs. The fact is: it depends. It depends on your investment goals, your time horizon, your tolerance for risk, etc.

As a recent retiree, I began on my own self-directed investing journey about 15 years ago, right around the time of the GFC. As a result of my own experience, plus the vast wealth of information that is available from Seeking Alpha, I determined that an Income Compounder strategy to generate a passive income stream in my retirement was the direction that I would choose to support my lifestyle while no longer working fulltime.

During my working years and based on my desire to save for my future retirement years in a self-directed IRA, I began by buying mostly growth stocks that I believed would appreciate substantially over the long term. After a few years of building up some wealth in the form of a stock portfolio based on individual stocks, I started to look at some income generating stocks like BDCs and REITS.

As my total portfolio value grew larger, I began to capture capital gains from swing trading my growth stocks to buy shares of dividend paying stocks. During the development of my hybrid growth and income portfolio, I began to see the benefits of reinvesting some of those dividends into more shares of my existing holdings to continue to grow my overall portfolio value. Adding more shares of high yielding (in my case 8% plus back when interest rates were near zero) dividend payers led to more dividends being paid every month or every quarter, depending on the specific stock.

Then around 2018 my knowledge of income investing was further expanded by learning about CEFs (closed end funds) that are designed to generate steady, high yield income often paid monthly. Although I knew a little about ETFs, which were mostly used in those days to follow indexes and offered passive income (while now the trend is toward actively managed ETFs), CEFs require a bit more knowledge and comprehension to recognize the inherent benefits to income-oriented investors like me.

For one, CEFs often rely on leverage to enhance the yields they can offer during good times (which increases the risk during bad times, and thus must be carefully managed). Also, CEFs are frequently designed to pay regular steady distributions, often monthly, that is another distinct advantage to the income compounding approach. Best of all, CEFs trade at a discount or premium to NAV, which may afford unique buying opportunities when the market misprices the fund.

Many of the high yield CEFs that I prefer also give shareholders a discount to DRIP (reinvest shares) and in some cases those discounts include up to 95% of the market price, which results in an immediate discount of up to 5% to buy new shares by reinvesting dividends. Most of the Pimco CEFs like PDI, PDO, and PTY offer the DRIP discount when those funds trade at a premium, which they typically do. I own shares of PIMCO Dynamic Income Fund (PDI) in my IC portfolio and several analysts on SA have recently covered that fund in more detail.

PDI: Steady High Yield Income

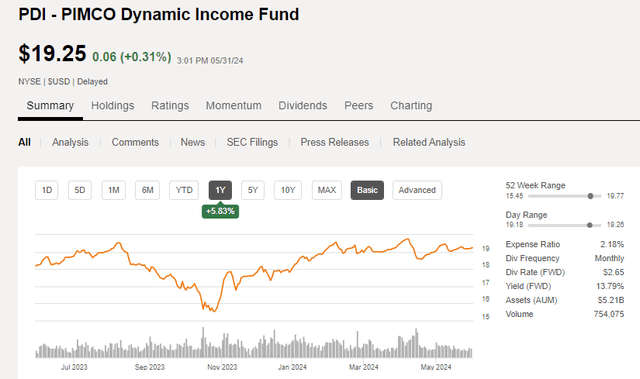

With a name like “dynamic” income fund, you would expect more variability in the fund’s distribution history. However, one of the things that I like about PDI is that it has paid the same $.2205 dividend per share every month since September 2015! In addition, the fund has paid several special dividends in addition to the regular monthly dividend (most recently in December 2022). At the current market price of about $19.25, the monthly distribution amounts to an annual yield of almost 14%. The price of PDI has only gone up by about 5% over the past year, however, the dividend has remained steady for nearly 10 years now with a reliable monthly income that shareholders have enjoyed.

Seeking Alpha

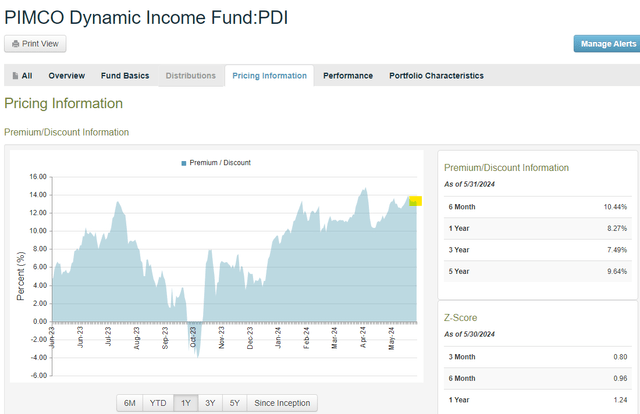

For investors who are new to PDI, I would not recommend buying at the current price due to its relatively high premium, however, for existing shareholders who reinvest, the effective yield is further enhanced, and the cost basis of shares owned is lowered by taking advantage of the DRIP discount. Historically, PDI over the past 5 years has traded at an average premium near 10%. Back in October 2023, the price dropped all the way to a discount of more than -2%, which would have been an excellent time to add shares. Since then, as shown in this pricing chart from CEFconnect, PDI has recovered to a premium that is now more than 13% above market price. The reason for the higher premium is due to investor confidence in the fund being able to maintain the high yield distribution as interest rates stabilize.

