RHJ

introduction

of Kameko Corporation (New York Stock Exchange:International Labour Organization) (TSX:CCO: Canada) has become the gift that keeps on giving.

I started Cover I acquired this Canadian uranium mining company in November 2022. Since then, I have written five bullish articles on the stock. Most Recent There are title “The Golden Age of Uranium: Positioning Itself with Cameco” February 14.

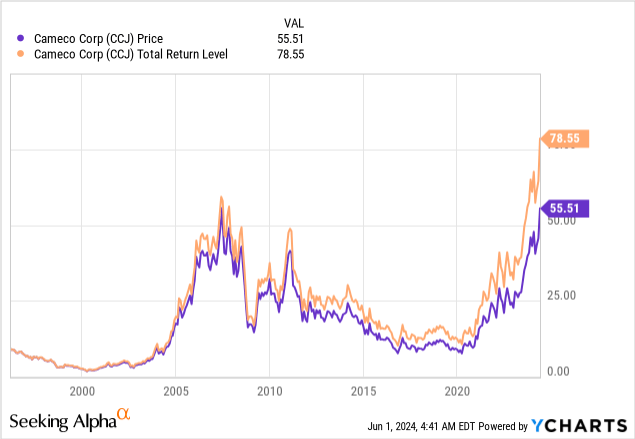

Since then, the stock has risen another 32%, giving the company a market cap of over $24 billion. In the past 12 months, the stock has risen 99%.

Even excluding dividends, New York-listed stocks are back to their all-time highs from July 2007.

After all, the uranium bull market is only getting stronger, buoyed by ongoing supply issues, geopolitical decisions, and accelerating ongoing AI applications that require large amounts of additional energy.

In this article, we will explain all this while updating your CCJ. A bullish case.

Let’s get started!

Uranium bull market continues

On May 26th, The Atlantic magazine ran an interesting article. article About the resurgence of nuclear energy in the United States.

In essence, the United States may have no choice but to rely on its own ‘traditional’ renewable energy sources if it wants to advance its 2050 climate goals.”It almost certainly won’t be enough.“

Another issue is land and resource access.

According to the article, nuclear energy can produce the same amount of energy as solar or wind energy while using one-thirtieth of the land.

Even better, nuclear reactors can be built anywhere, regardless of how bright the sun is or how strong the wind is.

