Jet City Image

Dear readers and followers,

You may remember my article on SpartanNash (Nasdaq:spectrum) About a year ago, a reader asked me if I had sold my shares in this business in light of the business’s relatively negative trends. Have you seen it? My answer to that question was a simple but emphatic “No.”

In this article, I will explain why I believe this company is not as undervalued as the market is currently valuing it, why I think there is significant upside potential here, and why a valuation below 10x P/E (currently it is 10x) would suggest that this company has significant upside potential.

SpartanNash is small. Its market cap is currently less than $700 million. I’m talking about this category of small caps based in the U.S. Their long-term debt to equity ratio is 50%, which is not a very low leverage ratio, but this is relatively common and fairly typical for these companies.

However, there are still positive aspects to consider when looking at the company’s business operations.

Let’s see what’s here and give you an update on this company.

SpartanNash – Despite it all, there is still some good

Given the company’s unpleasant trends, My last article is hereIf the advantages I spoke of then were no longer there, I would say not.

As I have said in previous articles, investing in quality food production, logistics and food related services is not a net negative for me. These, like utilities and similar sectors, are sectors with significant upside potential over time, even if we are currently in an environment where valuations for these companies are dropping lower and lower due to rising risk-free interest rates, rising debt costs and overall inflation and rising costs. That being said, you need to be aware of the risks and SpartanNash is not risk-free.

As I have said, and as the company has said previously, this is a business in the midst of transformation. Net profit margins have collapsed and the company has a lot of work to do. In relative terms, high leverage means interest coverage is below par for the sector and there is not much cash on hand, with debt-to-cash ratio at 0.02x as of my last article.

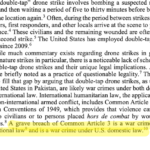

However, SpartanNash is a solid investment in two highly synergistic segments, retail and wholesale, with strong revenue and a high TAM. If you follow my work, you know I consider TAM to be largely irrelevant for any business, but the revenue numbers here are impressive. The company also projects sizable revenue and EBITDA growth rates, and unlike other risky businesses, I don’t consider these unrealistic.

Spartan Nash IR (Spartan Nash IR)

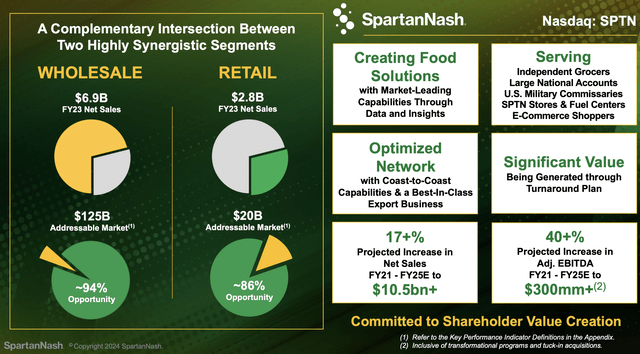

The upside in revenue and performance is supported by quarterly sales exceeding $2.8B, net income up 14.4% year over year, and stable EBITDA. EBITDA is down a bit, but only by 2.4% during the company’s transformation. Net margins are improving slightly (actually that’s a rounding error; a sub-$1B company shouldn’t brag about a 7 bps improvement). the current The full year guidance is as follows:

Spartan Nash IR (Spartan Nash IR)

That’s what I want to see: potential EBITDA improvement, not declining sales. This means the company is profit-focused, not revenue-focused. Too many companies are still overly focused on sales, including food company HelloFresh SE, which I wrote about recently.

This is not to say that we don’t think revenue is important, but if you have revenue and negative profits, it’s less important. For too long, investors have accepted the argument that “enough volume will make profits.”

Unless you have over a billion dollars in profits, you’ll never get there.

