Daniel Griselli

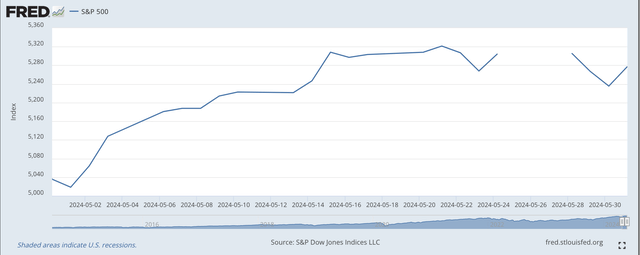

The US stock market performed well in May, despite going through a period of decline that looked somewhat ominous.

The S&P 500 Index closed at 5,277.51 in May, up from 5,035.69 on April 30, 2024. 31st, 2024.

The S&P 500’s all-time high of 5,321 was reached on May 21, 2024.

Here’s what the 4.8% increase looks like.

S&P 500 Stock Index (Federal Reserve)

The Dow Jones Industrial Average rose 2.3% in May, while the Nasdaq rose 6.9%.

As you can see from the chart, the stock market was essentially flat in the second half of May, with a couple of big declines.

What was going on?

Recently, investors have been worried that the Federal Reserve There was no intention to cut interest rates this year.

The cause of the delay is the demon of inflation.

For much of the month, investors have been concerned that the inflation picture is not looking all that great, meaning the Fed is likely to cut interest rates, keep them at current levels, or even raise them, as some have suggested.

Stocks opened higher on Friday after several days of declines.

That’s because on Friday morning, before the markets opened, information was released about the Personal Consumption Expenditures Price Index (PCE), the Fed’s preferred price index.

news, The PCE price index is up just 2.7% from April 2023.

This increase, according to Charlie Grant, The Wall Street Journal “That was in line with expectations of economists surveyed by The Wall Street Journal.”

The core price index rose 2.8% from a year earlier, slightly above the 2.7% expected.

“The new price data comes on the heels of news that the economy started the year growing more slowly than previously thought,” Grant added.

This information has influenced investors’ views on the likelihood of the Fed cutting interest rates. Now, Grant said, investors see an 81% chance that the Fed will cut interest rates at least once by the end of 2024.

So investors acted and the stock market rose… on the hope that the Fed would cut interest rates at least once before the end of 2024.

That’s it, everyone!

The Fed intends to keep stock prices at these lofty levels or even higher.

To Lydia DePilis The New York Times The state of the economy and the future of inflation

“Spending remains healthy. The stock market is strong and home prices are high, giving affluent consumers the confidence to take luxury vacations and buy new cars, even as delinquency rates rise for people who have maxed out their credit cards.”

“Consumers are borrowing because they can, because their balance sheets are so healthy.”

“The ‘wealth effect’ makes them believe they can do it.”

And the stock market goes up.

To me, the key statement here is “consumers borrow because they can.”

Check out my recent “Federal Reserve Watch” posts.There is plenty of money“

The Federal Reserve has been pumping money into the economy, and much of that money is still there.

But the presidential election will be the focal point for the rest of the year, and the big question is what the Federal Reserve will do ahead of the election.

My answer to that is that Federal Reserve officials do not want to see a sudden, sharp decline in the stock market, or in the financial markets.

I’ve written quite a bit about this issue.

Heading into the presidential election, Federal Reserve officials want to avoid any decisions that could trigger a stock market collapse or lead investors to believe they are acting to get the current president re-elected.

That means we are entering a period in which Federal Reserve officials will want to keep as low a profile as possible.

Officials hope they can get through by “continuing to do what we’ve always done.”

That means Federal Reserve officials want to stay out of the picture until the end of November, or possibly beyond.

Fed officials want the Fed to be invisible.

Stock markets and other financial markets have been relatively calm for much of this year.

If they can stay calm for the rest of 2024… I think most Fed officials would prefer that.

I think Fed officials want to get through the rest of the year with rates unchanged. Raising rates is a big no-no. Lowering rates… maybe… but don’t worry too much about it.

Federal Reserve officials have already said they will continue to reduce the size of the Fed’s securities portfolio, and they have also said they will probably reduce the size of the monthly reduction in the size of the Fed’s securities portfolio.

However, the Fed will still seek to keep the commercial banking system’s “cash reserves” relatively stable and will manage these “excess reserves” to maintain market calm and stability.

I firmly believe this is what Fed officials want to accomplish over the remainder of 2024.

This would allow Federal Reserve officials to weather the presidential election with little or no recrimination.

They may be “accused” of something anyway, but they want to remain “innocent” so they can contend that they did nothing to influence the election outcome.

This leads me to believe that monetary policy over the next six months will be broadly similar to the first five months of 2024.

In the first five months of 2024, the S&P 500 stock index rose 10.4%.

Don’t dress too dirty.

Federal Reserve officials remain confident that they would be open to another rate hike of around 10.0 percentage points in the second half of 2024.

Sure, the Fed can be accused of acting to benefit the current president, but they can point to statistics time and time again to show that they are simply continuing the policies they have had in place since March 2022.

This is what I think the Fed is going to do going forward.

Barring any major disruptions to the economy in the second half of 2024, I believe the Fed will be able to get this kind of market reaction.

More than anything, Fed officials want to stop investors and the public from trying to predict every move the Fed might make over the next five months.

Federal Reserve officials… want to get out of the headlines.