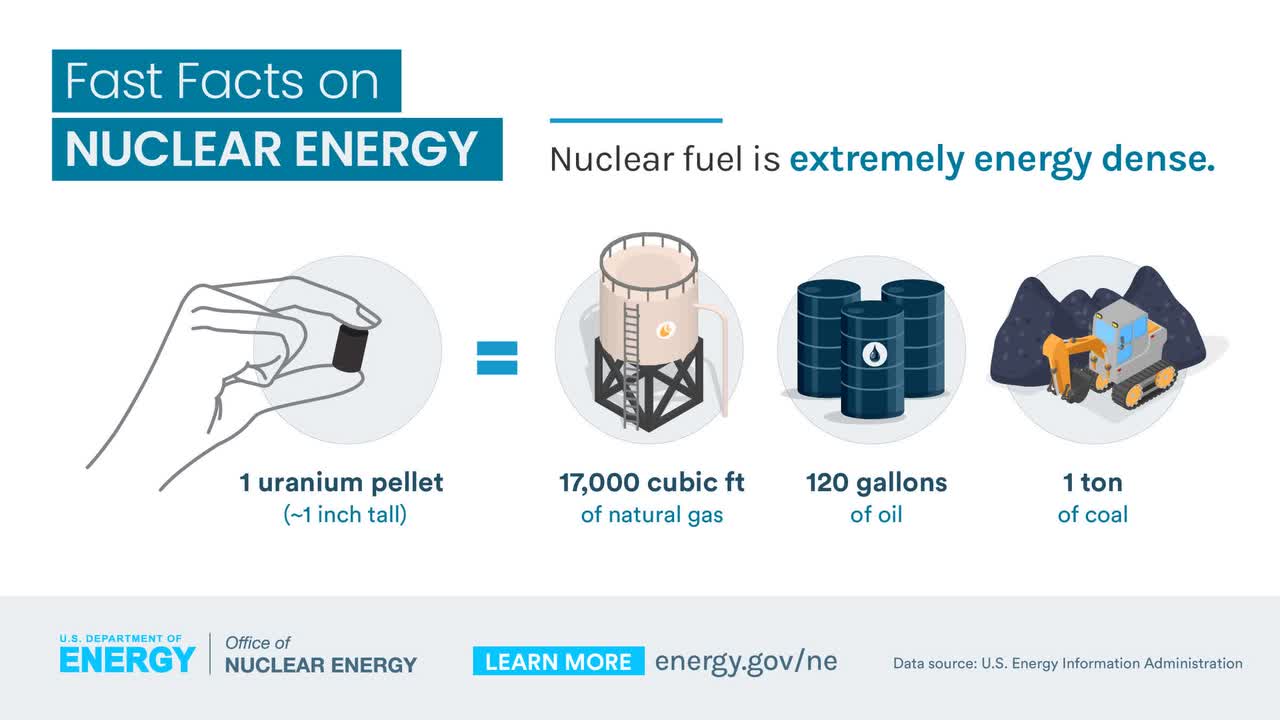

Previous Cameco articles have also highlighted these benefits, showing that one small uranium pellet produces the same amount of energy as one ton of coal, 120 gallons of oil, or 17,000 cubic feet of natural gas.

Energy Information Administration

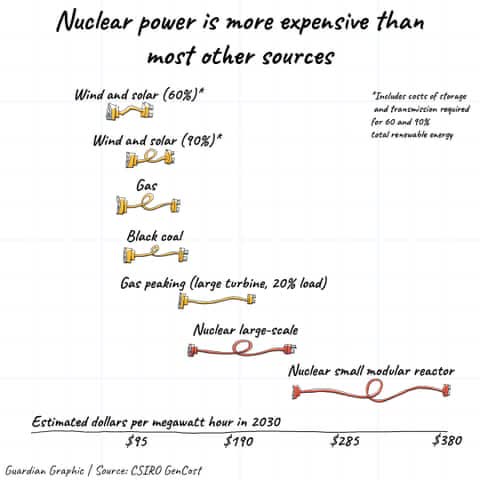

The problem is that nuclear energy is expensive, at least initially, because it is expensive to build.

according to ParentsNuclear energy is more expensive than renewables, gas and coal. This includes the storage and transmission costs required to support renewables.

Parents

The good news is that targeted government spending and innovation are making nuclear energy more attractive.

Back to Atlantic:

The climate change bill signed by the president Inflation Control Lawwhich includes generous tax credits, Potential to reduce nuclear project costs by 30-50%and the Bipartisan Infrastructure Legislation Including $2.5 billion Fund the construction of two new reactors using the original designMeanwhile, the Department of Energy is considering various options for permanently storing nuclear waste. Investing in building a domestic uranium supply chainand helps companies navigate the approval process for reactor designs. — The Atlantic (emphasis added)

In other words, the U.S. is getting serious about nuclear energy, and with energy demand exploding, the timing couldn’t be better.

On May 28th I article We focused on the bull market in natural gas, fueled by the AI boom.

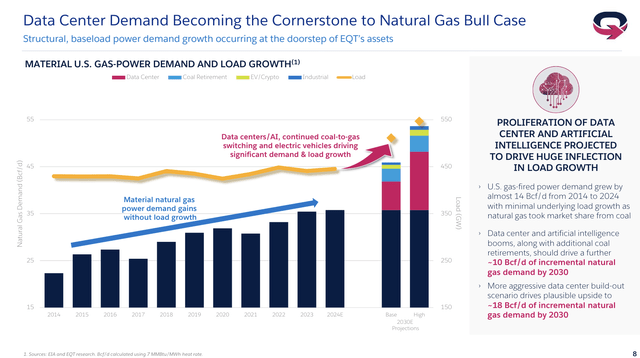

- Between 2014 and 2024, demand for gas-fired power generation increased by about 14 billion cubic feet per day (Bcf/d), but this was primarily due to a shift from coal to natural gas, with little underlying load growth.