CEFconnect

CLO Funds Offer Sweet Spot for Income Investors

Another category of CEFs includes those that invest in CLOs (collateralized loan obligations) and offer high yield income to investors at relatively low risk despite the ultra-high yields. I wrote about Oxford Lane Capital (OXLC) back in April when I explained how core NII easily covers the distribution, which at that time yielded 19%. Since that article was published just over a month ago, the fund reported its fiscal Q4 2024 earnings in which core NII “slipped” but still far exceeded the distribution paid out during the quarter. In addition, the dividend was increased by 12.5% from $.08 per share monthly to $.09 for the months of July, August, and September.

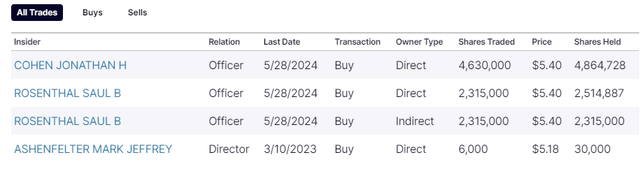

Furthermore, recent insider buying by both the President and CEO of about 4.6 million shares each affirms management’s belief in the fund’s prospects going forward.

NASDAQ

While some investors are still skeptical about the ability of OXLC to continue to pay out such a high yield distribution, the fund continues to deliver strong returns from its mostly CLO equity holdings.

Other CLO funds that hold mostly CLO equity positions are also delivering strong returns with increasing distributions including OCCI and CCIF.

OCCI: Stabilizing NAV, Increasing Dividend

When I recently covered OFS Credit Company Inc (OCCI), it was on May 3, the day after the fund announced a 5% increase to the monthly dividend. I discussed how I believe that OCCI is now even better than its CLO peers.

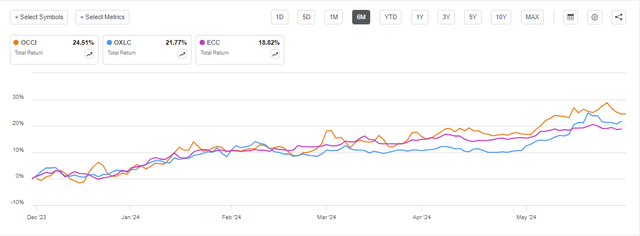

If you were not already aware, OCCI moved to a monthly distribution that was announced back in November 2023 and the stock performance has been excellent since that time. Furthermore, with the recent announcement of the dividend increase, OCCI now yields about 17% annually, competitive with peer funds like OXLC and ECC. The 6-month total return for OCCI has exceeded that of both those peer funds.

Seeking Alpha

In addition, OCCI also offers a DRIP discount (up to 95% of the market price) for those shareholders who wish to reinvest. While OCCI uses leverage, the cost of financing is lower than other peer CLO funds due to its low-cost preferred share issuances which average 5.6% at stated rates. Therefore, even if interest rates stay higher for longer, OCCI is well positioned to take advantage with their strong balance sheet and low cost of leverage.

ASGI: Another Dividend Increase from this Global Infrastructure Fund

Like CLOs, global infrastructure has found its sweet spot in 2024 too, as I discussed in my March review of the abrdn Global Infrastructure Income Fund (ASGI). At the time, this is what I wrote about ASGI:

While there are several options available in infrastructure funds for income-oriented investors to choose from, I feel that ASGI offers one of the best risk-adjusted rewards and I rate ASGI a Buy with its monthly distribution that currently yields about 10% while trading at a discount to NAV of -13.5%.

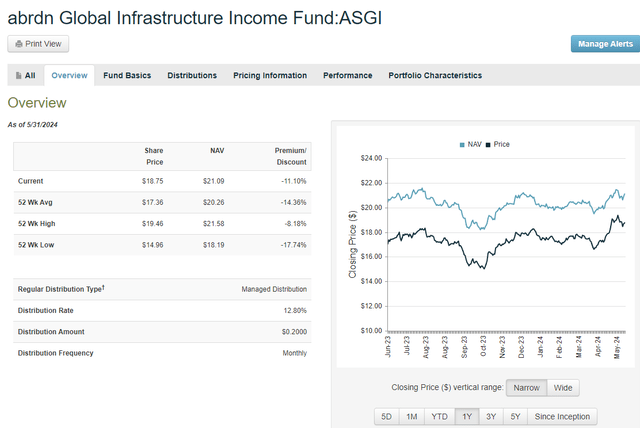

The fund managers announced a new distribution policy effective January 2024 that was based on 9% of NAV each month. They stated at the time that they intended to maintain that distribution policy for the next 12 months, however, on May 9, 2024, the fund’s Board announced an additional 33% increase to the distribution, raising the monthly dividend from $.15 to $.20 per share.