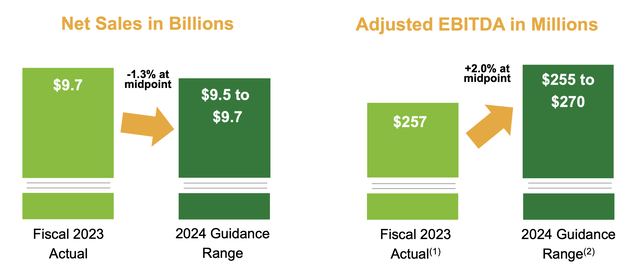

Meanwhile, SpartanNash’s turnaround is guiding the company in the right direction: Following the COVID-19 downturn, which is not surprising given the company’s industry and segment, it is now on track to reach $300 million in EBITDA.

Spartan Nash IR (Spartan Nash IR)

And throughout this turnaround, SpartanNash has faced some significant headwinds, including labor costs, logistics costs, food inflation, and fluctuations in market demand. However, the company remains committed to its strategic commitments.

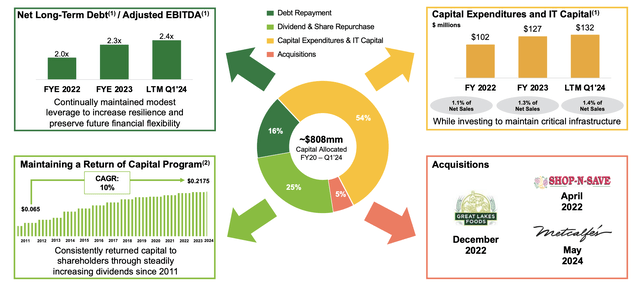

The company’s approach to capital allocation at this point remains very conservative. CapEx and IT as a percentage of sales is around 1-2% given the company’s situation. However, there is not much left to pay down debt. The company believes that 2.4x net debt/EBITDA is sufficient. I disagree, but this is debatable. 25% of capital is actually dedicated to shareholder returns, which is secondary to capex. A very small portion is dedicated to M&A.

Spartan Nash IR (Spartan Nash IR)

To be honest, my view on this company and its long-term potential has changed very little since my last article. I could say that the company has not yet delivered the upside that some expected or hoped for, but the truth is, I did not expect them to do so at such a rapid pace.

The reason I support SpartanNash is that it continues to focus on its core business and has many key advantages specific to the company, including the military sector. SPTN maintains a military sector, distributing dry groceries, frozen foods, beverages and meats to the U.S. military grocery stores and supply exchanges. This is somewhat unique, as the company, along with its third-party partner, Coastal Pacific Food Distributors, The only shipping solution Provide this level of service to the Defense Logistics Agency worldwide.

While this alone doesn’t make it a “buy,” coupled with the reversal rally happening here, a well-covered yield above 4.4% would encourage me to stay invested and maybe even increase my investment.

Let me be clear about my assessment of the business at this point.

SpartanNash – PT is attractively valued at over $30 per share.

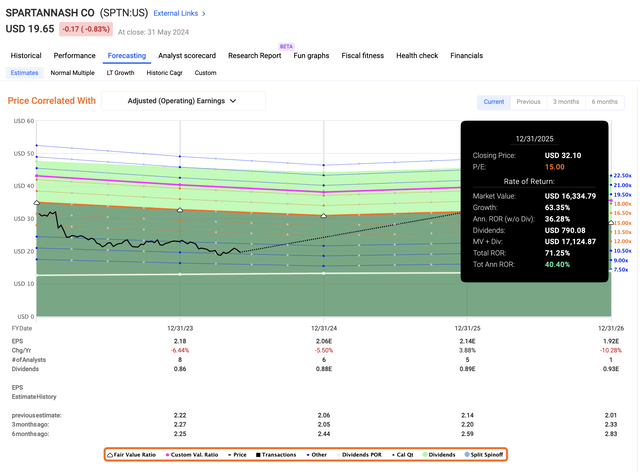

In my previous article, I predicted the company’s PT to be around $30 per share. Current expectations are that EPS will continue to decline slightly, with one analyst predicting a double-digit decline in EPS in 2026, but I don’t have much faith in that at the moment, as I can’t find any evidence beyond that target.