- AI alone could lead to an additional 10 Bcf/d of demand by 2030.

- Even more bullish projections put AI alone at 18 billion cubic feet per day by 2030…

But strong demand is also putting pressure on supply.

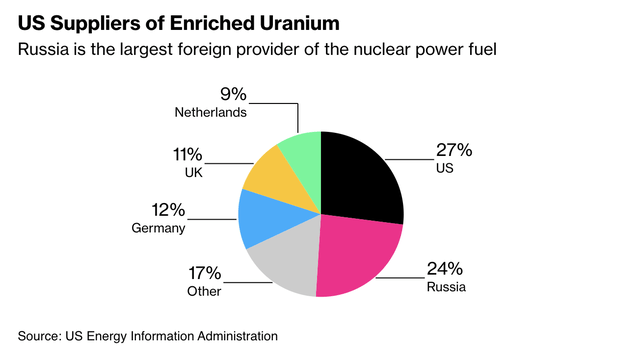

On May 16th report President Biden has signed a bill banning the import of Russian enriched uranium.

This is a big deal because Russia supplies roughly a quarter of the uranium needed for American nuclear reactors and is America’s largest supplier of uranium.

A supply cut could send uranium prices soaring by 20%, according to Jonathan Hinze, president of nuclear fuel market research firm UxC. – Bloomberg

There is now a growing possibility that Russia will use its influence to pressure Western countries on nuclear energy in general.

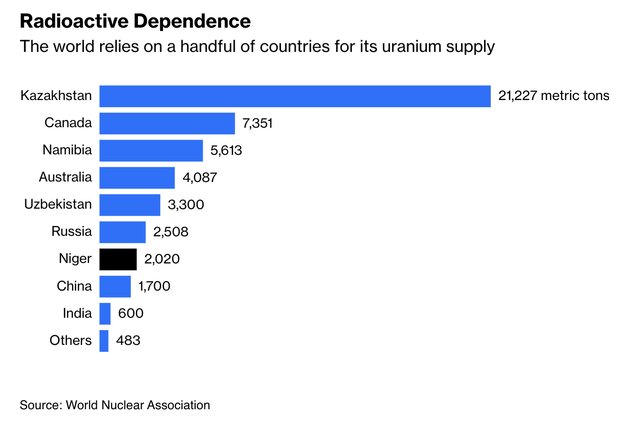

After all, global supplies are heavily dependent on countries like Kazakhstan, which have strong ties to Russia.

All of this bodes well for uranium prices and supplies in the West.

That’s where the camera comes in.

CAMECO continues to operate at full speed

Cameco is one of those companies that offers the right product at the right time and in the right place.

As production challenges and growing geopolitical uncertainty increase supply risks, power companies are evaluating their nuclear fuel supply chains. As a reliable commercial supplier with nuclear fuel assets in geopolitically stable jurisdictions, we work with our customers to ensure long-term commitments that support the long-term operation of our production capacity while also working to mitigate risk in their nuclear fuel supply chains. Cameraman (emphasis added)

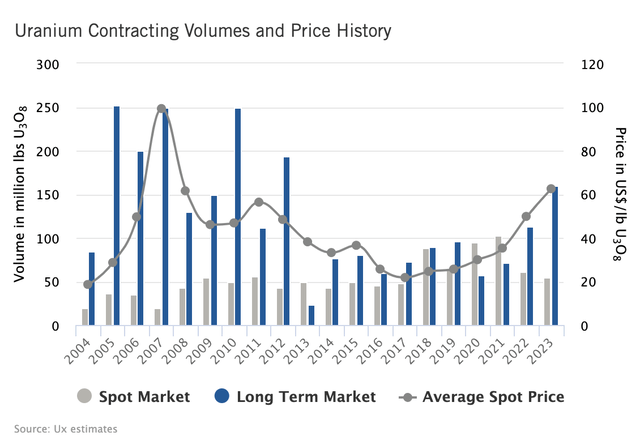

Looking at the Cameco data below, we can see that between 2017 and 2023, the price of U3O8 roughly tripled as the price of the uranium compound triuranium octoxide jumped from $20 to $60.