At the same time, they modified the distribution policy to pay out 12% based on the annualized rolling NAV going forward. This was the third increase in the fund’s distribution since its inception in July 2020.

ASGI (the “Fund”), a closed-end management investment company with Net Assets of $523.3 million and market capitalization of $452.7m (as of May 8, 2024), announced today its Board of Trustees (“Board”) has approved an increase in the Fund’s annualized distribution rate on NAV from 9% to 12%. As of May 8, 2024, this increase would equate to a distribution rate on share price of 13.4%.

Notably, ASGI had previously announced a 25% distribution increase in December 2023, which increased the annualized distribution rate from 7.14% to 9%. The distribution rate for each Fund has therefore increased by 68% since the beginning of 2024 and is the third increase in the distribution rate since the Fund was launched in July 2020.

The increase in rate will commence with the distribution payable on May 31, 2024, to all shareholders of record as of May 23, 2024 (ex-dividend date May 22, 2024). The Fund intends to maintain the increased Managed Distribution Policy rate for at least the next 12 months unless there is a significant and unforeseen change in market conditions.

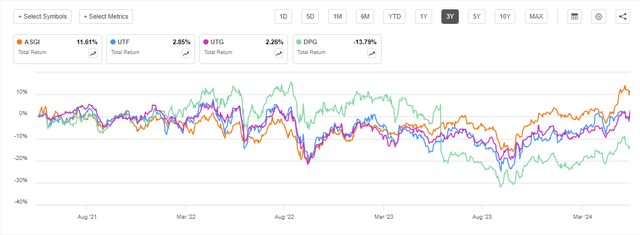

Because ASGI is less than 4 years old it does not get a lot of recommendations from other analysts and is often overlooked as an infrastructure investment. However, comparing total returns from ASGI to other more commonly known funds like UTF, UTG, or DPG, it is evident that over the past 3 years at least, ASGI is the clear winner with its recent increase in both distributions and share price.

Seeking Alpha

Yet even with the increased distribution the fund still trades at a discount of about -11% to NAV as shown in this screenshot from CEFconnect, only slightly better than the one-year average discount of about -14%.

CEFconnect

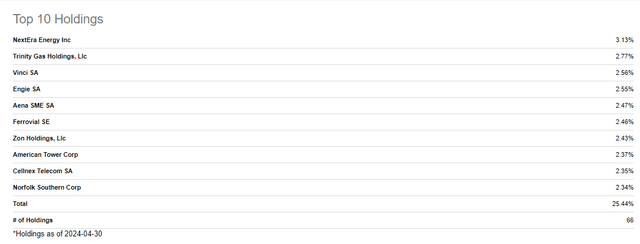

As of April 30, 2024, the fund holdings include 66 total global equity investments that are all invested in infrastructure including gas, telecom, renewable energy, utilities, railroads, etc.

Seeking Alpha

I still rate ASGI a Buy for income investors who wish to receive a monthly dividend that offers an annual yield approaching 13% at the current price. The global infrastructure spending trends are only going to continue regardless of what happens with inflation, interest rates, or geopolitical concerns.

Concluding Thoughts: Four Funds Delivering High Yield Income

Anyone who is interested in generating a passive income stream to support their retirement years needs to consider risks, market action, their own investment objectives, and goals for withdrawing cash from their investments. Total return can be achieved from both distributions and capital appreciation but the amount of growth versus income is an important factor to consider.

While some funds offer both regular high yield dividends and some capital gains from price appreciation, the cash flows from the distributions are of most importance to me as an income investor because the share price fluctuates daily and only becomes a factor if you decide to sell shares. By reinvesting in funds that offer a discount to DRIP, more shares can be added at a lower price reducing your cost basis while increasing your future income stream. If you rely on growth in the share price to achieve your total return, you may be forced to sell shares at an inopportune time if you need to withdraw cash to cover an unexpected expense.

In this review of four different CEFs that offer high yield distributions, it is quite possible to build an income stream that delivers monthly cash flow to help cover living expenses or support your lifestyle in retirement without the need to sell shares to capture gains. This approach may not work for everyone, but it has definitely been working for me. I own full positions in all 4 funds mentioned above: PDI, OXLC, OCCI, and ASGI.