I would also like to point out that SpartanNash almost always delivers exactly what you would expect, and sometimes even exceeds expectations. This happens over 75% of the time. (Paid FAST graph link). With a two-year MoE of around 20%, only around 20% of the time it actually misses out negatively.

My contention is that a foodservice company with such a solid track record, even a small one, should be worth at least 12-15x P/E, especially if things turn around. Hoping for the situation to improveIf you don’t believe this to be true, then this is probably not a good investment for you.

But if you, like me, see potential for a turnaround here for SpartanNash, then based on a P/E of just 15x, I’d expect ~40% upside per year through 2025, which would put the PT at about $32 per share, which is above my $30 per share, so in my opinion the company doesn’t need to manage it.

Benefits of high-speed graph SpartanNash (Advantages of FAST Graphs SpartanNash)

My guess is that the company only needs to trade around $28-29, or a P/E of 13-13.5x, which would give it a 30% annualized yield at this point. Granted, current low growth projections and a pullback this year could cause the company’s stock to stagnate for a while, but patience is key here. This is why yield is so important to me when investing. Not only do I want to get paid on capital appreciation, I also want “interest” on my money.

In this case, I am earning 4.43% interest on a dividend rate well below 60%, which I believe is enough to justify continuing to take on this risk in exchange for the potential for market-beating returns.

As long as this thesis doesn’t deteriorate, I will continue to stay invested this way and in this company. I’m not selling just because the company hasn’t peaked, I’m selling because the thesis has fallen apart.

SpartanNash’s thesis is not bankrupt.

We are talking about companies that are disadvantaged in the market because of macroeconomic, inflationary and ongoing economic recovery. It is entirely legitimate to penalize these companies. At this level, it may be going a bit too far.

The risks here remain margin deterioration and failure to recover. Some targets and recoveries have been “postponed” in terms of timing, but I do not view this as synonymous with an upswing or recovery never coming.

At the moment, many investors are taking refuge in high-value tech stocks. I do the exact opposite. I try to find quality stocks that are the least valued and have the most upside potential. Because anyone who “promises” quadruple-digit gains in a short period of time or anything that “sounds too good to be true” probably is. This doesn’t mean I don’t invest in tech. I do, and I’ve been successful. But I’m very careful about how I invest in tech.

At this point, I would argue that SpartanNash remains a “buy”, and here’s why:

paper

- The company is currently trading at a PT of $30 per share, which was also what I predicted previously. The main difference is that in my last article it was over $30 per share, whereas now it is closer to $20. Any well-performing company can be attractive at the right price. After a 40% drop, it’s time for SpartanNash to be attractive as well.

- This is a company that is fundamentally attractive, and I think this is where you can really start buying SpartanNash common stock, and I recently added more shares to the company.

- I value SPTN at a PT of $30 per share and currently rate it a Buy, which indicates a change in my rating for this company.

- I have looked at the current options market and have not found anything attractive enough to invest in. However, I will continue to look at and update if any cash secured puts catch my eye.

- This article will be updated in June 2024, but I will be keeping an eye on the final price and may add to the company’s shares in the future.

Keep in mind, I am working on the following:

- You buy undervalued companies (even if the undervaluation is only slight and not mind-bogglingly large) at a discount and let them normalize over time, earning capital gains and dividends in the meantime.

- If a company becomes overvalued far beyond normal, I take profits, switch my position to other undervalued stocks, and repeat #1.

- If the company is not overvalued and remains within its fair value range or returns to being undervalued, I will buy more as time allows.

- Reinvest earnings from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company meets them:Italics).

- This company is overall high quality.

- The company is fundamentally safe, conservative and well-managed.

- The company pays a well-covered dividend.

- This company is currently cheap.

- The company has realistic upside potential based on earnings growth or price multiple expansion/reversion.

I maintain a “buy” view here as I believe the company is cheap and also has room to upside.