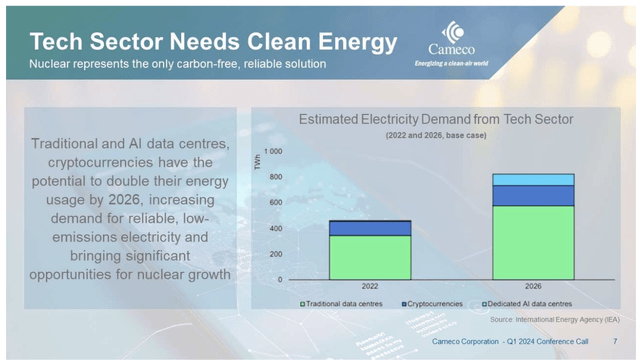

In its Q1 2024 earnings call, the company confirmed what was stated earlier in this article, noting that demand for nuclear energy is increasing as governments, electricity suppliers and industrial consumers recognize nuclear energy as a key part of the ongoing energy transition.

The company also noted that national security is an increasingly important driver of growth, as reliance on uranium supplies from unreliable partners could have a negative impact on the energy transition.

The ongoing war in Ukraine is a case in point.

- Russia cut off most natural gas exports to Europe in the early stages of the war.

- Sanctions have hit uranium supplies from Russia.

- Russia could retaliate by pressuring its partners to cut uranium exports.

And then you made a really interesting comment about AI, which is not only driving up electricity demand in general, but also getting tech companies interested in nuclear energy.

Cameco said some companies have already signed contracts to enable their facilities to use nuclear power.

Tech companies and Silicon Valley billionaires have been pouring money into nuclear energy for years, arguing that sustainable sources of energy are essential to going green, but now they have another incentive to push it forward: artificial intelligence.

“Basically in today’s world, the two limiting commodities you see everywhere are intelligence, which we’re trying to address with AI, and energy,” he told CNBC in 2021 after investing $375 million in Helion Energy, a nuclear fusion startup where Altman is chairman. Microsoft agreed last year to buy electricity from Helion starting in 2028. Oklo, where Altman is chairman, focuses on the opposite reaction, nuclear fission, which creates energy by fusing atomic nuclei. NBC News

I believe that the interest of tech giants and pioneers in nuclear energy is misconceived, because they know exactly how demanding AI applications are for energy needs and how efficient nuclear energy is.

It is also reliable, something that cannot be said for wind or solar power.

One of the needs of modern technology applications (or the economy in general) is reliable, affordable energy.

With that in mind, it helps that Cameco is extremely reliable and efficient when it comes to uranium production.

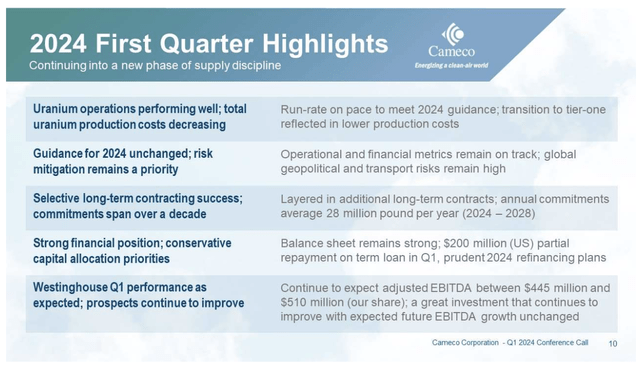

In its earnings call, the company said its first-quarter 2024 performance was strong and in line with its full-year guidance due to its successful transition to a Tier 1 cost structure.

With an average period price of $77.50, even though we’re not yet at replacement rates, it’s a very positive situation for us and a great situation for existing producers with tier 1 assets and brownfield leverage and a great opportunity to take advantage of that value capture. So we’re very positive on the underlying market fundamentals.” – CCJ Q1 2024 Earnings Call

In general, the company’s strategy is primarily focused on securing long-term contracts rather than wasting time in the much more volatile spot market.

The company said this approach would result in a significant increase in annual commitments, averaging around £28 million per year between 2024 and 2028.

What’s more, the company’s investment in Westinghouse is paying off.

Last year, Kameko Bought 49% of the shares Westinghouse, 51% acquired by Brookfield Asset Management.

This enabled Cameco to profit from the growing demand for nuclear energy and from Westinghouse’s nuclear power plant technology, products and services.

The company continues to expect its share of adjusted EBITDA from Westinghouse to be between $445 million and $510 million this year.

Even better, the segment is expected to grow at an average annual rate of 6% to 10% over the next five years.

evaluation

CCJ’s New York-listed shares are up 29% so far this year, with a 12-month performance of 99%.

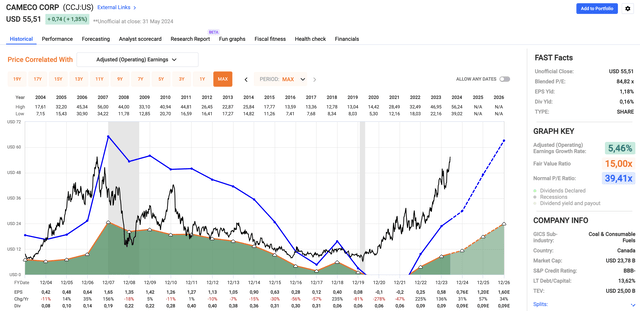

As a result, CCJ is currently trading at a blended P/E ratio of 84.8x, which is significantly higher than its long-term normalized P/E ratio of 39.4x using FactSet data in the chart below.

But the situation is not as bad as you might imagine.

Using the same FactSet data again in the chart above, analysts expect EPS growth of 31% this year, with growth of 57% and 34% likely to continue in 2025 and 2026, respectively.

While these figures are subject to change, the company expects to enjoy double-digit annual growth over the long term.

That said, if we apply a 39x multiple to these figures, the fair value share price comes to $62, which is 12% higher than the current price.

I buy Valuations don’t suggest great risk/reward ratios.

To be sure, the long-term bull scenario remains great, and we believe investors are willing to pay a premium until that changes.

But I wouldn’t be aggressive in investing at this level.

If I was looking for exposure to CCJ, I would buy incrementally. If the stock corrects, investors can average down. If the stock continues to rise, investors can get a foothold.

As for my situation, as I wrote in my previous post, Caterpillar (Cat) to cover mining-related demand. Due to active investments in energy and related stocks, commodity-focused exposure has not yet grown.

remove

Cameco continues to prove its value with its share price up 32% since our last article.

The uranium market is booming due to supply constraints, geopolitical changes, and surging energy demand driven by AI applications.

Needless to say, the resurgence of nuclear energy, bolstered by government support and interest from the tech industry, bodes well for Cameco.

Although the stock trades at a high price-to-earnings ratio, strong earnings growth projections justify a bullish outlook.

But given current valuations, a careful, incremental investment may be the way to go.

Ultimately, Cameco provides reliable and efficient uranium production and remains a major player in the energy transition.

Pros and Cons

Strong Points:

- Uranium Market Strength: CCJ is benefiting from a robust uranium market driven by supply constraints and increasing demand for nuclear energy.

- Geopolitical Support: As geopolitical tensions impact uranium supplies, CCJ benefits as a reliable commercial supplier.

- Technology Industry Interest: The growing interest in nuclear energy from tech giants underscores its importance in meeting energy demand.

- Revenue growth potential: Analysts expect CCJ’s earnings to grow significantly, which supports the current valuation.

- DiversificationThe Westinghouse acquisition was a smart move to differentiate the business.

Cons:

- Highly Recommended: CCJ’s current P/E ratio is significantly higher than its long-term normalized ratio, meaning that negative headlines could hurt the company’s share price.

- Market volatility: Like the uranium market, CCJ’s share price has been volatile.

- Uncertain regulatory environment: Regulatory changes and shifts in government policy regarding nuclear energy could affect CCJ’s business and valuation.